Gold price | CHART: Interest rates vs <b>gold price</b> shows plenty upside | MINING.com |

- CHART: Interest rates vs <b>gold price</b> shows plenty upside | MINING.com

- 2 Attractive Alternatives To Play A Higher <b>Gold Price</b> - Seeking Alpha

- Silver Wheaton, Pan American Hammered by Low Silver and <b>Gold</b> <b>...</b>

- <b>Gold Price</b>, Global Politics & Ukraine: Expert Roundtable | Gold News

- <b>Gold Price</b> Bears Half-Wrong in Mid-2014 | Gold News - BullionVault

| CHART: Interest rates vs <b>gold price</b> shows plenty upside | MINING.com Posted: 13 Aug 2014 04:07 AM PDT Gold was trading sideways on Wednesday around the $1,310 level, holding onto gains of nearly 9% this year. This year the price of gold has found some support from safe haven buying thanks to the political crises in Eastern Europe and the Middle-East, but the number one negative factor working against the metal has been expectations of higher market interest rates and rising bond yields in the US. As the chart shows the relationship between real long-term interest rates in the US (as proxied by 10-year US inflation-linked bonds) and the gold price is strongly negative. Rising real interest rates raises the opportunity costs of holding gold because the metal provides no yield, and entices investors to rotate into riskier assets like stocks as evidenced by outflows from physical gold-backed ETFs which have continued this year. Higher rates also boost the value of the dollar which usually move in the opposite direction of the gold price. But despite consensus forecast by economists of higher rates the expected upward march of bond yields seems to have thoroughly reversed, even as the world's largest economy continues to recover and the Federal Reserve throttles back monetary stimulus. On Wednesday benchmark treasuries were testing support at 2.46% from above 3% last year, while adjusted for inflation yield in the US sunk to a meagre 0.22% versus 0.75% at the start of the year. According to this chart, 0.22% yield on Treasury Inflation Protected Securities or TIPS (which is actually up from a 14-month low hit last week) seems more consistent with a gold price of around $1,400 an ounce versus today's levels.  Source: Saxo Bank |

| 2 Attractive Alternatives To Play A Higher <b>Gold Price</b> - Seeking Alpha Posted: 15 Aug 2014 09:11 AM PDT You don't have permission to access "http://seekingalpha.com/article/2427045-2-attractive-alternatives-to-play-a-higher-gold-price?" on this server. Reference #18.2f0af748.1408128295.4a66e27 |

| Silver Wheaton, Pan American Hammered by Low Silver and <b>Gold</b> <b>...</b> Posted: 14 Aug 2014 04:24 AM PDT Silver futures traded at around $19.85 on Wednesday afternoon, down from their 52-week high of $25.11 and not much above the 52-week low of $18.65. Low prices coupled with still-high costs typically mean lower operating profits — and that is what we saw from two silver companies. Silver streamer Silver Wheaton Corp. (NYSE: SLW) posted earnings per share (EPS) after markets closed on Wednesday of $0.18 on revenues of $148.57 million. The company was expected to post EPS of $0.24 on revenues of $185.96 million. In the same quarter a year ago, the company posted EPS of $0.20 on revenues of $166.89 million. Silver Wheaton reported cash costs of $4.72 per silver equivalent ounce, down from $4.77 in the second quarter a year ago. The silver equivalent realized price fell from $23.05 per ounce a year ago to $19.83 this year. Gold sales accounted for about 30% of Silver Wheaton's sales, and the company's realized gold price of $1,295 per ounce was included in a 14% drop in the silver equivalent price. Shares closed at $27.18 on Wednesday and were trading down 1.8% at $26.69 in Thursday's pre-market session. The stock's 52-week range is $19.23 to $29.17 Pan American Silver Corp. (NASDAQ: PAAS) said it posted adjusted EPS of $0.01 per share on revenues of $200.8 million. In the second quarter a year ago, the company posted a loss of $0.07 per share on sales of $175.58 million. The consensus estimates called for EPS of $0.03 on revenues of $195.91 million. Including a $10 million charge to inventory values and "abnormally high" income tax expense, Pan American posted a net loss of $0.04 per share. The company's consolidated cash costs per ounce of silver came to $12.06 and the company's average realized price for silver during the second quarter was $19.58 per ounce, down from $22.68 in the year ago quarter. Gold, which accounts for about 25% of Pan American's sales, also suffered from tumbling prices. A year ago, gold fetched $1,423 per ounce compared with $1,289 in the second quarter this year. Pan American's shares closed at $15.11 Wednesday night and are trading down about 0.7% Thursday morning at $15.00. The stock's 52-week range is $9.78 to $15.97. |

