GOLD PRO Weekly June 09-13, 2014 |

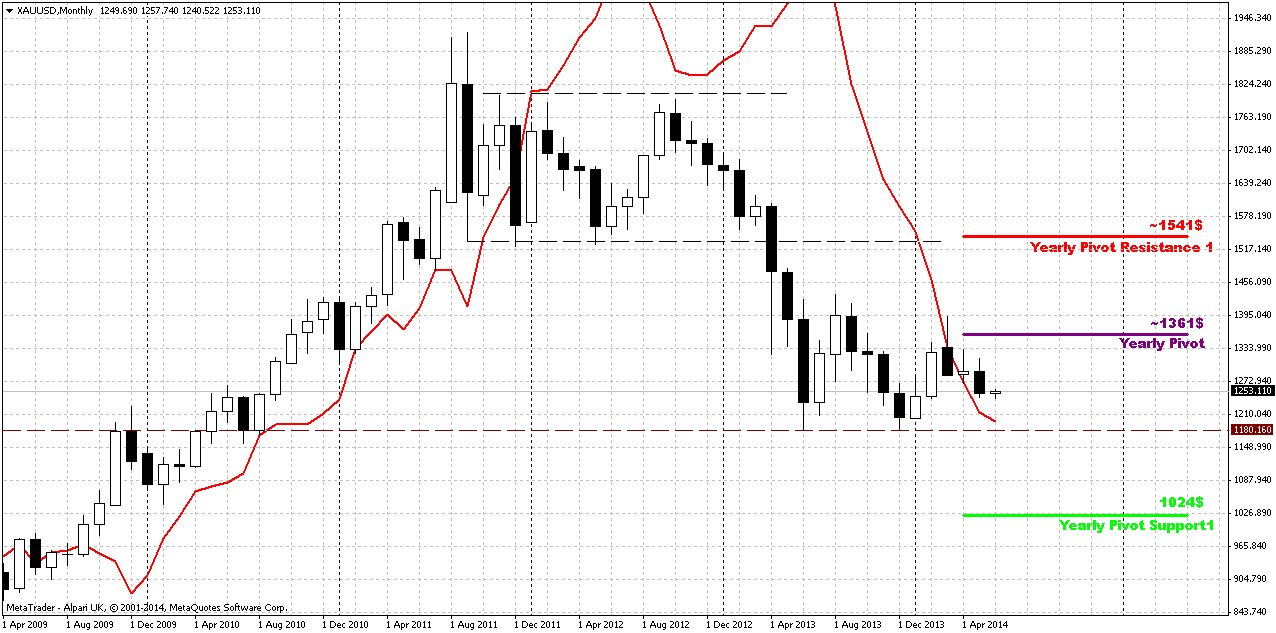

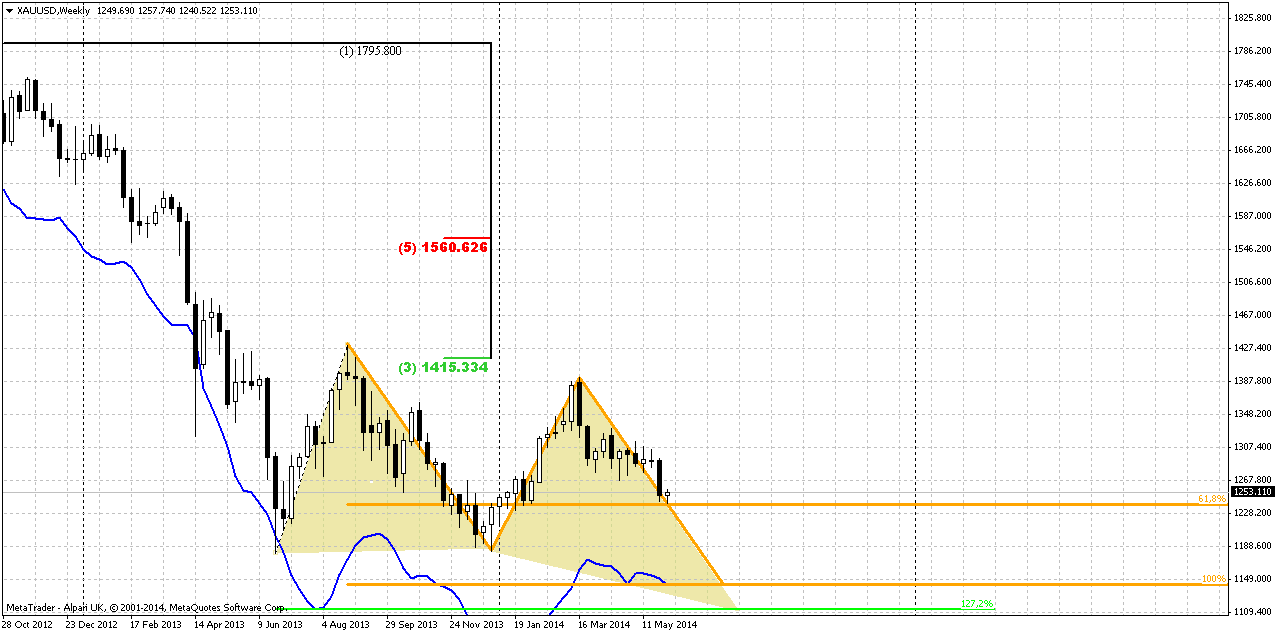

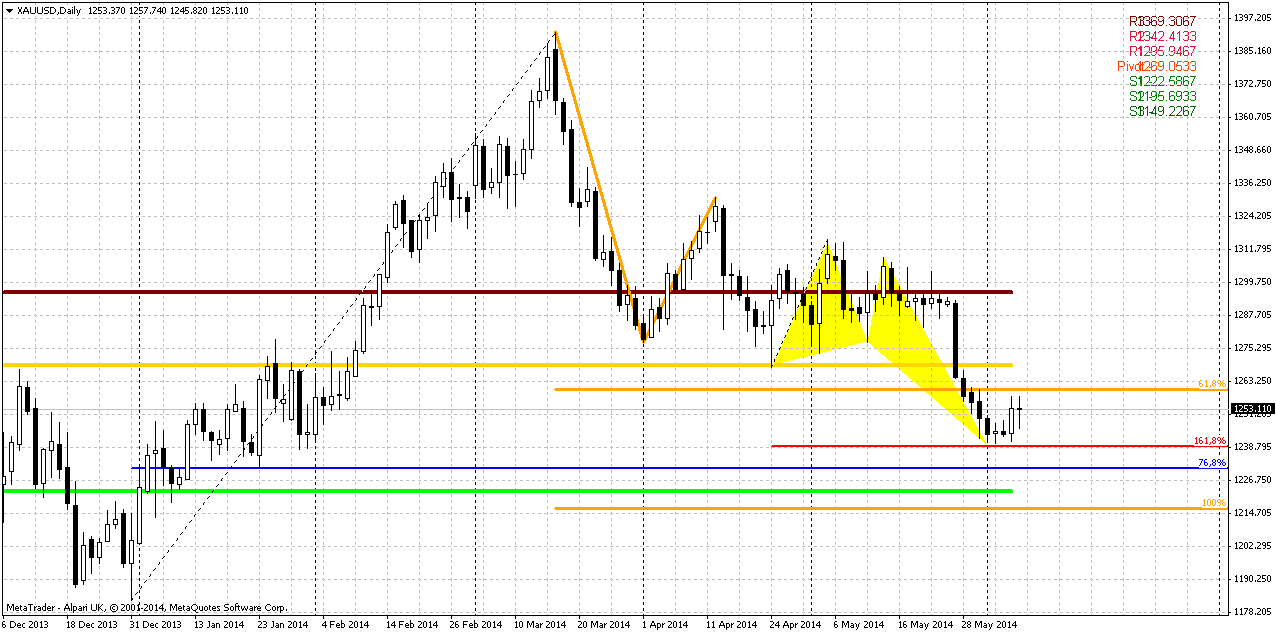

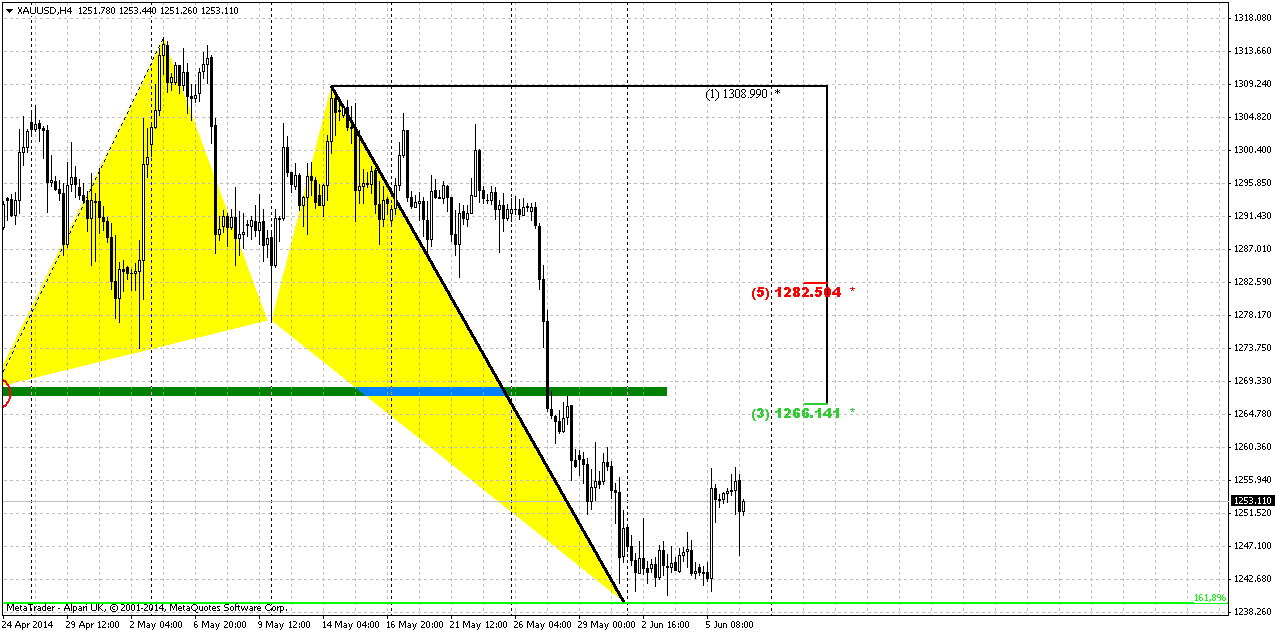

| GOLD PRO Weekly June 09-13, 2014 Posted: 07 Jun 2014 10:14 PM PDT Follow The Raw Fundamentals& Let Your Dreams Come True Open Real Account ( Standard ) & Get Free €50 ( No Deposit Bonus ) This exclusive offer is available between 25/03/2014 and 25/06/2014 Join us now What You Waiting For?  Gold prices were slightly lower on Friday as the dollar rose after a closely watched monthly U.S. jobs report underscored expectations of a steady recovery in the world's No. 1 economy, while platinum group metals were buoyed by strikes. Traders had held off taking new positions ahead of the data after a near 1-percent gold price rally in the previous session following new stimulus measures from the European Central Bank. While appetite for the metal initially picked up after the report, gains were capped by expectations that the Federal Reserve will continue to unwind its stimulus measures and that other assets will offer better returns, as well as the dollar's recovery. "There can't be a substantial price rebound without any meaningful investor or consumer buying," VTB Capital analyst Andrey Kryuchenkov said. "Major players will remain on the sidelines for now. European investors would be putting money into blue-chip equities, while with improving risk sentiment there is even less incentive to invest in gold." Nonfarm payrolls increased 217,000 last month, the Labor Department said on Friday, against expectations for a 218,000 rise, while data for March and April was revised to show 6,000 fewer jobs created than previously reported. The dollar initially fell after the report as U.S. Treasury yields dipped, but later rebounded. U.S. stocks rose. Among other precious metals, platinum added to gains after South Africa's AMCU union president said the union's 12,500 rand ($1,200) per month wage demand was "non-negotiable", dashing hopes of a speedy resolution to a five-month strike. Spot platinum touched fresh August 2011 highs of $844 per ounce and was up 0.5 percent at $1,444 an ounce, while spot palladium was up 0.8 percent at $842.00 an ounce, on track for its fourth straight week of gains. "If after further arbitration, the strike is not resolved the government has the option of declaring the strike illegal," HSBC said in a note. "The apparent stalemate has boosted platinum group metal prices but we are mindful that any bearish news could take prices lower, at least in the near term." Spot silver was down 0.11 percent at $18.98 an ounce, but the industrial metal put in its best week since mid-March. May right at the end has shown it's power by solid plunge down. It could