13 August 2014 - Harga Emas Naik Didorong Ketegangan Geopolitik di Ukraina |

- 13 August 2014 - Harga Emas Naik Didorong Ketegangan Geopolitik di Ukraina

- 13 August 2014 - Quick! Buy Gold "Before the Fed Hikes Rates"

- 13 August 2014 - India’s Gujarat gold traders see easy availability of smuggled metal

- 13 August 2014 - 美联储疯狂印钞 黄金或成投资“宠儿

| 13 August 2014 - Harga Emas Naik Didorong Ketegangan Geopolitik di Ukraina Posted: 13 Aug 2014 03:03 AM PDT From:http://bisnis.liputan6.com/read/2090212/harga-emas-naik-didorong-ketegangan-geopolitik-di-ukraina Liputan6.com, New York - Harga emas dunia mencatat kenaikan usai mengalami penurunan selama dua hari didorong tanda-tanda ketegangan politik antara Rusia dan Ukraina yang melukai kepercayaan ekonomi di ekonomi zona euro. Melansir laman Reuters, Rabu (13/8/2014), harga emas berjangka AS untuk pengiriman Desember ditutup naik 10 sen menjadi US$ 1.310,60 per ounce. Harga emas di pasar Spot naik 0,1 persen menjadi US$ 1.309 per ounce. Moral analis dan investor di Jerman yang merupakan negara dengan pereonomian ekonomi terbesar Eropa, jatuh pada bulan Agustus ke level terendah dalam lebih dari satu tahun setengah karena krisis di Ukraina mengambil korban, menurut survei bulanan ZEW. Emas meraup keuntungan sedikit juga karena penguatan dolar terhadap euro imbas dari sentimen laporan Jerman, di mana bursa saham AS ikut tergelincir karena ketidakpastian kondisi Ukraina dan Timur Tengah. Sedangkan imbal hasil obligasi Treasury AS naik tipis tetapi tetap mendekati level dalam 14-bulan. Rusia mengatakan konvoi 280 truk telah pergi untuk memberikan bantuan kemanusiaan kepada Ukraina, di tengah peringatan Barat tentang penggunaan bantuan sebagai alasan untuk invasi. Harga emas telah naik sekitar 9 persen tahun ini, sebagian besar dipicu ketegangan antara Barat dan Rusia atas Ukraina dan kekerasan di Timur Tengah. Logam mulia ini dipandang sebagai alternatif investasi untuk aset berisiko seperti ekuitas. Emas selama ini sebagian besar berada pada level US$ 1.280 dan $ 1.325 dalam 30 hari terakhir di tengah meningkatnya ketegangan geopolitik. "Kecuali kita melihat perubahan besar lain, saya tidak berpikir berita saat ini akan membawa kita untuk keluar dari kisaran tersebut," kata analis Mitsubishi Jonathan Butler. (Nrm) Source:http://bisnis.liputan6.com/read/2090212/harga-emas-naik-didorong-ketegangan-geopolitik-di-ukraina |

