Sell gold | Why We Are Now <b>Selling</b> Our <b>Gold</b> Positions For Silver Positions <b>...</b> |

| Why We Are Now <b>Selling</b> Our <b>Gold</b> Positions For Silver Positions <b>...</b> Posted: 31 May 2014 09:09 PM PDT Summary

In the past we've been very bullish of gold and the gold ETFs (SPDR Gold Shares (GLD)) and less bullish on silver and the silver ETFs (iShares Silver Trust (SLV) and the Sprott Silver Trust (PSLV)), with our biggest reason to own silver simply being its correlation with gold. We are starting to change our mind and believe that investors should begin to allocate more of their precious metals portfolio to silver over gold. We want to stress this isn't because we're bearish on gold (quite the contrary), but rather that we believe that the potential returns on silver are potentially much better than in gold.

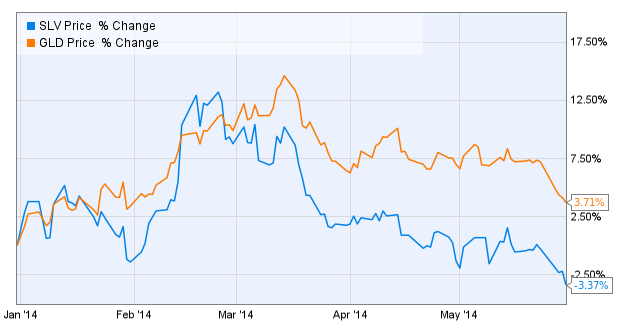

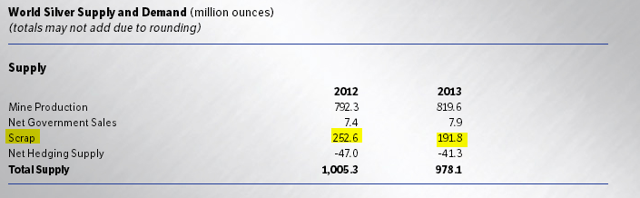

Year-to-date silver (represented by the SLV ETF) has given investors negative returns as it has fallen over 3%, while gold has actually gained almost 4% YTD. So despite the precious metals rally we've seen in the first half of 2014, physical silver prices have actually dropped for the year - so why are we bullish on silver? Silver Recyclables PlummetingA recent report by the Silver Institute and research by the GFMS team at Reuters show that silver scrap dropped by 60 million ounces in 2013. Source: The Silver Institute This large drop in scrap silver led to total silver supply dropping in 2013 despite an increase in mine supply. In fact this was the largest drop in scrap silver since the 1980's as the large price drop discouraged people and industry to sell scrap silver. Looking forward, we believe that we may continue to see scrap supplies drop further because silver prices have dropped significantly since even 2013 - the average price of silver in 2013 was around $23.79. Since current prices are around $18.80 per ounce, there will be even less reason for people to sell scrap silver - we may see scrap supply drop below 150 million ounces. This would leave a deficit of 40-50 million ounces of silver that would have to be made up from elsewhere to keep the market in equilibrium. Since mine supply growth will not be able to supply that amount of silver, we can see quite a bit of loss in investment demand before there will be a true surplus in the market - quite a bit of leeway for investors. Primary Silver Producers Struggling to Produce Silver Profitably at Under $20 per OunceWe haven't released our report on the real costs of silver producers for 2013 (those who are interested can subscribe to our free soon-to-be-released Weekly Gold & Silver Newsletter), but the SRS Rocco team (which has an excellent newsletter that we'd highly advise precious metals investors to sign up for) has released their report and it should come as no surprise that in 2013, costs were higher than the average silver price (even after considering write-downs).

