Gold price | Will <b>Gold Price</b> Continue to Consolidate? :: The Market Oracle <b>...</b> |

- Will <b>Gold Price</b> Continue to Consolidate? :: The Market Oracle <b>...</b>

- The <b>Gold Price</b> Rose $1.40 this Week Closing at $1320.40

- Why <b>Gold Prices</b> Hit a Three Month High This Week :: The Market <b>...</b>

- Silver and <b>Gold Prices</b> Both Rose Today with the <b>Gold Price</b> Closing <b>...</b>

- <b>Gold Price</b> "Bullish", Unmoved by Strongest US Jobs Data Since <b>...</b>

| Will <b>Gold Price</b> Continue to Consolidate? :: The Market Oracle <b>...</b> Posted: 05 Jul 2014 06:37 AM PDT Commodities / Gold and Silver 2014 Jul 05, 2014 - 03:37 PM GMT By: Chris_Vermeulen

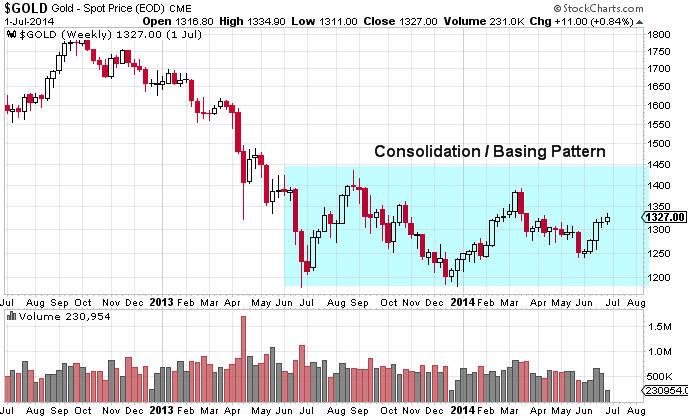

Gold prices have been in a giant basing or consolidation pattern for more than one year. As can clearly be seen below, gold futures prices have traded in a range between roughly 1,175 and 1,430 since June of 2013.

The past few weeks we have heard more about gold prices as we have seen a five week rally since late May. I would also draw your attention to the fact that gold futures also made a slightly higher low which is typically a bullish signal. At this point in time, it appears quite likely that a possible test of the upper end of the channel is possible in the next few weeks / months. If price can push above 1,430 on the spot gold futures price a breakout could transpire that could see $150 or more added to the spot gold price. Clearly there are a variety of ways that a trader could consider higher prices in gold futures. However, a basic option strategy can pay handsome rewards that will profit from a continued consolidation. The trade strategy is profitable as long as price stays within a range for a specified period of time. Ultimately this type of trade strategy involves the use of options and capitalizes on the passage of time. The strategy is called an Iron Condor Strategy, however in order to make this trade worth while we would consider widening out the strikes to increase our profitability while simultaneously increasing our overall risk per spread. Consider the chart of GLD below which has highlighted the price range that would be profitable to the August monthly option expiration on August 15th. As long as price stays in the range shown above, the GLD August Iron Condor Spread would be profitable. Clearly this strategy involves patience and the expectation that gold prices will continue to consolidate. This trade has the profit potential of $37 per spread, or a total potential return based on maximum possible risk of 13.62%. The probability based on today's implied volatility in GLD options for this spread to be profitable at expiration (August 15) is roughly 80%.

Our new option service specializes in identifying these types of consolidation setups and helps investors capitalize on consolidating chart patterns, volatility collapse, and profiting from the passage of time. And if you Advanced options trades are not your thing, we also provide Simple options where we buy either a call or put option based on the SP500 and VIX. The nice thing about buying calls and puts is that you can trade with an account as little as $2,500. If You Want Daily Options Trades, Join Technical Traders Options Alerts: www.TheTechnicalTraders.com/options Chris Vermeulen Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return. This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The <b>Gold Price</b> Rose $1.40 this Week Closing at $1320.40 Posted: 04 Jul 2014 06:36 PM PDT

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why <b>Gold Prices</b> Hit a Three Month High This Week :: The Market <b>...</b> Posted: 06 Jul 2014 07:59 AM PDT Commodities / Gold and Silver 2014 Jul 06, 2014 - 04:59 PM GMT By: Money_Morning

