Goldman Sachs in huge bullion buy from cash-strapped Ecuador |

- Goldman Sachs in huge bullion buy from cash-strapped Ecuador

- IEA: Coal mining needs $735 billion investment through 2035

- CHART: Gold price vs rates shows rally catalyst 'already in place'

- Iron ore miner pulls staff after Sierra Leone Ebola outbreak

- Rio: $80 iron ore price means 'a lot' of miners will disappear

- Most US companies ‘unsure’ of whether they use conflict minerals in their products

| Goldman Sachs in huge bullion buy from cash-strapped Ecuador Posted: 03 Jun 2014 03:13 PM PDT New York investment bank Goldman Sachs has picked up 466,000 ounces of gold from cash-strapped Ecuador. According to the South American nation's central bank, Goldman acquired 1,165 gold bars, worth roughly $580 million at today's ruling price. Ecuador under socialist President Rafael Correa is seeking sources of cash "after borrowing more than $11 billion from China since defaulting on $3.2 billion of foreign debt five years ago," reports Bloomberg. Ecuador's is the only country on the continent using the US dollar as currency and the central bank explained it "invested" the gold with Goldman in exchange for more liquid assets. The country will get the gold back within three years and the central bank expects to turn a profit of as much as $20 million on the transaction without explaining how. George Gero, a vice president and precious-metals strategist in New York at RBC Capital Markets told Bloomberg: "It's really a puzzling transaction. The idea that there was a large sale and you don't know when it will come out into the market is probably pressuring prices." The price of gold fell 3% last week and on Tuesday continued to hover near four-month lows of $1,245 an ounce. Gold remains some 4% to the upside for 2014 but is down $135 from highs reached mid-March as the rally on the back of safe haven demand and bargain hunting loses steam. |

| IEA: Coal mining needs $735 billion investment through 2035 Posted: 03 Jun 2014 01:55 PM PDT The International Energy Agency's latest forecast of energy trends for the next 20 years predicts a significant fall in the share of fossil fuels in the global energy mix. Even with widespread deployment of CCS technology, fossil fuels' proportion of global energy is set to fall from the current 82% to 65% in 2035 according to the IEA's most likely scenario. However, at $19.2 trillion, total investment in gas, oil and coal still accounts for around half of total supply-side investment to meet global energy demand. Annual capital expenditure on oil, gas and coal extraction, transportation and on oil refining has more than doubled in real terms since 2000 and surpassed $950 billion in 2013. Investment in coal supply is much less expensive per equivalent unit of output than oil or gas; cumulative requirements in mining amount to $735 billion, with a further $300 billion in transportation infrastructure (mainly railways). The $1 trillion investment needed does not include the actual mining operation nor the costs of transporting the coal, which typically account for a large share of the delivered cost of coal. China accounts for around 40% of total capital expenditure on coal over the next 20 years the new report predicts. The epicentre of increased oil and gas investment activity has been North America, with the rapid expansion of shale gas and tight oil output, but investment in other parts of the world has also been on an upward trend. Annual investment in upstream oil and gas is predicted to rise to more than $850 billion by 2035, with gas accounting for most of the increase. More than 80% of the cumulative $17.5 trillion in upstream oil and gas spending is required to compensate for decline at existing oil and gas fields. Around one-quarter of the total goes to producing unconventional resources, e.g. oil sands, tight oil, shale gas. Gradual depletion of the most accessible reserves forces companies to move to develop more challenging fields; although offset in part by technology learning, this puts pressure on upstream costs and underpins an oil price that rises to reach $128/barrel in real terms by 2035. Importers of fossil fuels rely for secure supply on the adequacy of investment in resource-rich countries; the investment needed to supply India and China with imported oil and gas over the period to 2035 is more than $2 trillion, a level that helps to explain the push by their national oil companies to secure investment opportunities abroad. Meeting long-term oil demand growth depends increasingly on the Middle East, once the current rise in non-OPEC supply starts to run out of steam in the 2020s. Yet there is a risk that Middle East investment fails to pick up in time to avert a shortfall in supply, because of an uncertain investment climate in some countries and the priority often given to spending in other areas. The result would be tighter and more volatile oil markets, with an average price almost $15/barrel higher in 2025. High transportation costs for gas, compared with other fuels, are a constraint on the prospect of more globalised gas markets. More than $700 billion invested in LNG over the period to 2035 accelerates the integration of regional gas markets and has the potential to reduce current price differentials. However, the high cost of many liquefaction projects and cost inflation could dampen the hopes of LNG buyers for more affordable supply. Europe's near-term perspective for expanding LNG purchases is constrained by the need to outbid Asian consumers for available gas. |

