Barrick scraps corporate development team: report |

- Barrick scraps corporate development team: report

- Iron ore falls again, hits fresh two-year low

- Chinese investment to make Peru world’s second-largest copper producer

- Cameco shuts down operations, locks workers out

- Largest iron ore miners smashing Chinese competitors

- Why short-term slowdowns are great

| Barrick scraps corporate development team: report Posted: 27 Aug 2014 01:24 PM PDT Barrick Gold (NYSE:ABX) is disbanding its corporate development team and further cuts may be coming as the company works to reduce costs, according to a report by Reuters. Former investment banker Rick McCreary, head of the development team since 2011, is leaving the Toronto-based company this week, a Barrick spokesman was quoted by the news agency as saying. A new group, called business development, will be created following the elimination of the corporate development team, which dealt mainly with identifying and evaluating assets to purchase. "The change reflects our focus on achieving operational excellence across the company, with an emphasis on optimizing our existing portfolio and further improving efficiency across our operations," said Barrick's Andy Lloyd. Most members of the team being dissolved will exit the company, while some will become part of the new business development group, according to the Financial Post. Both reports said the spokesman declined to discuss whether the world's top gold miner in terms of production is conducting another series of cuts that other sources said would be announced in the coming weeks. |

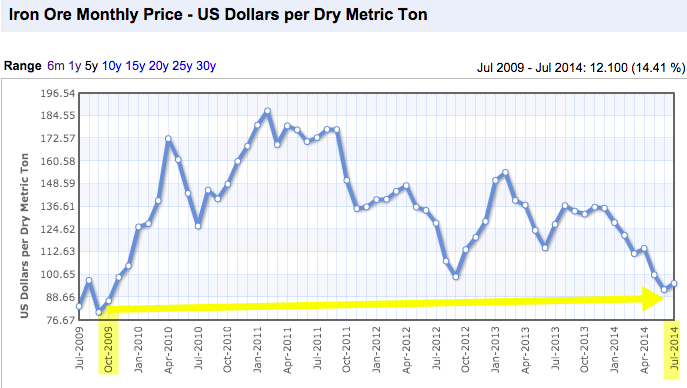

| Iron ore falls again, hits fresh two-year low Posted: 27 Aug 2014 10:57 AM PDT Prices for iron ore tumbled again Wednesday for the eighth day in a row, hitting a fresh two-year low. Benchmark Australian ore, with a 62% iron content, dropped 70 cents to $88.20 a tonne, according to The Steel Index, bringing the losses since the middle of the month to 5.6%. So far this year the commodity has dropped 35% due to a surge in supply and a slowdown in China, which consumes more than two-thirds of the 1.2 billion seaborne trade. After reaching a high of $158.90 in February, the industry was jolted on March 10, when iron ore suffered the worst one-day decline since the 2008-2009 financial crisis, cratering 8.3% in a single session.  Dangerously approaching a 5-year low. Source: Index Mundi. The recovery from there was swift, but by June this year it was sliding again, hitting a low of $89 a tonne. Iron ore prices slowly clawed back some of those losses for a 2% gain in July breaking a six-month losing streak. But August has brought renewed selling, and the commodity fell yesterday to the lowest since September 5, 2012. The steel-making raw material is vital to the profitability of many of the world's largest miners, such as BHP Billiton, Rio Tinto, Anglo American and Vale. They are spending billions of dollars ramping up output to meet anticipated future demand, and capture market share, while pushing the global market into surplus. If the commodity loses another $2 a tonne, it will be the lowest price since October 2009. Image from archives. |

