Buy Gold Bullion | <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News - BullionVault | News2Gold |

- <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News - BullionVault

- Prices to <b>Buy Gold</b> "Led by Geopolitics & Bond Yields" as Shanghai <b>...</b>

- <b>Gold Bullion</b> Price Falls from 4-Week High on Bernanke's Tapering <b>...</b>

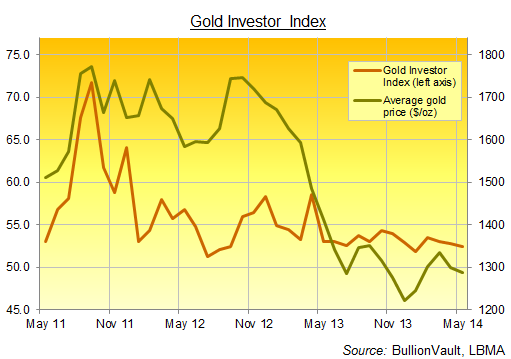

| <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News - BullionVault Posted: 03 Jun 2014 01:02 AM PDT Gold Investor Index falls, one-fifth of May's buyers jump on 4-month lows... If GOLD INVESTOR sentiment reflects financial stress and anxiety, then it has clearly dropped since the price peaks of mid-2011, writes Adrian Ash at BullionVault. The stock market is setting new record highs, after all. Right alongside, gold sentiment amongst private investors ebbed further in May, as our Gold Investor Index shows today. Wall Street's S&P500 broke 1,900...a rise of 23% from 12 months ago and more than doubling from May 2009. The gold price meantime fell to 4-month lows. And sentiment?

The Gold Investor Index is calculated using proprietary data from Bullionvault, the 24-hour precious metals exchange which leads the market for physical bullion online. More than 52,000 people have now used BullionVault to buy, store and trade physical gold and silver – the internet's largest pool of private precious metals investors. Between them, they own $1.3 billion worth of gold bullion (£785m, €965m) – more than is held by most of the world's central banks, and unchanged in May from April. Instead of surveying intentions, or simply reporting the change in total client property, the index shows the balance of individual actions across the month. It take the number of net sellers – people who reduced their holding – from the number of net buyers (including new users, who started at zero), and gives that figure as a proportion of all gold owners at the start of the month. That is rebased so that 50.0 would signal a perfect balance. The chart above shows how the Gold Investor Index has varied over the last three years. (Data attached as XLS below. You can read more about its methodology and aims in Fear, Delusion & the Gold Investor Index here.) The index recorded a series low of 48.8 in February 2010 as the financial crisis took a pause. It then peaked at 71.7 in September 2011 as gold prices hit record highs. And in May 2014, with prices in a tight, boring range until the very last week, the index gave a low but positive reading of 52.4. That 3.9% drop in Dollar gold prices counted, however. One-fifth of May's net gold buyers on Bullionvault acted in the last 4 days of the month, pulling the index higher...from what would have been a near 2-year low...as investors took advantage of lower prices. Short term this looks still distinctly unbullish. Investors are buying the dips, not driving any new phase in the metal's previously long upwards trend. More starkly still, silver buyers on Bullionvault last month added more metal than any month since December 2012. Again, this bargain-hunting came on a sharp drop in prices, swelling total silver holdings by 2.9% in May to some $282m by value (£169m, €207m). Longer-term, such Dollar-cost averaging looks smart. Private investors as a group continue acquiring bullion as part of their broader savings, well-remembering the lessons of the financial crisis but not chasing prices higher as they buy financial insurance. And since the price crash of last spring, gold sentiment has mirrored the broader moves in bullion prices, flattening but holding positive as new investors continue to join the market. |

| Prices to <b>Buy Gold</b> "Led by Geopolitics & Bond Yields" as Shanghai <b>...</b> Posted: 23 Jul 2014 07:31 AM PDT BUY GOLD bids eased back in London on Wednesday, holding spot prices flat around $1308 per ounce as US stock markets rose to record highs despite fresh violence in Ukraine and Gaza. The United Nations said there is a "strong possibility" Israel has violated international law "in a manner that could amount to war crimes." Kiev said pro-Russian separatists today shot down two Ukrainian fighter jets near last week's crash site of civilian airliner MH17. "Prices [to buy gold] have gained somewhat recently," says a report from Dutch bank ING's investment management division, "resulting from heightened geopolitical risks. "The decline in long-term real US Treasury yields also supported gold...[but] upward yield pressure as the global cycle improves and disappointing physical demand in China and India remain downward forces." Yields offered by 30-year US Treasury bonds today fell near 13-month lows as prices rose after yesterday's US inflation data failed to deliver the "spook that guys were looking for," according to one primary bond dealer in New York quoted by Bloomberg. UK gilt yields also fell today, as did the Pound, following news that the Bank of England's policy team voted 9-0 to keep its key interest rate unchanged at a record low 0.5% for the 64th month running earlier in July. Italian bond prices extended their best rise since 2010, pushing the yield offered to new buyers down to 2.76% – barely one-third the Euro Crisis peak of late 2011. Targeting sub-$1200 prices however, "Gold is in a speculative bubble in the process of deflating," says commodities analysis from French investment and London bullion bank Societe Generale. "The triggers were lack of inflation and Fed tapering [of its QE asset purchases]. We expect further large-scale ETF selling." The giant SPDR Gold fund (NYSEArca:GLD) yesterday expanded after shedding metal Monday, with shareholders wanting to buy gold exposure through its ETF trust structure adding 1.5 tonnes to holdings of 803 – a five-year low when reached during the 2013 price crash. Meantime in China – where end-user gold consumption fell 19% from last year's record levels over the first 6 months of 2014, according to trade-body the China Gold Association today – an overnight dip in prices "was quickly scooped up by bargain hunters," according to a trading note from Swiss-based refining and finance group MKS. However, versus prices to buy gold in London – center of the world's wholesale bullion trade – the price in Shanghai "remains around a small discount to flat," MKS goes on. That has "failed draw out any further business from arb traders" who could more usually buy gold in London and sell in China for a certain profit. |

