Spot Chart | <b>Gold</b> and Silver <b>Chart</b> Comparisons :: The Market Oracle :: Financial <b>...</b> | News2Gold |

- <b>Gold</b> and Silver <b>Chart</b> Comparisons :: The Market Oracle :: Financial <b>...</b>

- Jesse's Café Américain: <b>Gold</b> Daily and Silver Weekly <b>Charts</b> - Hi Ho <b>...</b>

- Trader Dan's Market Views: <b>Gold</b> pushes further into <b>Chart</b> <b>...</b>

- This <b>chart</b> shows mini <b>gold</b> price rally could have legs | MINING.com

- Silver <b>Chart</b> And Sentiment Show Potentially Very Sharp Rally | <b>Gold</b> <b>...</b>

- Trader Dan's Market Views: <b>Gold Chart</b>

| <b>Gold</b> and Silver <b>Chart</b> Comparisons :: The Market Oracle :: Financial <b>...</b> Posted: 21 Jun 2014 02:37 AM PDT Commodities / Gold and Silver 2014 Jun 21, 2014 - 11:37 AM GMT By: Austin_Galt

Gold Weekly ChartWe can see gold has surged in the last week. I have drawn a downtrending line across the two previous tops. I originally thought this is where price would find resistance and turn back down. It still may. However, I've seen this trend line on a lot of charts recently so it is starting to appear too obvious. So I started to think about alternatives. I have drawn a horizontal line which I've labelled Minor resistance. This level stems from the March 2014 high at US$1389. I suspect price can push up to there before turning back down. This can be seen in the green highlighted circle. I have also drawn a horizontal line at the lows which I've labelled Major support. This level stands at US$1180. Now, as I noted in my previous gold report, we can see a double bottom has formed at this level. As Gann noted, double tops and bottoms generally don't end trends and I highly doubt this double bottom will end the downtrend in the gold price. Now the reason I expect gold will not rise above the minor resistance level is that if it did it would be a sign of bullishness. And considering I believe there is still lower to go before the final correctional low, I struggle to see price showing too much bullishness at the moment. As outlined in my previous gold report, I am looking for the gold price to finally bottom out under the important psychological level of US$1000 which is conveniently close to the 76.4% Fibonacci retracement level of the upleg from 2008 low to 2011 high. That level stands at US$973. Let's now have a look at the weekly silver chart and see what comparisons we can make. Silver Weekly ChartAs with gold, we can see the silver price has also surged this week. So much in fact that it has taken out the downtrending line I have drawn across recent tops. This breakout can be seen in the green highlighted circle. I expect to hear a lot of hooting and hollering from chartists now referring to this breakout and calling the end of the silver bear market. Hogwash is what I say. Admittedly, silver does appear to be in a more bullish position than gold which still hasn't reached its downtrending line. Therefore, I expect the silver price to bust out higher above the horizontal line I've labelled Minor resistance which stems from the February 2014 high at US$22.03. A break of this level will be more evidence of bullishness and should see price, unlike gold, push up to the horizontal line I've labelled Major resistance. This level stems from the August 2013 high at US$25.12. We can see a triple bottom has formed in the silver price around the level I've labelled Major support. Now just as gold's double bottom is unlikely to be the end of its bear trend, so too is the triple bottom in silver unlikely to be the end of its bear