Silver prices | <b>Silver Prices</b>: Is 14% Enough for 1 Month? | Gold News |

- <b>Silver Prices</b>: Is 14% Enough for 1 Month? | Gold News

- The Six Major Fundamental Factors that Determine Gold and <b>Silver</b> <b>...</b>

- <b>Silver Prices</b> May Level Off - but Will Stay Strong in Coming Months

| <b>Silver Prices</b>: Is 14% Enough for 1 Month? | Gold News Posted: 02 Jul 2014 11:30 AM PDT Spec shorts hit a record start-June, then covered faster than ever helping prices jump... SILVER PRICES hit new 15-week highs Wednesday, writes Adrian Ash at BullionVault, adding 14.1% from end-May's drop near 4-year lows. Any more gas in the tank for extra gains short term? Summer is typically boring for gold, and by extension silver prices. (The median move during June-August is the smallest 3-month change over the last 45 years, stats fans.) But 2014 has seen both gold and silver prices buck the seasonal lull so far. June saw gold add 6% against the Dollar. Silver doubled that move. The immediate cause, certainly for silver prices, was plainly short covering. Bullionvault wasn't alone in spying the all-time record number of bearish bets against silver held at the start of last month by hedge funds and other speculators. We weren't alone either in guessing that could end badly for silver's short sellers if prices rose. But we can't find many other commentators noting that, derivatives trading aside, June was actually quiet for silver investment demand. Indeed, after May's stellar addition to BullionVault user holdings – the largest 1-month rise since end-2012 – holdings were flat overall last month as more users opted to take profit than buy more following the sharp leap through $19...$20...and then $21 per ounce. The rise in gold and silver prices meantime hit those hot-money traders betting against them so badly, they all ran to the other side...and at a record pace. The question now is whether there's any cash left to join the bullish betting short term.

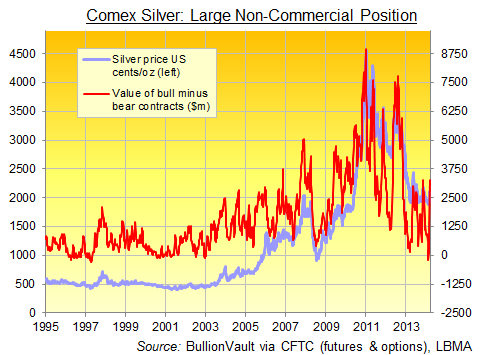

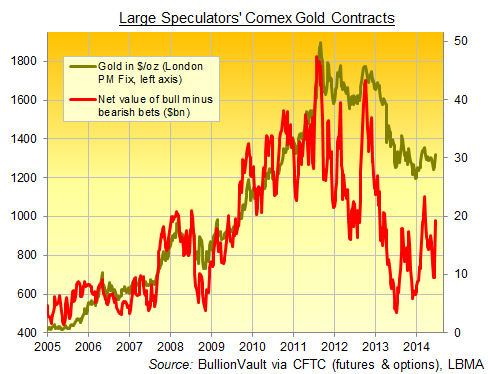

Every Friday, after the futures market closes in New York, US regulators print data showing how traders were positioned the previous Tuesday. Tracking the changes lets you see what the big money is thinking. If it's thinking at all. On one side are the "commercials"...the producers and merchants who make a living selling the stuff. On the other are the "speculators"...the hot-money funds who try to make a living betting which way prices will move. Now, at the start of last month, the specs were holding more bets against silver prices than ever before. Looked at as a group overall, they were "net short" silver (bullish minus bearish bets) for the first time in 11 years. This made sense from a technical view. Silver prices, like gold, were marking a tight range which only got tighter. Higher lows and lower highs created a triangle shape. Technical analysts studying chart patterns could see the final corner drawing near. Hitting that apex as time rolled by, silver would either shoot higher or, they guessed, sink hard. But then Janet Yellen spoke...coughing about how maybe the Fed won't actually ever, y'know, raise interest rates from zero...and the precious metals shot right where the silver shorts hoped they wouldn't. Having started with a record large speculative short bet against silver, June saw the fastest swing in bullish betting on silver, net of bearish contracts, on record. The so-called spec net long rose 150%...swelling over $2bn by value...and growing faster than any week since at least 1986 as prices jumped. Speculative gold betting was similarly dramatic in the week-ending last Tuesday. Faster than January 2012, the jump in net bullish betting totaled some $7.3bn. That jump is beaten only by mid-July 2011, when the US debt downgrade and Eurozone debt crisis sparked that summer's record peak in gold prices.

