Ben Bernanke comments on bitcoin |

- Ben Bernanke comments on bitcoin

- Here's how the US is becoming the world's biggest oil and gas producer

- Strikes, guerrilla attacks take their toll in Colombia’s coal output, down 11%

- Samsung investing in rare earth alternatives

- Gold price: Yellen rally fizzles out as ETF sell-off continues

- Vale Canada charged in fatal Thompson mine accident

| Ben Bernanke comments on bitcoin Posted: 18 Nov 2013 04:37 PM PST  Federal Reserve Chairman Ben Bernanke | Creative Commons image by Talk Radio News Service On Monday, US legislators held their first-ever congressional hearing on virtual currencies, in particular bitcoin – the controversial crypto-currency. As US authorities discussed the pitfalls and benefits of bitcoin – citing concerns over anonymity and lack of regulation – the price of one bitcoin soared to more than $750 apiece. Monday's hearing is the first of two being held this week, but no legislative proposals are expected, according to the Wall Street Journal. The purpose of discussions is information gathering. In a letter dated September 6 but released Monday, US Federal Reserve Chairman Ben Bernanke weighed in. Some have called the letter a "cautious blessing" while others say Bernanke "mostly distanced himself" from the virtual currency. Excerpts from Bernanke's September letter, in response to a letter from the Committee on Homeland Security and Governmental Affairs asking for information on virtual currencies:

|

| Here's how the US is becoming the world's biggest oil and gas producer Posted: 18 Nov 2013 02:33 PM PST Last week the International Energy Agency reported that the US will become the world's top oil producer by 2015 – that's two years earlier than previously predicted. The driver is shale – a natural gas trapped in sedimentary rock, extracted by drilling and then injecting a watery mixture into shale formations. According to the IEA, this boom in natural gas production could cut the US's dependence on foreign oil almost entirely over the next two decades. But another document from the Energy Information Administration shows something even more interesting: Six regions account for nearly 90% of US oil production growth and 100% of domestic natural gas production growth.

Image featured on homepage by ezioman |

| Strikes, guerrilla attacks take their toll in Colombia’s coal output, down 11% Posted: 18 Nov 2013 12:03 PM PST Colombia's coal production dropped more than 11% in the first nine months of 2013 to 60 million tonnes, mainly due to several strikes affecting its main coal companies as well as guerrilla attacks, said Monday the National Mining Agency. The nation's coal industry was severely affected this year by two major strikes, said the organization. The first hit Colombia's No. 1 coal miner, Cerrejón, in February, while its US-based rival Drummond faced nearly two months of labour action over wages, which ended only after the Colombian Ministry of Labour's intervention. Output from small and medium producers tumbled 3% to 4.9 million tonnes during the period, compared to the 5.1 million tonnes produced in the first nine months of 2012. The country's estimated reserves are predicted to last for at least another century. However, the sector faces major uncertainties that have left millions in losses and jeopardized the 97 million tons of coal forecasted for this year's production. With almost 90 million tonnes of coal generated in 2012, Colombia is the world's fourth largest exporter and South America's No. 1 coal producer, according to data from the World Coal Association. |

| Samsung investing in rare earth alternatives Posted: 18 Nov 2013 11:43 AM PST Our phones wouldn't be the same without rare earth elements: They're found in our LCD display screens, the motors that make our phones vibrate, the speakers – all that to make our phones small and awesome. Other technologies also depend on REEs: Microphones, TVs, electric and hybrid vehicles, headphones, X-ray machines … the list goes on. But the problem with these materials is that more than 95% of our supply comes from China, putting some tech companies and other users at the mercy of Chinese suppliers. South Korea's Samsung is looking for alternatives. Through its Future Technology Cultivation Project, the massive manufacturing conglomerate plans on financing 27 projects, including research on materials that can substitute the use of rare earths, ZDNet reports. Unveiling the plans last week, Samsung said it would invest in seven areas of research into new materials. When China announced that it would restrict REE supplies in 2010, car manufacturers began looking for other options. At the time, Jack Lifton, co-founder of Technology Metals Research, said that the industry would "engineer this stuff out." And indeed, in 2012 Hitachi introduced an energy-efficient motor that doesn't use rare earths. |

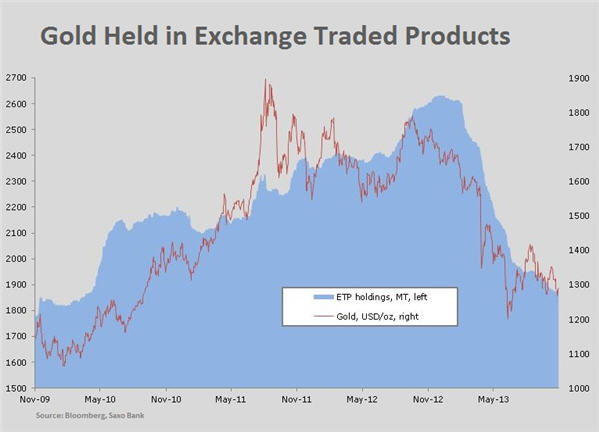

| Gold price: Yellen rally fizzles out as ETF sell-off continues Posted: 18 Nov 2013 11:38 AM PST The gold price on Monday gave up some of last week's hard-won gains, sliding more than $16 to a day low of $1,269.20 In lunch time trade December gold futures were changing hands for $1,372.80, retreating from highs of $1,294 set Thursday last week following Fed chair nominee Janet Yelen's comments on the bank's stimulus program. Losses in the volatile silver market was steeper with the metal losing 1.7% to $20.37, up from $20.30 earlier in the day. Silver is down 6.6% so far this month. The precious metals weakness comes as institutional money continue to exit the market in droves. Gold-backed ETF holdings of the metal dropped 7 tonnes last week to the lowest level since April 2010, while outflows from silver funds totaled 122 tonnes, the second biggest weekly reduction since June according to Saxo Bank. Institutional investors, especially the leveraged types such as hedge funds have increasingly been growing impatient with gold's prospects resulting in a doubling of the gross-short exposure through futures during the week ending November 12. Ahead of Yellen's speech which was broadly supportive of the Fed's QE program, pushing out indefinitely any tapering of the $85 billion being pumped into financial markets each month, net longs in gold were cut by 36%. Large investors are opting to put their clients' money into the US stock market which continues to set new highs. In 2013, the Standard & Poor's index of the 500 largest companies in the US, is up some 30%, while gold has retreated 24% from its opening levels of $1,677. The extent to which investors have abandoned gold-backed ETFs is most striking when you consider the world's largest gold ETF, SPDR Gold Shares (NYSE: GLD). Holdings in the fund established November 2004 are now at their lowest level since February 2009 even though net redemptions have slowed dramatically from the torrid pace of earlier in the year. As of Friday GLD has experienced year-to-date outflows of 485 tonnes to 865.7 tonnes, down just under 36% from the start of the year. |

| Vale Canada charged in fatal Thompson mine accident Posted: 18 Nov 2013 10:34 AM PST Brazilian miner Vale's Canadian unit has been charged with 10 counts of violating the workplace safety act of Manitoba, after a 51-year-old man died in one of the mining giant's operations in Thompson in 2011. The accusations, laid by the province's Workplace Safety and Health division in October, include allegations that Vale did not provide a safe workplace, did not have safe work procedures and had unsafe equipment. According to Canada's United Steelworkers Union, this is the first time a mine has been charged in Manitoba in connection to the death of a worker. In September Vale Canada received the largest fine ever imposed by an Ontario court for violations of the province's workplace safety law. Image from Wikimedia Commons. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Ben Bernanke comments on bitcoin"