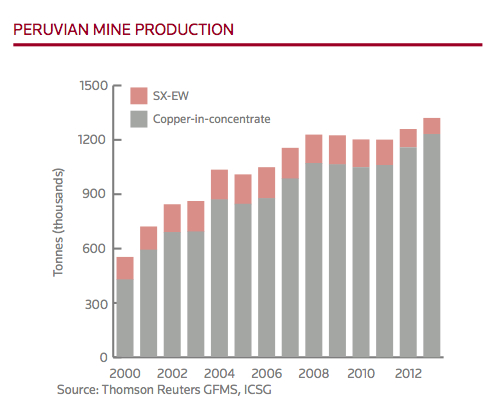

| Chinese investment to make Peru world’s second-largest copper producer Posted: 27 Aug 2014 09:24 AM PDT  The biggest push came from China Minmetals' MMG subsidiary in July, with its $7 billion acquisition of Glencore's flagship Las Bambas project. A $20 billion pipeline of China-backed mining projects in Peru is set to place the country back in the second position among the world's largest copper producers by 2016. The biggest push came from China Minmetals' MMG subsidiary last month, with its $7 billion acquisition of Glencore's (LON:GLEN) flagship Las Bambas copper project, in the southern part of the country. According to FT.com (subs. required) that meant that Chinese backers are now behind one-third of all Peru's new mining investments by value, officially estimated at $61 billion (in Spanish). Ironically, by investing in Peru, Asian capitals are helping the nation take over China as the world's No. 2 producer of the red metal, a title the South American country lost in 2012. Currently China's output stands at about 1.6 million tonnes per year, well below the nearly 5.8 million annual tonnes produced by Chile, the world's leader, based on data provided by CRU Consulting earlier this year. Peru's energy and mining minister, Eleodoro Mayorga Alba, has repeatedly said the country's total production will hit 2.8 million tonnes in 2016, up from 1.4 million tonnes in 2013. This, thanks major projects slated to begin operations by or during that year. Freeport-McMoRan's (NYSE:FCX) Cerro Verde's $4.6bn expansion: Scheduled for completion during the first quarter of 2016, with initial production to begin next year; Southern Copper's (NYSE, LON:SCCO) $1bn Tía María mine, near Arequipa, which received final approval earlier this month, after being halted for almost three years due to opposition from nearby communities concerned about the mine's use of water; Chinalco's (HKG: 3668) $4.82bn Toromocho copper mine, currently undergoing an expansion; Minmetals and Jiangxi's $2.5bn El Galeno, a copper, gold and silver project. Other Chinese mining investments in Peru include a $1.5bn expansion of iron ore mine by Shougang Hierro Peru in Marcona, and Jinzhao Mining's planned $3.28bn investment in Pampa de Pongo, also an iron ore mine. |

| Cameco shuts down operations, locks workers out Posted: 27 Aug 2014 07:00 AM PDT Canadian uranium producer Cameco (TSX:CCO)(NYSE:CCJ) said Wednesday it is halting production at two of its Saskatchewan uranium operations over a labour-management dispute. The Saskatoon-based miner has initiated a shutdown at the McArthur River uranium mine, the largest in the world, as well as the Key Lake mill, after workers' union said they planned to strike starting Saturday. Employees at both operations have been without a contract since Dec. 31, 2013. The company and union jointly applied for conciliation under the Canada Labour Code in July. Cameco said the labour disruption is not expected to affect its 2014 uranium delivery commitments. There are 535 unionized workers at the two operations. Uranium prices have recently continued their slide to new record lows. Although there's no spot price for the metal, UX Consulting's most recent indicator, published Aug. 25, came to $31 a pound. For years, Canada was the world's largest uranium producer, accounting for about 22% of world output, but in 2009, was overtaken by Kazakhstan. Currently the country's production comes mainly from the McArthur River mine Image courtesy of Cameco. |