All told then, June 2014 saw $13bn-worth of speculative bets jump onto the long side of gold and silver contracts at the US Comex exchange. So like we suggested to Bloomberg's Alix Steel last week, the hot money has run to the other side very fast. This has proven a welcome dose of good luck for physical investors in silver bars wanting to pocket a tidy gain for the summer. But further ahead?

With silver up 12% in 4 weeks, why not? Bottom line, silver is volatile enough without needing to borrow money...and multiply your risk of ugly losses as well as profit...to play the futures or options market. Let the hedge funds set themselves up for a fall if they wish. As for choosing silver over gold, that's a tough call. But when silver moves in the same direction as gold (some 75% of all trading days since 1968) the cash price moves very much faster. Three to four times as fast in fact. That cuts both ways remember. Up and down. |

| The Six Major Fundamental Factors that Determine Gold and <b>Silver</b> <b>...</b> Posted: 13 Apr 2013 12:35 AM PDT For us, gold and silver are the most complicated assets to price. Stocks, currencies and other commodities mostly depend on fundamental data of the stock, the country or on physical demand and supply of the commodity. Once fundamental data about the asset comes out, even an inexperienced investor can understand most price movements. Pricing gold or silver on a fundamental basis is far more difficult because prices depend on the valuation of other assets and on differences between U.S. data and the rest of the world. We think that gold and silver are valued somehow "indirectly", it is a relative valuation and describe a "delta" between the US and the rest of the world. This makes trends driven by fundamentals very difficult to understand. Maybe therefore, gold and silver are far more subject to "love it or hate it". Many analysts base their arguments to buy or sell gold on a limited set of fundamentals or only on technicals. Many gold bulls based their analysis mostly on the explosion of public debt and/or on real interest rates. Since these bulls do not get the fundamentals right, they got caught on the wrong foot and consequently they speak about conspiracy theories and market manipulation when the gold price falls. Many opponents, however, argue ingeniously that gold brings no income, but has only a cost of carry. To grasp this sentence more easily we determined six major fundamental drivers:

Technical support and resistance levels might be more important for gold and silver than for other assets because fundamentals are difficult to understand. 1) Gold and silver move with other commodity prices and global growthGold and silver are correlated to other commodity prices. In particular the global Brent oil benchmark and copper, in the last years a proxy for Chinese investments, are closely linked.  Gold, copper, zinc prices compared (source) Recent developments (March 2013): Higher supply of U.S. oil and slower global growth helped to weaken oil prices and consequently gold prices. Copper got under pressure by slower Chinese growth and the regulation of Chinese housing, where the law disallows to buy a second home. 2) Gold and silver prices are correlated to global money supply and inflation. Metals appreciated until 2011 with rising money supply and inflation in emerging markets: Due to the high portion of food and energy in these countries' CPI baskets, the effect of rising commodity prices on inflation is stronger than in developed nations. Since summer 2011, but also between spring 2008 and autumn 2008, global inflation figures fell and consequently also gold and silver prices. The following chart shows the relationship with the yearly change of U.S. CPI inflation.  Gold versus US YoY CPI rate until summer 2011 (source) These charts, however, show two measures of the CPI-adjusted gold price: The common view that the gold price is related to U.S. inflation is difficult to sustain in a world where emerging markets soon achieve half of global GDP. During the end 1970s "gold bubble", however, U.S. inflation was the main driver of high gold prices (see more under point 5). 3) Gold and silver prices appreciate with trade and growth "im-balances" against the United States: the "fear factor" Gold and silver typically rise together with economic improvements in emerging markets and (historically) Europe when the U.S. cannot cope with this pace. This imbalance leads to a "fear factor", namely that suddenly U.S. consumers stop spending like they did in 2008. Between 2009 and summer 2011 emerging markets continued their ascent but high oil prices and the weak housing market hampered the United States. A similar situation happened in the 1970s when Southern America and Europe showed far higher growth than the U.S. While these improvements helped the oil price, the U.S. trade deficit increased. This resulted indirectly in higher US debt. While the U.S. has high debt and trade deficits, countries like Germany or China exhibited current account surpluses and high savings. These must be:

