Gold price | CHART: <b>Gold price</b> vs rates shows rally catalyst 'already in place <b>...</b> |

- CHART: <b>Gold price</b> vs rates shows rally catalyst 'already in place <b>...</b>

- Silver and <b>Gold Prices</b> Higher, <b>Gold Price</b> Climbed $9 to Close at <b>...</b>

- <b>Gold Price</b> Key Fundamental Driver :: The Market Oracle :: Financial <b>...</b>

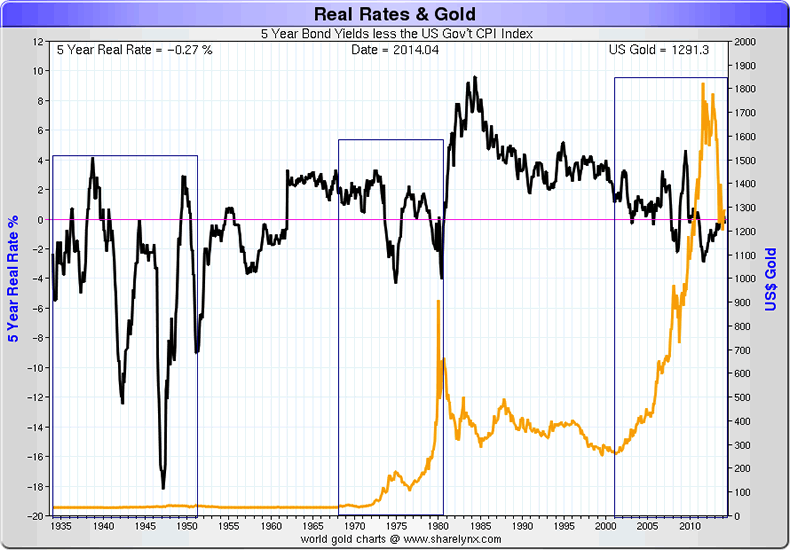

| CHART: <b>Gold price</b> vs rates shows rally catalyst 'already in place <b>...</b> Posted: 03 Jun 2014 12:46 PM PDT A number of gold market analysts have made the case that the one major factor influencing the price of gold is US inflation-adjusted interest rates and that the correlation is so strong that the gold price can be used as a predictor of rates, serving as an early warning system on both the direction and magnitude of moves. The underlying reason for the relationship is that as yields rise, the opportunity costs of holding gold increases because the metal is not income producing. Higher rates also boost the value of the dollar which usually move in the opposite direction of the gold price. Recently though this inverse correlation is between US 10-year real yields (Treasury Inflation Protected Securities or TIPS) and the price of gold has broken down. The 10-year TIPS is currently at 0.32% (which is consistent with a gold price north of $1,400), down from 0.68% two months ago. In a new research note Julian Jessop Head of Commodities Research at Capital Economics says this is a bullish sign for the gold price: "This decline at least partly reflects growing speculation that the neutral level for official interest rates in the longer term has fallen, which should reduce the opportunity cost of holding gold," says Jessop. The independent macro-economic research house notes based on the decoupling evident on this graph "there is already a catalyst in place for a near-term rally in the price of the precious metal". While US rates have not risen as expected, Europe's central bank is on the verge of moving rates below zero and may launch a full-blown quantitative easing program later this year and Japan is likely to extend its asset purchases through 2015. "Unless there is a decisive move below $1,200 per ounce, which seems unlikely given the (rising) floor set by mining costs, we are therefore retaining our end-2014 forecast of $1,450," the report concludes.  Source: Capital Economics | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and <b>Gold Prices</b> Higher, <b>Gold Price</b> Climbed $9 to Close at <b>...</b> Posted: 05 Jun 2014 05:16 PM PDT

