Silver prices | Gold and <b>Silver Prices</b> Tumble 1.7% | Coin News |

- Gold and <b>Silver Prices</b> Tumble 1.7% | Coin News

- Gold and <b>Silver Price</b> False Break Lows? :: The Market Oracle <b>...</b>

- How Short Contracts Have Moved <b>Silver Prices</b> <b>...</b> - ETF Daily News

- <b>Silver Prices</b> Today Bounce on Geopolitical Tensions - Money Morning

| Gold and <b>Silver Prices</b> Tumble 1.7% | Coin News Posted: 02 Sep 2014 12:33 PM PDT  Gold, silver and other precious metals plunged on Tuesday, the first trading day of the new month Gold and silver prices tumbled 1.7% Tuesday, their lowest levels since June. Declines following the extended U.S. Labor Day Weekend were attributed to strength in the dollar, which surged to a more than one year high. Gold for December delivery declined $22.40 to close at $1,265 an ounce on the Comex division of the New York Mercantile Exchange. The settlement price was the lowest since June 17.

Gold prices ranged from a low of $1,263.10 to a high of $1,290.90. Silver for December delivery shed 34 cents to $19.15 an ounce. The white metal traded from $19.11 to $19.57. Elsewhere in precious metals trading:

London Fix Precious MetalsEarlier fixed London precious metals declined as well. When comparing London bullion Fix prices and the LBMA Silver Price from Monday PM to Tuesday PM:

US Mint Bullion Sales in AugustUnited States Mint bullion sales were unchanged Tuesday as of 3:11 PM ET. Below is a sales breakdown of U.S. Mint bullion products with columns listing the number of bullion coins sold last week, last month and the year to date.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and <b>Silver Price</b> False Break Lows? :: The Market Oracle <b>...</b> Posted: 04 Sep 2014 08:21 AM PDT Commodities / Gold and Silver 2014 Sep 04, 2014 - 05:21 PM GMT By: Austin_Galt