| <b>Gold Price</b>, Global Politics & Ukraine: Expert Roundtable | Gold News Posted: 06 Mar 2014 03:29 AM PST Andrew Hecht and Dennis Gartman join expert panel debating Russia/Ukraine crisis and gold prices... GOLD PRICES rise on war and geopolitical threats. Or so runs a common idea now Russia is threatening Ukraine, writes Miguel Perez-Santalla, vice president of BullionVault, the world's largest physical metals exchange for private investors online. Current events in the Crimea make this gold price assumption an urgent topic for savers and investors. Which is why I just hosted this roundtable of market experts to discuss global politics and how it impacts commodities markets. Speaking to four leading experts on gold prices, commodities markets, economics and politicals, I gathered their latest insights on the Ukraine-Russia events, precious metals outlook, and investment perspectives. Listen To Business Internet Radio Stations with New York Markets Live on BlogTalkRadio Bill O'Neill of Logic Advisors has visited Ukraine twice in the past 18 months. Bill believes the situation will quiet down in the short-term. "But don't be surprised to wake up one morning to hear that there is shooting going on..." Commodities trader and author Andy Hecht agrees. "It's not the end, it's the beginning," he told my gold price panel, pointing out that crude oil has backed off in the past couple of days, although palladium is still up strongly. Because "Russia produces 80% of the world's palladium." Author of daily trading advisory Dennis Gartman said events in Ukraine sparked an instantaneous flow of money into gold. Grain and crude oil also saw price spikes, on the belief that supplies would be cut off from the Ukraine – the world's third-largest exporter of corn and fifth-largest exporter of wheat.

Gold politics and investment expert George Milling-Stanley meantime noted that either "gold has had a really bad time, because it's dropped more than 30% from an all-time high. Or you can say that gold is actually performing quite well because it's building a base that's 5-times the level of where it was just a decade ago." Listen to the full hour-long show here at Bullion Vault's New York Markets Live special on Ukraine and commodities. |

