<b>GOLD Price</b> Rally Correction Within Downtrend :: The Market Oracle <b>...</b> |

|

Posted: 05 Feb 2014 09:57 AM PST

Commodities / Gold and Silver 2014 Feb 05, 2014 - 03:57 PM GMT

By: Gregor_Horvat

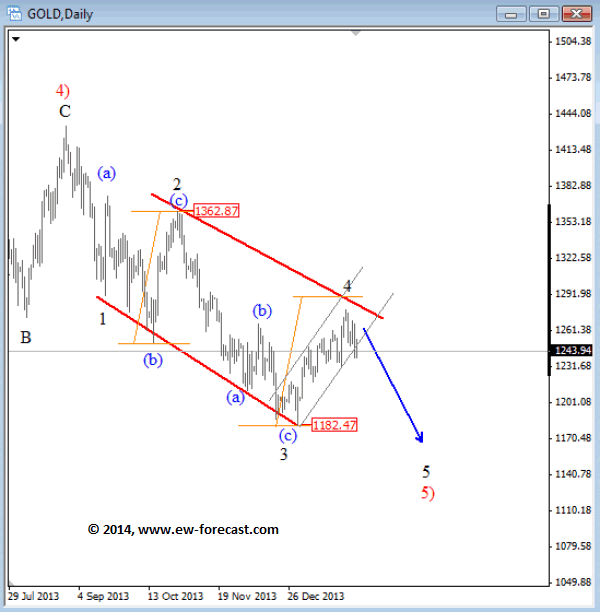

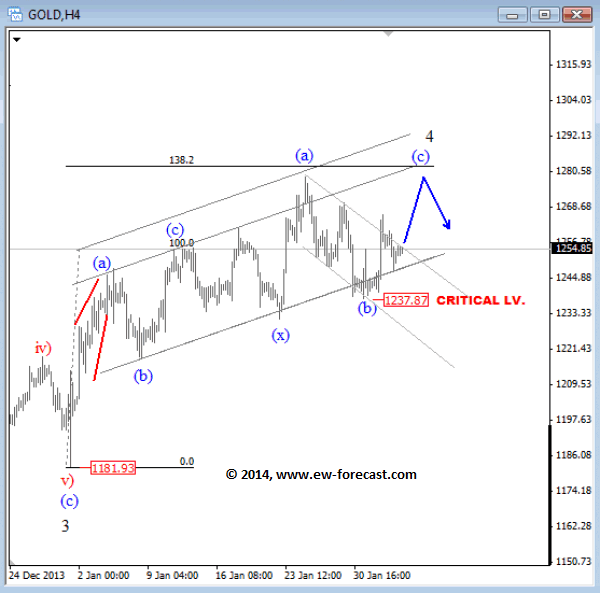

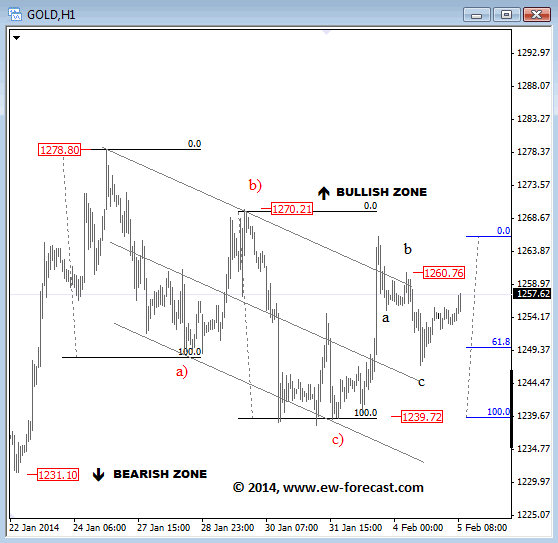

Gold has been trading higher since start of January but recovery is slow and overlapping within a trading channel which we think it's a corrective move. We are tracking wave 4 that can be part of an expanding diagonal in wave 5) down. If that is the case then current rally should stop somewhere around 1280-1300 region. Break of 1230 will confirm weakness for wave 5 of 5) going towards 1100/50. Gold has been trading higher since start of January but recovery is slow and overlapping within a trading channel which we think it's a corrective move. We are tracking wave 4 that can be part of an expanding diagonal in wave 5) down. If that is the case then current rally should stop somewhere around 1280-1300 region. Break of 1230 will confirm weakness for wave 5 of 5) going towards 1100/50.GOLD Daily Elliott Wave Analysis  GOLD Four HourGold found a support in the last few trading days at the lower side of a corrective channel, at 1237 where we see a completed three wave decline from the top, now labeled as wave (b). As such, we suspect that new highs are underway with wave (c) that may complete a second zigzag around 1280.GOLD 4h Elliott Wave Analysis  GOLD One HourGOLD is still trapped between 1231 bearish and 1270 bullish zone, but because of only three wave fall from 1278 we expect a continuation higher, back to the highs; ideally from current levels while 1239 holds.GOLD 1h Elliott Wave Analysis  Written by www.ew-forecast.com | Try our 7 Days Free Trial Here Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power. Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders. He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices. © 2014 Copyright Gregor Horvat - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

