Iron ore price breaks fall |

- Iron ore price breaks fall

- CHART: Gold now cheapest vs stocks since January 2008

- Centerra to shut Kumtor gold mine if doesn't get permits

- CHARTS: Platinum, palladium ETF holdings jump to record highs

- Marubeni eyes Vale’s halted Rio Colorado potash project in Argentina

- Obama unveils historical attempt to curb coal power plants emissions

| Posted: 02 Jun 2014 04:03 PM PDT Benchmark iron ore managed to eke out a small gain on Monday after a 4% gap down on Friday to fresh lows last seen September 2012. According to data from the The Steel Index, the import price of 62% iron ore fines at China's Tianjin port was pegged at $92.10 per tonne on Monday, up $0.30 on the day after a 7% fall last week. Iron ore is down 31.5% year to date and apart from that quick gap down in 2012 when the steelmaking raw material spent two weeks below $100 a tonne ore hasn't traded in double digits at all since 2009 during the financial crisis. China is responsible for two-thirds of the 1.2 billion tonne seaborne trade and last week the country's powerful central economic planning agency said lower price are here to stay "blaming languishing ore prices on a flood of supply". Stockpiles of imported iron ore at Chinese ports are at record highs above 110 million tonnes according to industry consultancy Steelhome, up more than 50% from this time last year. A slowdown in the world's second largest economy – particularly the property sector that accounts for almost half of all steel demand – has unnerved producers in Australia, Brazil and Africa even as they ramp up supply of the raw material to unheard of levels. Global supplies of iron ore are set to exceed demand by 175 million tonnes next year as top producers Vale, Rio Tinto and BHP continue to increasey capacity, Goldman Sachs predicts. BHP said its on track to up production at its newest mine Jimblebar to 55 million towards its longer term target of 270 million tonnes per annum. Rio Tinto is most aggressive – it is ahead of schedule to reach 290 million tonnes per annum and is targeting 360 million tonnes per annum in the longer run. Vale has been struggling to keep up with the Pilbara producers but the company is nevertheless sticking to its medium term expansion plans to lift its output above 400 million tonnes from the current 300 million tonnes-plus by 2018 as giant projects like S11D in the Carajas complex come on stream. Anglo American's Minas Rio project in Brazil could add another 26 million tonne before the end of this year at the same time its Kumba unit in South Africa return to nameplate capacity of 40 million tonnes-plus. Gina Rinehart's recently okayed Roy Hill project could dump an additional 55 million tonnes on the market by the end of next year. Canada last week okayed its biggest greenfield project in many year and has a number of ore projects in the offing, but further out Africa is destined to become the price trendsetter. Rio's deal with Guinea on developing the Simandou deposit announced this week creates the prospect of a greenfield 95 million tonnes per annum mine within a decade. Rio's $20 billion project with Chinese and World Bank backing constitutes less than half the Simandou mountain range leases while smaller producers in West Africa are close to bringing to market ore from equally rich fields surrounding the Nimba mountains. |

| CHART: Gold now cheapest vs stocks since January 2008 Posted: 02 Jun 2014 12:31 PM PDT The price of gold fell 3% last week and continued to drift lower on Monday, hitting fresh four-month lows at $1,243 an ounce. Gold remains some 4% to the upside for 2014 but is down $135 from highs reached mid-March as the rally on the back of safe haven demand and bargain hunting loses steam. US stock markets however have been on an incredible winning streak. In a new note, the research team at ETF Securities points out that the gold to S&P 500 ratio has fallen close to its lowest level since early 2008. The institutional investment advisers based in London says this begs the question: "Is gold a cheap insurance option right now?" "The VIX equity volatility index declined to near its lowest level since 2007. Meanwhile the S&P 500 extended its longest winning streak above its 200-day moving average since 1998, helping drive the gold/S&P 500 ratio to 0.65, near the lowest level since January of 2008. "In our view it is difficult to believe volatility can remain this low indefinitely. Therefore now may be a good time for investors to consider looking at gold as insurance against a potential rise in volatility."  Source: ETF Securities |

