Silver prices | <b>Silver</b> and Gold <b>Prices</b> Have Turned Up, Stop Waiting and Buy |

| <b>Silver</b> and Gold <b>Prices</b> Have Turned Up, Stop Waiting and Buy Posted: 06 May 2014 05:35 PM PDT

The GOLD PRICE lost 70 cents today to close Comex at $1,308.30. Silver added 7.8 cents to end Comex at 1959.8c. GOLD/SILVER RATIO fell slightly to 66.757 to one. (Perfect time to swap gold for silver. Call us.) (Y'all don't miss my special offer today at the bottom -- it's a good one.) That gold price action stinks, but I'm not sure whether it smells of sardines or government mackerel. US dollar index falls 0.5% and gold FALLS seventy cents? Oh, yes, and the check is in the mail. Either that indicates gold is awfully weak, an interpretation gainsaid by Friday's strong reversal close and key reversal, or the invisible hand of the Nice Government Men is acting to stem a panic out of the dollar thanks to a war in Ukraine and fear in the stock market. That fear is certainly present in the bond market. 10 Year yield has broken down (yields fall when bonds rise and vice versa). 30 year bond yield has also fallen out of bed and is bumping on the cold floor. When things don't add up, there's usually a NGM finger on the scale. But then, I am only a nacheral born durn fool from Tennessee and always suspicious of the yankee government, especially when they say they aim to he'p me. Let that be, since today didn't damage gold's rosy outlook, just roused raw suspicions. The GOLD PRICE remains above its 200 DMA (1,300.95) and 20 DMA ($1,301.38). Just above stands the 50 DMA ($1,317.00), which gold has a fair chance of climbing over tomorrow. Urgent that it cross $1,317 soon. With a high today at 1975 cents and a close at 1959.8c, silver is playing footsie with its 20 DMA at 1962c. Key reversal from Friday confirmed on Monday remains in place. Now silver: get up there over 2000c. Y'all ought to recall that when the SILVER PRICE pulls on its seven league books it can leap breathtaking distances. Don't judge silver by the stagnation of these last 5 weeks. Key reversals in silver and gold prices last Friday argue that silver and gold should move higher smartly. Gold and silver have turned up. Stop waiting to buy. As I was observing yesterday, it doesn't happen in nature that the US dollar index closes within one point for four days. Today the deception gave way and the US dollar index fell 40 large basis points (0.5%) to 79.15. That whispers rather loudly that the Dollar Index will smash through 79. The October low was 79.06, and that's the last sky-hook the dollar can grab hold of -- possible, but doubtful. Like drawing to an inside straight. Lest y'all forget, a falling dollar helps gold and silver Euro finally broke out with conviction and rose 0.38% today to $1.3928, above the upper channel line which defeated it in March. Once close over $1.3958 (last high) sends it sprinting for $1.4000 - $1.4300. Yen must be catching a safe-haven bid thanks to the turmoil in Ukraine. It broke out over the downtrend line from June 2013. Rose 0.45% to 98.36. If it clears 99.5 it could reach 103.5 cents/Y100. All this supposedly happened on good euro zone economic statistics, but since we know the euro government lies as facilely and continuously as our own, that's not much of an excuse. Recall that stalled markets often only appear to be dead, while under that mask they hide momentarily balanced fierce opposing forces. When one blinks, the other flashes a right hook. Owch. Stocks felt that right hook today. Nasdaq composite closed below its 20 DMA, Dow touched and S&P500 neared. Dow tumbled 0.78% (129.53) to 16,401.02. S&P 500 fell 0.9% (6.94) to 1,867.72. Today's reverses carry both indices back below the downtrend lines they broke above five days ago, and make that breakout look like a fakeout. Closes below the 20 DMA would secure that interpretation. Since early May hath not historically been a happy time for stocks, this might mark their turndown. Stocks have run out of wriggle room: must rise or die. Dow in silver has seemed the key indicator to me. After hitting a recovery high at 869.46 oz (S$1,124.15 silver dollars) on 1 May, it closed today down another 0.61% at 837.64 oz (S$1,038.01). A break this quickly is not what I expected, but never argue with a chart. MACD turned down yesterday, and other indicators have rolled over earthward as well. All this happens on stock weakness alone. What will happen when silver strength is added? Dow in gold lost 0.65% to 12.64 oz. (G$261.29 gold dollars). Closed below its 20 DMA (12.43 oz). Not far above its 200 DMA (12.20 oz). All needles pointing down. What will happen next? More gravity. QUICK SPECIAL OFFER I found some US $5 commemorative gold coins right close to their spot gold value, so I'm offering them to you. These United States gold coins commemorate various events and are minted to the ancient gold standard at 0.2419 troy ounces. I have only one (1) of the $10 commemoratives, so the first one to mention that will receive the one $10 (0.4838 oz) commemorative in lieu of two $5 commems. This price is based on spot gold at $1,308.3 and spot silver at $19.60. THE OFFER One lot of SIX (6) each US commemorative gold $5 coins at $338.00 each for a total of $2,028.00 plus $35 shipping for a grand total of $2,063.00. That's a premium of 6.5% over melt value. NOTE: I will charge shipping only once per order no matter how many lots you buy. Special Conditions: First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your e-mail. Send email to offers@the-moneychanger.com Sorry, we will not take orders for less than the minimum shown above. Sorry, no sales to Tennessee or outside the United States. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. It increases your chances of getting your order filled if you offer me a second choice, e.g., "I want to order Three lots but if not available will take One lot." ORDERING INSTRUCTIONS: 1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Please do NOT order by replying to THIS email, because it will not reach me timely. Please include your name, shipping address, and phone number in your email. Surprising as it is, we cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. Repeat, you must include your complete name, address, and phone number. We will read your mind, but will have to charge you three times the price. Cheaper if you just supply your information so I don't have to read your mind. 2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, and you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down. If you break your word to us, we will never again do business with you. 3. Orders are on a first-come, first-served basis until supply is exhausted. 4. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail. 5. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled. 6. You will need to send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours. 7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship. 8. Mention goldprice.org in your email. Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