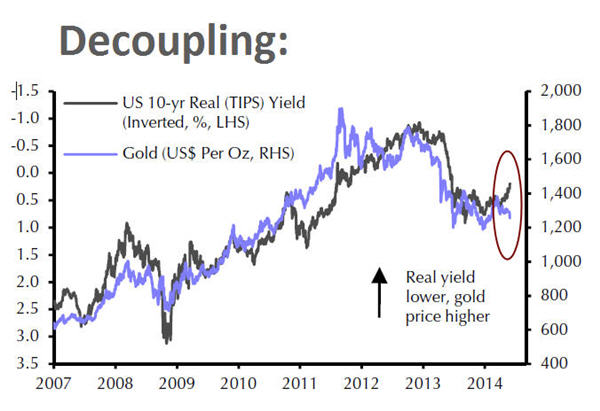

| CHART: Gold price vs rates shows rally catalyst 'already in place' Posted: 03 Jun 2014 12:46 PM PDT A number of gold market analysts have made the case that the one major factor influencing the price of gold is US inflation-adjusted interest rates and that the correlation is so strong that the gold price can be used as a predictor of rates, serving as an early warning system on both the direction and magnitude of moves. The underlying reason for the relationship is that as yields rise, the opportunity costs of holding gold increases because the metal is not income producing. Higher rates also boost the value of the dollar which usually move in the opposite direction of the gold price. Recently though this inverse correlation is between US 10-year real yields (Treasury Inflation Protected Securities or TIPS) and the price of gold has broken down. The 10-year TIPS is currently at 0.32% (which is consistent with a gold price north of $1,400), down from 0.68% two months ago. In a new research note Julian Jessop Head of Commodities Research at Capital Economics says this is a bullish sign for the gold price: "This decline at least partly reflects growing speculation that the neutral level for official interest rates in the longer term has fallen, which should reduce the opportunity cost of holding gold," says Jessop. The independent macro-economic research house notes based on the decoupling evident on this graph "there is already a catalyst in place for a near-term rally in the price of the precious metal". While US rates have not risen as expected, Europe's central bank is on the verge of moving rates below zero and may launch a full-blown quantitative easing program later this year and Japan is likely to extend its asset purchases through 2015. "Unless there is a decisive move below $1,200 per ounce, which seems unlikely given the (rising) floor set by mining costs, we are therefore retaining our end-2014 forecast of $1,450," the report concludes.  Source: Capital Economics |

| Iron ore miner pulls staff after Sierra Leone Ebola outbreak Posted: 03 Jun 2014 11:24 AM PDT London Mining's (LON:LOND) announced Tuesday eight of its employees have left the company's Marampa Mine in Sierra Leone due to an outbreak of the Ebola virus. The company said production has not been affected and no cases in communities around the mine have been identified, but it has also restricted non-essential travel and advised employees on holiday not to return. Marampa is about 120 km from Freetown, the capital of the West African nation. Marampa's full year production last year came in at 3.4 million wet metric tonnes (Mwmt), a 108% increase year on year according to the company's Q4 2013 production report. The Marampa mine is a brownfields site formerly operated by the Sierra Leone Development Company (DELCO) and William Baird between 1933 and 1975. Marampa reached a peak production of 2.5mtpa before low iron ore prices forced its closure. Continuing weak market economics and civil war prevented redevelopment of the mine until the mining licence was acquired by London Mining in 2006. London Mining is also developing projects in Greenland and Saudi Arabia.  London Mining acquired Marampa Mine in 2006. |

