Sell gold | <b>Gold Sell</b>-Off In 2014: A La 2013? | Seeking Alpha |

| <b>Gold Sell</b>-Off In 2014: A La 2013? | Seeking Alpha Posted: 05 Jun 2014 06:30 AM PDT Summary

Gold prices rose by almost 20% from late December 2013 to the middle of March 2014 from their June lows of $1,180/toz to nearly $1,400/toz. As I highlighted here, several factors pushed gold prices higher during the first quarter of 2014: i) Weak United States economic data ii) Rising geopolitical tensions between the United States and Russia iii) Strong physical demand in Asia, with higher premium in the Shanghai Gold Exchange The Technical picture suggests lower gold pricesFigure 1: Bearish technical picture for goldSource: Stock Charts The rally came to an end on March 17 as gold prices dropped by 8% to $1,278/toz on April 1. Then, gold market participants had become confused about the future gold price direction and the market had been trading sideways until May 26. On May 27, gold prices fell sharply by about 2.3% or $30/toz., resulting in a bearish technical picture, as seen in Figure 1:

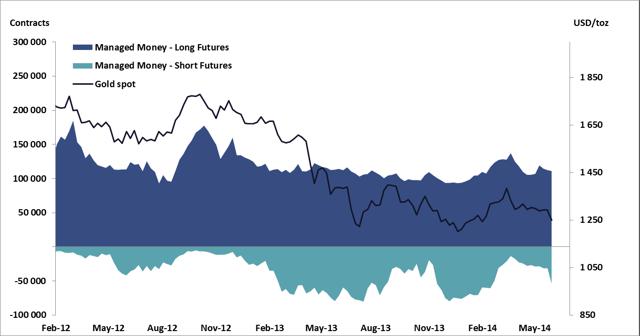

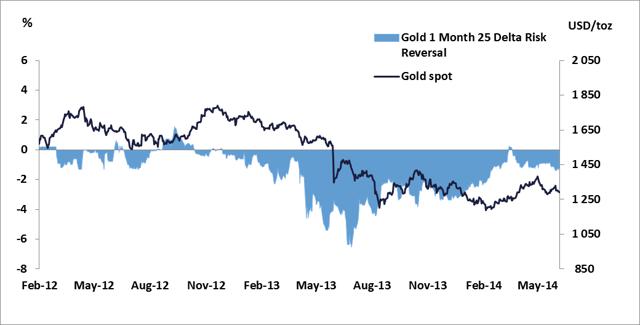

Consequently, market participants have become more confident about the continuation of the bearish trend this year. The Speculators futures positioningIn this section, the speculators futures positioning is discussed, providing some information about the future gold price direction for 2014. Indeed, as a market participant, the question that is confronting me now is whether gold prices are going to fall in a fast and sharp mode going forward. If so, will the $1,180/toz level hold? In my baseline scenario, the $1,180/toz level will not hold because the floor has not been reached yet, even though this level has provided a strong support previously. My thesis is based on the speculators futures positioning. Let's use CFTC reports on managed money positions in COMEX futures as a proxy for speculator's activity. Figure 2: Speculators have the capability to drive gold prices much lowerSource: CFTC, Bloomberg, Mikz Economics Figure 2 suggests that speculators can have a large influence on price movement in the short and medium term. In my view, speculators will have a negative impact on gold prices in 2014 in a greater magnitude than 2013. In 2013, speculators began to build short positions based on the thesis that gold prices had risen too much for too long and the peak of the fear trade had passed. It is not coincidence to me that the gold market experienced a massive sell-off of 28% in 2013 (the worst year since 1981) following 12 consecutive years of boom, with a dramatic rise during the financial crisis. To be more precise, gold entered in a bearish trend in the beginning of October 2012 when it failed for the third time to break above the $1,800/toz level. What went up… had to go down? 2013 proved it. However, Figure 2 shows that speculators began to cover their shorts positions in the end of 2013 into the first quarter of 2014, which have pushed gold prices higher. Interestingly, they started to build new short positions again in May 2014, putting downside pressures on gold prices. It is important to note that, at this stage, speculators have a lot of room to expand their short positions, which would suggest that they have the capacity to drive gold prices to much lower levels going forward. The question now becomes whether speculators will expand their short positions this year. My view is that we are likely to see aggressive selling in the futures market due to a bearish sentiment. What drives gold in the short term is mainly sentiment. In 2013, sentiment has become more bearish but not sufficiently bearish in order for the gold market to create a bottoming process. Historically, gold prices have been near a bottom when an extremely bearish sentiment is reached while near a peak when an extremely bullish sentiment is reached. As the $1,180 level was tested twice, in June and December 2013, and the sentiment was not sufficiently bearish at that level to lead to a real bottoming phase, this would suggest that gold prices may have to decline even lower. In the next section, the options market positioning is discussed in more detail, providing some information about the future gold price direction in the very short term. The Options market positioningWhile the speculators future positioning gives us some perspective about the future gold price direction for this year, it is important to have a clearer view on gold prices in the very short term. In other words, is the gold price going to decline in a fast and sharp mode, à la April 2013? In my baseline scenario, this is not likely. My analysis is based on the options market positioning. Analyzing how the gold options market is pricing options enables me to gauge traders' sentiment. In order to know whether options traders are biased for the downside or upside price action, one will use risk reversals. As noted in a previous article on January 14, 2014, the options market positioning suggested that the gold market would not be ready yet to recover as market participants were still worried about further decline in prices. This hypothesis was proven right even though gold prices continued to rally until the middle of March. As a reminder, a risk reversal in options market can be defined as the implied volatility on call options minus the implied volatility on put options, both with the same delta and maturity. To put it another way, a positive risk reversal means that the implied volatility of call options (downside protection) is greater than implied volatility of put options (upside protection) so options traders are optimistic about the future gold price. On the contrary, a negative risk reversal means traders are biased for downside price action. Finally, a change in risk reversal would suggest a change in market expectations. Let's compute Gold 1 Month 25 Delta Risk Reversal (R25). Figure 3: Gold Prices and Risk ReversalSource: Bloomberg, Mikz Economics As seen in Figure 3, R25 began to decline in September 2013 and plunge below 0% in February 2013, signaling that the sentiment had become bearish for the year ahead. This was proven right as, the gold market, down by 28% in 2013, had its worst year since 1981 when it plunged by 33%. After reaching a low of -6.3% on June 21, 2013, R25 rebounded to peak on March 14 at +0.25%. However, R25 failed to stay above the 0% level and declined sharply thereafter. It was a signal that gold prices may decline in the very short term and it was proven right. Interestingly, the sharp sell-off in gold from May 27 did not impact negatively R25. In fact, it has remained stable; suggesting that market participants do not express a renewed interest for gold upside protections. If this signal proves correct, this will mean that gold prices will not decline sharply in the very short term and we may see some short covering. Having said that, a sharp decline in R25 cannot be excluded and this would indicate that gold prices may drop imminently. In sum, the speculators futures positioning suggests that they have a lot of room to expand their short positions and to put downside pressures on gold prices this year. However, the options market positioning suggests that participants do not expect an imminent sell-off in gold prices in the very short term. In my baseline scenario, gold will remain in its bearish trend in 2014 and 2015 while the support at $1,180/toz will be eventually broken even though this level provides a strong support due to physical demand out of Asia. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. |