trend. However, silver is in a stronger technical position than gold. Even so, price should be held by the major resistance level. If and when rejected, price should come back down to major support. But unlike gold making a clean break of major support, silver's strong technical position should prevent it from a clean break below support. I expect only a false break marginally below the June 2013 low at US$18.17. In my previous silver report I drew Fibonacci retracement levels of the upleg from 2008 low to 2011 high. And just as I expect gold's final low to be around the 76.4% level, so too do I expect silver's final correctional low to be around the 76.4% level - this stands at US$18.10, just below the June 2013 low. So there we have it folks. Silver is currently in a stronger technical position than gold. This should see silver rise higher than gold in the current run up while gold should push lower than silver in the next decline. But the bear market in both commodities is not over yet, well as far as I'm concerned anyway. Bio Please register your interest in my website coming soon. Any questions or suggestions, please contact austingalt@hotmail.com © 2014 Copyright Austin Galt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| Jesse's Café Américain: <b>Gold</b> Daily and Silver Weekly <b>Charts</b> - Hi Ho <b>...</b> Posted: 19 Jun 2014 01:41 PM PDT There was intraday commentary about the metals rally here. There is also a Summer assignment for those of you who wish to have a framework for the unfolding tragedy that is the Anglo-American financial system. I suggest you scroll down for it. I had taken my trading account down to effectively zero cash on this last move lower in the metals, especially in the last two weeks. That was how sure I was that these market were grossly oversold. So this multiday move higher has been rewarding, and I thank God for it. I did take some trading positions off the table today to get back to a more 'comfortable' trading position. I do not touch my long term positions and try not to even think about them. So what next? Follow through is everything here. We have taken out some good resistance levels and some important moving averages as I show in a gold and silver technical chart below. But we still have not taken out the big downtrend in gold. Silver as well. Today was nice. It would have been nicer to have known why the metals moved so violently higher today, in what certainly turned into short covering. I have picked up almost no rumours from trading desk chatter today. That in itself is some information. Price movement makes market commentary. I don't think the Fed's statement yesterday is what caused this, but it is the go to plug for those who have to say something. Anyone who thought the Fed would do anything else must be a tourist. Tomorrow is stock option expiration. The miners had a significant move higher today. There was no meaningful action in the Comex warehouses. It is like watching a portrayal of some market in Madame Tussauds' Wax Museum. I am leaning toward the unwind of commodity rehypothecation in China as is ZH, but it bothers me that so far it is all base metals being discussed. We know there is a lot of leverage in the precious metals. And as you know, these latest antics by the Pigmen and their Merry Pranksters with the sovereign debt of Argentina was a real stick in the eye for the BRICs. So let's see what happens tomorrow. And let's enjoy today. I include a closeup of the gold chart just below so you can more easily see exactly where we are with respect to the longer term trends. |