mean that bearish grabber that was formed 2 months earlier is taking it's power. Also we've discussed possible bearish dynamic pressure here and now it looks as clear as never before. At the same time our reversal level here becomes farer and farer. Even if price will reach 1350 area – it will not change big picture. Situation could change only if market will move above 1400 area. Grabber pattern and pressure is so important right now, because they provide direction for long-term perspective. At the same time grabber has appeared right at Yearly Pivot Point – this is not best combination for bulls and could indicate reaction of the gold on Yearly pivot. Otherwords it could be a confirmation of bearish sentiment for the whole year. Grabber potentially strong pattern that could lead price back at least to 1180 lows again. That's being said recent action indicates that bears' power is growing and may be market finally has turned to more active behavior. Besides, if we even will get any deeper retracement up - hardly it will change long-term picture. Currently, there are 3 major driving factors on gold - some unexpected geopolitical tensions, inflation and seasonal trend, i.e. spot demand. None of them show significant appreciation. Hence, it is very difficult to take bet on upward reversal on gold market by far. Even more, US fundamental data and seasonal trend now makes pressure impact on gold.  Weekly It is difficult to add something new to our analysis, because recent week was really small and it has not changed picture that we've discussed previously. Weekly chart is major one for gold right now. Mostly because it shows intermediate targets. Nearest target stands at 1236 area – just 10$ lower than the current market. This level probably will become the major one again. We thought that it should be reached on previous week, but this has not happened. By taking farer look – market could form AB=CD down to 1140$ area, because monthly grabber suggests taking out of previous lows and next nearest target below it is precisely AB=CD objective point. And finally, guys, here could be even butterfly Buy pattern. It has even lower target – 1110$. At the same time guys, this area around 1000-1100$ will become an area of big demand. This is the breakeven cost of gold mining. Price will not be able to hold below this level for long period, otherwise it will be just unprofitable to mine gold… I dare to suggest that market could reach it at the end of the summer, when seasonal trend shifts bullish.  