Silver prices | <b>Silver Prices</b> Move Higher Amid Stock Market Sell-Off, Dovish Fed <b>...</b> |

- <b>Silver Prices</b> Move Higher Amid Stock Market Sell-Off, Dovish Fed <b>...</b>

- <b>Silver Price</b> Finally Outperforms – How Bullish Is That? :: The Market <b>...</b>

- Shocking Charts Show Silver Set For A Staggering <b>...</b> - <b>Silver Prices</b>

| <b>Silver Prices</b> Move Higher Amid Stock Market Sell-Off, Dovish Fed <b>...</b> Posted: 11 Apr 2014 08:12 AM PDT Silver prices spiked some 2%, or $0.51, to $20.49 an ounce intraday Thursday before closing the session up $0.37 to $20.14 an ounce. It was an agonizing day for stocks across all sectors. The Dow Jones Industrial Average tumbled 1.62% to 16,170.54. The S&P 500 Index slumped 2.09% to 1,883.11. The tech-heavy Nasdaq plunged a painful 3.19% to 4,054.11. The risk-off trade had investors seeking shelter in safe-haven silver. Also attracting precious metal investors to silver were mounting concerns over escalating tensions between Russia and Ukraine. The situation in the region is growing more heated as pro-Russian demonstrators in Ukraine have recently become more active. Thursday, NATO's secretary general called on Russia to pull its troops from the Ukraine border and stop instigating trouble. Conditions could quickly flare up at any moment, and the area is once again a geopolitical hotspot. Additional unrest in the area will likely stoke silver demand further. Note: The Fed's 2014 taper means volatility ahead. So we've outlined how to find profits in a volatile market – like triple-digit gains in just days – if you start with this strategy… Also fueling silver prices is a more dovish-like sentiment from the U.S. Federal Reserve. Dovish Fed Sentiment Favors SilverWednesday's release of the minutes from the March Federal Open Market Committee (FOMC) meeting indicates several Fed members said projections for an interest rate increase sooner rather than later might be overstated. Chair Janet Yellen said on March 20 that rates might start to rise about six months after the central bank ends its monthly assets purchases. Silver prices fell 1.9% following Yellen's comments, as rising interest rates tend to draw investors away from silver. The March minutes, however, played down the remark. Perception of a prolonged low interest rate environment took the dollar lower Thursday. A weaker greenback typically boosts silver. And, consumer demand for silver remains strong… U.S. Mint Reports Robust Silver Coin SalesThe U.S. Mint reached milestone after milestone last year as strong American Eagle Silver coin sales hit records on numerous occasions. While 2014 hasn't been as momentous, March was indeed a good month for the Mint. Sales of American Silver Eagles totaled 5,354,000 last month, up 30% from February and up 59.5% year over year. It marked the Mint's fourth-biggest sales month ever. The March tally bought Q1 2014 sales of the coins to a whopping 13,879,000. The only time sales during the same three-month period have been better were in record-breaking 2013. Sales would likely have been even higher if the Mint hadn't been forced to ration sales due to its "inability to source sufficient precious metals blanks." Safe-haven seekers, savvy investors, and bargain hunters understand silver's worth goes sufficiently further than just an investment. It's an attractive alternative asset with real, tangible value. Silver prices will only run higher as investing in and demand for the white metal continues to grow. Read why Money Morning Resource Specialist Peter Krauth believes silver could stage another 1,000% run here. Related Articles:

| |

| <b>Silver Price</b> Finally Outperforms – How Bullish Is That? :: The Market <b>...</b> Posted: 11 Apr 2014 10:55 AM PDT Commodities / Gold and Silver 2014 Apr 11, 2014 - 04:55 PM GMT By: P_Radomski_CFA

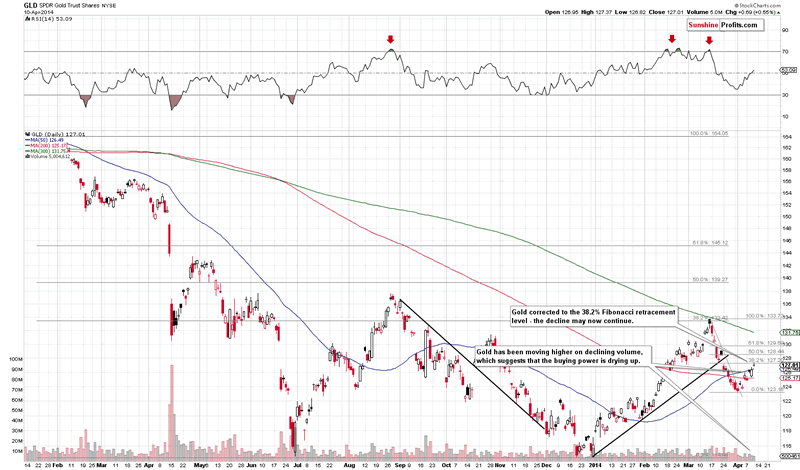

We sent out 2 Gold & Silver Trading Alerts yesterday and the situation at this time remains just as we described it in the second of them. Consequently, we will mostly quote it, illustrate the phenomena mentioned, and add more comments when necessary. Let's start with gold (charts courtesy of http://stockcharts.com). - About gold: "Please note that this upward correction is relatively small – it hasn't even wiped out 38.2% of the March decline. Perhaps this is the level that will be reached before the next local top is in – we will watch out for signals confirming this theory." This level was reached today.

