Sell gold | <b>Gold</b> Investment <b>Sell</b>-Off Reversed at 8% Discount | <b>Gold</b> News |

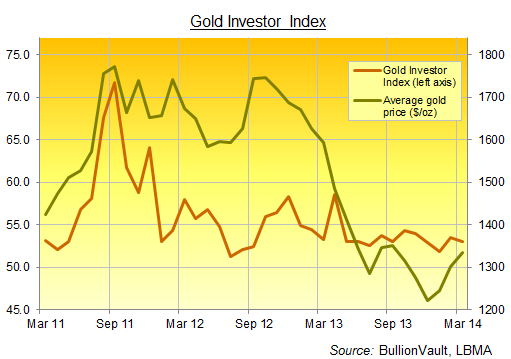

| <b>Gold</b> Investment <b>Sell</b>-Off Reversed at 8% Discount | <b>Gold</b> News Posted: 01 Apr 2014 01:17 AM PDT Gold investment sentiment ends Q1 positive on BullionVault's index of user buying and selling... GOLD INVESTMENT holdings sold during the price crash of spring 2013 have been three-quarters rebuilt and at an 8% discount, writes Adrian Ash at BullionVault. As well as outweighing sellers, self-directed private gold investment buyers also continue to outnumber them. Sentiment towards financial insurance remains positive, in short, and people continue to buy at lower prices. That's the conclusion from our latest Gold Investor Index. It tracks the number of BullionVault users growing their holdings versus those who reduce them, and gives a reading of 53.0 for March. A reading of 50.0 would signal a perfect balance of net buyers and net sellers across the month. Falling slightly from February's level of 53.5, the index ended the first quarter as good as unchanged from where it started, back at 52.9 for the end of 2013.

What does this index of gold investment sentiment show? BullionVault is the world's No.1 gold-ownership service online. Its users are predominantly self-directed private investors (people making their own investment decisions and putting them into action themselves). In the main they live in Western Europe or North America (some 90% of customers). These investors ended March owning 32.7 tonnes of gold (1.05 million Troy ounces), up from the end of February by nearly 200 kilograms (6,400 ozs), and all held in the form of London Good Delivery bars. Worth some $1.36 billion at March's last London Fix of $1291.75 per ounce, that's more investment-grade gold than most of the world's national central banks hold in reserve. It's stored in independent, non-bank vaults in the user's choice of London, New York, Singapore, Toronto or Zurich. The Gold Investor Index is calculated using proprietary data from BullionVault's live, 24-hour precious metals exchange for physical bullion online. Instead of surveying intentions, the index takes the balance of net buyers over net sellers across the month, and shows it as a proportion of all existing gold owners, rebased to 50. To learn more, see the May 2013 article about the Gold Investor Index in the London Bullion Market Association's Alchemist magazine. The chart above shows how it has varied over the last three years, peaking at 71.7 in September 2011. And rebounding from the 18-month low hit in January at 51.9, the Gold Investor Index was little changed at 53.0 last month from December's 52.9. Now, the last four times sentiment on the Gold Investor Index gave a reading at this 53 level, Bullionvault users were either net sellers of gold or flat over the month. But with March adding to February's strong addition, customers have now bought back three-quarters of the 1.1 tonnes liquidated last spring – when gold prices crashed to deliver their sharpest drop in three decades. In aggregate, they've rebuilt that position at a discount averaging more than 8% too. Since the Q2 crash of 2013, when the metal averaged $1414.80 per ounce, Dollar gold prices have averaged $1297.87 (London PM Fix). But the average monthly gold price across March 2014 was $1336.08, the highest since September. So, while gold prices averaged a 6-month high in March, physical bullion continues to look good value to private individuals and households making their own investment decisions. Financial insurance is still on sale. And like any effective cover, the best time to buy is before trouble strikes. | ||||||||||||||||||||||||||||||||

| Curved Baseball Coins <b>Selling</b> Fast, Collectors Voice Frustration <b>...</b> Posted: 01 Apr 2014 02:59 PM PDT  The new curved baseball coins are popular with the gold $5 commemoratives already sold out. The $1 silver commemoratives are selling quickly. Demand for the curved 2014 National Baseball Hall of Fame Commemorative Coins remains strong following a tidal wave of orders on opening day, new United States Mint sales figures reveal. Debuting on Thursday, March 27, the two gold coins went on a waiting list within hours until the U.S. Mint officially declared all 50,000 sold out. Sales as of Sunday have the splits at 32,000 for the proof and 18,000 for the uncirculated. The fast sellout left some collectors empty-handed and pointing to the Mint's ordering limit of 50 gold coins as an "unforced error," forgive the pun, believing it was too attractive to dealers. CoinNews.net reader "RonnieBGood" succinctly commented on the subject:

The gold baseball coins could have potentially sold out sooner. Until the day prior to their launch, the U.S. Mint did not have any ordering limits. They were added on March 26.

Household ordering limits of 100 coins each are in place for the silver dollars and clad half-dollars. Silver and Clad Baseball Coins Next likely to sell out are the silver dollars. The National Baseball Hall of Fame Commemorative Coin Act, Public Law 112-152, authorized a maximum of 400,000. As is typical with silver coins, collectors prefer the proofs over the uncirculated by about a 68/32 split. The latest sales stand at 155,523 for the proof silver dollar and 73,002 for the uncirculated silver dollar for a total of 228,525, or 57.1% of the mintage. The last commemorative silver coins from the U.S. Mint to sell out were the 2010 Boy Scouts of American Centennial Silver Dollars. It took a bit over one month for the authorized 350,000 to move. There is less interest in the 50-cent clad versions when compared against the silver coins, at least for now. Of the permitted 750,000, a total of 111,380, or 14.9%, have sold with 67,236 in proof half-dollars and 44,144 in uncirculated half-dollars. Here is a table offering the latest available coin sales as of Sunday, March 30: Sales of 2014 National Baseball Hall of Fame Commemorative Coins

Prepare to wait for the next batch of sales figures because they may not be released for another week. Baseball Coin Sales Top $34.9 Million Across all six baseball coins, 389,905 have sold for a sales total in dollars of $34,905,252.75. Surcharges Top $4.5 Million Public Law 112-152 mandated that the U.S. Mint include surcharge amounts of $35 per $5 gold coin, $10 for each silver dollar and $5 per 50-cent piece to be paid to the National Baseball Hall of Fame to help fund its operations. Prices above include those surcharges and total $4,592,150.00 based on sales through Sunday. Ordering Baseball Coins To place orders for the National Baseball Hall of Fame Commemorative Coins, visit the U.S. Mint website, right here, or call 1-800-USA-MINT (872-6468). Prices for the curved baseball coins are at introductory levels until April 28, 2014 at 5 p.m. ET. After that time, prices for the silver dollars increase by $5 and prices for the half-dollars rise by $4. |

| You are subscribed to email updates from Sell gold - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

1 Comment for "Sell gold | Gold Investment Sell-Off Reversed at 8% Discount | Gold News"

Highly researched based Stock Tips, reports,charts are helpful to deal good in stock market.