Daily Finally we reach daily chart. Trend is bearish here. Situation on daily is very tricky – partially because we do not have any clear patterns yet, partially due anemic action on previous week. I draw a lot of color lines here, so let's find out their purpose here. First of all, guys take a look at downward AB=CD pattern and 0.618 extension target that gold has broken 2 weeks ago. This was not just minor AB=CD extension but also major 5/8 Fib support, i.e. we had an Agreement and market has passed through it without any respect. This fact just tells us how weak market is and this is also confirmed by recent talks from analysts that demand in general anemic for gold. SPDR fund assets stand around lows, just 10 tonnes higher from absolute minimum. This level in June coincides with MPP that has not been tested yet. As market has tendency to re-test strong levels that were broken without respect – I suspect this could become the target of possible retracement up – 1270 area of MPP. Next line is red – 1.618 extension of butterfly pattern. As we've talked previously, market turns to upside bounce on ECB speech but has not quite reached as butterfly as AB=CD weekly 0.618 extension target around 1236$. It means that market hardly will show deep bounce prior reaching of 1236 area, so be careful with any long position if you have it. This is always very dangerous to go long right above untouched target. Finally, next target will be probably combination of MPS1 and AB=CD destination around 1214-1218 area.  4-hour And the last one – 4hour chart. Here we clearly can see how price hovers above 1236 area. Market has shown tenuous bounce but suddenly it has stopped on Friday as no sufficient demand on market by far. Here we could get 2 possible scenarios. First is appearing something like Double bottom pattern, if market will return right back down, show W&R of previous lows and hit 1236 level finally. Second – gold will form some AB=CD pattern right tno 1265-1270 area and test MPP. Personally, guys, knowing gold's cunning and habits, I would bet on first scenario. We can't also exclude that market will form some other patterns a bit later, say, butterfly "Buy", but right now we will monitor coiling around 1236 area.  See Why VantageFx ? _Trade with Winners: Australian financial service providers, Vantage FX, have received a multitude of awards over the years including those from IB Times, Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more. _Vantage FX have: Award-winning Execution Speeds Competitive spreads from 0.0 pips 24/5 Premium Customer Support _Trade with Choice: Take your pick. Choose from --> 32 Forex currency pairs Major indices including SPI200, S&P500, DJ30 Commodities – gold, silver and crude oil Binary Options – click here to read more about this exciting, new way to trade _Trade with flexibility: Choose your leverage amount ranging from 1:1 to 500:1 Choose your lot size - micro, mini or standard lots Choose your account type – Standard or Pro, Individual or Joint _Trade Your Way: Choose the trading solution that matches your