Dont forget the long term with Silver and <b>Gold</b> - <b>Gold</b>, <b>Gold</b> News <b>...</b> |

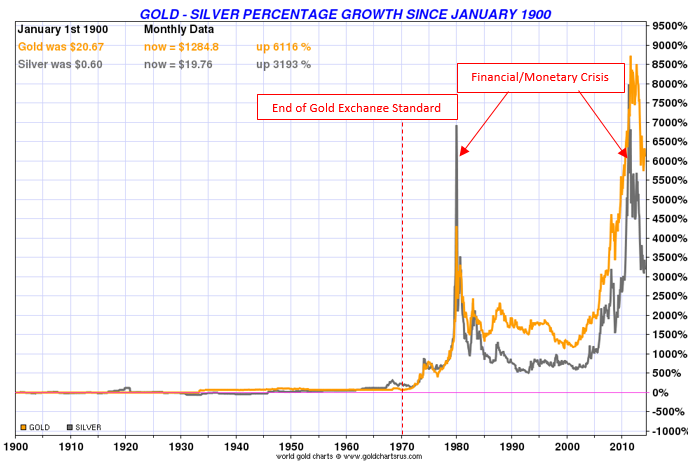

| Dont forget the long term with Silver and <b>Gold</b> - <b>Gold</b>, <b>Gold</b> News <b>...</b> Posted: 03 Jun 2014 04:31 AM PDT Gold is mostly a monetary metal while silver is today mostly an industrial metal, but still with a large monetary component, especially in a monetary crisis, as "poor man's gold". Recent performance of silver confirms that even though it is mostly an industrial metal its monetary aspect largely dominates its price performance in these circumstances. With the help of a few graphs, going from the very long term to the short-term, let us look at gold and silver's performance since the beginning of the 19th century. North American culture considers a 100-year analysis as an absurdity while, for Europeans, it is acceptable and, for Asians, quite normal. I still have three gold coins left that I received from my grandfather dating to the beginning of the 19th century. I have exchanged some gold coins close to $800 and some at $300 but I was always able to exchange them for a lot of goods and services. One hundred years allows us also to observe the performance of gold and silver through different monetary systems, several economic crises and two World Wars. One hundred years represents also the majority of the fiat money's history, first backed by gold, and then backed by nothing but trust in sovereign debt. Aristotle, the Greek philosopher, student of Plato and teacher of Alexander the Great, was mentioning fiat money 2,400 years ago when he said, "In effect, there is nothing inherently wrong with fiat money, provided we get perfect authority and godlike intelligence for kings." Paper money,a more recent form of fiat money,has its origins in China in the 9thcentury. We learned about this first experience and collapse of paper money from Italian explorer Marco Polo, who brought some samples back from his voyage to China. When you first look at the gold and silver chart in graph #1, you cannot avoid but being impressed by the change in percentage growth that happened since 1970. What happened in 1970 to create such volatility and growth in gold and silver price? Even though paper money was introduced at the beginning of the 19thcentury, it was in 1971 that all currencies have been de-linked from real assets through gold. Gold, since 1900, was up 6,116% and silver was up 3,193% but as you can see, most of this stellar performance is relative to fiat money (US dollar) and mostly since 1970. That is the year paper money was totally de-linked from gold. Chart #1: Gold & Silver percentage growth since January 1900