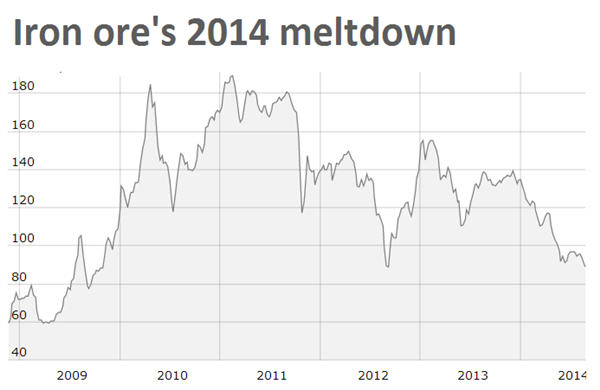

| Largest iron ore miners smashing Chinese competitors Posted: 27 Aug 2014 03:45 AM PDT It may sound odd, but there are a few iron ore producers quite happy with the slump in the commodity price. They are the market's "big three " —Rio Tinto (ASX:RIO), BHP Billiton (ASX:BHP) and Vale (NYSE:VALE)— whose vast low-cost mines are driving Chinese higher-cot rivals out of the market. According to a recent research report by Australian analyst Michael Komesaroff (subs. required), the triumvirate of global iron ore miners have kept supply growth at full tilt even as demand decelerates. "As long as this state of affairs continues, the ore price will stay below the level dictated by cost-curve fundamentals: probably in the US$95-US$100 per tonne range," he writes in the paper published by the global research powerhouse Gavekal's China-based arm Gavekal Dragonomics. Komesaroff notes the drop in prices has nothing to do with a lack of demand, but with the fact that Rio Tinto, BHP and Vale continue to ramp supply up. In fact, Australian annual output is now 150 million tonnes, higher than in 2011. The problem for Chinese producers, which feed 35% of the local demand, is that their ore is lower grade than the foreign imports. At the same time, their production costs are at the upper end of the big three. The analyst believes the situation is not sustainable for much longer and that once high-cost Chinese miners are driven out of the market, iron ore prices will rise back to around $110. Collateral damage Mid-cap Australian iron ore miners will also fall victim of this fight to the death, as the ore price is beginning to reach levels where they will struggle to break even. According to UBS estimates, published by The Sydney Morning Herald, Australian miners Grange Resources (ASX:GRR) and Gindalbie Metals (ASX:GBG) are facing uneconomic production, with break-even prices of $87 a tonne and $98 a tonne respectively. Atlas Iron (ASX:AGO) and Arrium (ASX:ARI) are next in the firing line with cash costs over $80 a tonne. No one is predicting a move back to the early days of the iron ore trade when the price, set during secretive annual contract negotiations, never strayed from $10 a tonne for more than 20 years. But it is worth noting that back in 2007 the commodity was still trading at $36 a tonne. And the all time high of $192 in February 2011 now seems like nothing more than an aberration. Image by Inc| Shutterstock.com |

| Why short-term slowdowns are great Posted: 27 Aug 2014 01:50 AM PDT As an investor, operator, and merchant banker, I am happy to see all the short-term pain in the industry. We are going through a thinning process that will, in the near-term, hurt everyone and everything, but in the long-term, put the industry on better footing. Here's why: No commodity demand destruction: Let's start with a core concept that people seem to be missing — this industry reset is not a demand-driven reset, it is a capital market-driven reset. The fact is that commodity demand is still high, people are using stuff and most of the world is coming out of the recession, and it has a pent-up demand. Even China is still growing. Let's face some facts, China is not falling off of a cliff and demand is going to stay up there, and it will probably continue to grow. No one is going back to the Stone Age, and Americans are still going to expect new cars. India, and every second- or third-world country, is also coming into the modern world; we are not going to see a halt in global development. Capital redirection: 2004-2012 was a period where a lot of capital chased stupid projects. Everyone did it, from the majors on down, and now they are being forced to go through and decide what to fund and what to cut off/kill on the vine. Just because $100m was spent does not mean the project should get another $20m. If it is not economic, it is never going to be economic, and if it sits under a large sacred lake it should probably be ditched. Majors are doing the best job of killing projects, but the public market is also doing a good job of it; however, the public market seems to fund some things for years that will never become a mine… Majors are not stupid: Just because the price of iron ore is down and the majors are taking a year to shake out the market, it does not mean that the price will stay there for a long time. In markets that are managed, a year of bad earnings that shores up market share and wipes out the weak companies is GREAT. Prices will bounce back, but second-rate Chinese domestic production will not. Pipeline interruptions: Everyone, including majors, has been forced by the capital markets to put projects on hold. This period of market correction has put 10-50 good projects on care/maintenance and will slow down the increase of supply in commodities like zinc and copper, where supply should be growing. This slowdown is going to seriously impact supply in 2016-2020 and lead to the next bubble. What juniors should do?: Either partner project in markets that matter to majors, or focus on markets that are going to be independent of major involvement — like zinc or mineral sands. But in either case, figure out how to operate with less capital. If you are management, what is your business plan? Running a pipeline company that is generating projects for majors, or running a development company that is focusing on niche projects/markets that do not matter to majors, but can still make money? Don't do both. What should investors do?: Find cheap options and buy them. Buy quality companies that are going to weather the storm. Buy BHP or VALE, or find beaten down juniors who have material projects to majors, but do not chase grassroots exploration plays at this point. - Benjamin Cox |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Barrick scraps corporate development team: report"