trading style: The popular MetaTrader 4 (MT4) MT4 for Mac – Exclusive to Vantage FX in Australia MetaTrader 5 WebTrader Mobile trading apps for iPhone, iPad and Android Social trading via FX Copy _Trade Securely and with Transparency: No Dealing Desk Execution. No Requotes 100% Straight Through Processing ASIC Regulated Standards Funds Secure in Segregated Client Accounts at NAB _Trade Wisely: Daily market analysis from our key expert writer and currency strategist, Greg McKenna Daily Forex Currency Highlights reports Learn, follow and copy leading successful traders on FX Copy Free Autochartist tools for live Vantage FX account holders Free webinars and access to webinar archives Other educational resources including infographics, glossary and guides Samer Al Reifae support5002@vantagefx.com https://www.facebook.com/LORDOFTRUTH https://www.facebook.com/FollowTheRaw https://www.facebook.com/groups/vantagefx/ http://lordoftruth.blogspot.com/ Get the newly designed trading tools package that can enhance your trading and assist you in achieving your trading goals. Maximize returns and discover new trading opportunities with this wide range of seriously advanced tools. What is the SmartTrader Tools Package? Nine unique and powerful trading tools completely designed for MetaTrader 4 (MT4) and available in one user-friendly, easy-to-install package. The package includes:  Sentiment Trader At a quick glance, see what the general sentiment is and trade directly within the same window  Correlation Trader Determine correlation patterns between pairs in one app with key figures & notes  Session Map A visual world sessions map synced to your local time-zone with calendar events  Trade Terminal Advanced trade execution and analysis tool for quick, precision trading  Excel RTD Link The bridging tool for Excel pros allowing you trade from Excel based trading rules  Alarm Manager Go beyond just receiving alerts. Automatically trigger orders or close trades based on your pre-set rules.  Correlation Matrix A flexible and comprehensive matrix grid. See at a glance correlation scores and the strength of patterns.  Market Manager Customise and create a Market Watch window with different layout options  Connect Panel Your personal pick of news feeds and Binary Options trading direct from MT4 How do you get the package free? Visit our SmartTrader Tools webpage for more information on each tool and how to register. Why Vantage FX? Trade with Winners Australian financial service providers, Vantage FX, have received a multitude of awards over the years including those from IB Times, Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more. Vantage FX have Award-winning Execution Speeds Competitive spreads from 0.0 pips 24/5 Premium Customer Support The Gold Price & Trend Predictions blog made