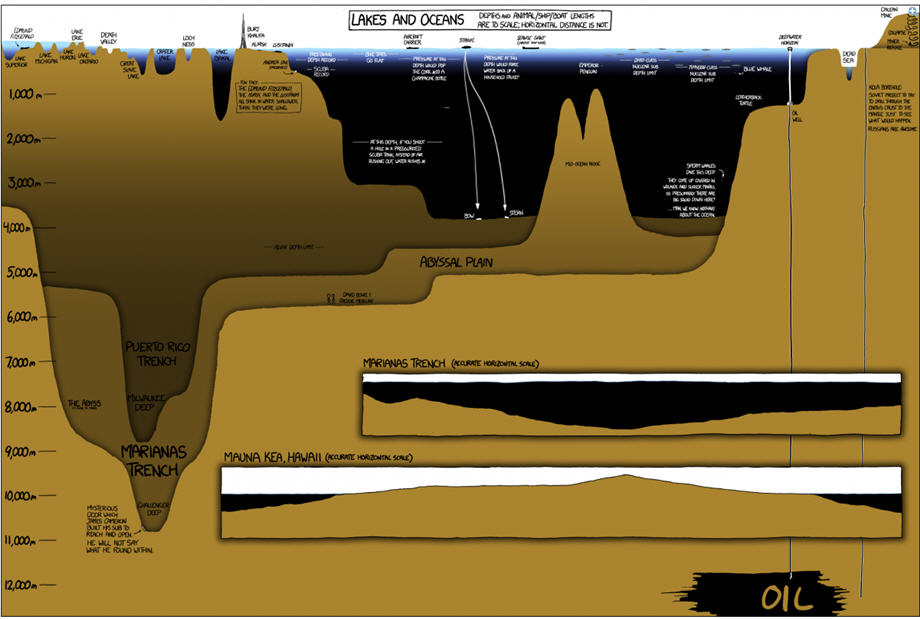

INFOGRAPHIC: Comparing the depths of lakes, oceans and oil wells |

- INFOGRAPHIC: Comparing the depths of lakes, oceans and oil wells

- Three-month high for gold

- Jellyfish numbers are rising and that's bad for coal, nuclear plants

- Could gang violence end Mexico's shale dream?

- My air is more expensive than your air

- Vale may leave ICMM over Rio Tinto lawsuit: WSJ

| INFOGRAPHIC: Comparing the depths of lakes, oceans and oil wells Posted: 01 Jul 2014 09:32 PM PDT Get a handle on the relative depth of lakes, oceans and oil wells using this illustration by cartoonist xkcd.com. The oceans cover 75% of the earth surface but much of it is unexplored. The illustration shows why. The depths are great. Xkcd.com even threw in the trapped Chilean miners, all the way over on the far right. Hat tip, Business Insider |

| Posted: 01 Jul 2014 04:30 PM PDT  Six-month spot gold prices. Spot gold traded at a three-month high hitting $1,329.60 per ounce. Gold has not traded well above $1,320 since April. Kitco's Jim Wyckoff attributed the uptick to technical traders and bargain hunters. "Perceived bargain hunting by traders and investors has also been prevalent in gold and silver recently," says Wyckoff. "Gold market bulls have the overall near-term technical advantage and have gained fresh upside momentum early this week. Prices are in a four-week-old uptrend on the daily bar chart. "The gold bulls' next upside near-term price breakout objective is to produce a close above solid technical resistance at $1,350.00." Silver had a high of $21.27 per ounce. The important US job's report will be released on Thursday, a day early due to July 4 celebrations. |