| Trader Dan's Market Views: <b>Gold</b> pushes further into <b>Chart</b> <b>...</b> Posted: 19 Jun 2014 02:47 PM PDT While the pit session close was very strong, the screen trade continuing in the later afternoon hours has seen the metal moving further up into the next level of chart resistance. Adding the upward march has been good buying that has continued into the closing bell in the mining sector. I am currently showing the HUI up over 5% compared to gold currently up 3.75 % and silver up 4.89%. One wants to see the gold shares leading any charge higher in the metals and we are definitely seeing that occur. I am reposting the gold chart from earlier today since the metal has risen further and I do want to note its position on the Daily Chart and show the next challenge that gold bulls need to tackle. As you can see by examining the chart, the metal is knocking on the LOWER portion of that next resistance zone. As a side note here ( will someone please explain to the gold perma bulls or GIAMATT crowd that "YES", technical charts DO MEAN SOMETHING, in spite of their protestations to the contrary whenever the metal is moving lower), observe how the breach of the initial and a KEY resistance level near $1280 brought in more buying in the form of heavy short covering and fresh new buying. It works the same way in reverse folks - breaches of support levels bring in new selling and induce long liquidation. This buying produces MOMENTUM and that is what attracts the momentum-based hedge funds who will now come in on that side of the market while those in that crowd who are short will be forced to exit by their computers. Here's how the technical picture now looks - if the bulls can take out this next zone of resistance, I see another band of resistance centered near $1350 - $1360. Above that, frankly I do not see much, if any, until the market would get nearer to the $1385 level. Resistance would extend from that point all the way to round number and psychological resistance at $1400. I want to give a tip of the hat to one of our regular readers and frequent poster, Steve Brassey, who rightfully has noted that the Argentinian debt situation is worth monitoring. As Steve has noted, problems tend to start around the periphery and slowly work inward so any sort of fresh occurrence of sovereign debt fears could reawaken some strong interest in gold once again. It should be noted that equities have been the "go-to" investment of choice by large money managers and institutional funds. Ditto for the hedge fund community. If equities begin to falter (remember what happened when sovereign debt fears arose over Europe), there is going to be some diversification out of them and into gold, especially since its price has been so beaten down in comparison to the major stock indices. Traders/investors are not going to want to lose their nice, fat profits in equities so if they begin to get nervous, they will book some of those gains, take the profits and stash them into safe havens. A question that I have is whether or not the Dollar and the Yen would serve as safe havens in that event. Today, neither one of them look remotely life a safe haven. It was the European currencies which attracted the big money flows, especially Pound Sterling which registered a near 5 year high against the greenback. Traders have been looking to sell gold on rallies as it was not performing as were equities. Combine that with the fact that the inflation genie has been relatively well confined in his bottle, (at least in the minds of the majority of players ) and there was every reason to sell the metal. A couple of things have since changed however. The ECB seemed to take the first step with their recent monetary stimulus measures ( lowering rates from .25% to .15% and implementing negative interest rates for bank excess reserves). Since that time, the Euro has refused to break down below the key 1.350 level, something I have found quite remarkable. It is now back above 1.360 again. The second thing is Yellen's comments which caught a lot of traders leaning the wrong way. Most everyone expected the Fed to announce further tapering, which they did, to the tune of another $10 billion/month reduction. But most expected the Fed to sound a more upbeat tone about the economy and begin to start preparing the markets for an eventual rate hike. Quite the opposite happened. Disappointed traders, or better yet, shocked traders, ran for cover. Lastly, is that concern that Argentina's situation has now once again raised and brought onto the radar screens of traders. I would also like to take this opportunity to hoist up a longer term chart of gold. This is a weekly chart. Notice that today's big move on the Daily Chart above still leaves gold well within the TRADING RANGE market that has held it for a year now. If you look at the previous trading range, $1800 on the top and $1525-$1530 on the bottom, you can see that was in existence for 20 months! When gold finally broke down below the bottom of the range, it entered a bear market. It is currently working within a very broad consolidation pattern bounded by approximately $1400 on the top and $1200 or so on the bottom. It is now, as a result of today's big move higher, a wee bit above the MIDPOINT or center of this range. For gold to have a chance at ending the bear market, it would have to break out from the topside of this new range at the very least. It would also have to Close ABOVE the bottom of the former range. That means it would have to regain the $1530 level. One thing I am noting that makes this weekly chart and the price action within this new and lower range a bit more constructive than the previous range is the fact that the market has bounced higher within this range but the more recent low formed near $1240 is HIGHER than the low of the range ( near $1200). If you look at the previous range, gold tended to move to the bottom of the range before it rebounded back up to the $1800 level. In this newer range, the market has made a HIGHER LOW which is constructive as it gives the bulls a bit more reason to be hopeful than it does the bears, who were unable to bring the metal back down to the $1200 level for another test. Buyers emerged prior to this occurring which is friendly. I will want to see several thing now - first of all, I want to see the holdings in GLD move higher. If the ETF fails to confirm this move, it will NOT be a good sign for continued strength. WESTERN INVESTMENT DEMAND must surface and remain solid if the price is to continue moving higher. Secondly, I want to see continued weakness in the US Dollar, especially at the hands of the European based currencies, notably the Euro. Thirdly, I want to see continued upward progess in the commodity indices. And lastly, I want to see some weakness in the equity markets of sufficient magnitude that it would reflect some real FEAR exists out there among stock bulls. The VIX has been and remains comatose and that bothers me. If there is real nervousness out there, it should be seen in this Volatility index careening higher. Either that or stock bulls are just punch drunk and nothing is going to trouble them until it just does. Check out this chart - NO FEAR ANYWHERE - it is absolutely astonishing....! and scary! |

