Sell gold | <b>Gold Sell</b>-Off In 2014: A La 2013? | Seeking Alpha |

| <b>Gold Sell</b>-Off In 2014: A La 2013? | Seeking Alpha Posted: 05 Jun 2014 06:30 AM PDT Summary

Gold prices rose by almost 20% from late December 2013 to the middle of March 2014 from their June lows of $1,180/toz to nearly $1,400/toz. As I highlighted here, several factors pushed gold prices higher during the first quarter of 2014: i) Weak United States economic data ii) Rising geopolitical tensions between the United States and Russia iii) Strong physical demand in Asia, with higher premium in the Shanghai Gold Exchange The Technical picture suggests lower gold pricesFigure 1: Bearish technical picture for goldSource: Stock Charts The rally came to an end on March 17 as gold prices dropped by 8% to $1,278/toz on April 1. Then, gold market participants had become confused about the future gold price direction and the market had been trading sideways until May 26. On May 27, gold prices fell sharply by about 2.3% or $30/toz., resulting in a bearish technical picture, as seen in Figure 1:

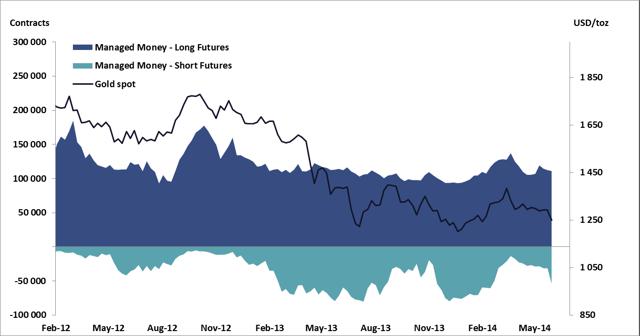

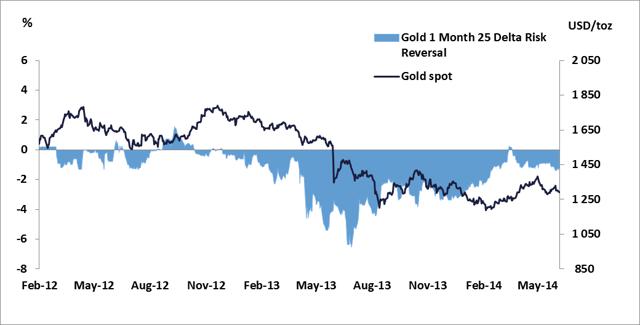

Consequently, market participants have become more confident about the continuation of the bearish trend this year. The Speculators futures positioningIn this section, the speculators futures positioning is discussed, providing some information about the future gold price direction for 2014. Indeed, as a market participant, the question that is confronting me now is whether gold prices are going to fall in a fast and sharp mode going forward. If so, will the $1,180/toz level hold? In my baseline scenario, the $1,180/toz level will not hold because the floor has not been reached yet, even though this level has provided a strong support previously. My thesis is based on the speculators futures positioning. Let's use CFTC reports on managed money positions in COMEX futures as a proxy for speculator's activity. Figure 2: Speculators have the capability to drive gold prices much lowerSource: CFTC, Bloomberg, Mikz Economics Figure 2 suggests that speculators can have a large influence on price movement in the short and medium term. In my view, speculators will have a negative impact on gold prices in 2014 in a greater magnitude than 2013. In 2013, speculators began to build short positions based on the thesis that gold prices had risen too much for too long and the peak of the fear trade had passed. It is not coincidence to me that the gold market experienced a massive sell-off of 28% in 2013 (the worst year since 1981) following 12 consecutive years of boom, with a dramatic rise during the financial crisis. To be more precise, gold entered in a bearish trend in the beginning of October 2012 when it failed for the third time to break above the $1,800/toz level. What went up… had to go down? 2013 proved it. However, Figure 2 shows that speculators began to cover their shorts positions in the end of 2013 into the first quarter of 2014, which have pushed gold prices higher. Interestingly, they started to build new short positions again in May 2014, putting downside pressures on gold prices. It is important to note that, at this stage, speculators have a lot of room to expand their short positions, which would suggest that they have the capacity to drive gold prices to much lower levels going forward. The question now becomes whether speculators will expand their short positions this year. My view is that we are likely to see aggressive selling in the futures market due to a bearish sentiment. What drives gold in the short term is mainly sentiment. In 2013, sentiment has become more bearish but not sufficiently bearish in order for the gold market to create a bottoming process. Historically, gold prices have been near a bottom when an extremely bearish sentiment is reached while near a peak when an extremely bullish sentiment is reached. As the $1,180 level was tested twice, in June and December 2013, and the sentiment was not sufficiently bearish at that level to lead to a real bottoming phase, this would suggest that gold prices may have to decline even lower. In the next section, the options market positioning is discussed in more detail, providing some information about the future gold price direction in the very short term. The Options market positioningWhile the speculators future positioning gives us some perspective about the future gold price direction for this year, it is important to have a clearer view on gold prices in the very short term. In other words, is the gold price going to decline in