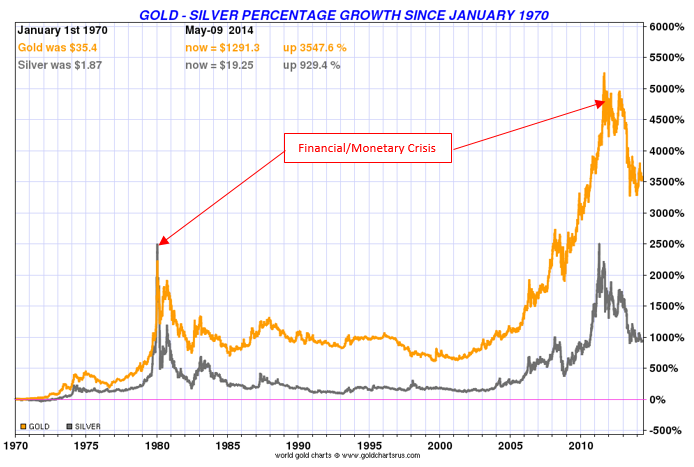

In graph #2 we see the performance of both gold and silver since the end of the gold exchange standard. Gold was up 3,547.6% and silver 929.4%. Both spikes in price took place during a financial/monetary crisis. Chart #2: Gold & Silver percentage growth since January 1970