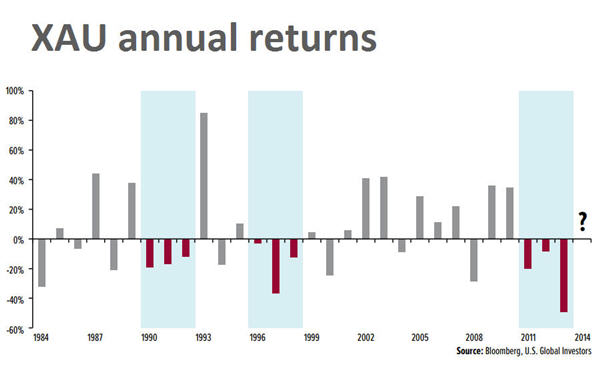

| This <b>chart</b> shows mini <b>gold</b> price rally could have legs | MINING.com Posted: 12 Jun 2014 02:39 PM PDT The gold price jumped to a near three week high on Thursday, buoyed by safe haven buying following outbreak of violence in Iraq and disappointing economic news out of the US. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery in afternoon trade exchanged hands for $1,274.20 an ounce, up $13 or 1% from Wedensday's trading session and near its highs for the day. Technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing how the Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) of top precious metal stocks can act as a leading indicator of the gold price: The XAU index rises faster than rising prices of gold and silver and falls faster than declining prices of gold and silver. And over the past week or so the metals and the XAU have been rising with the XAU rising faster. In fact InvesTRAC's OB/OS indicator (0-100 scale) is rising at 8.7 which suggests a good deal of upside potential before becoming overbought…InvesTRAC's forecaster is showing high June 16, low 27 and high July 8…let's look at the daily chart below which shows that the XAU/GOLD PRICE ratio has pushed up through its declining upper channel line and is through the tandem moving average…it is about to encounter its 200 day moving average with the potential to rise to the previous top at 0.0783 which is 10 per cent higher than the current level. What I like about the chart is that the ratio is bouncing off its previous low which implies further upside potential.  Source: InvesTRAC Back in February, firm US Global Investors also used the performance of the XAU index which thanks to its long existence has turned out to be a good predictor of trends. The boutique investment argued that shares in precious metals miners were approaching "the historical limits of multi-year declines" pointing out that over the last three decades there has never been a period where gold and silver stocks have declined four years in row. So far this rule of thumb is holding up: XAU is up 9% so far this year. |

| Silver <b>Chart</b> And Sentiment Show Potentially Very Sharp Rally | <b>Gold</b> <b>...</b> Posted: 16 Jun 2014 02:38 PM PDT There is an extremely interesting development brewing in the silver market. Chances are high this will turn out bullish, although one should not exclude a bearish outcome. Silver (and gold) forecasts in 2014 have been rather unanimously bearish or neutral, with only a minor number of analysts being positive. Longer term, we could expect better returns for the metals, for instance by analyzing the long term silver cycle reaching new highs in 2016. On the near term, two important indicators are flashing a potential key reversal, at least for the short and mid term. First, sentiment is at an important pivot point. Second, the long term silver chart seems to be accomplishing ("resolving") a multi year chart pattern. Let's review both in this article. Silver sentimentThis is an excerpt from last week's Sentimentrader's analysis (subscribe here): Pessimism in a bear market has to reach a whole other level than pessimism in a bull market in order to consistently generate positive returns going forward. Since silver has been mired in a bear market for at least a year, we've been looking for true historic extremes in pessimism. It's getting there. The latest data show that large speculators are net short silver futures to the greatest degree in a decade. At the same time, Public Opinion has dropped below 25%, one of the lowest readings since 1990. The green highlights on the chart show the other times that both indicators were as extreme as they are now at the same time. All three led to at least a short-term bump in silver, but only the occurrence in 1997 led to a lasting rally of at least several months. In 2000, silver just kept dripping lower until finally the selling pressure abated and it ignited the massive bull market. In June 2013, the extremes saw silver climb more than 25% over the next couple of months, but obviously that rally failed. It's time to pay attention and start looking for reversal patterns in price. Chart patternFrom a chart point of view, it seems clear that silver is ready to start trending. It is impossible to predict in which direction. Given the above and the multiyear chart formation which has set a solid base going back to 2009, it is very likely that the trend will be up. Very close attention should be paid at price action in the coming days and weeks, as nobody can exclude a bearish outcome. The key area to watch is $20 per ounce silver. If that level were to give away, then we are about to experience fireworks in the metals. Chart courtesy: sharelynx.com. A five year chart formation carries a lot of power. On the shorter timeframe (second chart) there is a first sign of a breakout, or, at least, a serious attempt. The same chart reveals that $19.50 is the key price level. It is safe to consider $20 as the key breakout area. Once breached, it is important to note that the silver price should stay there for at least 3 days and, in case it would retest $20, that it stays above it. |

