Buy Gold Bullion | One Ton <b>Gold</b> Shipment Into Hong Kong Revealed To Contain Just <b>...</b> | News2Gold |

- One Ton <b>Gold</b> Shipment Into Hong Kong Revealed To Contain Just <b>...</b>

- <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News

- Chinese businessman buys 200 million RMB worth of African <b>gold</b> <b>...</b>

| One Ton <b>Gold</b> Shipment Into Hong Kong Revealed To Contain Just <b>...</b> Posted: 06 Jun 2014 11:49 AM PDT Two years ago, stories of fake tungsten-filled gold coins and bars began to spread; it appears, between the shortage of physical gold (after Asian central bank buying) and the increase in smuggling (courtesy of India's controls among others) that gold fraud is back on the rise. As SCMP reports, a mainland China businessman, Zhao Jingjun, discovered that HK$270 million of 998kg of gold bars he bought in Ghana had been swapped for non-precious metal bars. What is perhaps even more worrisome, given the probe into commodity-financing deals and the rehypothecation evaporation; these gold bars were shipped to a Chinese warehouse before Zhao was able to confirm the fraud. As South China Morning Post reports, police were last night making arrangements with a mainland businessman to check whether HK$270 million of gold bullion he bought in Africa was genuine after part of the consignment was swapped with metal bars.

We can't help but feel this is not the last time as commodity-backed financings are unwound en masse and the underlying collateral found missing... sourcing the underlying by any means will be on the rise. * * * For those who want to learn more about China and gold, please read "How China Imported A Record $70 Billion In Physical Gold Without Sending The Price Of Gold Soaring" For those curious what a fake 10oz bar looks like, here it is again: It appears in thise case, the fraudsters could not even afford Tungsten (or maybe the Tungsten was rehypothecated elsewhere)... (39 votes) |

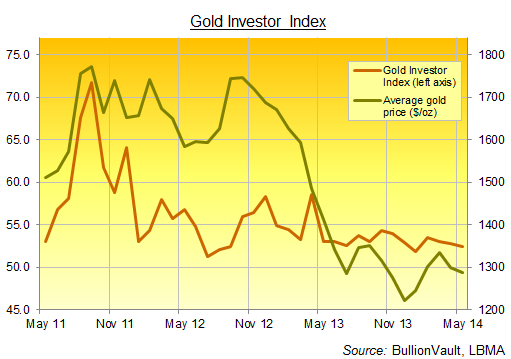

| <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News Posted: 03 Jun 2014 01:02 AM PDT Gold Investor Index falls, one-fifth of May's buyers jump on 4-month lows... If GOLD INVESTOR sentiment reflects financial stress and anxiety, then it has clearly dropped since the price peaks of mid-2011, writes Adrian Ash at BullionVault. The stock market is setting new record highs, after all. Right alongside, gold sentiment amongst private investors ebbed further in May, as our Gold Investor Index shows today. Wall Street's S&P500 broke 1,900...a rise of 23% from 12 months ago and more than doubling from May 2009. The gold price meantime fell to 4-month lows. And sentiment?

The Gold Investor Index is calculated using proprietary data from Bullionvault, the 24-hour precious metals exchange which leads the market for physical bullion online. More than 52,000 people have now used BullionVault to buy, store and trade physical gold and silver – the internet's largest pool of private precious metals investors. Between them, they own $1.3 billion worth of gold bullion (£785m, €965m) – more than is held by most of the world's central banks, and unchanged in May from April. Instead of surveying intentions, or simply reporting the change in total client property, the index shows the balance of individual actions across the month. It take the number of net sellers – people who reduced their holding – from the number of net buyers (including new users, who started at zero), and gives that figure as a proportion of all gold owners at the start of the month. That is rebased so that 50.0 would signal a perfect balance. The chart above shows how the Gold Investor Index has varied over the last three years. (Data attached as XLS below. You can read more about its methodology and aims in Fear, Delusion & the Gold Investor Index here.) The index recorded a series low of 48.8 in February 2010 as the financial crisis took a pause. It then peaked at 71.7 in September 2011 as gold prices hit record highs. And in May 2014, with prices in a tight, boring range until the very last week, the index gave a low but positive reading of 52.4. That 3.9% drop in Dollar gold prices counted, however. One-fifth of May's net gold buyers on Bullionvault acted in the last 4 days of the month, pulling the index higher...from what would have been a near 2-year low...as investors took advantage of lower prices. Short term this looks still distinctly unbullish. Investors are buying the dips, not driving any new phase in the metal's previously long upwards trend. More starkly still, silver buyers on Bullionvault last month added more metal than any month since December 2012. Again, this bargain-hunting came on a sharp drop in prices, swelling total silver holdings by 2.9% in May to some $282m by value (£169m, €207m). Longer-term, such Dollar-cost averaging looks smart. Private investors as a group continue acquiring bullion as part of their broader savings, well-remembering the lessons of the financial crisis but not chasing prices higher as they buy financial insurance. And since the price crash of last spring, gold sentiment has mirrored the broader moves in bullion prices, flattening but holding positive as new investors continue to join the market. |

| Chinese businessman buys 200 million RMB worth of African <b>gold</b> <b>...</b> Posted: 06 Jun 2014 09:57 AM PDT

Zhao Jingjun, a mainland businessman, was horrified to discover that the over HK$270 million of gold bullion (around 217 million RMB) he bought in Africa was swapped for worthless metal bars. Police are currently looking into a possible counterfeit scheme, which if uncovered, could prove to be the biggest heist of the decade. Expecting to see a fraction of the 998kg gold bars before him, Zhao opened part of his shipment in front of his buyer in Hong Kong and discovered his bullion had been switched. The golden goods, all 14 cases, were accompanied by his staff from Ghana on a private flight last month. "Officers were told that his employee confirmed the cases contained the gold before it was loaded onto the chartered flight in Ghana," explained a police source. After the bullion arrived in Hong Kong Zhao's employee left the delivery to the staff of a logistics company at Chek Lap Kok airport where it was then couriered to a Tsuen Wan warehouse. Zhao Jingjun arrived in Hong Kong on Monday as he was set to meet his buyer on Wednesday for their meeting. He'd arranged for five of the cases to be couriered to the buyer's office in Hung Hom, but according to the source, "when he opened the boxes, he found they were filled with metal bars instead of gold bullion,". Zhao presented documents to the police proving that he bought the bullion in Ghana and that they were delivered to Hong Kong. However, a police investigator said: "We don't rule out the possibility that the gold bullion may have been switched for metal bars before being delivered to Hong Kong." Stealthy work indeed, but I wouldn't like to be the one on the receiving end of Zhao's temper if they are ever found out. A similar incident occurred 4 years ago when 265 gold bars were taken from a Yuen Long company. Fortunately police recovered most of the missing HK$90 million and arrested three men in connection with the crime so there is hope for Zhao yet. [Pic via kinibiz.com] By Sophie Regan |

| You are subscribed to email updates from Buy gold bullion - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Buy Gold Bullion | One Ton Gold Shipment Into Hong Kong Revealed To Contain Just ... | News2Gold"