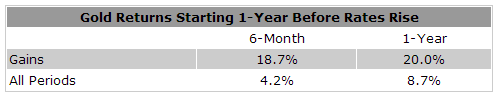

| 13 August 2014 - Quick! Buy Gold "Before the Fed Hikes Rates" Posted: 13 Aug 2014 02:58 AM PDT From:https://www.bullionvault.com/gold-news/gold-fed-rates-08201410 SIMPLE logic would tell you to sell gold when the Federal Reserve raises rates... not to buy it, writes Steve Sjuggerud in his Daily Wealth email. But the truth is, based on history, the price of gold actually soars in the 12 months before the Federal Reserve raises interest rates. Chances are the Fed will raise interest rates in 2015...so we are in that 12-month period right now. (I explained why rates will likely rise next year in this recent DailyWealth.) I know today's message will surprise you. But we have a fantastic opportunity to buy gold today, before the Fed hikes rates. Logically, gold should do well when interest rates are near zero – not when the Fed is raising interest rates. But history shows that's not actually the case. You see, when rates are near zero, there's no penalty for owning gold (which pays you no interest). When interest rates rise, on the other hand, you're giving up a potential yield on your money in order to hold gold. That yield should discourage gold demand and hurt gold prices. The problem is, markets don't always work based on simple logic. And in the case of gold, rising rates actually gives us a fantastic opportunity. We sized up over 40 years' worth of data. We looked at all the times when the US moved from periods of low or falling rates into periods of rising rates. History shows that the biggest gains in gold come roughly one year BEFORE the Fed raises rates. The numbers get a little crazy. But they're absolutely true. The table below has the full details... Fed rates vs. gold price gains As you can see, buying gold one year before the Fed raises rates leads to massive gains. One year before rates rise, gold increases 20%, based on history...crushing the "buy-and-hold" one-year gain. And most of the gains come in the first six months, as the table shows. In short, we want to own gold before and as the Fed raises rates. The Fed will almost certainly raise interest rates in 2015. So we want to own gold today. I know this will seem illogical and backward to many investors. Rising rates "should" hurt gold. But history tells a different story. With rising rates on the way next year, gold is in a prime situation to soar. Buy gold at the lowest prices in the safest vaults today... Source:https://www.bullionvault.com/gold-news/gold-fed-rates-08201410 |

| 13 August 2014 - India’s Gujarat gold traders see easy availability of smuggled metal Posted: 13 Aug 2014 02:54 AM PDT From:http://www.mineweb.com/mineweb/content/en/mineweb-gold-news?oid=249955&sn=Detail MUMBAI (MINEWEB) - Despite some minor relaxation in government curbs in May this year, gold imports into Gujarat state have fallen to a record low in July. Data showed that just 3.06 metric tonnes of gold was imported in July 2014, which has been termed the lowest figure for July in the last six years, and as compared to 8.9 metric tonnes in July 2013 – down around 60% year on year. This parallels somewhat similar figures elsewhere in India After several months, gold imports had re-crossed the double digit mark in June 2014, recording 17 tonnes in Gujarat – the home state of India's new Prime Minister, Narendra Modi. Analysts had said this was one of the main reasons why the new government did not relax its stranglehold on gold import curbs in its first Budget in July. Bullion traders have maintained that since gold is easily available in the market given the unprecedented rise in smuggling, there is no urgency to bring in the precious metal via the legal channels. Reports indicate that in Gujarat alone, over 130 kilograms of smuggled gold has been recovered as of July 2014, by central intelligence authorities. These are the official figures, and traders indicate that the amount could be higher by several thousand kilograms. A faint silver lining is visible however. Silver imports in Ahmedabad, Gujarat, which had crossed 1,500 metric tonnes during April 2013 to January 2014, a record high for the last five years - is showing signs of a renewed small revival. Imports of the white metal have recorded a small rise in comparison to June 2014, with 6.87 tonnes of silver imported in July 2014. However, it was hugely below the 274.92 metric tonnes imported in July 2013. Silver imports by the Indian state had earlier recorded a 450% jump in the nine month period 'til January 2014, as compared to the previous corresponding period of last year. The government's high import duty on gold, which was also applied to silver, has clearly put paid to the huge 2013 appetite, said traders. Source:http://www.mineweb.com/mineweb/content/en/mineweb-gold-news?oid=249955&sn=Detail |