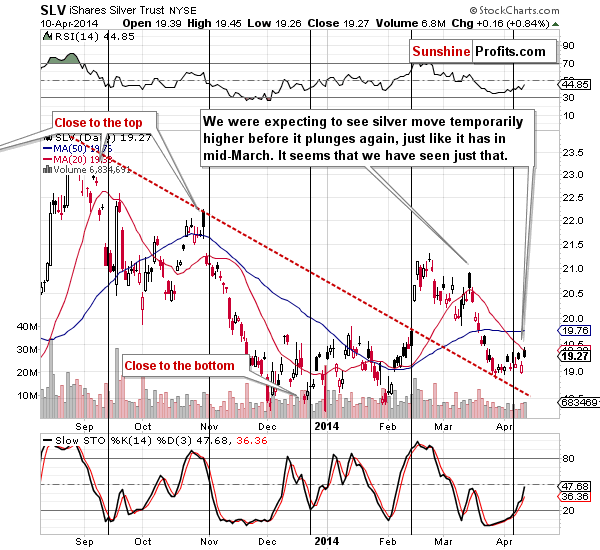

Today, we can add that the GLD's rally was accompanied by volume that was slightly lower than on the previous day, when the rally was much smaller. The above is another bearish sign. - About silver: "Silver continues to underperform and miners are indeed moving higher, but they are doing so on rather low volume. It does seem that the current upswing is a corrective move, not a true rally. If silver finally rallies strongly relative to the rest of the precious metals sector it will quite likely not be a bullish sign, but a day when the entire sector tops (or very close to it). That's not a clear prediction, just an early heads-up – we don't think that jumping on the silver bandwagon as soon as it seems to be gaining speed is a good idea at this market juncture. There will be a time when silver rallies strongly and the rally will be sustainable, but it doesn't seem we are at this point just yet." Silver rallied by more than 1.5%, while gold moved higher by less than 1% and miners didn't rally. Silver moved above the previous April highs - we are seeing the very short-term outperformance.

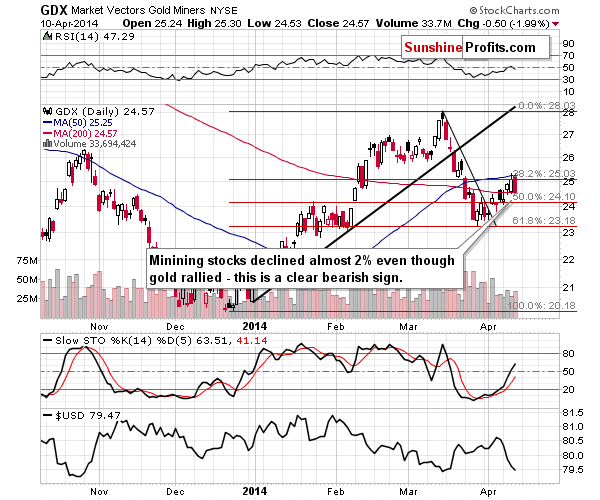

Silver finally ended the session lower than it had been when we sent out yesterday's alert, but still, it moved higher (percentagewise) than gold and mining stocks, so the implications remained in place. - About mining stocks: "The mining stocks are still moving higher and are still doing so on low volume. Miners are moving up more visibly than gold does, which is a slight indication that the move higher is not over yet, but at the same time the low volume suggests that the rally will not take place for much longer." Today, miners are underperforming in a very visible way. They might catch up later today, but for now, we get a clear bearish indication for the short term.