The GOLD PRICE climbed $9.00 (0.72%) today to $1,253.00. Silver rose also, 28.9 cents (1.54%) to 1905.5c, over 1900c for the first time in five days. Silver's volume rose strongly, but the SILVER PRICE has passed no milestones. 20 DMA stands above at 1922c. Indicators are moving toward the upside, but no proof yet. The GOLD PRICE RSI is coming up from a very overbought reading. Full stochastics are scraping bottom, ready to rise. MACD might be ready to rise. So we have silver and gold prices higher today, but without any solid confirmation that they have indeed reversed. I've been suckered so many times that I want some proof. But do watch out. Silver can move with blinding speed when it turns. By fall silver and gold prices at these levels will seem absurd. Today the European Criminal Bank announced it was trimming its main lending rate from 0.25% to 01.5%. It also instituted a CHARGE (but called a "negative deposit rate") on bank reserves parked at the central bank, lowering that rate from zero to -.1%. On its marginal lending facility the ECB cut the rate from 0.75% to 0.40%. Charging banks for parking reserves with the ECB is supposed to flush them out of the bushes and make them lend. We'll see, as no other central bank has tried this trick. Other technical measures will also add to euro inflation. On a huge trading range (1.2%, from $1.3503 to $1.3670) the euro shot up 0.46% to $1.3663. That close took it above its 200 day moving average and left it not far below its 20 Dma (1.3676). The shorts got caught short. This action shows how loony, how goofy, these central bank denominated markets have become. Now think: interest rates chiefly determine currency exchange rates, along with inflation expectations: higher the rates, more desirable the currency; lower the inflation, more desirable the currency. The ECB just CUT its interest rate to inflate the currency more, and the euro rose. Give the euro a week or two, then gravity will reassert itself. The European criminals are taking the same path Bernanke and the US criminals have taken, guaranteeing perpetually rising stock markets by keeping the new money flowing. This will end in tears, wailing, and gnashing of teeth. But who knows? I'm only a nacheral born fool from Tennessee. Maybe in Europe pigs do have wings and anvils can fly. Some 56% or so of the US Dollar Index is made up of the euro, so big gains in the euro translate to big losses in the US dollar index. Dollar hit a high of 81.07 before turning and sinking to close at 80.39, down 33 basis points (0.42%). From 8:00 Eastern Time until the ECB announcement about 8:30 the dollar was climbing, then commenced dropping and kept on dropping all day. Yen rose 0.32% to 97.66, which didn't paint much of a splash on the chart. On the other hand, today could end the dollar's promise of a rally. Yield on the US 10 year treasury note fell 0.84% to close at 2.584%. That means that both bonds AND stocks rose today, a right rare occurrence. Stocks went hog wild at the prospect of money printing spreading around the globe. Dow made a new all time high, up 98.35 (0.6%) to 16,835.88. S&P500 made its seventh new high in eight days, rising 12.54 (0.65%) to 1,940.42. Folks, when the thought that crosses your mind is "It don't get no better than this," it probably won't. Now here's an odd and intriguing observation. While the Dow and S&P500 have been making new highs, the Dow in Gold and Dow in Silver have turned down. Oh, nothing dispositively certainyet, but still down. Dow in silver hit its overhead resistance line at 892.99 oz (S$1,154.57 silver dollars) on 1 June and bounced down. Today it dropped 0.98% to 882.26 oz (S$1,140.70). Chart is right here, http://scharts.co/Tj9TcZ RSI, MACD, Rate of Change, and full stochastic are all rolling over. But I'd like to see confirmation with a close below the 20 DMA at 864.84 oz (S$1,118.18). My maximum upside target has been and remains 912 oz (S$1,179.15). Dow in gold chart can be seen here, http://scharts.co/1unBfMx Since June 1 it has stalled, but only sideways. Today dropped 0.18% to 13,43 oz (G$277.62 gold dollars). Indicators are trying to roll over but no strong confirmation yet. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Gold Price</b> Key Fundamental Driver :: The Market Oracle :: Financial <b>...</b> Posted: 06 Jun 2014 05:29 AM PDT Commodities / Gold and Silver 2014 Jun 06, 2014 - 10:29 AM GMT By: Jordan_Roy_Byrne

Despite having spilled tons of ink on the subject, Ritholtz has continually failed to mention the major driver of Gold which is the direction of real interest rates. Ironically, Ritholtz often writes about following the data and avoiding narratives, yet he ignores this when discussing the yellow metal. Gold rises when real interest rates are negative or declining sharply. Its simple to understand. If investors and fund managers can earn a real rate of return on a money market fund, CD, or bond then there is no need for an alternative currency. If you can't earn a real rate of return safely then you'll seek alternative currencies such as Gold and Silver. The following chart from Nick Laird shows real rates and Gold over the last 80 years.