a fast and sharp mode, à la April 2013? In my baseline scenario, this is not likely. My analysis is based on the options market positioning. Analyzing how the gold options market is pricing options enables me to gauge traders' sentiment. In order to know whether options traders are biased for the downside or upside price action, one will use risk reversals. As noted in a previous article on January 14, 2014, the options market positioning suggested that the gold market would not be ready yet to recover as market participants were still worried about further decline in prices. This hypothesis was proven right even though gold prices continued to rally until the middle of March. As a reminder, a risk reversal in options market can be defined as the implied volatility on call options minus the implied volatility on put options, both with the same delta and maturity. To put it another way, a positive risk reversal means that the implied volatility of call options (downside protection) is greater than implied volatility of put options (upside protection) so options traders are optimistic about the future gold price. On the contrary, a negative risk reversal means traders are biased for downside price action. Finally, a change in risk reversal would suggest a change in market expectations. Let's compute Gold 1 Month 25 Delta Risk Reversal (R25). Figure 3: Gold Prices and Risk ReversalSource: Bloomberg, Mikz Economics As seen in Figure 3, R25 began to decline in September 2013 and plunge below 0% in February 2013, signaling that the sentiment had become bearish for the year ahead. This was proven right as, the gold market, down by 28% in 2013, had its worst year since 1981 when it plunged by 33%. After reaching a low of -6.3% on June 21, 2013, R25 rebounded to peak on March 14 at +0.25%. However, R25 failed to stay above the 0% level and declined sharply thereafter. It was a signal that gold prices may decline in the very short term and it was proven right. Interestingly, the sharp sell-off in gold from May 27 did not impact negatively R25. In fact, it has remained stable; suggesting that market participants do not express a renewed interest for gold upside protections. If this signal proves correct, this will mean that gold prices will not decline sharply in the very short term and we may see some short covering. Having said that, a sharp decline in R25 cannot be excluded and this would indicate that gold prices may drop imminently. In sum, the speculators futures positioning suggests that they have a lot of room to expand their short positions and to put downside pressures on gold prices this year. However, the options market positioning suggests that participants do not expect an imminent sell-off in gold prices in the very short term. In my baseline scenario, gold will remain in its bearish trend in 2014 and 2015 while the support at $1,180/toz will be eventually broken even though this level provides a strong support due to physical demand out of Asia. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. |

| <b>Gold</b> “Important” And No Plan To <b>Sell</b> Significant Quantity Of – ECB <b>...</b> Posted: 19 May 2014 04:28 AM PDT The ECB, the Swiss National Bank (SNB) and the Riksbank of Sweden announced a new gold agreement this morning. They announced they have no plans to sell significant quantities of gold and reaffirmed the importance of gold bullion as a monetary reserve. Today's AM fix was USD 1,301.00, EUR 948.67 and GBP 773.85 per ounce. Gold fell $2.50 or 0.19% Friday to $1,293.10/oz. Silver slipped $0.12 or 0.62% to $19.36/oz. Gold and silver both finished up for the week at 0.34% and 1.10% respectively. Gold moved higher today in euros, pounds and dollars after the ECB and 21 other central banks announced a new gold agreement. The new agreement was expected but the timing was unexpected as the last agreement was not due to expire until September 27.

The crisis in Ukraine and risk of increased tensions between Russia and the west continues to provide support for gold. A further deterioration in relations seems likely and should push gold higher. Also supporting gold is the likelihood that the incoming government in India will relax import restrictions and duties, in the world's second largest buyer. Over the weekend, incoming Indian leader Modi told thousands of supporters that he represents a break from past governments after winning the nation's biggest electoral mandate in 30 years. Last week, Reserve Bank of India Governor Raghuram Rajan said that the new Indian finance minister will decide on easing gold import curbs.