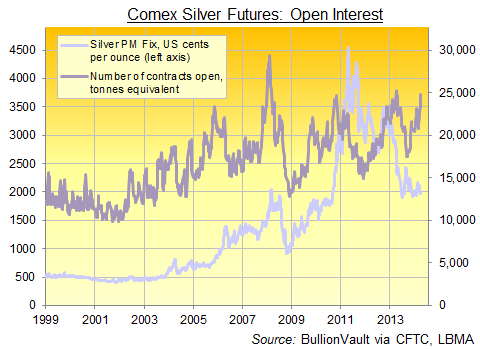

| <b>Silver Prices</b> "Ready to Break Out" as Futures Betting Jumps to Pre <b>...</b> Posted: 14 Apr 2014 03:06 AM PDT Long-term silver price chart shows "bearish trend" meeting "5-year bull support"... SILVER PRICES traded in a tight range last week, hitting a high of $20.30 and a low of $19.68 before closing just a few cents higher from the previous Friday as tensions rose over Ukraine's response to pro-Russia separatists. Tracking gold's short-lived spike mid-week, silver prices had risen sharply – hitting their high for the week – after Wednesday's release of notes from the Federal Reserve's mid-March meeting. The minutes showed Fed members less eager to raise Dollar interest rates than chair Janet Yellen had suggested in recent comments. Friday's Fixing for wholesale silver bullion bars in the London market came at a price of $20.06 per ounce, some 16¢ higher than the week before and over 4% higher from silver's low of the year. New York's Comex exchange saw May silver futures, now the most actively traded monthly contract, settle at $20.091, up by 15¢ from the previous Friday. "The [silver price] range has been sideways for the past three weeks," says the latest technical analysis from London market maker Scotia Mocatta, part of Canada's ScotiaBank, "with support at the low in the 19.57-19.62 area. "There is a long-term bearish trend line, which is providing resistance…in the 21.21 area." But silver prices are also "trading on the edge of the 5-year trend line support," says Yana Stunis at Standard Bank's London office in a note to clients. "No surprise to see open interest pile in to see a break out either way...[Silver prices are] about ready for a break out." Open interest in Comex silver futures rose again last week, up for the fifth week running and growing by 5% to the largest level since the same week last year – just before silver prices were hit by April 2013's gold crash. Its previous peaks also marked major price moves in late-2010, early 2008 and New Year 2006.

Speculative traders have been taking the bearish side of the bet, cutting their net position on silver prices rising by 45% since the 4-month high at $21.73 per ounce hit in mid-February. The long-term chart which Standard Bank highlights shows a wedge formation, with silver prices recording lower highs since May 2011 but touching 3 higher lows since late 2008. Silver investment holdings at the major exchange-traded trust funds meantime ended last week unchanged on Bloomberg data, just shy of 19,764 tonnes. Although silver prices were virtually flat over the first 3 months of this, "Silver saw the largest inflows [amongst commodity ETFs] during the quarter," says the Wall Street Journal, citing one provider's data, "as investors looked to the metal as a leveraged play on improved sentiment towards gold." The only major silver coin producer to release frequent data, the US Mint reports 2014 sales now running 2.5% below 2013 levels to end-March. Legal gold and silver imports to India, a major consumer market, showed a drop of 40% in fiscal-year 2013-2014 according to the Press Trust of India, down to $33.46 billion thanks to the government's anti-gold import rules, aimed at cutting India's large current account deficit with the rest of the world. |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver prices | Silver and Gold Prices Have Turned Up, Stop Waiting and Buy"