If capital exports are smaller than the current account surpluses, then the currency is a rare good, it typically appreciates. When the yield of foreign investments is too low (see also factor 5), then surplus countries prefer to invest in the local economy, often in real estate to counter inflationary effects. None the less, with rising wages and partly due to the stronger real effective value of the yuan, the Chinese current account surplus has considerably weakened. Recent data showed a Chinese trade deficit, even if distorted by the Chinese new year.  China Current Account and Real Exchange Rate (source Paul Krugman) Stronger investments and real estate prices in the U.S., however, tend to weaken the gold price. Rather, they raise expectations of a US interest rate hikes (see point 5). The graph above shows that the monthly U.S. trade deficit ex-petroleum has remained pretty stable around 25$ bil. US$ for 13 years, except some excesses before and some temporary improvements after the crisis. This implies that the U.S. trade balance is mostly dependent on supply and demand of oil (factor 1). 4) Gold prices are correlated to central banks' activitiesFor decades central banks in emerging markets relied on buying US treasuries. Due to higher wage increases, higher inflation and the interest rate parity, the emerging market currency depreciated with time. This fulfilled a double advantage: the central bank had inflation-resistant reserves and could profit on an appreciation of the dollar. From the year 2002 on, however, most currencies improved against the dollar and destroyed a part of the central banks' profitability. In the Bretton Woods system, other countries fixed their N currencies against 1 currency, the US dollar. The Fed was obliged to exchange one ounce of gold into 35 US$. This created a so-called N:1 currency system. The gold share of central banks of for emerging markets is still low today, whereas it is very high for many European countries. The reason is that the central banks of Germany, France and Italy (all three with 72% gold holdings, see the full list of global gold holdings) could build up their reserves during the Bretton Woods era. The following charts show the gold purchases of central banks and the increase of currency and gold reserves of emerging markets compared to US GDP.

The IMF demonetization of gold policy urged central banks to sell their gold, countries like the UK and Switzerland followed these calls. Together with falling inflation (factor 2) and a strong US current account (factor 3) these gold sales helped to put downwards pressure on the gold price between 1998 and 2005, while the strong rise of other commodity prices (factor 1) sustained it. Today the Fed is still the leading central bank in an implicit N:1 system of central banks. A weak US economy urges the Fed to act within its double mandate of to maintain low inflation and to reduction of unemployment. The Fed often implements easing measures and expands its balance sheet. Typically gold prices rises and the US dollar weakens after this "quantitative easing", because private investors and some central banks move out of the dollar into gold. In 2011 and 2012 more and more central banks in emerging markets reduced their dollar share and bought gold instead. China holds 1.7% of reserves in gold, India 10%, Brazil only 0.5%. In particular, countries with current account deficits, like India (10% central bank gold holdings), Belarus (30%), Egypt (25%), often prefer gold to stabilize their currency, while Western central banks still stick with the former IMF rule not to buy gold any more. Recent developments (April 2013): The recent discussion about the Cyprus gold reserves had woken up fears about the gold sales of other central banks like Spain and Italy. On the other side the dip in gold prices make the metal interesting for central banks with continuing surpluses. 5) Gold and silver prices rise with falling U.S. real interest rates, with "financial repression" Still today American funds are the most important driver of financial markets. Therefore gold and silver prices fall when for these investors U.S. treasuries become more attractive relative to gold or silver. In times of high real interest rates, the gold price is weak and vice verse. The following graph gives a bit more differentiation. It shows periods when the simple relationship stipulated in this point gets overlaid

The gold price falls when the U.S. economy improves and the chances of a Fed Funds rate hike increase, even if this hike is far in the future. Particularly when more U.S. jobs are created, then gold and silver prices decline. Wages as underlying factor for interest rates and the gold priceDuring the 1970s, inflation expectations and consequently wages rose in response to oil shocks and rising oil prices. The gold price moved upwards together with wages and oil prices.  source Paul Krugman The Fed chairman Volcker finally hiked interest rates so that unions stopped higher wage demands, new supply (e.g. North-sea oil) suppressed the oil price and the incomes of emerging markets. Global growth was sluggish. Consequently the Fed managed to keep inflation under control, company margins and stock price rose again: The Fed destroyed the gold price. In the year 2013, the opposite picture arrived: U.S. wages had been nearly steady for years, but company margins were increasing. The wage share of GDP is declining, while companies could profit on global supply chains and cheap labor in emerging markets. Leading economists like Paul Krugman, spoke out in favor of rising wages. 6) Gold and silver prices move with physical supply and demandUpdate 2013: Demand and supply for physical gold and silver diverted sharply. The above five factors are certainly visible in the supply and demand situation for gold and silver, still price movements are often more reflected in modern instruments like ETFs and futures. ETFs made it possible that new investors were able to buy the metals more easily. With the resurgence of Asia after the crisis of 1998, gold and silver prices have seen a big bull run. One reason is that China and, even more, India have a strong gold and silver tradition and massively increased their physical purchases. The Indian savings rate is over 20%, a bigger part of savings move into gold. Silver has more industrial use, often in emerging markets. Silver reacts more strongly to physical supply and demand than gold.  source Seeking Alpha Other commodities, especially oil react very strongly to temporary disruptions of supply. This is not the case for gold: temporary disruptions like a strike of South African miners does not affect the price very strongly. Supply: Newly discovered gold in California weakened its price in the 19th century. Silver appreciated with higher industrial use at the end of 19th century. Silver prices also rose with the switch of the Netherlands and India to silver-backed currency. As a consequence, some years later, cheaper gold and higher silver prices let many central banks switch from bi-metal or silver-backed currencies to gold-backed currencies, to the gold standard. The CEO of Barrick in a note to shareholders, said that:

