<b>gold price chart</b></b></b></b> - News 2 Gold - News 2 Gold - Blogger |

- <b>gold price chart</b></b></b></b> - News 2 Gold - News 2 Gold - Blogger

- <b>Gold</b>: More Than A Real Store Of Value - Recent Evidence [ETFS <b>...</b>

- <b>Gold Prices</b> To Rise on Bullish Technical <b>Charts</b>

| <b>gold price chart</b></b></b></b> - News 2 Gold - News 2 Gold - Blogger Posted: 06 May 2014 04:04 PM PDT

A single bitcoin broke the price of an ounce of gold five months ago. Now, it's worth less than half that – and, of the two, it's bitcoin's price that's bouncing around the most. For people trying to evaluate bitcoin's potential against other commodities, its relative price volatility could be a worry or an opportunity, depending on your appetite for risk. So, how closely can we map bitcoin's volatility against other commodities? Not very closely, argues Kirill Gourov, Director of Finance for Blocktech, a new company that creates open-source block chains for industries in need of disruption. He recently wrote a paper that explored whether there was an intrinsic value for bitcoin. Gourov pointed out that it is difficult to find a direct correlation between bitcoin and other commodities:

Copper's recent price drop looks dramatic, for example, but it represented a 9% decrease in its value. That may be considerable, but it's hardly in line with some of bitcoin's more dramatic yo-yoing. In five or 10 years, when the market is more developed, trends will be more prevalent and will force bitcoin to spike less, Krill suggested. But, today, the market is too easily manipulated. Physical vs virtualIf bitcoin's age is one factor that stops it being correlated easily with other commodities, then are there others? One of the issues separating bitcoin from other commodities is physicality, argues Antony Lewis, who works in business development at itBit. Most other commodities are used and transformed into something else, which drives certain behaviours, pointed out Lewis, who used to trade interbank foreign exchange at Barclays:

Conversely, he says, virtual currencies are bought either as a store of value or as a payment mechanism putting them in a different category to conventional commodities. Correlations existLet's not write bitcoin off as entirely separate from the commodities market, though, said George Samman, Chief Operations Officer at BTC.SX, which offers derivatives services for bitcoin traders. There are correlations today between bitcoin and at least one other commodity, Samman said, but they're only obvious if you turn them on their head. They are negative correlations, and we see them particularly between bitcoin and gold. When bitcoin goes up, gold falls, and vice versa, he suggested. Samman pointed to longer-term pricing for evidence of this effect. For example, when bitcoin rose dramatically at the end of last year, gold can be seen to fall (see chart). The linear chart shows bitcoin's price from around the time that it spiked, shortly after the financial crisis in Cyprus last year. However, the digital currency was showing slight gains on gold as far back as 2011, said Samman. Bitcoin's price doesn't seem to cross that of gold because the chart isn't granular enough, but it did. That crossover happened for a period of hours, and we're plotting closing prices at two-day intervals here. Gold's movement in relation to bitcoin might not seem that pronounced, he said, but don't be deceived. A $10 move in bitcoin wouldn't show clearly in a long-term chart because of its significant moves later on; furthermore, gold's high value makes it difficult to spot smaller price moves. Gold has been moving back up since the beginning of the year, while bitcoin has been going down, Samman added, which is clearly visible on the graph. Since then, gold has trended downwards, while bitcoin has been "semi-stable" in the mid-$400 range, he said. Samman admitted, though, that bitcoin has "bounced around" in that $400-$500 window, as would be natural for a young, relatively thinly-traded asset influenced by events such as the suspension of bitcoin trading in China by certain banks, and the perceptions around those events. Fear assetsThe link between bitcoin and gold makes sense. When the market flies from bitcoin, it has to go somewhere, and the argument goes that gold gets some of that action. If you see negative correlations in this chart, then why do they exist? It's because Gordon Gecko was only half right. Greed isn't the only factor driving financial markets: the other is fear. ItBit's Lewis calls gold a 'fear asset', and said that in time, it will make sense to compare bitcoin against the VIX. Also known as the 'fear index', the VIX is the colloquial name for the Chicago Board Options Exchange Market Volatility Index. It is a weighted blend of 30-day options across the S&P 500 index, enabling people to use it as a broad measure of volatility over the coming month. In short, when markets get wild, the VIX goes up. In the meantime, Samman is waiting for the time when he can more easily compare bitcoin's activities in a broader context, outside of commodities. He likes exploring intermarket dynamics, evaluating the performance of different asset classes such as equities, bonds, and commodities, in relation to one another. What about the longer-term opportunities for bitcoin? While we read the market's entrails looking for relatively short-term correlations now, will bitcoin and other commodities draw closer over the years? "Some people believe we are in a commodity supercycle which began around 1990, supercycles generally last 30 years, give or take, if thats the case we are likely to see another up leg in this cycle, and I think it will be caused by inflationary events," Samman said of long-term cycles in the commodity markets. Built-in scarcityIn particular, the tendency towards quantitative easing – central banks creating more money – and the spectre of rising interest rates come to bear here. "This all bodes well for bitcoin to spike again as well," he argued. Some also point to correlations between the price of bitcoin throughout its young life, and the longer-term price of gold, potentially supporting theories of long-term similarities.