| Jellyfish numbers are rising and that's bad for coal, nuclear plants Posted: 01 Jul 2014 03:58 PM PDT Jellyfish population may be on the rise and that is a concern for coastal coal and nuclear power plants that rely on seawater. Last year the United Nations warned that jellyfish populations were on the rise. A University of British Columbia study cautiously stated that jellyfish populations seem appear to be climbing. Lead author Lucas Brotz found that out of 66 large marine ecosystems studied, 45 showed an increasing trend in jellyfish population. Large jellyfish blooms have shut down power plants. Last year the Oskarshamn nuclear plant in southeastern Sweden had to cope with a jellyfish bloom that clogged the intake pipes. Three years ago a surge in jellyfish shut down the Orot Rabin coal-fired power plant in Hadera, Israel after jellyfish blocked the seawater supply. Coincidentally the Torness nuclear power station in Scotland also closed after jellyfish were also found to be obstructing water filters. Jellyfish haven't just caused problems with cooling systems for power plants. In October stinger jellyfish caused $2 million in damage to salmon farms in Ireland. Reasons for the increase are unclear. Possible causes are a warming climate. As the oceans become more acidic, jellyfish can do better. There is also loss of jellyfish predators due to over-fishing. However, help may be on the way: a robotic jellyfish terminator has been developed by Korean engineers. The KAIST Civil and Environmental Engineering Department unveiled last year the unmanned aquatic robots capture and grind the jellyfish. A formation of three robots can wipe about about 900kg of jellyfish per hour. Video of the device in action below. Jellyfish warning sign by Nelo Hotsuma |

| Could gang violence end Mexico's shale dream? Posted: 01 Jul 2014 12:52 PM PDT

Violence in Mexico could thwart hopes of a budding shale boom, as oil and gas companies operating in Texas may think twice about moving south of the border. Mexico holds an estimated 545 trillion cubic feet of technically recoverable shale gas and 13 billion barrels of shale oil, but progress in developing those resources has been slow. The obstacles to kick-starting Mexico's shale industry have dampened the once lively enthusiasm surrounding Mexico's historic energy reform. Mexico passed legislation last year that opened up the country's oil and gas sector to private investment, ending a 75-year monopoly by state-owned Petroleos Mexicanos (Pemex). But the secondary laws that the government must pass to actually implement the legal framework for oil and gas development are proving much more contentious. Political disputes over what could be 21 separate laws have thus far delayed passage, threatening to push back Mexican President Enirque Pena Nieto's goal of producing 3 million barrels of oil per day by 2018. That would be roughly a 25 percent increase from the current output level of 2.4 million barrels per day, but it is looking increasingly difficult to achieve. "We can increase, of course, but not enough to arrive at 3 million [b/d]," Fluvio Ruiz Alarcon, an independent board member at Pemex, told Platts on June 24 at a Wilson Center event in Washington, D.C. "I'm sure we're going to produce over 3 million [b/d] but not by 2018. Maybe 2020, but not before," he added.

In order to access the potentially abundant oil and gas from Mexican shale, the government will need to rely upon the private sector. Under the energy reform, Pemex is given first refusal over any projects – meaning that it can keep the assets it really wants, but allows the rest to go to bidding for private companies. Pemex will likely stick with its wells that are already producing, and leave drilling new shale wells to incoming private companies. However, many areas in the Burgos Basin – which lies just south of the rich Eagle Ford formation in Texas – are suffering from intense gang violence.Bloomberg News reported on the conditions in Tamaulipas, a state in eastern Mexico, which at times resembles a "war zone." A power vacuum left over by the arrest of the leaders of the Zetas and Gulf Cartels last year has the eastern coast dealing with heightened violence – shootings along highways and burned down buildings are commonplace as rival drug gangs jockey for territory. Further north, shootings and kidnappings plague Highway 2, which runs parallel to the border with the United States. The violence poses an immediate threat to the oil companies working there. The Mexican Army is now escorting workers of Weatherford International, an oilfield services firm, to and from their drill sites after a drug gang shot up a hotel where the workers were staying. Aside from violence, theft of oil and gas by drug cartels poses another threat to companies. In 2013, Mexican gangs stole around $790 million worth of fuel, which is siphoned off from pipelines and smuggled. Perhaps more importantly, the violence will undermine Mexico's attempts to boost oil production over the longer term. The Mexican government doesn't believe that Pemex will be able to increase production. The state-owned company's goal is to merely keep production steady as wells age and decline. Instead, the government will be relying upon the private sector. Over the next four years, the government expects 500,000 barrels per day to come from non-Pemex sources. But that goal will prove elusive if independent oil and gas companies are scared off by violence. "It does raise the cost of doing business when you have to face the threats of kidnapping and extortion," Duncan Wood, director of the Mexico Institute at the Woodrow Wilson International Center for Scholars, told Bloomberg. If Mexico is to achieve its goal of reviving oil production, which has declined by more than one-third over the last decade, it will not only need to get the legal framework right, but the government will also need to ensure drug violence drops to a level that doesn't scare off private oil and gas companies. Source: http://oilprice.com/Energy/Energy-General/Gang-Violence-Slowing-Progress-On-Mexican-Shale.html By Nicholas Cunningham of Oilprice.com |