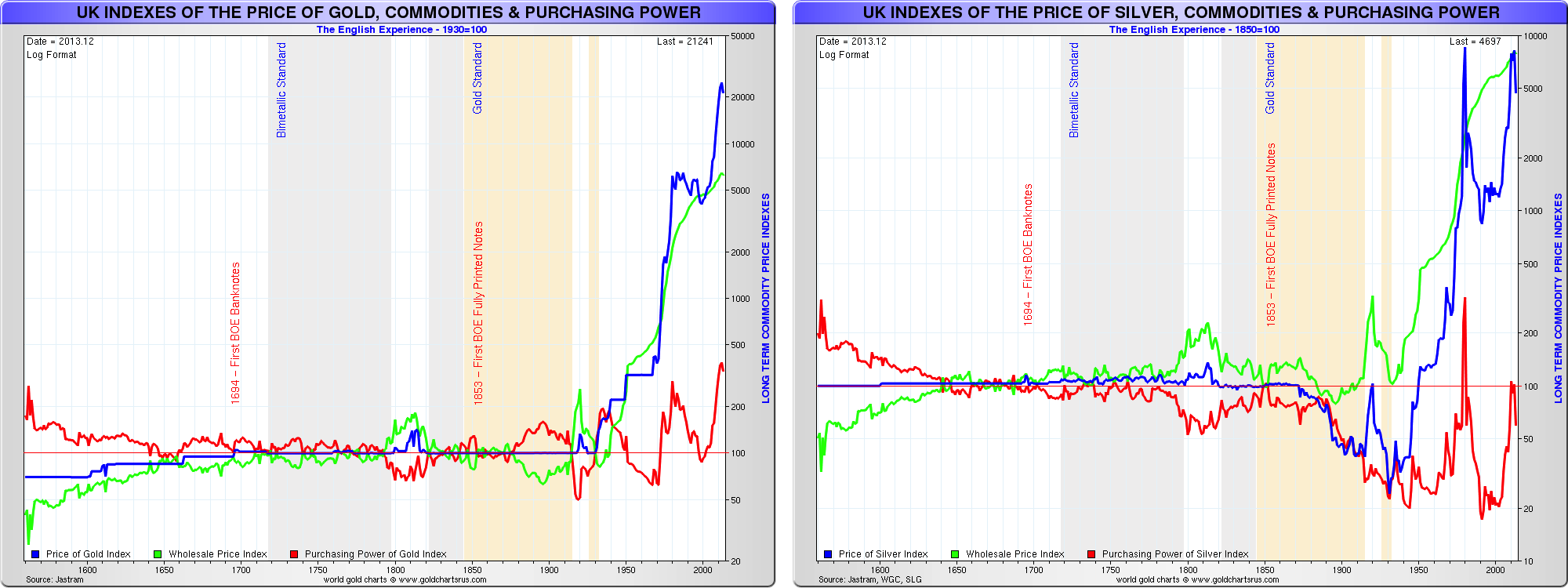

Since 2000, the performance of gold peaked at 550% while silver peaked at 800% and it is now, as of May 2014, at 348.7% for gold and 256% for silver. Even adjusted for inflation, it is still not a bad performance. Chart #3: Gold & Silver percentage growth since January 2000 If we look now at the performance of gold and silver since the 2008 financial crisis, we see in graph #4 that, after a drop of about 80% during the crisis,gold and silver grew 94.9% and 70.1%, respectively. Chart #4: Gold & Silver percentage growth since January 2008 As we can see in chart #5, since the top in April 2011, gold fell 43% and silver 97%. Since July 2013, we seem to be creating a base. Any collapse of the US dollar, which I think is imminent, will create a reversal and a breakout of both gold and silver. I expect gold to lead and silver to follow, but at a faster rate of change. I will not be surprised to see a collapse of the dollar that will trigger major upward moves in gold of $500 per day and the equivalent in silver in that environment. Chart #5: Gold & Silver percentage growth since January 2011 When you look at these performance charts, you must keep in mind that the percentages are in nominal terms, therefore not adjusted for inflation. The two next charts (#6 and #7) show gold and silver prices adjusted by inflation since 1900. You can see the enormous volatility introduced by inflation since 1900. Chart #6: Gold & Silver real prices (adjusted for official US inflation) Chart #7: Gold & Silver real prices (adjusted for pre-1980 official US inflation – ShadowStats) The last two charts (#8), show the evolution of gold and silver prices in British pounds, both versus UK inflation and price adjusted for UK inflation. Again, we see the dramatic volatility introduced by inflation and the illusion of money that inflation creates. Chart #8: Gold & Silver prices adjusted for inflation since 1520 (Nominal, Real & UK Inflation) Regularly I am criticized by people, mostly traders and mostly from North America, for showing very long-term charts. However, at this very important time in history when paper money is very close to a collapse and an international monetary system reset, it is very foolish to ignore history. Riding the waves when a tsunami is coming is very foolish. History repeats itself, but not necessarily the most recent one. We are witnessing events we have not seen in 300 years. Most of the financial and economics manuals have been written in a never-ending inflationary environment. Regularly we hear, even traditional economists and central bankers, say that we are in "unchartered territory". Having a longer time perspective today is not a luxury but a necessity. Even for those who bought gold and silver at the top in 2011, at US $1,911 and US $46 respectively, and have now a loss of 43% and 97% respectively, if they bought gold and silver as a protection against the collapse and a reset of the current monetary system, then they will soon not regret their decision. If they bought for short term speculation, then they should have followed technical indicators and timed their exit and re-entry to avoid the pain of the loss. Behavior finance research found that the pain of a loss is three times larger than the pleasure of a gain; so the pain of the 43% nominal loss for gold must fell like a 129%loss and the 97% nominal loss for silver must feel like a 291% loss. Gold and silver (as the poor man's gold) are hard cash and, in either a deflationary or hyperinflation collapse, will at least maintain their value with respect to other hard assets. What is important to remember is that gold and silver are also hard currencies, since they are the most liquid and marketable assets. You should not invest in them but use them as a protection against uncertainty. There will be a time after the reset of the international monetary system to exchange them for whatever you wish.After the collapse of the current monetary system, you will be glad to have hard money to exchange in the new system that will emerge. Just as in 1945, the collapse of the pound Sterling was not the end of the world, nor will a collapse of the US dollar be the end of the world, but just a reset. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>CHART</b>: <b>Gold price</b> vs rates shows rally catalyst <b>...</b> - News 2 Gold Posted: 07 Jun 2014 04:05 PM PDT