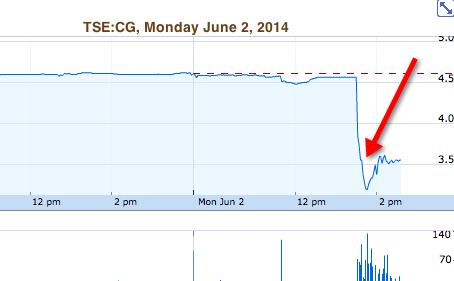

| Centerra to shut Kumtor gold mine if doesn't get permits Posted: 02 Jun 2014 12:06 PM PDT Canada's Centerra Gold (TSX:CG) has warned the government of Kyrgyzstan it is planning to shut down operations at its Kumtor gold mine unless its gets the necessary permits by June 13. The Toronto-based company has been negotiating for months the possibility to swap the government's stake in the company for a direct interest. A non-binding pact last year was rejected by the Kyrgyz parliament following public opposition. A new agreement was signed in December and approved last February by parliament, creating a joint venture that evenly splits control of the Kumtor gold mine. Despite apparently having made peace, the company and authorities have continued talks. The deal, in fact, has not yet been finalized, and Centerra is still facing a $300 million ecological damages suit filed by the government. Regardless of endless political turmoil, the Canadian gold miner has successfully operated the mine, located high in the Tien Shan mountains, since 1997. It has become is a significant employer and taxpayer in the country and a key contributor to the Kyrgyz economy. The vast open pit gold mine accounts for 60% of the nation's industrial output and, according to the company, it is the largest gold mine operated in Central Asia by a Western-based company. But all those benefits would go down the drain if Centerra decides to close shop. While the company said Monday it would keep staff on site for environmental and safety monitoring, as well as for security and required maintenance, it noted that Kumtor has "significant geotechnical and other challenges." The firm said the wall of the open pit is unsteady, as it is being affected by ongoing water flows and ice movement from a nearby glacier. "An extended shutdown without active monitoring and management of such challenges would likely have a material adverse impact on the Kumtor mine and the company's operations, future cash flows, earnings, results of operations and financial condition," it said in the release. Output for this year was expected to almost double to as much as 600,000 ounces, according to Centerra, but that may change depending on whether it closes down Kumtor and the duration of such shutdown, it added. Shares in the company collapsed on the news. They were down 23.2% to $3.54 at 2:32 pm ET. Image courtesy of Kumtor Mine |

| CHARTS: Platinum, palladium ETF holdings jump to record highs Posted: 02 Jun 2014 11:47 AM PDT Labour negotiations at South Africa's PGM mines are once again poised on a knife edge after producers slightly upped an earlier offer to the more than 70,000 workers who've been on strike for more than four months. Workers at the world's three largest platinum and palladium producers, Anglo American Platinum (LON:AAL), Impala Platinumm (OTCMKTS:IMPUY) and Lonmin (LON:LMI), went on strike January 23. The latest offer from management calls for a monthly increase of R800 ($75) a month every year for five years for those at the bottom of the pay scale and smaller hikes for those that earn more. The R800 equates to 16% pay increase for the first year for those earning the minimum of some R4,500 ($420) a month currently. The new offer comes after failed mediation talks through the country's labour court and overseen by the newly-installed Minister of Mineral Resources Ngoako Ramatlhodi. The Amcu union said they would respond to the latest offer which does not differ much from previous proposals without canvassing workers. Boss of the militant union Joseph Mathunjwa last week described the Labour Court proposal as "repackaging of the same old offer" reports Johannesburg paper Business Day. According to a website set up by producers the companies' have lost combined revenue of R20.6 billion (some $1.9 billion) while striking workers have lost nearly $900 million in forfeited wages. Roughly 10,000 ounces of platinum production and 5,000 ounces of palladium are lost each day the strike drags on. Even when strikers do return to work it would take up to three months to restart production. The strike and a stand-off between the West and Russia over Ukraine have pushed the platinum price up 4.4% this year, while the palladium price has surged 16% this year to three-year highs. South Africa and Russia combined account for close to 80% of global supply of palladium and 70% of platinum output which are mainly used to clean emissions in automobiles. The price of June palladium was down slightly on Monday to $834 an ounce, not far off a three-year high. Palladium hit a record high of $865 in February 2011. July platinum pulled back over 1% to $1,436 an ounce and down is now down sharply from the $1,493 level hit just last week over renewed hopes for an end to the strike and the easing of tensions with Russia following the mostly peaceful presidential election in Ukraine. A huge factor boosting the the palladium price has been the launch of two new physical palladium-backed exchange traded funds in Johannesburg in late March. Ole Hansen, head of commodity strategy at Saxo Bank said in a squawk on Monday precious metals prices suffered "a major setback" during the final week of May as global equity markets and the dollar rose, "further reducing the need for alternative investments." Holdings in palladium-backed ETFs nevertheless rose to fresh record highs of more than 85 tonnes or over 3 million ounces as at 30 May following the launch of two physical palladium funds listed in Johannesburg a few weeks after the strike kicked off. Holdings in a platinum ETFs are also at an all-time high. Industry consultants Johnson Matthey Plc said in recent report platinum consumption will beat supply by 1.22 million ounces while the palladium shortfall will widen to 1.61 million ounces, from 371,000 ounces last year and the eighth year in a row of deficits. That would constitute the largest market deficits ever, based on Johnson Matthey data going back to 1975 for platinum and 1980 for palladium. Image of Johannesburg Stock Exchange by Pavel Tcholakov |