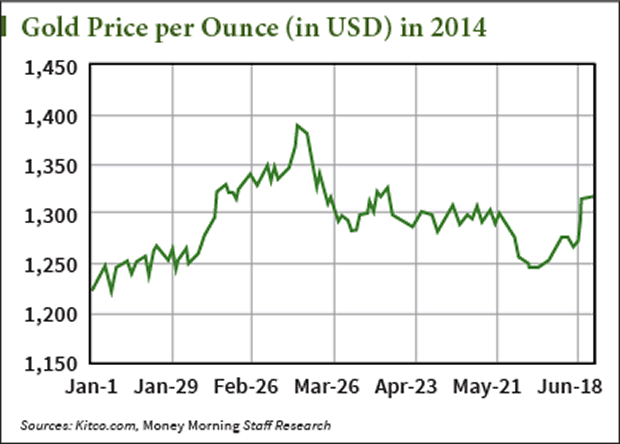

Gold for August delivery traded up $4.70 at $1,326.70 an ounce in early market action Tuesday. At last check, spot gold was up $2.70 to $1,333.60, its highest level since March 24.

Since gold's surge of more than $50 an ounce on June 19, the yellow metal has been back in the spotlight. Gold investors have recently bulked-up bullish positions in the shiny metal. According to data released Friday from the U.S. Commodity Futures Trading Commission (CFTC), hedge funds and other large gold investors added a record amount of ounces to their long positions in the week ending June 24. Long positions rose 61% to 47,784 contracts, or 4.8 million ounces. That was likely the biggest weekly increase on record, or at least since 2007 when the CFTC changed the way data is collected, according to Ole Hansen, head of commodity strategy at Saxo Bank. Short positions fell by nearly 25,000 contracts. The bullish stance comes as gold prices recover from a brutal 2013. Gold plunged 28% last year, its biggest annual decline since 1981. The current price of gold is down 31% from gold's all-time high of $1,923.70 hit in September 2011. Yet gold's solid year-to-date gains have been a bit overshadowed amid record-setting rallies for equity markets. "Many have failed to notice the fact that gold has shown a strong performance this year, and it seems that the 2013 slump is still fresh in people's minds," Michael Gayed, chief investment strategist at Pension Partners LLC, told Bloomberg. The yellow metal logged its second consecutive quarterly gain Monday, as Q2 2014 came to a close. June was the precious metal's best month since March. Gold prices rose 6.1% during June, putting the metal's gains for the recent quarter at 3%. Year to date, gold prices are up 10%, the best start to a year since 2010. What's Boosting the Current Price of Gold Goosing the price of gold this year has been continuing tensions between Russia and Ukraine, and fears of an all-out civil war in Iraq. The yellow metal is frequently bought as a safe-haven hedge against geopolitical disturbances. Iraqi army tanks and armored vehicles arrived in the northern city of Tikrit on Sunday. It was the second day of fighting to retake the city from Sunni militants, which now occupy large parts of the country. Tuesday, mortars landed at the golden-domed al-Askari mosque, injuring at least 14 people. The shrine holds the tombs of Ali al-Hadi and his son Hassan al-Askari, both descendants of the prophet Muhammad, and considered by Shiites to be among his successors. Following the 2006 al-Qaida bombing of the revered shrine, thousands were killed and the sectarian violence put Iraq on the path of a full-scale civil war. Also on Tuesday, Ukrainian forces launched full-scale military operations against pro-Russia separatists in the east just hours after the country's president ended a cease-fire agreement. The Defense Ministry said Ukrainian forces "carried out strikes from the air and on land" Tuesday morning against separatist positions in eastern Ukraine. Societe Generale analyst Robin Bhar said the geopolitical factor is difficult to predict and that uncertainty could "keep gold above $1,300 just on its own." Also likely to keep the current - and future - price of gold propped up are inflation fears... Inflation Is Bullish for Gold Prices Now Gold has recently taken up its familiar position as an inflationary hedge. Inflation has been heating up in the last several months. In May, consumer prices rose at more than a 4% annual pace. Prices for beef, pork, and other food prices are soaring. Core inflation - prices less food and energy - after remaining fairly tame for several years, is also accelerating. Americans could be facing inflation greater than 3% or even 4% for the rest of 2014 and 2015. "Going ahead, economic data will guide gold prices," Jeff Sica, who helps manage $1 billion at Sica Wealth Management, told Bloomberg. The metal could see additional gains if the U.S. economy slips or geopolitical turmoil accelerates, Sica said. Sharing that sentiment is Howie Lee, an investment analyst at Phillip Futures. "This quarter (Q3), we expect gold to remain elevated or even possibly climb due to multiple uncertainties," Lee told Reuters. He added that uncertainties over the uneven U.S. economic recovery and geopolitical tensions will provide a cushion for gold. Lee also sees a positive technical picture for gold in Q3, with resistance at $1,365 and support at $1,189. Gold prices could see some action later this week. Thursday brings the closely watched June jobs report, as well as the European Central Bank's policy meeting. Money Morning recently delivered for our Members a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here. Money Morning/The Money Map Report ©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and <b>Gold Prices</b> Both Rose Today with the <b>Gold Price</b> Closing <b>...</b> Posted: 02 Jul 2014 04:20 PM PDT