The GOLD PRICE lost a nothing 90 cents today to close at $1,252.10, but it's above $1,250. Way up above at $1,275 stands the 20 day moving average, first milestone that will prove gold has turned its face skyward. Really the gold price needs to rise above $1,280 where it broke down. $1,295 and the 200 dma would be better still. The RSI shows the gold price rising up from a severely oversold condition. Full stochastics have been as oversold as they've been in the last 12 years. MACD is trying to turn up. But all this must be confirmed by the only indicator that counts: higher price. The SILVER PRICE dropped 9.2 cents to 1896.3c, but traded most of the say above 1900c. As with gold price is the only indicator that counts in the end. For silver, that means climbing above 1950c, then over 2050c. Both silver and GOLD PRICES seasonally post lows in June-July, so we might see one spike move down. Everything is in place, however, for a reversal -- they just haven't reversed yet. If I told y'all that silver rose more than the Dow or the S&P500 last week, y'all would tell me I was lying and throw a pop bottle at my head, but just you look. Silver rose 1.7% this week but the Dow only rose a piddling 1.2% and the S&P500 rose 1.3%. Those are just the numbers. Gold rose 1/2% while the US dollar index stayed plumb pancake flat, didn't move ne'er a hair. Platinum rose only 30 cents. I reckon it makes a difference who writes the headlines. Which reminds me, who gets to pick the news? Did y'all notice that whatever some lamebrain in New York or Washington says is news is what they spotlight? Obama Administration is good at this, floating a new crisis every week as "news" when actually it's either "olds" or just their agenda. But the news from the yankee government was good today for Wall Street, the unemployment is steady and jobs have grown by over 200,000 a month for the last three months. Now if you all have never heard SHAMELESS LYING before you heard it from this lying report. I'm just a nacheral born fool from Tennessee, but I know to go to the St. Louis Fed's database Fred and look up Civilian Labor Force Participation and see that it's now at 62.9%, against a high in July 1997 (right, 17 years ago) of 68.1%. 62.9 is itself a level not seen since May 1978. Then I went and read what John Williams of www.shadowstats.com had to say. John is an expert in unravelling their statistical lies, and he says unemployment is closer to 23% and the gimmicks the Bureau of Labor Statistics uses overstate job growth by 200,000 a month. But welcome to America, where the truth don't count, only the illusion of an economy. Stocks rose again to new highs, the eighth out of the last 10 days for the S&P500. It rose 8.98 (0.46%) to 1,949.44. Dow rose 88.17 90.52%) to 16,924.28. Both have now poked through overhead resistance lines. They could break down here -- new highs on 8/10 days is not a sequence nature encourages -- or they could go wilder still, although both have reached overbought territory. But overbought can get overboughter still. The end lieth not far away. About now it's getting time to sell stocks and put the proceeds into silver and gold. The Dow in Gold today rose 0.59% to end at 13.51 oz (G$279.28 gold dollars), a new high for the move since March, but not nearly the high for the move, which remains 13.80 oz (G$285.27) last December. It's likely forming a double top here, but that has to be confirmed by a reversal. Dow in Silver gained 0.66% to end at 890.75 oz (S$1,151.35). It has bounced off its upper resistance line this week, but needs to drop through the 20 DMA (866.37 oz) to confirm a reversal. I don't expect it can get higher than 912 oz (S$1,179.15), and may have already turned. Wasn't a shining week for the US dollar index. Yesterday's announcement from the criminals at the ECB sent the dollar up first to 81.07, then it collapsed all the way to 80.39 Today it ended where it began the week, at 80.43, just above the 20 DMA at 80.31, but below the 200 DMA at 80.48. Has the dollar aborted its uptrend? I don't know, but watch 80.20, even 80.05, the 50 DMA. It ought to hold those if it aims to rise. Euro collapsed from 1.3993 in early may all the way to $1.3503 when it bounced back yesterday. Today it lost 0.13% to $1.3645. The enthusiasm spawned by the ECB's announcement it would inflate the snot out of the euro will wear off in two weeks at most, and it will commence sinking again. The yen continues to slide sideways, losing 0.11% today to 97.55, below all its moving averages. Yet the yen abideth still in the same range it hath inhabited since 2014 began, from 94.83 to 99.24. Nothing happening here. The 10 year treasury yield in the last week has been working to undo its breakdown in early May. Remember that suppressing interest rates is the key to the central banks' house of cards. Once the market takes control and starts raising rates, the central banks are cooked. Watch thos einterest rates for the first sign of trouble. On 6 June 1934 US President Franklin Roosevelt signed the Securities Exchange Act establishing the Securities and Exchange Commission so that wholesale fraud upon the American public could be supervised by government authorities. Next week I will be travelling so won't publish commentaries any day but Monday, unless I just have time and take a notion. Y'all enjoy your weekend! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Dont forget the long term with Silver and Gold - Gold, Gold News ..."