Scarcity helps drive up the price of a commodity. Food prices rise when a drought chokes off supplies, for example, and bitcoin has its scarcity built in, Samman said, adding.

This scarcity is both a known and unknown quantity in bitcoin. Scarcity has a big impact on price action, which is caused by big disparities in supply and demand. Conventional commodities can be moved by external events that affect demand and supply, such as bad weather (wheat), or growing unrest in Ukraine (oil), for example. With bitcoin, there is a base level of supply which is relatively known, because it is underpinned by the mining community, which produces them at a predefined rate of 3,600 coins per day. However, bitcoin's algorithmically coded scarcity isn't the only part of the equation; just as with commodity markets, other factors come into play. With institutional miners producing bitcoins, and with large funds holding significant percentages of the digital currency, it's hard to predict what that supply will look like in the future, and when people will begin letting more bitcoins out onto the market. The same is true on the demand side. "Demand is the unknown here. We are hearing of many millions of dollars being lined up to buy bitcoin when the time is right," pointed out Lewis. Looking for liquidityIf and when the volume of bitcoin trading increases substantially, we'll see bitcoin become more liquid. Liquidity dampens volatility, because there is more of an asset moving through the system. This in turn makes it harder for people to move the market substantially with relatively small trades, or for events to move the market by spooking enough inexperienced investors into knee-jerk reactions. One thing that will help here is the build-out of more established, reliable exchanges to provide a base level of reliability and choice to the market. The other is the building up of more sophisticated services on those exchanges, such as derivatives trading. We're starting to see markets for bitcoin derivatives emerge, such as BTC.SX. More will come, said Gourov, although the market is too immature to support complex trades yet. He explained:

However, he thinks that will change: "There are several companies creating products and platforms to facilitate this as I type." Even when its price volatility smoothes out, though, the chances are that bitcoin will remain a distinctly different animal from many other assets, making it hard to see correlations with lots of commodities. For now, the cryptocurrency is a young, idiosyncratic asset all its own. As the honey badger of money, it tends to be a solitary animal, unaccustomed to moving with a herd. Graphs image via Shutterstock |

| <b>Gold</b>: More Than A Real Store Of Value - Recent Evidence [ETFS <b>...</b> Posted: 31 Mar 2014 11:35 AM PDT

I often like Barry Ritholtz's thinking. A March 28, 2014 article in Bloomberg on the long term real price of gold however, needs re-framing in a global context. Since Roy Jastram published his deservedly esteemed "The Golden Constant", gold has been viewed as a (constant) store of real value. A wealth of statistics presented by Jastram seemed to show this. An update of some of his analysis in a LBMA article by Jill Leyland has this graph:

In his article, Barry Ritholtz presents a graph from Catherine Mulbrandon of Visualizing Economics:

This chart includes the market price of gold as well as the U.S. government pegged price. Sure enough, the real gold price seems to be going nowhere in the long run; a store of value. In this SA article, I have argued that gold in fact is more than a store of value; it earns a real yield and thus gains in world purchasing power in terms of goods and services per unit. Rather than use my data, I thought I would show some relevant and interesting findings from others. A recent BusinessInsider article has this chart from Ian Bremmer of Eurasia Group showing national shares of world GDP: Now, let's consider the implications of a quintupling share of U.S. world GDP over the period of time when the USD real price of gold remained constant. The two main world economic powers were the United Kingdom and the U.S. The USD purchasing power in terms of pounds sterling remained fairly constant since 1820 before nearly tripling since the early 1900's. The purchasing power of the dollar moved much higher against other world currencies, however. Further evidence of this comes from a graph in Barsky-Summers' seminal 1988 paper on the Gold Standard Gibson's Paradox "Gibson's Paradox and the Gold Standard". Their chart of the world price index during this time is declining. Since most of the world in terms of GDP was on a fixed gold standard, the price is in terms of gold - meaning, that the purchasing power of gold in real terms, against a basket of world goods and services - rose. The inescapable conclusion is that a constant real USD gold price actually gained in world real purchasing power. Jastram and other analysts fell into the mindset of viewing gold through pricing in the two strongest currencies of the time - not in terms of world purchasing power which is what matters for an asset traded in a world market. I made precisely this critique of the gold-as-a-store-of-value belief in my eBook showing how gold is actually valued. Investment Considerations Contrary to World Gold Council research, store of value graphs and popular belief based on statistics showing the price of gold in dollars, gold obtains an increasing global real yield and return. In the long run, a unit of gold will earn in real terms exactly what other long term investments return including stocks and long bonds. The logic, match and evidence for this is beyond the scope of this brief article but is more fully discussed in the referenced book and a number of journal publications. Disclosure: I am long DUST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. |