Gold "Important" And ECB No Plan To Sell Significant Quantity Of Gold Twenty one central banks including the ECB, the central banks of the euro area (Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, Spain), the SNB and the Riksbank announced the fourth gold agreement between the central banks for the next 5 years. In a joint statement, the central banks confirmed their intentions with regard to their gold holdings and the participants in the gold agreement made the following declaration: - Gold remains an important element of global monetary reserves. - The participants in the gold agreement will continue to coordinate their gold transactions so - The participants currently have no plans to sell any substantial quantities of gold. The press release from the SNB can be read here. The agreement, which applies as of 27 September 2014, following the expiry of the current

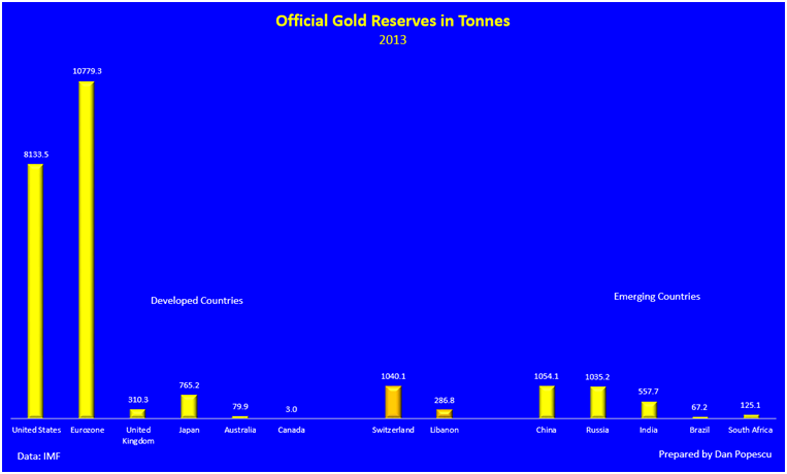

The timing of the announcement was unexpected as the current agreement does not expire until September. It is understandable that the central banks value their gold as "important element of global monetary reserves," given the still lingering economic problems in Greece, Italy, Spain, Portugal, Ireland and Cyprus and continuing ultra loose monetary policies in the Eurozone – with the possibility of negative interest rates. Thus, European central banks are likely to continue to be reluctant to sell their substantial gold reserves which total of 10,779.3 tonnes or 8,972.6 tonnes ( EU G6). There is also the fact that while Eurozone banks balance sheets have recovered somewhat, many are far from robust and remain vulnerable. Should there be a 'Black Swan' event or economies slow down again, central banks may require their gold reserves in order to maintain confidence in the single currency and other fiat currencies. It is believed that there is little appetite for a new gold agreement among the rest of the world and among the emerging market central banks such as China. Most of the central banks that were signatories to the Washington Agreement, clearly do not want to sell their gold reserves. The World Gold Council released data showing that global official gold reserves totalled 31,890.7 tons as of February, 2014. Of this total figure, the euro area held a total of 10,779.3 tons making it the largest holder of gold reserves in the world with 36.6% of the total global gold reserves. The second largest holder of gold reserves is the U.S. with 8,133.5 tonnes. China's central bank gold reserves data has remained at 1,054 tons since the beginning of 2009. No change has occurred in 4 and a half years, despite most market participants believing that China is quietly accumulating gold reserves. China is likely to announce a sharp increase in their reserves to over 3,000 or 4,000 tonnes in the coming months. The previous European gold agreement, agreed in August 2009, committed the central banks to sell no more than 400 tonnes per year and no more than 2,000 tonnes in the five-year period. Sales under the current pact have only totalled around 200 tonnes, 10 times less than was permissible. The global and Eurozone debt crisis created a new found awareness of gold as a safe haven monetary asset. This reluctance to sell gold is likely to continue. Indeed, many central banks are already under pressure to repatriate their gold reserves from the UK and the U.S.

Gold reserves and the price of gold are closely watched on financial and foreign exchange markets – as a barometer of inflation expectations, of systemic risk and of confidence in fiat currencies. The central banks at the time of the first agreement, the Washington agreement, affirmed that gold remained an important part of the global monetary system, setting the basis for a long and upward trend for the gold price. The initial statement does not mention the sales ceiling for the pact and some market participants are surprised they did not reaffirm the sales ceiling. The European Central Bank has told Reuters that there is indeed no formal ceiling included in the new CBGA. There was no mention of gold leasing and the use of futures and options by central banks in the agreement. There was in 1999 and 2004 but not in 2009 and again now. The Bank of England did not sign the agreement. The Bank of England signed the first Washington Agreement in 1999 but opted out in 2004 and 2009. The opt out may be because the UK gold reserves are now insubstantial. By signing the agreement, the BOE might again draw attention to Gordon Brown's controversial gold sales. Click here for the GoldCore Essential Guide to Storing Gold In Signapore. |

| You are subscribed to email updates from Sell gold - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Sell gold | Gold Sell-Off In 2014: A La 2013? | Seeking Alpha"