| <b>Gold</b> Investors Weekly Review – June 6th | <b>Gold</b> Silver Worlds Posted: 07 Jun 2014 06:13 AM PDT In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. Gold closed the week at $1,253.25, up $3.52 per ounce (0.28%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, gained 0.73%. This was the gold investors review of past week. Gold Market StrengthsThe gold price declined on Friday morning after U.S. employment data was released, but recovered intraday, closing unchanged. U.S. employers added 217,000 jobs in May after a 282,000 gain in April. The median Bloomberg forecast called for a gain of 215,000 jobs in May. Gold rose $9.77 per ounce on Thursday after the European Central Bank (ECB) cut its deposit rate to 0.1 percent. The ECB became the first major central bank to take one of its main rates negative, as President Mario Draghi unveiled historic measures to fight deflation. By cutting the deposit rate to 0.1 percent, the central bank will effectively charge banks for holding money overnight. The bank also cut its main refinancing rate to 0.15 percent. Dennis Gartman, author of The Gartman Letter, said "the ECB's policy changes were very expansionary and that on-balance is supportive of gold…I think more is coming." China and India (Chindia) are consuming more gold than the global production, according to Bloomberg's Ken Hoffman. His research shows that China is consuming gold at a rate of 5.15 million ounces per month, while India, at the current import-tariff reduced rate, is consuming 2.85 million ounces per month. The total Chindia consumption is 8 million ounces per month, or 560,000 ounces higher than the estimated 7.44 million ounce per month global-mine output. With this deficit in mind, any relaxation of Indian import curbs will likely skew the fundamental supply-demand balance even further into deficit. Gold Market WeaknessesThe U.S. Mint's gold coin sales slumped in May, reaching a total of 35,500 ounces, 7.9 percent lower than the preceding month. The report reinforces the expectations for weak seasonal demand as we head into the summer. On a positive note, the Mint reported silver coin sales rose 12 percent from April and 15 percent from a year earlier. PwC, in its latest Mine Report published Thursday, says "2013 was a year that forced the global mining industry to realign expectations in one of the most difficult operating environments for years." Gold's greatest decline in three decades, coupled with record impairments of $57 billion last year, saw global mining profits plunged 72 percent to a decade low of $20 billion in 2013. Gold miners lost $110 billion off market capitalization, while gold reserves fell 8 percent in 2013, to 431 million ounces. Gold Market OpportunitiesWhile its commodities analysts bash gold, calling it a "slam-dunk" sell, Goldman Sachs is actually buying gold. The bank has agreed to swap dollars for gold with the government of Ecuador, a total 466,000 ounces (or $580 million), at an estimated price of $1,245 per ounce for a three-year term. Even though the Ecuadorian side denied that the transaction was a sale, it is highly unlikely the South American government will have the means to recover its gold in three years. This is especially possible since Ecuador's use of the dollar as official currency means it can't finance its deficits by printing money. Actions speak louder than words, and Goldman is buying gold. Gold Market ThreatsGold prices are set to decline below $1,000 per ounce by 2016, according to a recent report by Societe Generale. The French bank believes the Federal Reserve is likely to hike rates at a much faster pace than currently discounted by the market. As such, bullion prices will trade below $1,200 next year and below $1,000 in 2016. In addition to selling gold, the bank also recommends selling silver due to high physical ETF holdings, as well as copper due to the Chinese slowdown. The Philippines government expects to double its annual returns from mining under a new revenue-sharing scheme approved this week. The scheme aims to retain as much as 55 percent of the industry's net revenues, or 10 percent of gross revenue, whichever is higher. In a similar move, the Tanzanian government, Africa's fourth-largest gold producer, is reviewing mining contracts to ensure the government earns a larger share of revenues. |

| You are subscribed to email updates from Sell gold - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Sell gold | Gold Sell-Off In 2014: A La 2013? | Seeking Alpha"