George Kesarios explains here that gold prices can even move under production costs like in the 1990s, but he sees the production price around 1000 US$. In the second part we explain which of these long-term fundamentals for gold and silver are still positive by April 2013. In the latest update we explain that the Fed destroyed the gold price in the early 1980s, but now they will continue to be the biggest supporter of the gold price for years.  Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and we encourage you to complete your own due diligence when making an investment decision. Even if we often write about Forex trading, our advices aren't written for day traders who follow technical channels, but rather for mid- and long-term investors. Our aim is to show discrepancies between fundamental data and current asset valuations, which can lead in mid-term to an inversion to technical channels. |

| <b>Silver Prices</b> May Level Off - but Will Stay Strong in Coming Months Posted: 27 Jun 2014 12:49 PM PDT Silver prices got a slight bump this week, as traders continue to feed into the momentum of precious metal investments generated by fear of earlier-than-expected interest rate hikes. Silver prices are up about 1.3% on the week to $21.13 as of 12:17 p.m. today (Friday). This week's climb is not as dramatic an increase as last week when the specter of rising interest rates hung above investors following the U.S. Federal Reserve's FOMC meeting. Silver was up 6.1% last week and volume picked up as well because of the Fed.

A lot of the trading this week is investors looking to pile up on last week's surge, Richard Checkan, president and chief operating officer of Asset Strategies International in Rockville, Md., told Money Morning. Silver Recovers from Bearish Precious Metals MarketThis month silver has performed well, bringing in 12.3% returns since it bottomed out at the end of May. Silver is trading above both its 50-day moving average of $19.54, and its 200-day moving average of $20.43. "I think silver prices have been strong because they've simply lagged for a long time, and because gold has also recently reversed and headed strongly higher," Money Morning'sResource Specialist Peter Krauth said. Silver will often move with gold prices, Checkan said, because as investors move into gold for one reason or another, they will look to diversify within precious metals and silver is an obvious second choice. Because the silver market is very small compared to the gold market by volume, when investors do pour into silver, it will not only increase with gold, but outperform it. "Once the trend is established, silver starts getting buyers, it starts to outpace gold because it's a smaller capitalized market," Checkan said. "It's like throwing a rock into a lake versus a puddle, the relative splash is much bigger in the puddle." And that's been the case this month... Gold is up from its $1250.00 opening on June 2 only 5.4% to $1317.80 by market close yesterday (Thursday). However, when investors pull back on gold, it has the same magnified effect in reverse for silver, which explains why gold is up 9.4% on the year compared to silver's 8.6%.The summer months are historically less active for precious metal traders, Checkan said, so the timing of this month's surge may be out of the ordinary. But the Fed comments can explain this slight aberration from historical trends. "Summer is kind of steady to trending weaker just because people aren't paying attention," Checkan said, and he said this could be the case in the coming weeks. And as it stands, silver may be a little overvalued, prompting some to sell off. "We could see a bit more strength, but I wouldn't be surprised to see a bit of profit-taking as the price may have gotten temporarily ahead of itself," Krauth said. While both Krauth and Checkan said they could see silver trading slow down, they also see potential upside in the coming months. Krauth said after some traders move from silver, "we could well see continued strength." Krauth said the next target for silver will be $22.50, and it could be picking up in the months to come. It could even take out the February highs, when silver prices hit $22.18 before closing at $22.05 on Feb. 24. More on Precious Metals Investing: Money Morning recently detailed for our Members the importance of owning gold now - and delivered a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here. |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver prices | Silver Prices: Is 14% Enough for 1 Month? | Gold News"