The venerable Ned Davis Research, as reported in Barrons yesterday noted that real interest rates recently have turned favorable for Gold. That is probably why they concluded that the bull is alive but wounded. Capital Economics, as reported by Frank Els also notes in a report that the real yields have declined. I happen to agree with NDR's view that the short-term technical situation is not conducive to speculative positions. Last week we wrote that Gold could fall to $1080 before the bear ends. A weekly close below $1200 would likely trigger that final washout. Ritholtz's arguments for the end of Gold's secular bull are surprisingly weak. Of course none revolve around the end to negative real rates. He cites a chart and some commentary which regards the dollar rebound as potentially an epic squeeze. This Business Insider style observation bears no reality. The US Dollar index is up less than 2 points in the last month and the commitment of traders report does not show a huge speculative short interest conducive to a short squeeze. Ironically, the epic squeeze is likely to come in Silver and on a lesser scale Gold. Gross short positions in Silver reached a new all time high last week. Further weakness in both metals could setup a large short squeeze in the coming months. By now you know that Ritholtz's conclusion (the bullish factors from 2001-2011 are gone) is incomplete and irrelevant. His five points help explain the bear market in Gold but none of them reveal anything about an end to negative real rates, which is the key driving force. If one wants to make a case that the secular bull is over then they need to make the case that real rates have bottomed and will rise indefinitely. This is what happened following 1951 (commodity peak with gold price fixed) and 1980. With the latest uptick in inflation and decline in yields, real rates are again negative and trending favorably for Gold. Statistically speaking inflation has almost no downside and has in fact started to trend higher. Core inflation in the OECD countries is at an 18 month high while inflation in Canada is at a two year high. The CPI and PCE in the US have started to tick up. MIT's Billion Prices Project which has led the CPI at key turning points since 2009 has accelerated higher since December 2013. This implies the CPI has further upside. With regard to rates, we know that each 1% rise in rates equates to an additional ~$180 Billion in interest costs. That is over 6% of FY 2013 federal revenue. Policy makers want but more importantly need inflation to get the debt burden under control. Real rates were strongly negative for much of 1942 to 1949. Inflation surged while real growth stagnated but we got the debt burden under control. It led to a tremendous uninterrupted equity advance from 1949 to 1956. However, that was after a rip roaring advance in hard assets. Hopefully this missive cut through both the bull and bear BS on Gold. Gold bugs will shamelessly promote anything as bullish while gold bears will mention anything but the only fundamental that matters, negative real interest rates. The historical bear analogs, sentiment and negative real rates argue that the precious metals complex is nearing the conclusion to a cyclical bear market within a secular bull. If you've followed my work you will know that I have been bearish since the hard reversal in March. Patience and discipline will be the name of the game over the coming weeks. Discipline is required to exit hedges at the right time while patience is required to buy as low as possible. I am looking at JNUG (3x long GDXJ) as well as several juniors I believe have exceedingly strong upside potential over the coming quarters and years. If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service. Good Luck! Email: Jordan@TheDailyGold.com Service Link: http://thedailygold.com/premium Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| You are subscribed to email updates from Gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Barry Ritholtz is out with another article spelling more doom for the precious metals sector and the gold bugs. The self proclaimed "Gold Agnostic" penned a 2500 word missive in January which followed a blog post amid the spring 2013 collapse titled

Barry Ritholtz is out with another article spelling more doom for the precious metals sector and the gold bugs. The self proclaimed "Gold Agnostic" penned a 2500 word missive in January which followed a blog post amid the spring 2013 collapse titled

0 Comment for "Gold price | CHART: Gold price vs rates shows rally catalyst 'already in place ..."