| My air is more expensive than your air Posted: 01 Jul 2014 11:16 AM PDT Clean-coal technology does work… but it isn't cheap. Welcome to the future. China and India lead the charge in forecasted coal-fired electricity demand. Growth rates in China this year are expected to be 143% of 2010 levels, while India will have a 148% jump.

The chart below shows (no surprise) that the bulk of CO2 emissions is going to come from China. So clearly our look at coal's future must include China, and it must include limiting CO2 emissions.

Here's a chart of reserve-to-production ratios that shows how long a country's coal reserves will last at current production rates. You see what could potentially happen down the road if there's a moratorium on coals with low caloric content (the "dirty" type of coal).

All of a sudden, our proven and probable reserves don't look quite so comforting. Nor do these numbers take into account any ramp-up in production. It's clear that producers with mostly high-caloric reserves—such as those in North America, Russia, and Australia—would be the winners, but overall, a ban on low-caloric coals would cause a significant supply shock. Cleaning Up Coal's Act The clean-coal initiative has become more than a buzzword in recent years—it's a very big deal, with hundreds of millions of dollars being poured into the sector. Many of these projects are still in their infant stages, so the cost of capital is very high. For example, there's a large project in the works in South Korea, where in 2011 the government commissioned the construction of a clean-coal power-generating facility to the tune of $3 billion. The United States and China are leading the way in large-scale, integrated carbon capture and storage (CCS) projects, with 19 and 12 respectively out of 60 worldwide. These are the three types of CO2 capture:

Some of this high cost is to be expected at the beginning of the learning curve. Here's the forecast for costs between now and 2040.

What to Do with That Captured CO2 Half the battle is keeping CO2 from going into the atmosphere—but what to do once you've captured it? Here are the current options, of which two are similar.

Most recently KOSPO, South Korea's state-run power company, purchased a Foster Wheeler CFB power plant that's expected to cost upward of $3 billion. Britain-based Foster Wheeler (FWLT), an engineering and construction company that specializes in power generation, has built 300 CFBs all over the world. Image of coal flyer by Russ Walker |

| Vale may leave ICMM over Rio Tinto lawsuit: WSJ Posted: 01 Jul 2014 10:22 AM PDT Vale is threatening to leave the International Council on Mining and Metals because Rio Tinto is suing the Brazilian miner. The Wall Street Journal, relying on unnamed sources who are "familiar with the situation", reports that Vale wrote a letter to the ICMM "regarding its membership in the body." The International Council on Mining and Metals has declined to comment on the dispute only confirming that it has received the letter. Formed in 2001 the ICMM aims to "to maximize the contribution of mining, minerals and metals to sustainable development." The ICMM has become a useful forum for top mining executives to meet. In April Rio Tinto (NYSE:RIO) launched a lawsuit against Vale (NYSE:VALE) over control of Guinea's Simandou, a rich iron ore deposit. The London-based miner claims Vale used that "highly confidential and proprietary information" in its favour. Simandou mine is one of the world's largest with estimated reserves of 2.4 billion tonnes of ore grading 65% iron metal. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "INFOGRAPHIC: Comparing the depths of lakes, oceans and oil wells"