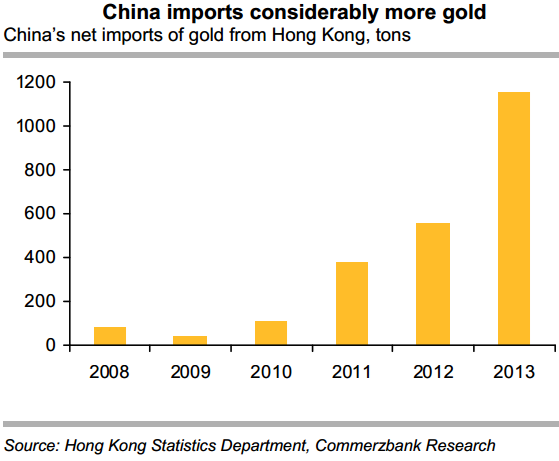

| <b>Gold Prices</b> To Rise on Bullish Technical <b>Charts</b> Posted: 22 Feb 2014 01:11 AM PST  Gold prices to rise further next week on bullish technical charts.Reuters Gold prices are set to rise further next week, supported by bullish technical charts. As many as 19 of 23 analysts polled in a Kitco Gold Survey said they expected gold prices to rise, while two predicted that prices would drop and two forecast prices to remain unchanged. Ralph Preston, principal, Heritage West Financial, listed several technical-chart points -- The double bottom lows from July and December 2013, gold rising above $1,280 and breaking the downward sloping trend-line drawn over the peaks of August at $1,430 and October at $1,375, and the metal rising above the 200-day moving average, which comes in Friday at $1,308.80, Preston told Kitco on 21 February. Adrian Day, chief executive at Adrian Day Asset Management, said the change in sentiment for gold, which compelled formerly bearish traders to scramble, also helped the metal. Kevin Grady, of Phoenix Futures and Options, said: "We continue to see tightness in the forward markets which I feel will spill over into the futures. Although the jewelers do not appear to be buying at these levels, there continues to be a bid under the market. This leads me to believe that we may be seeing some central-bank buying. "A key factor for gold this week was the release of the Federal Reserve minutes. Although the verbiage led us to believe that the current tapering plan would continue, the gold price held up under immediate pressure. The 200-day moving average comes in around $1,305. We need to hold this area for gold to attract new buyers," Grady said.  China's imports of gold from Hong Kong.HK Statistics Department, Commerzbank Research Commerzbank Corporates & Markets said in a 21 February note to clients: "The price of gold has recently climbed to its highest level since October 2013, the main reasons being a weaker dollar, speculative buying and lower outflows from gold ETFs. Last year, investors took some 900 tonnes of gold out of ETFs and contributed significantly to the slump in prices. "Strong physical demand from China in particular should continue to support the price of gold in the medium term. The January figures from Hong Kong's Statistics Department on gold trade with China, due out next week, should confirm high Chinese buying interest. That said, the potential is limited in the short term." Commerzbank Corporates & Markets said in a separate note: "For the first time since 1980, Switzerland [on 20 February] published detailed statistics regarding its gold trading activities, showing that around 85 tons of gold were exported to Hong Kong in January; this accounted for almost half of the country's total gold exports. The gold is likely to have been shipped on to China, which points to continuing high gold demand there. The Census and Statistics Department of the Hong Kong government will be reporting during the course of next week on its trading activities with the Chinese mainland. "Other major buyers of the Swiss gold were India, Singapore and the United Arab Emirates. Switzerland does not produce the gold itself, however; it imports it from other countries and then melts it down to sell to Asian buyers in smaller units. By far the largest quantity of gold (119 tons) was imported from Great Britain - part of this total is likely to have come from sold ETF holdings. This underpins the gold flow from west to east that has been underway for months now." Gold Ends Higher Spot gold inched up 0.2% to $1,324 an ounce on 21 February, down from the three-and-a-half month high of $1,332.10 struck on 18 February. US gold futures for delivery in April finished $6.70 higher at $1,323.60 an ounce on 21 February. For the week as a whole, futures added 0.38%. Bullion prices have risen over 9% so far this year as concerns about global economic growth boosted the precious metal's safe-haven investment allure. However, prices are still far below the record high of around $1,920 per ounce struck in 2011. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "<b>gold price chart</b></b></b></b> - News 2 Gold - News 2 Gold - Blogger"