<b>Gold Prices</b> From 1971 To 2014 in 3 Waves | Gold Silver Worlds |

- <b>Gold Prices</b> From 1971 To 2014 in 3 Waves | Gold Silver Worlds

- New <b>Gold Price Chart</b>: Fed Minutes and Middle East Solidify Gold <b>...</b>

- This <b>chart</b> shows mini <b>gold price</b> rally could have legs | MINING.com

| <b>Gold Prices</b> From 1971 To 2014 in 3 Waves | Gold Silver Worlds Posted: 31 Jul 2014 01:31 PM PDT Ignore the hype regarding gold, bonds, booms and busts, hope and chains, "shock and awe," stock market crashes, "money honey" commentary, and ignore the politicians. Don't obsess over High-Frequency-Trading and market manipulation. Instead, focus on the big picture as shown in the following chart of monthly gold, which has been divided into 3 phases since 1971. Phase 1: Gold rallied from about $42 in 1971 to over $800 in 1980, thanks to massive money printing, debts, deficits, wars, and a loss of confidence in the US dollar. Phase 2: Gold prices crashed subsequent to the bubble of 1979-80, and then drifted lower for about 20 years. It double bottomed in 1999 and 2001. Phase 3: Gold rallied off the 2001 low of about $255 to over $1,900 in August 2011. Since then it has corrected to under $1,200, and double bottomed in June and December 2013. Current price is about $1,300. How Will Gold Prices Change in the next 3 – 5 Years? Option 1: Gold prices will continue rising, erratically of course, within the green "megaphone" pattern shown above. In my opinion this option is the most likely unless we descend into a global deflationary depression and/or nuclear winter, which the politicians and bankers will do "whatever it takes" to avoid. or Option 2: Gold prices continue falling much like they did subsequent to the 1980 bubble high. I consider this option unlikely. What Else Supports Option 1 – Higher Prices?

What Else Supports Option 2 – Lower Prices?

CONCLUSIONS This is not 1979 or 1980 when political and economic conditions were drastically different. Perhaps a better analogy would be about 50 years ago (1964) when the Vietnam War was escalating, US citizens were angry and marching in the streets, a gallon of gasoline cost 25 cents, coffee in a restaurant cost ten cents, and a decent middle-class wage was $2.50 per hour. The subsequent 20 years were life-changing and financially difficult for many people. Consumer prices increased drastically, the purchasing power of savings was destroyed, and people lost confidence in government and the US dollar. Gold prices will rally much higher in the next 5 years. Jim Sinclair's initial target of $3,500 seems very likely by 2016 – 2019. If the powers-that-be choose hyperinflation to deal with their massive debts, then much higher prices are "in play." There are many other options. For example, if you don't trust or like gold, a bank will pay you 1% interest each and every year if you invest in a Certificate of Deposit. Additional Reading: GE Christenson | The Deviant Investor |