Source: SRS Rocco Report There's a lot of interesting details in this table which we won't get into, but investors should note that the adjusted net loss of $140 million (again excluding write-downs) was reported for production of approximately 92 million ounces sold at an average price of $23.09. SRS Rocco reports a loss of $0.97 per ounce sold, while our calculations give us a loss of around $1.50 an ounce (Silver Sold / Adjusted Income). Regardless of the method used, the top 12 primary silver miners reported a loss of anywhere from $0.97 to $1.50 per ounce sold - and this was at silver prices 25% higher than the current spot price! There's no doubt that silver miners have cut back on costs, development programs, and have started to high-grade their mines to bring costs down, which we've started to see in Q1FY14. But all the low and mid-hanging cost savings have already been done and little more cost savings remain, and with prices under $20 per ounce, many of these miners are losing money despite all the cuts. Add in the new Mexican Mining tax that may add 50 cents or more per ounce of silver production from the world's largest silver producing country, and you can see how it will be tough for silver miners to cut costs much further in 2014. Finally, and perhaps more importantly, most of these cuts have medium to long-term side effects of cutting future production. Silver miners have been cutting back significantly on exploration and development expenses, which benefits the bottom line in the short term, but in the long term it ends up cutting future production. Throw in the fact that many of these miners are high-grading existing mines which ends up lowering mine life, and you have a formula that will result in future drops in silver production. As we discussed in our first point, silver scrap has been plummeting and should fall further in 2014 as prices are much lower than in 2013, what happens if mine supply does not grow as many current analysts predict? What if we actually see a drop in mine production as primary silver miners cut back on production or process less, more profitable ore? In that case we'd be pairing a decline in scrap with a drop in mine supply and we'd have the formula for a surprise supply deficit - even as most metal advisory firms and analysts predict a surplus. That is how contrarian trades are made and won by thoughtful investors. What About Silver Being Mined as a Byproduct?Many of you will point out that even if there are cuts in production from primary silver miners, most silver production (around 70%) comes as a result of the mining of other metals, so primary silver production drops may not have a large effect on total mine supply. That is true, but that also means that silver mine production can be affected by the production of these other primary metals - that is silver production can actually fall despite a rising silver price. According to NRC research from 2008 (we haven't had any luck finding more recent numbers but readers who know of more recent data please let us know), the majority of silver mine reserves were held mostly in copper-zinc ore (55 percent); other sources include gold and silver ore (23 percent), lead-zinc ore (18 percent) and nickel-copper ore (4 percent). So what happens to copper, gold, lead, and zinc will have a major effect on future silver production. We already know that gold production is expected to drop starting in 2015 (we think it will drop in 2014), so that should take quite a bit of silver byproduct production with it. Additionally, according to Joseph Gallucci of Dundee Capital markets in an interview earlier this year, he noted that a number of "…big zinc ore bodies are near an end and there is no replacement on the horizon," which will again have a domino effect on the silver production associated with those deposits. Finally, copper production isn't doing particularly well as Codelco, the world's largest copper producer, reports that prices are rising due to declining output. So there are significant headwinds for gold and base metals that produce silver as a byproduct, which we believe will at least flatten production output and possibly lower it regardless of the silver price. Meanwhile on the Demand Side…We believe that economic growth will be nil to weak in the next few years, which will constrain base metal production growth and thus byproduct silver supply. But if we do have strong economic growth, then we can also see a situation where silver demand grows as most silver is used for industrial purposes (about 60%). That means we can have a situation where investors are busy selling silver because of its correlation to gold, meanwhile industry is taking advantage of low silver prices to purchase forward as much physical silver as possible as their usage grows. This was something that was recently alluded to by Coeur Mining Inc. (CDE) CEO Mitchell Krebs - and we think he has some excellent points. Conclusion for InvestorsThere are a number of other reasons we like silver, but even the three strong reasons listed above are enough for us to consider trading some of our gold for silver. Not because we think that gold has a dull future, but because silver simply has a brighter future at current prices. The kicker for us is that the silver market is much smaller than the gold market and any sizable movement of money into the market has the potential to move it quickly. Investors should remember that annual silver market supply at current prices (1 billion ounces multiplied by the spot price) is under $20 billion. That is five times LESS than the amount of annual gold mine production (a little over $100 billion) - a few hedge funds could quickly move the price up with very little leverage. We would expect a move in silver to be sharp and fast, so this is not a market that investors should be looking for a nice bottom - the silver market is too small for that. This is the type of market that we expect to see a V-bottom type event - maybe that's what we are seeing now as silver approaches its 2013 lows. We have already started re-allocating from cash and gold to silver and silver equities because we don't expect a smooth bottom and we don't want to miss out on the largest gains that are found during the early moves. Investors who believe in the fundamentals that we've outlined above should gain exposure to silver with positions in physical silver and the silver ETFs (iShares Silver Trust, PSLV, CEF). We like the miners even more because of the amount of leverage that they carry to the silver price and the fact that they have been beaten down pretty badly. Investors interested in the miners should consider companies like First Majestic Silver (AG), Pan American Silver (PAAS), Hecla Mining (HL), or Endeavour Silver (EXK). Investors looking for even more risk and reward may want to consider some smaller or more developmental stage companies such as MAG Silver (MVG), Revett Minerals (RVM) (though they are a different situation), or Great Panther Silver (GPL). Analysts and investors seem to be very bearish towards silver, but we think that the fundamentals of silver are now becoming extremely attractive in terms of contrarian opportunities. Volatility and risk are not always commensurate, and we believe that silver offers investors fundamentals that can be much stronger than expected and returns that would be magnified by the small size of the silver market (and the bearish positioning by participants). Contrarian investors would be wise to take note. Disclosure: I am long SIVR, AG, PAAS, GPL, RVM, MVG, EXK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. |