| Trader Dan's Market Views: <b>Gold Chart</b> Posted: 11 Jun 2014 04:54 PM PDT Gold has been trekking slowly higher on low volume as it inches away from support at $1240. Calls for slower global economic growth seem to be putting some firmness in the market as some shorts pull out and move to the sidelines with some bargain hunters moving in as well. Also, the ECB's recent move to provide some monetary stimulus, while knocking the Euro lower, has chased a few shorts out of the gold market in spite of the continued weakness in that key currency. Notice on the chart that price has managed to move back into the first of three FORMER support zones which were violated to the downside. Gold pushed through the first of these and is knocking on the lower boundary of the middle support zone. For the bulls to be able to shift the sentiment more towards their liking, they will need to take price back through $1277 for starters but for a more convincing feat, $1280. For now, the low volume makes this current recovery look more like a dead-cat bounce but any break through $1280 that remains above that key level will have to be respected. In looking over the ADX, it shows the bears still remain in control but the current leg lower has been halted near $1240. That zone is shaping up to be just as important as $1280 had been. As I have written previously, below this level, a goodly number of hedge fund positions from earlier this year will be underwater. So far, it seems this is the pattern that we can expect to see in gold - a slow, steady grinding move lower instead of any sharp falls in price. The price drops, then stabilizes, then drops some more, then stabilizes, etc. I think this is mainly a function of the extended move lower for nearly the last three years and the remaining stubborn and persistent bullishness on the part of some of the large hedge funds that moved onto the long side earlier this year. Most of those who have given up on gold have already done so and are in equities. Those that persist in gold are a bit more ideologically persistent and will only exit reluctantly if successive support levels give way. Keep in mind that a market can find a long term bottom and still not make any sharp moves to the upside. Instead it can continue meandering back and forth, working essentially sideways for quite some time ( quite longer than many traders have patience for ). Some seem to think that once a market bottoms, it is off to the races once again. Nothing could be further from the truth. As a matter of fact, most markets do not as a general rule put in spike reversals without a abrupt shift in fundamentals but instead slowly transition from bear markets or bull markets through a period of consolidation ( sideways trade ) which can last for a fairly long period, before then entering a solid trending move in the other direction. Sometimes the initial trend actually resumes. When it comes to gold this has been perfectly illustrated when the market topped out in August 2011 just above $1900. It experienced a sharp selloff, then stabilized above $1530 whereupon it moved sideways for nearly 1 1/2 years when it was stuck in a range between $1800 on the top and $1530 on the bottom. Then it dropped out of that range falling over $300 all the way to $1180 whereupon it once again entered another period of sideways trade which it has remained in for nearly a full year now. The top of that range is up near $1400 and the bottom remains near $1180. There is really no telling how long gold might remain in this "RANGE TWO". It could be for months or it could be for years. No one really knows. If we compare the secondary range to the initial one, this current one has at least six more months to go (wouldn't it be nice if markets were all that well behaved - we would all be so wealthy we could retire the national debt all by ourselves). Within these broad ranges there exist smaller, tighter ranges. Those tend to show up better on the Daily Chart. Just keep these things in mind whenever someone gets too wildly bullish or too wildly bearish. Gold is stuck in a very broad range with the shorter term charts showing a bearish pattern for the time being. If gold were to take out the bottom of the former range near $1280, then it would have the potential to move back up towards the top of that range near $1320. Again, as noted above, a break below $1240 however would give the potential for a move all the way back to $1200. By the way, GLD has not given us any updated numbers for some time now. |

| You are subscribed to email updates from gold chart - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Spot Chart | Gold and Silver Chart Comparisons :: The Market Oracle :: Financial ... | News2Gold"