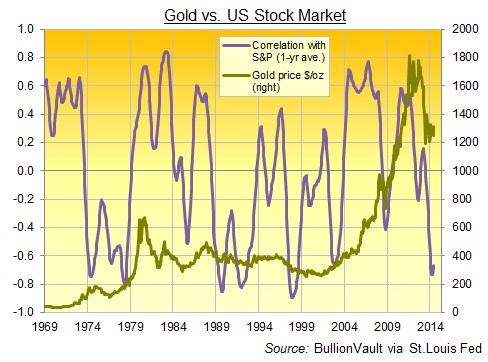

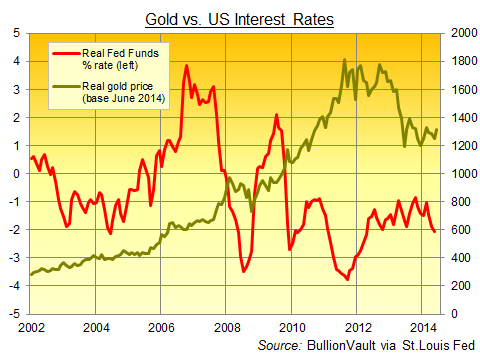

| <b>Gold Price</b> Bears Half-Wrong in Mid-2014 | Gold News - BullionVault Posted: 18 Jul 2014 10:50 AM PDT Higher interest rates & rising equities must mean gold prices fall. Right...? GOLD was a universal "sell" for professional analysts at New Year, writes Adrian Ash at BullionVault. Losing 30% in 2013, the gold price faced the long-awaited start of US Fed tapering – widely supposed to make fixed-income bonds go down, nudging interest rates higher – plus strong hopes for further gains in world equities. Who needed the barbarous relic? Half-way through 2014 however, the gold price has since rallied, recovering one-third of 2013's near-record losses and beating all other major asset classes so far. Why? The market, reckons Nic Brown, head of commodities research at French investment and bullion bank Natixis, "is taking the view that the Fed is behind the curve and may be allowing inflation pressures to creep into the system." But most other analysts still forecast fresh losses for gold prices in the back-half of 2014, and they still point to US Fed policy and the rising stock market as your No.1 reasons to sell. ABN Amro's commodity analysts put it plainly last week. They expect gold's 11% rise in the first-half of 2014 to be "temporary" because US Fed rates hikes are coming, while the outlook is "positive" for equities. Such thinking makes sense based on 2013's example. Taper talk pushed bond prices down last year, nudging market interest rates higher. The S&P500 meanwhile returned 32%, a little more than gold prices fell. Logic might also see a trade-off between gold and rising returns on other assets. Because the metal yields nothing and does nothing. It can't even rust. Equities and interest-paying investments on the other hand work to increase your money. So gold prices should fall when equities rise, and also when the markets expect higher interest rates. Or so analysts now think. Consensus and logic are only half-wrong. Almost exactly half wrong in fact. Since 1969 gold prices and US Fed interest rates have moved in opposite directions 47% of the time (rolling 12-month periods). That proportion rises to 54% if you adjust both gold and Fed rates for inflation. But this relationship remains far from strong enough to make certain forecasts. As for equities, gold also moves in the opposite direction to the US stock market just less than half of the time, some 48% of all 12-month periods since 1969. What's more, the rolling 12-month correlation of gold prices with the S&P 500 over the last 45 years averages zero. The mean is -0.002, the median 0.02 – as near a perfect non-correlation as equity investors wanting to diversify their holdings could wish for.

To achieve that long-term zero, gold prices in fact swing from a strongly positive to strongly negative correlation with the US stock market, as the chart shows. The 15 months to July 2014 were the longest run of negative correlation in 11 years, suggesting a period of co-movement is now due. Yet with both gold and equities rising in June, several analysts called it an "unusual combination", one which "does not normally last long." During gold's long bull market starting 2001 however, it rose when stocks fell, and rose again when they gained. So once again, the statistics beg to differ. So much for the data. Gold bullion is often cast as a "narrative asset" – an investment choice built on stories and sentiment because it lacks a yield on which to base any value analysis. So let's assume that both equity prices and rate expectations do rise in the second-half of 2014. How might that story run for gold? The most recent period when Fed rates rose with equities should give gold bears pause.

From spring 2004 to summer 2006, and starting from what were then all-time low "emergency rates" of 1.0%, the Fed raised its key interest rate 17 times in "baby step" increments of 25 basis points. The S&P 500 gained 13%, but gold priced in Dollars rose nearly 60%, gaining 48% when adjusted for the change in US consumer prices. All this while the real Fed Funds rate, also accounting for inflation, rose three percentage points to turn positive for the first time since mid-2002. One explanation is that the big money which drives gold higher or lower doesn't tend to make decisions based on overnight rates. Instead, it looks at longer-term yields, most notably 10-year US Treasuries. Fed chairman a decade ago, Alan Greenspan noted how his central bank's tightening cycle hit a "conundrum" in the bond market, because longer-term yields failed to rise in tandem. Indeed, real 10-year yields actually fell between mid-2004 and mid-2006, briefly turning negative for the first time since 1980. Here in 2014, bond yields have again ticked lower so far, despite the Fed's quasi-tightening of tapering its quantitative easing asset purchases. Both gold and equities have risen with bond prices. Short-term rates will meantime start the next hiking cycle from new record lows, and the current "emergency rate" has also been applied far longer than Greenspan's 1.0% low – a full six years by end-2014, against just 12 months for the Maestro's tech-crash reflation. You won't need reminding how the US economy reacted to "normalization" a decade ago. Given 0% money and QE since 2009, can it really bear a return to positive real rates next year? The gold market says not. |

| You are subscribed to email updates from Gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price | CHART: Interest rates vs gold price shows plenty upside | MINING.com"