| <b>Gold</b> Price Manipulation Was "Routine", FT Reports | Zero Hedge Posted: 03 Jun 2014 11:02 AM PDT Two weeks ago when news broke about the first confirmed instance of gold price manipulation (because despite all the "skeptics" claims to the contrary, namely that every other asset class may be routinely manipulated but not gold, never gold, it turned out that - yes - gold too was rigged) we said that this is merely the first of many comparable (as well as vastly different) instances of gold manipulation presented to the public. Today, via the FT, we get just a hint of what is coming down the pipeline with "Trading to influence gold price fix was 'routine'." We approve of the editorial oversight to pick the word "influence" over "manipulate" - it sound so much more... clinical.

Well, then, if gold price manipulation, pardon, "influence" was routine, be it to avoid digital option trips or any other reasons, then it's all good, right? Apparently not, especially if a "customer" of a bank that was running a prop trade against the customer ended up costing said customer millions in lost profits.

The only piece of actionable information from the above sentence is that Barclays actually has customers: we expect that to change. After all, with the exception of Goldman's muppets, there hasn't been a more clear abuse of client privileges than what relatively junior trader Daniel Plunkett did while at Barclays. However, Plunkett is just the first of many. Many, many.

That, naturally, assumes that the FCA wasnt to catch more manipulators, pardon, "influencers" of gold and other OTC derivative prices. Which is hardly the case: after all one never knows which weakest link rats out the people at the very top: the Bank of England itself, and perhaps even higher: going all the way to the BIS and those who equity interests the BIS protects. So just what is the most manipulated product with either gold or FX as underlying?

Ideally, the underlying will be relatively illiquid, with a price fixing set by a small number of individuals, individuals who can be corrupted or simply onboarded to your strategy, thus incetivizing them to keep their mouth shut and assist you in ongoing rigging attempts.

Still, why did gold manipulation go on for as long as it did? Because the Barclays trader was an amateur, and instead of taking the money of one of the "old boys' club" participants, ended up robbing an outsider, someone who had the temerity fo lodge a formal complaint.

Wait a minute... this smells remarkably familiar to the LIBOR rigging - after all there it was one "sophisticated" investors against another: the impact of rigging the IR market hardly ever escaped the arena of "sophisticated" influencers, pardon, traders. It is also why Libor was manipulated for a decade before the regulators finally figured it out: because while banks may have lost money to this rigger or that, they were all in it together, and better to lose money individually than to sink everyone at the same time. Alas, that is precisely what happened with Libor. And now it is coming to gold.

it gets worse:

Well that's ironic: because it has always been done this way. Influenced. Or manipulated... or however you want to call it. And while in the case of Libor the regulators could get away with it by stating only other professionals were impacted by years of wholesale market rigging because tracking the impact of daily gyrations in a rigged fix are virtually impossible for normal individuals to trace, and thus prove monetary impairment, with the gold market they may find some significant resistance using this approach. So what approach will they use? Why, just like in the case of HFT: there may have been manipulation, but it only impacts hedge funds and other "sophisticated" investors they will say. Because when it comes to rigged markets, mom and pop have surely never had it better. (36 votes) |

| You are subscribed to email updates from Sell gold - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Sell gold | Why We Are Now Selling Our Gold Positions For Silver Positions ..."