for gold traders to find good news and to provide the traders with daily price predictions and to learn how to trade the Forex Market for free.Just pure learning! It will be of great fun.You can judge by yourself the quality of information that I will be giving you in my blog. Welcome to my blog where you can learn how to trade the Forex Market for free.The material is all created by myself and not copied from anywhere. There is a lot yet to come since there is a lot that you need to learn, and there is a lot that I need to share with you! So please just be patient – it will be worth it.You can judge by yourself the quality of information that I will be giving you . So just go now and start learning! Below is a quick guide of how this website is structured, so you can find what you are looking for fast. Remember that I update the pages every day so either check back often. In this section you will find quite a long article of what Forex is all about. If you are a beginner, this is a must read. It explains in detail what is required to start trading, what you should do and not, typical traps to avoid as a beginner and a lot of valuable information which you as a beginner must digest and learn prior opening any Forex account with real money. In this section you will find your road map on how to become a real successful trader couple of months as from today. In this section you will know the 3 major areas – Technical Analysis, Fundamental Analysis and Trading Physcology. In this section you will find a gold mine of information about the technicalities of Forex. We will start from the very basics covering all the Forex jargon words which you will be hearing every day and we will be taking you up to the level required to finally learn to trade like a pro – technical analysis, also found in this section. In this section you will see the tips that will help you stay away from crap forex products, which unfortunately the Forex market is invaded with. This section has a very detailed article on how to avoid being scammed in this ruthless world of Forex. I will explain in detail six tips that you need to look for prior purchasing any products. Even though most of the time you may claim your money back,the time wasted is never returned. You should have used that time to learn how to trade! Read it! YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED. Do your own due diligence. No one knows tomorrow's price or circumstance. I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader. I do not accept responsibility for being incorrect in my speculations on market trend. King Regards |

| You are subscribed to email updates from Australia's Award-winning Forex Provider / Vantage FX To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "GOLD PRO Weekly June 09-13, 2014"