Buying Gold | <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News - BullionVault | News2Gold |

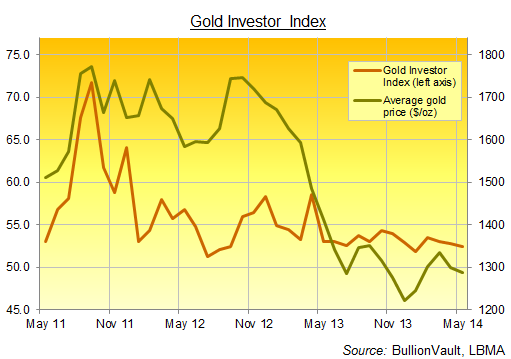

| <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News - BullionVault Posted: 03 Jun 2014 01:02 AM PDT Gold Investor Index falls, one-fifth of May's buyers jump on 4-month lows... If GOLD INVESTOR sentiment reflects financial stress and anxiety, then it has clearly dropped since the price peaks of mid-2011, writes Adrian Ash at BullionVault. The stock market is setting new record highs, after all. Right alongside, gold sentiment amongst private investors ebbed further in May, as our Gold Investor Index shows today. Wall Street's S&P500 broke 1,900...a rise of 23% from 12 months ago and more than doubling from May 2009. The gold price meantime fell to 4-month lows. And sentiment?

The Gold Investor Index is calculated using proprietary data from Bullionvault, the 24-hour precious metals exchange which leads the market for physical bullion online. More than 52,000 people have now used BullionVault to buy, store and trade physical gold and silver – the internet's largest pool of private precious metals investors. Between them, they own $1.3 billion worth of gold bullion (£785m, €965m) – more than is held by most of the world's central banks, and unchanged in May from April. Instead of surveying intentions, or simply reporting the change in total client property, the index shows the balance of individual actions across the month. It take the number of net sellers – people who reduced their holding – from the number of net buyers (including new users, who started at zero), and gives that figure as a proportion of all gold owners at the start of the month. That is rebased so that 50.0 would signal a perfect balance. The chart above shows how the Gold Investor Index has varied over the last three years. (Data attached as XLS below. You can read more about its methodology and aims in Fear, Delusion & the Gold Investor Index here.) The index recorded a series low of 48.8 in February 2010 as the financial crisis took a pause. It then peaked at 71.7 in September 2011 as gold prices hit record highs. And in May 2014, with prices in a tight, boring range until the very last week, the index gave a low but positive reading of 52.4. That 3.9% drop in Dollar gold prices counted, however. One-fifth of May's net gold buyers on Bullionvault acted in the last 4 days of the month, pulling the index higher...from what would have been a near 2-year low...as investors took advantage of lower prices. Short term this looks still distinctly unbullish. Investors are buying the dips, not driving any new phase in the metal's previously long upwards trend. More starkly still, silver buyers on Bullionvault last month added more metal than any month since December 2012. Again, this bargain-hunting came on a sharp drop in prices, swelling total silver holdings by 2.9% in May to some $282m by value (£169m, €207m). Longer-term, such Dollar-cost averaging looks smart. Private investors as a group continue acquiring bullion as part of their broader savings, well-remembering the lessons of the financial crisis but not chasing prices higher as they buy financial insurance. And since the price crash of last spring, gold sentiment has mirrored the broader moves in bullion prices, flattening but holding positive as new investors continue to join the market. |

| <b>Gold Buying</b> Mystery in China Returns | <b>Gold</b> News - BullionVault Posted: 13 Feb 2014 08:27 AM PST Gold buying soared in 2013 in China. But who was buying...? SO WHO's been buying gold in China? asks Adrian Ash at BullionVault. Everyone, says the Financial Times. "It's not only about increases in official [central bank] holdings. Every level of society, from individuals up to banks, has been allocating more to gold," it quotes Liu Xu, an analyst with Capital Futures in Beijing. "Wealth is expanding and people have limited investment channels, so gold is attractive." This isn't the first time the FT spied a gap between Chinese demand and supply data, and pointed to the People's Bank as a "mystery" buyer. But the Pink 'Un is growing more unsure each time... 16 Feb 2012: "China's central bank made significant gold purchases in the final months of 2011..." 18 Dec 2013: "The Chinese state could be behind a surge in bullion imports..." 11 Feb 2014: "Central bank buying is only one of the explanations..." Our view? BullionVault now has two Chinese language websites (so you can trade bullion in simplified Chinese or using traditional Han as you choose) plus full customer support. But beyond that, we're not privy to Beijing's central-bank strategy. Nor is anyone else writing about China's mystery gold buyer today. The mystery? Trade group the China Gold Association is the key source for demand and mining figures. And its mining members report output for last year of 428 tonnes. Gold sales as reported through other members' stores and dealerships reached 1,176 tonnes. So, given net imports through Hong Kong of 1,108 tonnes, plus a ban on exports to the rest of the world of this , that leaves 360 tonnes unaccounted for. "People's Bank?" suggests a leading bank analyst by email. "Can't be jewelry, as you'd see it in quarterly sales figures." It can't all be stockpiling by wholesalers either, we add. Because with private Chinese demand so rampant, and the price dropping 30% last year, then buying low would seem a smart move for bullion banks and distributors. But stockpiling 30% of last year's record-high demand from end-consumers? This doesn't mean the PBoC is involved. But buying gold low would also look smart for the world's largest foreign currency holder. The People's Bank does hold $1.3 trillion in US Treasury bonds, for instance. That's second-only to the US Fed's $2.2 trillion holdings...and the United States does hold nearly 8 times as much gold as the People's Bank of China as ballast, some 8,133 tonnes of bullion bars. Or so the official US data tell us. We can't know for sure, and nor can anyone else. All governments are secretive, Communist dictatorships more than most. Unless the PBoC suddenly throws the doors open and 'fesses up to buying gold...something its officials have repeatedly said in the past they're wary of, because it would push prices higher for Chinese consumers thanks to Western speculators piling in...all we can do is guess. At least we hope ours is an educated shrug. Beware charlatans telling you the rapture of Chinese central-bank gold hoarding is here, once more. Prices are higher yet again today, by the way. |

| You are subscribed to email updates from buying gold - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Buying Gold | Gold Investors Buying Dips, Not Bull | Gold News - BullionVault | News2Gold"