| <b>Gold Bullion</b> Price Falls from 4-Week High on Bernanke's Tapering <b>...</b> Posted: 17 Jul 2013 05:12 AM PDT The GOLD BULLION price rose to the best London Fix in 4 weeks above $1297 per ounce on Wednesday afternoon, gaining over 1.0% as testimony on "tapering" QE from US Federal Reserve chairman Ben Bernanke followed weaker-than-expected US housing data. Gold bullion then fell sharply as the US Dollar bounced, dropping towards this week's lows beneath $1280 as Bernanke repeated the Fed's aim of tapering its $85 billion in monthly bond purchases through quantitative easing by the end of 2013. "I think the markets are beginning to understand our message," said Bernanke during Q&A with lawmakers in his semi-annual testimony to Congress. "The volatility has obviously moderated." But tapering QE is not "a preset course," he said, adding that economic data will decide the central bank's actions. June figures for new building starts and permits both showed a marked decline for May, defying analyst forecasts for a rise. "We continue to consolidate in a $1270-1300 range" for gold bullion, says a note from Swiss refinery and finance group MKS. "The last 3 daily candles," says bullion bank Scotia Mocatta's technical note, "can be characterized as 'spinning tops' which have a low range from open to close, and are a sign of indecision in the market." Gold bullion prices are "seen remaining under pressure," says fellow London market-maker Societe Generale's latest Commodity iWatch, "on expectations of Fed tapering, rising [interest] rates, stronger US Dollar and investor selling." The Dollar had earlier held steady Wednesday against the Euro, but dropped 1.5¢ vs. the British Pound after minutes from the Bank of England's latest policy meeting showed a unanimous vote under new governor Mark Carney to keep rates and QE unchanged. That plus the price drop during Fed chairman Bernanke's QE tapering testimony knocked the price of gold bullion for UK investors back to a 4-session low of £844 per ounce – down 1.6% from Tuesday's near 4-week highs. "The Fed's bifurcated message [on rates and QE] will continue," Bloomberg today quotes Barclays' senior US economist Michael Gapen. "Their outlook is for an environment where we can start tapering -- so a hawkish tone on tapering switching to a dovish tone on rate hikes." "The unwinding [of QE] needs to be carefully phased, planned, communicated," said International Monetary Fund chief Christine Lagarde at a central-bank conference in Bucharest on Tuesday. Policy makers should play a "much more subtle game," she said. Because after proving "a massive positive" for the global economy, the effect of removing QE "remains to be seen." Voting policy-maker Esther George – president of the Kansas City Fed – said to Fox Business on Tuesday that starting to reduce QE could likely begin "going into 2014." Meantime in Asia today, gold bullion premiums over and above international benchmark prices held strong, Reuters reports. Hong Kong premiums held near $5 per ounce, while gold bullion dealers in Tokyo blamed a growing shortage of supplies for Japan's $2 premium. Chinese prices for immediate delivery of gold bullion eased back, however, with the premium over benchmark London settlement dropping to $25 per ounce on the Shanghai Gold Exchange, down from last week's $30 level. In India, in contrast – the world's No.1 consumer nation – "Demand [for gold bullion] will be less as there are so many restrictions on import of raw materials," says Haresh Soni, chairman of the All India Gem & Jewellery Trade Federation. "A lot of buying took place in April and May. Investment demand is also weak." Silver prices were little changed with gold in London trade Wednesday morning, holding in a tight range around $19.90 per ounce. Other commodities were also unchanged. Major government bond prices slipped, however, nudging 10-year US Treasury yields up to 2.55%. With longer interest rates rising as tapering talk continues, short-term rates remain held at zero, and the gap between 2-year and 10-year Treasury yields has widened since May to the highest level since summer 2011. So while "it seems as though the Fed is considering tightening with the 'taper' talk," writes Gary Tanashian in his Notes from the Rabbit Hole, "in reality it is laying the groundwork for the next phase of the ongoing inflation operation." |

| You are subscribed to email updates from Buy gold bullion - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Buy Gold Bullion | Gold Investors Buying Dips, Not Bull | Gold News - BullionVault | News2Gold"