Just to be picky about it, gold actually closed on Comex higher than the last (April 14) high, $1,330.70 today against $1,327.20 then. Anyway, you'd expect it to pause a bit to hammer through that high. Still, the clock is ticking, and when markets don't rise, they fall. Yes, that does sound like a profound but senseless tautology, but what I mean is that when markets stop progressing and lose momentum, they fall back. Leave it here: the GOLD PRICE needs to rise tomorrow, because it can't float here under resistance forever. The SILVER PRICE advanced to 2125.4c, above the range that had entrapped it. It needs to show strength by closing over 2150c, and remains very overbought on it's Relative Strength Index. Market has a proverb: "Bull markets climb a wall of worry." Here I am exampling it for y'all in living color. Here are some questions from a reader which many of y'all may share. Be warned to filter whatever I say thru the filter of knowing that I buy and sell silver and gold, and have done for 34 years, so my bias leans very much toward hard money. That doesn't say I am automatically wrong or right, it merely reveals my worldview. Question: I see some recommendations that IRAs invested in the stock market should be moved them to an IRA funded in physical gold or silver. What do you think of this? Answer. Fundamentally the stock market's rise since 2009 has been driven by the Federal Reserve's massive creation of new money, roughly quadrupling the money supply. Historically, there's no precedent for this. The Fed has avoided a hyperinflation in consumer prices in large part because the new money has been drained into and has driven the stock market. Instead of inflating consumer prices, the new money has inflated asset prices. Fundamentally, this promises that whenever the Fed stops creating new money, the stock market will stop rising. Why? Not economic outlook but inflation is driving stocks higher. Remove the cause (inflation), then the outcome (higher stock prices) ceases. The Fed has already begun removing the cause with its "tapering" since December 2013. Technically stock indices have formed a huge bearish rising wedge since 2009, which portends a breakdown and much lower prices. More, since 1995 the Dow and S&P500 have formed an enormous head and shoulders top that presages a huge drop. Third, stocks are at the top of a 300 year up cycle, which implies correcting a 300 year up move and therefore much lower prices. You are watching that topping process now, and it should be complete by the end of this year, perhaps sooner. Meanwhile, the massive inflation 2008 - now will eventually send up silver and gold prices, because fear of inflation creates the monetary demand that drives silver and gold higher. All these reasons lead to only one conclusion: sell stocks and put the proceeds into silver and gold. Question: I have seen another recommendation to cash out IRA accounts and pay the tax and penalty, then invest in gold and/or silver. Answer: An IRA puts you in partnership with the federal government, and they are the senior partner. They make the rules, and they can change the rules at any time. Ownership has two parts, title and control. You have title to your IRA, but the government has control. That may not bother you, but if you want control, too, you may only secure that by closing the IRA and paying the taxes and penalty. That is the price of getting control of those assets. Every individual has to weigh that against his own personal desires and prudence, asking, "Is it worth the price?" Only you can answer that question. Personally, I want no partnerships with the federal government, but everyone doesn't think as I do. You have another alternative, a Precious Metals IRA, i.e., sell the stocks within the IRA and put the proceeds into precious metals held by the IRA. For this you must move your IRA from whoever now manages it to New Direction IRA in Louisville, Colorado, our recommended IRA trustee. See http://newdirectionira.com/ Once you have transferred management of your IRA to New Direction and the funds are on account there, you can call us and order precious metals. They will be shipped to the IRA custodian of your choice. Now to markets: Buoyed by a lying employment report from the yankee government the US dollar caught wave today and surfed up 0.18% (14 basis points). This gainsaid my expectation, proving that the Dollar deserves a starring role in a Freddy Kruger movie. It jumped up enough to close above that downtrend channel line it had fallen through two days ago, bouncing off a scroungey internal support line. I've been bitten and fooled by the US dollar index so many times I'm not sure what to make of this, but if it climbs over 80.17, the 50 DMA, it