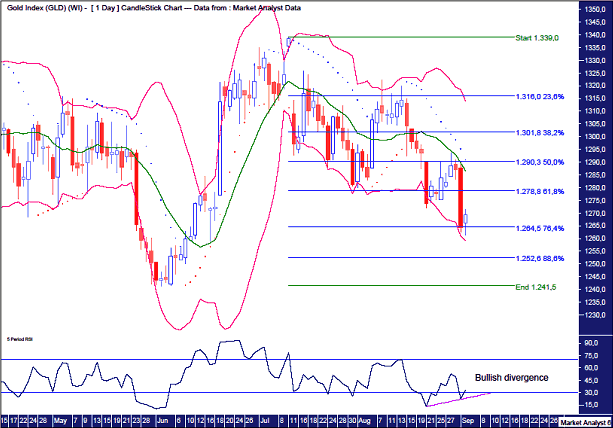

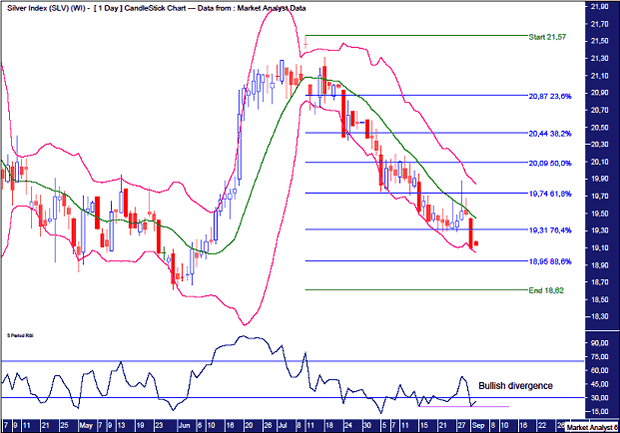

Gold Daily Chart I have added Bollinger Bands and we can see this move down has gone from the middle band back down to the lower band. The question now is will there be strong follow through to the downside that clings to the lower band or will it bounce right off it and head back up? I favour the latter. I have added Fibonacci retracement levels and price has now hit the 76.4% level. Perhaps that will provide the foundation for a turn and move back up. I have also added a Parabolic Stop and Reverse (PSAR) indicator just to demonstrate the corrective nature of trading since the July high. The dots have been busted every which way since that top. Price has been all over the place. Now compare that to the recent move up which seemed of an impulsive nature. Finally, I have added a Relative Strength Indicator (RSI) which shows this current low being accompanied by a higher RSI reading. A bullish divergence. Let's move on to silver. Silver Daily Chart The Bollinger Bands once again show price coming back to the lower band. One last kiss goodbye perhaps? I hope so. The low on Tuesday was at US$19.09. This is also where it closed. This low could well have exhausted the sellers. The previous week's low was bang on the 76.4% level. Price has now busted through but without any follow through to the downside, we may well have a false break low on our hands. If that is the case, then price should turn around and start to move up. This move up should be, to quote the great South African/English cricketer Tony Greig, "hard and fast". I have also added the RSI which is showing a triple bullish divergence. Interestingly, the third and current RSI reading is 20.30 while the second divergence showed a reading of 20.31. That is a double bottom on the RSI. And it is a double bottom with the trend as the first RSI reading was below those levels. This should lead to a powerful move up! This is very interesting indeed!! I suspect the move down this week would have been the last straw for many bulls. Not me though. While it can be a bit nervewracking, if you have confidence in the analysis then it is just a matter of putting stops well away from the market and staying solid. Both gold and silver have marginally broken their previous week's lows. This looks like the washout of selling which was mentioned as a possibility in a recent report. If prices can now turn around and move up strongly, we will likely have false break lows in place and the next leg up above the July highs in progress. As for me, apart from breaking my general rule of not trading against the main trend, I have just broken another by averaging down. I have added to current long positions down at these levels. But just in a small way. All that is left to do now is resort to positive thinking. C'mon!!! Bio Please register your interest in my website coming soon. Any questions or suggestions, please contact austingalt@hotmail.com © 2014 Copyright Austin Galt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Short Contracts Have Moved <b>Silver Prices</b> <b>...</b> - ETF Daily News Posted: 03 Sep 2014 11:07 AM PDT

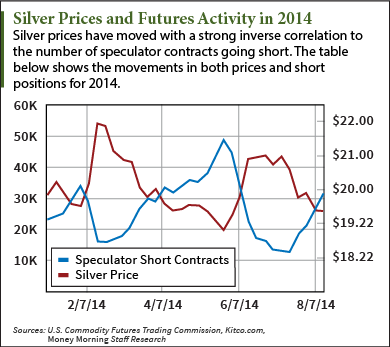

But the ceiling for mounting short positions is fast approaching as these positions escalate.

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?"I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets -- year-in and year-out." CLICK HERE to get your Free E-Book, "The Little Black Book Of Billionaires Secrets" As of last Tuesday, speculators had staked out 31,632 short positions on silver through short contracts – paper bets on future price declines – with an underlying 158.2 million ounces of the physical metal. On the year, this is the 12th largest volume of short contracts taken out for silver, and it's building ever closer to this year's previous highs. Not surprisingly, this buildup of short action has had a depressing effect on the silver price. It is now below its 2013 closing price of $19.565 an ounce, trading as low as $19.17 in the early morning today (Tuesday). The silver futures market and speculator activity has been a highly telling indicator for the future of silver price movements. When speculators begin buying up short positions in droves, the price of silver enters a bear session where declines become routine. But when silver speculation hits its peak and prices dive down to new lows, the speculators will begin to liquidate their short contracts and buy long. And when this happens, silver is taken for a ride… How Short Contracts Have Moved Silver Prices This Year Two good examples of this recurring cycle happened just this year. For the first month of 2014, speculators added to their short positions each week, growing that figure from 116 million ounces of physical silver underlying 23,206 contracts to 33,993 short contracts backed by 170 million ounces. In that period, silver price activity was effectively subdued, as prices dropped about $0.34 to $19.51, lower than the trading price of the white metal at the year's open. But it turned out that 33,993 was the magic number… With the current price of silver trading near yearly lows, speculators reversed course and began liquidating those positions quickly and buying long. Short contracts fell all the way to 15,904 contracts, or 79.4 million ounces, and prices shot up $2.455 an ounce to $21.965. This was the highest closing price for silver on the year, reached on Feb. 24. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Silver Prices</b> Today Bounce on Geopolitical Tensions - Money Morning Posted: 28 Aug 2014 02:39 PM PDT