|

Posted: 05 Feb 2014 04:33 PM PST

Gold Price Close Today : 1257.30

Change : 5.60 or 0.45% Silver Price Close Today : 19.785 Change : 0.383 or 1.97% Gold Silver Ratio Today : 63.548 Change : -0.966 or -1.50% Silver Gold Ratio Today : 0.01574 Change : 0.000236 or 1.52% Platinum Price Close Today : 1377.70 Change : 5.90 or 0.43% Palladium Price Close Today : 706.90 Change : 7.00 or 1.00% S&P 500 : 1,751.64 Change : -3.56 or -0.20% Dow In GOLD$ : $253.86 Change : $ -1.22 or -0.48% Dow in GOLD oz : 12.280 Change : -0.059 or -0.48% Dow in SILVER oz : 780.40 Change : -15.66 or -1.97% Dow Industrial : 15,440.23 Change : -5.01 or -0.03% US Dollar Index : 81.130 Change : -0.110 or -0.14% Lookie, lookie! The GOLD PRICE rose $5.60 (0.4%) to close Comex at $1,257.30. Silver vaulted 2%, 38.3 cents, to 1978.5c. Wow. Friends, the gold price today punched clean through that downtrend line from April, poked its head up to $1,274.50, but couldn't hang on there. Closed at $1,257.30, just beneath that downtrend line. However, it has traded out into an even sided triangle and is pushing to break out to the upside. My fastidious mind prevents me from speculating that while the stock market is sinking like an anvil flung out of a C140 cargo plane and the Nice Government Men, whose self-anointed duty has now become to keep stocks rising forever, are struggling to keep stocks floating, the NGM also have a substantial interest in keeping down gold. Whew. That was one whale of a sentence. The GOLD PRICE is pawing the ground, trying to jump that fence. It's likely to succeed this week. The SILVER PRICE breakout through its short term (since January) downtrend line was even more dramatic, and carried it above both the 50 and the 20 day moving averages (1979 cents and 1976c). However, although it reached 2033c at its high, it didn't stay there, and it didn't close above 2050c. Ain't no point in talking much till it does, although I confess I bought some back yonder near the lows, and a little more since then. Every day makes it more believable that 31 December marked a double bottom with June AND the last low for the 2011-2013 correction. It's a vexing project to try to compare prices over time, but the conclusion I have to draw is that both silver and gold are hugely undervalued against their historical values. I theorize that the entire money supply -- gold, silver, and money substitutes such as the US dollar -- has been so inflated worldwide by money substitutes, that it has taken all prices higher and severely undervalued silver and gold. Here's an example from a recent National Geographic. While building the dome on the Cathedral in Florence, Italy, 1420-1436, the city paid the architect, Filippo Brunelleschi, thirty- six gold florins a year, later increased to one hundred. What's a florin? A gold coin -- "ducat" -- first minted in Italy about 1150 a.d. containing 0.1109 troy ounce of gold (3.5 grams 99-2/3% pure). The denomination was adopted in Venice as the ducat or zecchino ("sequin") and in Florence as the "florin," and in Germany, Hungary, and the Netherlands. What was it worth? Thirty-six ducats equals 3.9924 troy ounces fine gold. At $1,250 an ounce, Florence was paying Brunelleschi about $4,990.50 yearly. See what I mean? Just doesn't sound like much to pay the man designing and building your republic's greatest monument. What about his raise to 100 ducats a year? That boosted his pay to 11.09 oz, or, at $1,250 an ounce, $13,862.50/year. Three conclusions remain: (1) the pathbreaking genius architect Brunelleschi was stupid, (2) worked cheap, or (3) gold is tremendously undervalued today. Now, today's market: Stocks tried to rally today but wilted. Dow fell as far as it climbed yesterday and touched the 200 DMA (15,478.57), where it fainted. Closed lower by 5.01 (0.03%) at 15440.23. S&P500 behaved much the same, but is above its 200 DMA (1,709.39). S&P500 gave back 3.56 points (0.2%) to 1,751.64. Somewhere here will come a little corrective wave up. Not much question this downward leg is aligned with the market's major direction (is impulsive) and not merely corrective. That implies that direction has changed and that we've seen the top, but wait for a final verdict. Dow in gold today fell 0.26% to 12.28 oz (G$253.85 gold dollars) while the Dow in silver really tumbled, 15.6 oz or 1.97%, to 776.87 oz. (Oddly enough, just about a thousand silver dollars, well, $1,004.49 silver dollars in fact). US Dollar Index acts like a teenage girl at a dance, turning first one way and then another. Do you want to dance, or not? Dollar fell again today, 11 basis points (0.13%) to 81.13. Last four days have established a small downtrend. Has now failed twice to pierce its 200 DMA. Not promising. Euro has risen enough to fill the gap behind four days ago when it fell. Rose 0.14% to $1.3534. Gravity now controlling its trajectory. Yen rose 0.14% to 98.53 and is closing in on its 200 DMA (100.09). Wants to rally further. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

1 Comment for "GOLD Price Rally Correction Within Downtrend :: The Market Oracle ..."

Traders dealing in stock market are always under risk.Analyzing market , targets are very important.One can get help from Epic Research for Stock Tips.