| Marubeni eyes Vale’s halted Rio Colorado potash project in Argentina Posted: 02 Jun 2014 10:57 AM PDT Brazil's Vale (NYSE:VALE), the world's biggest iron ore producer, could soon be closing the last chapter of its mining incursion history in Argentina, as Marubeni Corporation is reportedly interested in acquiring the now halted $6 billion Rio Colorado potash project. According to the pro-government newspaper Pagina 12 (in Spanish), the Japanese firm is seeking to enrol Chinese capitals and so make the potash endeavour in the province of Mendoza a profitable one. Another option for Marubeni would be to partner with Vale on the massive project inactive since January last year and officially suspended in March of 2013. Rio Colorado was set to be one of the biggest foreign capital investments in Argentina, turning Brazil's neighbour into a top supplier of potash. However, after spending $2.5bn and completing over 40% of the project Vale walked out on it, citing rampant inflation and exchange rate controls in Argentina as the main factors that made the project commercially unviable. It said the cost had almost doubled to $11bn from initial estimates. Originally scheduled to begin production this year, the project included an 800km railway from the mine in Mendoza province to Bahia Blanca, an Atlantic Ocean port. Rio Colorado mine life was expected to exceed 50 years with an average annual production estimated at 2.4 million tonnes in Phase 1 rising to 4.3 million tonnes per year in Phase 2. Vale's decision to ditch its only major asset in Argentina left both governments unhappy. About 8,000 Argentine workers in three provinces were left out of jobs, while Brazil saw its goal of becoming self-sufficient in fertilizer by 2020 seriously jeopardized. More than 90% of the country's vast potash consumption comes from imports, leaving the country's farms largely at the mercy of two producers: Russia's Uralkali and Canada's Potash Corporation of Saskatchewan. Vale acquired Rio Colorado from mining giant Rio Tinto (LON:RIO) in 2009. The company can keep the concession for up to four years. |

| Obama unveils historical attempt to curb coal power plants emissions Posted: 02 Jun 2014 08:00 AM PDT US President Barack Obama unveiled Monday his awaited new environmental policy aimed to curb the country's greenhouse gas emissions by 30% by 2030, with all the states having until 2017 to comply with the new rules. The 645-page document, developed by the Environmental Protection Agency (EPA), is a centrepiece of the Obama administration's climate change strategy. It is also the first time in the history of the US that a President imposes limits on power plant emissions, which could transform a sector that currently relies on coal for nearly 38% of electricity. The rule, scheduled to be completed a year from now, gives much flexibility to the states, as they can decide how to meet the reductions. This includes expanding renewable-energy generation, working with other states to create regional plans and investing in or creating new energy-efficiency programs. Each state will have a different reduction standard, and the national average will be 25% by 2020 and 30% by 2030, according to the EPA. The agency is asking states to submit implementation plans by June 2016, but the EPA is also giving states the option to extend that by one year. Critics of the agency are already questioning the rule's costs and benefits. The US Chamber of Commerce released a report last week predicting it would cost the economy $51 billion and 224,200 jobs each year. The report prompted a top EPA spokesman to respond with a blog post the same day. "The U.S. Chamber of Commerce released a report that makes unfounded assumptions about the EPA's upcoming proposal for common sense standards to cut the harmful carbon pollution from power plants," wrote Tom Reynolds, EPA associate administrator for external affairs and environmental education. According to the agency, the new rules will shrink electricity bills by an estimated 8% by increasing energy efficiency and reducing demand on the electricity system. But beyond figures, EPA's head Gina McCarthy said both the government and the industry have "a moral obligation" to act on climate. "When we do, we'll turn climate risk into business opportunity, we'll spur innovation and investment, and we'll build a world-leading clean energy economy," she said in her speech. "The science is clear. The risks are clear. And the high costs of climate inaction keep piling up," she added. Winners and losers Experts believe West Virginia will be the hardest hit by the new measures. The state, one of the US's three poorest by household income, sits at the heart of coal country. Official figures also show the state gets 95% of its power from the fossil fuel. The National Association of Manufacturers argues the plan will severely hurt American competitiveness. The EPA backfires saying the regulations could yield over $90 billion dollars in climate and health benefits. From a public health perspective, smog and pollution drops that would also be achieved through the plan, would translate into a $7 health benefit for every dollar invested in the plan, McCarthy says. And, according to the agency's estimates, reducing exposure to particle pollution and ozone could prevent up to 150,000 asthma attacks in children and as many as 3,300 heart attacks by 2030, among other impacts. The rules, when finalized, are expected to have an impact that extends far beyond the United States. National Post Editor Kelly McParland, for one, believes they will benefit Canada:

Coal-fired power plants have already been closing across the country. Department of Energy data indicates the number has fallen from 633 in 2002 to 557 in 2012 and it expects 60 gigawatts of coal-fired power — one-fifth of total US coal capacity in 2012 — will retire by 2020. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Iron ore price breaks fall"