| Rio: $80 iron ore price means 'a lot' of miners will disappear Posted: 03 Jun 2014 10:48 AM PDT Benchmark iron ore managed a second day of gains on Tuesday after a 7% slide last week to lows last seen September 2012. According to data from the The Steel Index, the import price of 62% iron ore fines at China's Tianjin port was pegged at $92.50 per tonne, up $0.40 on the day. Iron ore is down 31% year to date on expectations of a glut on markets just as demand from China, responsible for two-thirds of the 1.2 billion tonne seaborne trade, cools. Stockpiles of imported iron ore at Chinese ports are at record highs above 110 million tonnes according to industry consultancy Steelhome, up more than 50% from this time last year. Global supplies of iron ore are set to exceed demand by 175 million tonnes next year as top producers Vale (NYSE:VALE), Rio Tinto (LON:RIO) and BHP Billiton (LON:BHP) continue to increase capacity, Goldman Sachs predicts. Number two Rio has been on a massive expansion drive even as it cuts back on projects in its other divisions – it is ahead of schedule to reach 290 million tonnes per annum and is targeting 360 million tonnes per year in the longer run. Almost 9 out of every ten dollars of profit at the diversified Anglo-Australian giant is derived from mining the steelmaking raw material. Rio CEO Sam Walsh told Bloomberg TV on Tuesday the flood of new supply poses less of a threat to the London-headquartered miner than its peers: "We are the lowest-cost producer in the world with costs of $20 per ton compared to the price around $92 a ton; I think we'll be OK. I don't think we're going to go down to $80 or else a lot of my friendly competitors are going to disappear. "I think that $80 is too low, I suspect a level somewhere north of $100 is probably more realistic. We are confident with our projections that as we go forward the expansions that we're making will be justified, they will be required by the world." While Rio is the most aggressive, BHP is also expanding in Australia and is on track to up production at its newest mine Jimblebar to 55 million towards its longer term target of 270 million tonnes per annum. Vale has been struggling to keep up with the Pilbara producers but the company is nevertheless sticking to its medium term expansion plans to lift its output above 400 million tonnes from the current 300 million tonnes-plus by 2018 as giant projects like S11D in the Carajas complex come on stream. Ivan Glasenberg, CEO of the the world's fourth largest miner Glencore, recently criticized the likes of Rio for the rapid expansion of their iron ore businesses which the Swiss-based commodities giant blames for the price weakness and the less than rosy long term outlook for the industry. |

| Most US companies ‘unsure’ of whether they use conflict minerals in their products Posted: 03 Jun 2014 10:19 AM PDT  The Congo has been dominated by warlords who slaughter innocent people and take their land, rich in highly demanded minerals. After a two-year warning given to US companies by regulators to come forward and disclose whether their products contain minerals thought to fuel armed conflicts in central Africa, several firms still say they are not sure. In an effort to curb the imports of minerals fuelling armed conflict in African nations, the US and the Securities and Exchange Commission (SEC) rules requiring manufacturers to report where their tantalum, tin, gold and tungsten supplies come from. The ruling, which came into force Monday, also requires companies to disclose payments made to overseas governments to develop natural gas. The first statements however evidence that several firms are taking advantage of a provision that allows them to declare they don't know the source of the metals they use. These firms get an A+ Some tech giants that have taken a lead on this issue, such as Intel, Apple and HP, filed in-depth reports last week. Others large-size firm, including Toyota, Canon, Tata Motors, Herman Miller, Soda Stream, Oracle, and Texas Instruments, have also filed their reports, but they are quite vague.  A study published in April by PricewaterhouseCoopers showed that only 4% of the 700 companies surveyed across 15 industries had completed a draft of their SEC conflict minerals filings. Intel, which announced in January it had enter the new year with the goal of making sure its supplies are fully "conflict-free," said the first internal audit showed some of its products are "DRC conflict undeterminable." For its remaining products, Intel states that they passed the test with flying colours. Apple, which has been publishing quarterly smelter reports, said the majority of them and also its refiners in its supply chain are either designated "conflict free" by the Conflict-Free Smelter Program (CFSP) or an equivalent independent third-party audit program, or are undergoing conflict minerals audits. HP, also working with the CFSP, stated that only 60 of its 201 smelters have been accredited as conflict free. The rules, part of the 2010 Dodd Frank Act that emerged in the wake of the financial crisis, directly affects about 6,000 companies, who are in turn demanding answers on conflict minerals from a further 250,000 or so suppliers. The SEC estimated conflict-mineral reports would cost companies up to $4 billion in the first year, and drop to between $200 million and $600 million in later years. In March the US Court of Appeals for the District of Columbia struck down part of the directive. It ruled that forcing companies to list their products as "conflict free," or not, as the rule had required, violated their First Amendment right to free speech. The audits, however, are still required, and their conclusions, even when inconclusive, will have to be filed with the SEC. Image courtesy of ENOUGH Project. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Goldman Sachs in huge bullion buy from cash-strapped Ecuador"