| 13 August 2014 - 美联储疯狂印钞 黄金或成投资“宠儿 Posted: 13 Aug 2014 02:51 AM PDT From:http://finance.qq.com/a/20140813/010362.htm 若历史重演,且美联储如期在2015年三季度左右首次升息,则目前正值升息前的"喘息"阶段,或为黄金提供进一步上涨空间 尽管美联储(FED)极有可能于今年10月退出QE,但其印钞机转速较去年却不降反升,加之国际地缘政治局势越发紧张,黄金的"美好时代"真的来了吗? 彭博分析师Kenneth Hoffman本周一指出,截至2014年7月,今年美联储货币供应年率同比增幅已达7.7%,远高于2013年的4.75%,同时也略高于2012年的7.65%。美联储加大马力印钞或是黄金最大的利好因素。 货币宽松利好黄金 顺着Kenneth Hoffman的逻辑,M2货币供应速度加快意味着美联储正试图推高通货膨胀,而黄金作为传统的抗通胀资产,这无疑支撑了金价的持续上涨。 数据显示,黄金价格进入8月后强势反弹。在上周三当天,现货黄金甚至一日内急涨1.6%。而2014年至今,国际金价已经上涨约8.6%,截至《第一财经(微博)日报》记者发稿,报1315美元附近。 从另一方面而言,货币在逐步增加,但黄金供应的年率增幅只有1.5%~2.5%,随着通胀走高,黄金前景或自然向好。 同时,美联储连续重申在购买资产计划结束后的一段时间内保持高度宽松货币政策仍是合适的。即使就业和通胀接近目标水平,仍可能长期维持联邦基金利率低于正常水准。由此,低利率环境下通胀上行从根本上在中长期支撑金价。 此前,美联储在7月31日公布的政策声明中指出,通胀已经向"接近于"长期目标的水平发展,且通胀持续低于2%的可能性"有所降低"。然而,美联储在6月声明称其"低于"目标水平。对此细微措辞变化,分析人士曾指出,美国通胀水平已见明显好转。 加息前一年黄金或大涨20% 目前,市场普遍预期美联储将在2015年下半年左右首次升息。对于多数投资者来说,美联储加息会增加持有黄金的机会成本,因此金价会下跌。然而,过去四十多年来的历史数据却给出了新的见解。 Daily Wealth分析师Dr. Steve Sjuggerud收集了过去四十多年来美联储每次升息或降息时金价的历史变动数据,得出的结论令人咋舌:金价往往在美联储升息前的一年中会获得最大的涨幅。 Sjuggerud于上周撰文称,市场走势总是会和公认的"简单逻辑"相违背。因此,不排除美联储升息会为投资者带来一个绝佳的买入机会。他指出,金价在美联储升息前的一年中往往会大涨20%,而其中的绝大部分涨幅(18.6%)是在前6个月发生的。 若历史重演,且美联储如期在2015年三季度左右首次升息,则目前正值升息前的"喘息"阶段,或为黄金提供进一步上涨空间。Sjuggerud认为目前不失为一个买入黄金的绝佳时机。 然而,目前美联储内部对于货币政策立场的争议日趋白热化,外界猜测加息日程或将提前。美国费城联储主席普罗索(Charles Plosser)、里奇蒙德联储主席莱克(Jeffrey Lacker)近期纷纷展现强势鹰派姿态,不赞同FOMC在资产购买结束后相当一段时间才首次升息的声明措辞。 花旗银行(Citi)周一(8月11日)在报告中称,通常而言,美元走强利空黄金,但幸运的是美元和黄金都拥有避险的属性,近期的伊拉克局势、以巴冲突以及俄乌局势的风险都在持续推高避险情绪。因此只要地缘政治风险存在,美元与黄金同涨的情况将继续维持。 地缘政治风险短期助推金价 最新地缘政治风险又一次搅动了市场的脆弱神经:俄罗斯与西方之间上演互相制裁的戏码、美国在伊拉克发动定点空中打击等。地缘政治局势的错综复杂致使避险情绪抬头,金银价格大幅反弹,其或将继续成为支撑金价的一个重要"砝码"。 进入8月,黄金市场便开始上攻。而此前,受制于市场的加息预期,以及经济数据好转带来的避险情绪消退,国际金价持续回落。自7月14日的大跌以来,金价一直处于低位震荡状态,在1300美元/盎司一线徘徊。 有分析师对《第一财经日报》记者表示,目前支撑金价上涨的临时性因素居多,如美国国债收益率持续下跌和地缘政治紧张等。 也有分析师认为,从短期来看,金价上涨的原因是受到地缘政治危机的刺激,而避险买盘引发的反弹往往是暂时的,因此这类上涨的可持续时间并不长。 此外,上周五德意志银行(Deutsche Bank)在大宗商品周度报告中建议,美国经济复苏将导致美债行情向好,这在中期来看会阻滞金价反弹。 (第一财经日报) |

| You are subscribed to email updates from Home To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "13 August 2014 - Harga Emas Naik Didorong Ketegangan Geopolitik di Ukraina"