After closing yesterday up $0.08 to $19.435 an ounce, the white metal touched as high as $19.90 an ounce in the early morning, a two-week high, before the U.S. Department of Commerce revised up U.S. annual gross domestic product growth to 4.2% from its previously reported 4% figure. As of the late afternoon, silver was trading close to $19.60. Silver, as a precious metal investment, has a tendency to move on negative economic news or on tensions abroad, as it is seen as an alternative investment vehicle and a hedge against a weakening dollar. That's why silver got a bump in the early morning when officials from Kiev accused Russia of invading Ukraine, further escalating clashes between Ukrainian forces and pro-Russian militias. It's also why, when the U.S. Commerce Department released positive news on economic growth in the United States this morning, it dove back to trading around $19.60 from its intra-day highs of around $19.90. If silver does close out around its current prices, today's gains would be the most significant in three weeks, up $0.13 at 3:30 p.m. EDT. The last increase of this magnitude came on Aug. 6, when the white metal soared $0.265. This day of gains is a welcome change from the continual losses silver has been experiencing since mid-July... What Has Held Silver Prices Down?The silver price had been rallying for about six weeks in June before the summer doldrums kicked in and silver began a descent around mid-July. From its peak on July 11 of $21.445, silver has slid 9.4% as of yesterday's (Wednesday) close. The culprit behind this steady decline, which has culminated in silver trading down from its 2013 closing price for the first time in two months, was renewed short activity in the futures market. After short-side speculation hit an all-time high in the silver markets in early June, with short positions - paper contracts wherein the holder is entitled to profits if silver falls - reaching 49,000 contracts backed by about 245 million ounces of silver, speculators holding these short bets started to liquidate them and buy long. This was a key driver in silver's 11.7% gain in June. But as soon as the shorts stopped liquidating their positions in late July, with contracts hitting a low not seen since February 2013, totaling about 12,600, the short-side speculators reentered the market and helped plunge silver into a six-week bear session. As data from the U.S. Commodity Futures Trading Commission (CFTC) suggests, silver is currently in a period of short-building. Every week since hitting its low on July 29, short contracts have steadily built to 27,646. Tomorrow (Friday), the CFTC will release the latest numbers as of Tuesday, and reveal whether short interest is mounting, or if the shorts are beginning to liquidate. If the short positions begin to fall, it's expected that silver prices will begin to climb, as it will mean more traders are beginning to buy long. Outside of potential gains from short covering, silver is likely getting today's boost from the unrest in Ukraine, which began yesterday as Kiev officials announced that Russian forces were clandestinely entering Ukraine and supporting pro-Russian rebels. Silver gained $0.01 on Tuesday and another $0.08 on Wednesday, and, while modest increases, it marked the first time since July 22 that silver strung together two consecutive days of gains. And if it continues to trade at its current levels by the time of market close, it will be the first time since July 11 the white meal had three consecutive days of trading up. NOW: Numerous factors are building that make today's silver prices look downright cheap. Here's how you can invest in silver today for double-digit gains... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Both gold and silver have embarked on early week moves down. These moves reek of attempts to flush out the weak hands. Many of those bulls still remaining would surely have a good case of the heebie jeebies right about now. While I am also a bull, currently holding long silver positions, I have found the move less intimidating as I was expecting these downmoves. Although I must admit to getting a slight twitch come the end of trading on Tuesday! Let's investigate.

Both gold and silver have embarked on early week moves down. These moves reek of attempts to flush out the weak hands. Many of those bulls still remaining would surely have a good case of the heebie jeebies right about now. While I am also a bull, currently holding long silver positions, I have found the move less intimidating as I was expecting these downmoves. Although I must admit to getting a slight twitch come the end of trading on Tuesday! Let's investigate.

0 Comment for "Silver prices | Gold and Silver Prices Tumble 1.7% | Coin News"