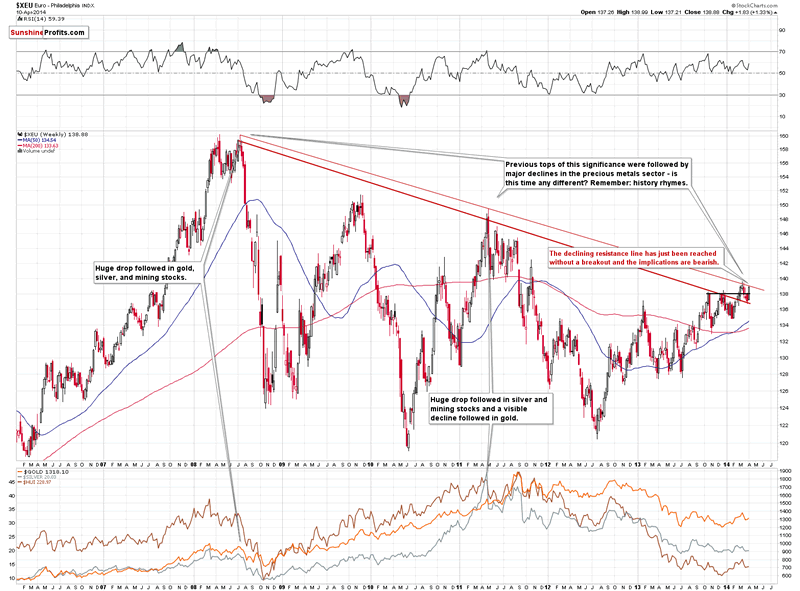

Miners didn't catch up – they declined even more, almost 2%. The volume that accompanied the decline was not huge, but was not very low either. The fact that miners have declined almost 2% while gold moved higher is much more important in our view. - About the Euro Index: "We will be looking for confirmations along the way, but at this time our best guess is that the Euro Index will rally to the 139 level or close to it (a move to the March high is not out of the question) and make gold move to one of the Fibonacci retracement levels – probably the first one, which is just about $10 higher than where gold closed on Wednesday." The Euro Index moved to 138.99 today - practically reaching the above-mentioned 139 level.

The 138.99 level was not breached yesterday, and we saw only a small move above it in today's pre-market trading (to 1.3906 in the EUR/USD exchange rate, after which we saw another slide back below 1.39). Consequently, the above-mentioned implications remain in place. On a side note, I (PR) am now co-authoring i.a. Forex Trading Alerts and in yesterday's alert we wrote about the situation being too unclear to open any positions in the EUR/USD pair because of a specific divergence (we did open a position in a different currency pair, though), but the situation is bearish enough to have implications for the precious metals market. In case of the latter, the EUR/USD outlook simply strengthens the signals coming from gold, silver and mining stocks, which are bearish on their own anyway. The way we summarized yesterday's second alert also applies today: All in all, the puzzles seem to be in place and the next downswing in the precious metals sector seems to be just around the corner. As always, it's not possible to tell if this is really the top or if we are going to see another (probably small if any at all) move higher before the decline materializes, but it seems that combining the odds with the possible sizes of price swings strongly favor opening short positions at this time. Please note that even if we see slightly higher precious metals prices it will not immediately invalidate the bearish outlook - unless the stop-loss levels are broken, the outlook will remain unchanged. To summarize: Trading capital (our opinion): speculative short positions (full) in gold, silver, and mining stocks. Stop-loss orders: - Gold: $1,353 Long-term capital (our opinion): No positions You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website. As always, we'll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you'd like to receive them, please subscribe today. Thank you. Przemyslaw Radomski, CFA Founder, Editor-in-chief Tools for Effective Gold & Silver Investments - SunshineProfits.com * * * * * About Sunshine Profits Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing. Disclaimer All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | |

| Shocking Charts Show Silver Set For A Staggering <b>...</b> - <b>Silver Prices</b> Posted: 10 Apr 2014 06:24 PM PDT Today KWN is putting out a special piece which has some absolutely outstanding silver charts that were sent to us by David P. out of Europe. These are charts that the big bullion banks follow closely in the gold and silver markets, as well as big money and savvy professionals. David lays out the roadmap for a stunning advance in the price of silver, and also reveals some fascinating points about this bull market in silver. Below are the fascinating charts sent to us by David P. out of Europe, along with the roadmap to $100 silver. Since the high in 2011, silver has gone through a major correction. Silver is roughly 60% off the 2011 high. This may sound extreme but for silver this decline is just a normal move in its bull market. The first big decline was from $8.40 to $5.40 back in 2004 -- that represented a 35% plunge. The next major pullback took place in 2008, when silver collapsed from $21 to $8.40 -- this, like the recent decline, represented a 60% plunge in price.... To continue reading the KWN piece please click here The miners have started 2014 very well indeed on the back of rising gold prices, so the question is; is this the real deal or another head fake? Is the bottom really in? Could there be a final capitulation just ahead of us? Will the summer doldrums take the PMs lower? If you would like to know which stocks we are buying and selling please join us at 'Stock Trader' our premium investment service. Subscribe for 12 months with recurring billing - $199 Buy 12 months of subscription time - $199 If you are new to investment in the precious metals sector then you can subscribe of our FREE newsletters regarding gold stocks, silver stocks and uranium stocks, just click on the links and enter your email address and we will email you our articles along with other interesting posts. Please remember to check your spam folder once you have subscribed to ensure that our verification email has not gone astray and you are getting our emails. |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Briefly: In our opinion the speculative short positions (full) in gold, silver, and mining stocks are justified from the risk/reward perspective.

Briefly: In our opinion the speculative short positions (full) in gold, silver, and mining stocks are justified from the risk/reward perspective.

0 Comment for "Silver prices | Silver Prices Move Higher Amid Stock Market Sell-Off, Dovish Fed ..."