has a chance to rally. Yen took it on the chin (a rhyme if you live in the South where we know no short e before n). Lost 0.25% to 98.25, falling like your glasses out of your breast pocket and into the lake, slicing through the 200 DMA (98.47). Still range-trading. Euro shrank back like the Wicked Witch of the West facing a bucket of water. Dropped back 0.16% to $1.3659, below the 200 DMA ($1.3669). A close below $1.3600 nixes any chance of a rally. Stocks millimetered up today (I'm going metric-- NOT). Dow added 0.12% (20.17) to 16,976.24. S&P500 "rose" 1.3 (0.07%) to 1,974.62. This has become a waiting game, waiting for the big break. Be patient. Dow in gold gained 0.04% to 12.78 oz (G$264.19 oz), flat from yesterday. Dow in Silver dropped 0.49% to 800.58 oz (S$1,035.09 silver dollars), bouncing off the very steep downtrend line. If a corrective rally is about to happen, this would be a likely place for it to start. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Gold Price</b> "Bullish", Unmoved by Strongest US Jobs Data Since <b>...</b> Posted: 02 Jul 2014 06:00 AM PDT GOLD PRICE gains of $5 per ounce were erased Wednesday lunchtime in London, as new US data showed a surprise jump in June employment and the Dollar rose on the currency market. Silver followed the gold price, spiking lower only to recover the tight range of the morning session around $21.05 per ounce. The private-sector ADP Payrolls report said the US added 281,000 jobs last month, the strongest rise since late 2012 and well ahead of Wall Street economists' consensus of 200,000. Peaking at $1329 just before the ADP jobs Report, the gold price eased back to $1324 – a two-day low some 0.6% higher for the week so far. The Euro currency fell harder, buoying the gold price for Eurozone investors above €970 per ounce, a 3-month high when first reached in late June. Sterling also dropped back vs. the Dollar after the ADP jobs data – widely seen signalling the US government's official Non-Farm Payrolls report due Thursday – but held near new 6-year highs after strong UK house price and manufacturing figures. The gold price for UK investors held above £772 per ounce, a level first reached in May 2010. "It's the first year in several," says Bloomberg, quoting Moody's Analytics director Marisa Di Natale, "where we haven't had some kind of manufactured fiscal showdown in Washington, which weighs on business confidence and consumer confidence." "If you have a desire," the newswire quotes one small-company boss, "and can write your name and will go out and work hard, you can get a job here today." Ukraine's armed forces and National Guard meantime continued what Kiev's parliamentary speaker called their "offensive on terrorists and criminals" in the country's pro-Russian separatist east. Crude oil prices slipped however, reaching 3-week lows on the Brent contract as a key Libyan port was re-opened. ISIS extremists in Iraq today ordered other Sunni groups to swear allegiance, meaning "our revolution has been hijacked" according to one militia leader. "The recent strength in the gold price," one Asian dealing desk said Wednesday morning, "continues to put downward pressure on premiums in India and China." Shanghai gold prices again ended the day at a $1.40 discount to London quotes. "Trending and momentum indicators are bullish," says the technical analysis team at Swiss investment and bullion bank UBS, looking at gold price charts. Silver prices, in contrast, have "failed to push higher with gold," says Australia's ANZ Bank in its daily commodities note, "struggling to overcome $21.20 despite numerous tests." |

| You are subscribed to email updates from Gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Until recently, the world has forgotten about gold and gold futures prices it would seem. A few years ago, all we heard about was gold and silver futures making new highs on the back of the Federal Reserve's constant money printing schemes. However, after a dramatic selloff the world of precious metals it became very quiet.

Until recently, the world has forgotten about gold and gold futures prices it would seem. A few years ago, all we heard about was gold and silver futures making new highs on the back of the Federal Reserve's constant money printing schemes. However, after a dramatic selloff the world of precious metals it became very quiet.

Diane Alter writes: The current gold price as of July 1 represents a three-month high amid a weaker dollar and ongoing geopolitical tensions.

Diane Alter writes: The current gold price as of July 1 represents a three-month high amid a weaker dollar and ongoing geopolitical tensions.

0 Comment for "Gold price | Will Gold Price Continue to Consolidate? :: The Market Oracle ..."