| New <b>Gold Price Chart</b>: Fed Minutes and Middle East Solidify Gold <b>...</b> Posted: 09 Jul 2014 11:54 AM PDT Gold prices today (Wednesday) finished back over $1,320 an ounce after the release of the latest U.S. Federal Reserve minutes, and amidst turmoil in the Middle East. Our new gold price chart reflects the current June-July rally. Gold prices have rallied with a 9.5% gain this year through the close of yesterday's session and are on track to tack on more gains today. U.S. gold futures for August delivery reached $1,324.50 an ounce as of midday for an $8 (+0.61%) rise, putting gold futures on track for the biggest gain in nearly three weeks. Gold spot price per ounce was up $5.30 (+0.4%) at $1,323.90 an ounce. On Tuesday, SPDR Gold Trust (NYSE Arca: GLD) - the world's largest gold exchange-traded fund (ETF) - reported its second consecutive session of inflows, according to Reuters. It's the first time since mid-April GLD's holdings reached above 800 tonnes. Here's the top market news that's affecting gold prices right now... Top Stories Affecting Gold Prices Right NowThe Federal Open Market Committee (FOMC) meeting minutes were released this afternoon at 2 p.m. EDT. They followed the FOMC meeting last month in which Fed Chairwoman Janet Yellen was dovish on interest rate talks. The market had a muted reaction to the minutes today because they were not unexpected. According to Kitco,August gold was $8.40 higher to $1,324.90 an ounce as of 2:16 p.m. EDT, compared to $1,324.70 two minutes ahead of the minutes' release. Per Yellen's previous comments, the Fed will likely end its monthly bond-buying program in October. There were no new insights on when the Fed might raise interest rates. "It was in line with expectations. There were no surprises, really," Citi Institutional Client Group's futures specialist Sterling Smith said to Kitco. Interest rates are important for goldbugs because higher interest rates are bad news for gold prices. Gold prices will typically weaken when rates go up as investors seek out higher-yielding assets. Geopolitical tension in the Middle East is the other major factor contributing to gold's recent gains. Here's how it's shaping the yellow metal right now... Geopolitical tension in the Middle East and in Ukraine is pushing gold prices higher. The safe-haven investment tends to enjoy gains when fear is in the air. Israel has launched a military offensive in the Gaza strip this week. It declared its purpose is to bring Palestinian rocket attacks to an end. The escalation in violence between Israel and Gaza militants has become the worst since November 2012. "Some investors are buying gold as the Middle East region is very tense," R.J. O'Brien & Associates senior commodity broker Phil Streible said in a telephone interview with Bloomberg. "We have been seeing an increase in the safe-haven premium since the violence in Ukraine started." With gold prices solidified above $1,320 an ounce, is it the right time to invest in gold? Time to Buy Gold?Money Morning Chief Investment Strategist Keith Fitz-Gerald said in May that the case for owning gold has never been stronger. Here's why now is the time to make sure the yellow metal plays a part in your portfolio... "Many investors are asking themselves if now is the time to buy gold. I think that's the wrong question," Fitz-Gerald said. "What they should be asking themselves is if they can afford not to buy gold." Fitz-Gerald highlighted the fact that central banks are trillions of dollars in the hole, so they are buying gold as a means of supporting their currencies. According to the World Gold Council (WGC), in 2013 net purchases totaled 369 tonnes. That represents 12 consecutive quarters in which the central bankers have reported net inflows. And recent gold news corroborates Fitz-Gerald's bottom line... You see, Fitz-Gerald also stressed that consumers in India and China - who jointly represent three out of every five people alive today - generally believe that gold is going to increase in price over time. Yet few actually own it, according to the WGC and U.S. Global Investors. "As the economic development in these two countries continues at a rapid pace, overall demand will increase, even if it falls off in developed countries like the United States and in the European Union," Fitz-Gerald said. "Already the statistics are proving this point. Consumer demand in China rose 32% in 2013 to a record 1,066 tonnes, while in India, demand rose 13% to 975 tonnes." Indeed, last month we reported that demand out of India and China are expected to send gold prices soaring in the second half of 2014. Barron's agrees. "We expect the weak physical demand seen in Asia of late to pick up again in the second half of the year, which should result in a rising gold price, especially since the headwind from ETF investors is likely to further abate," analysts Barbara Lambrecht and Michaela Kuhl said to Barron's in June. "We are confident that gold demand in India will pick up noticeably as compared with the first half year and last year once the import restrictions have been eased. China is also likely to demand more gold again in the coming months." As Asian demand picks up, look for our gold price chart to continue its upward swing in this latter half of 2014. Money Morning recently delivered for our Members a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here. Related Articles: |

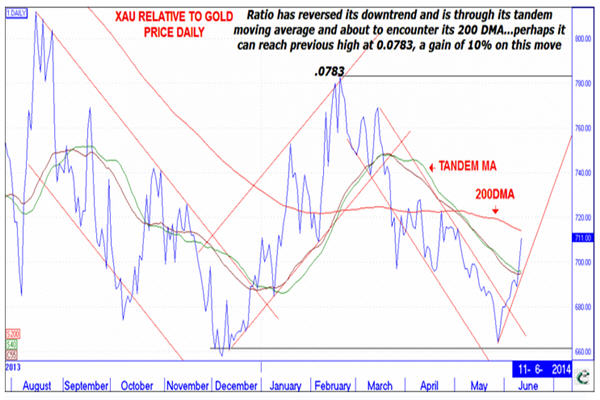

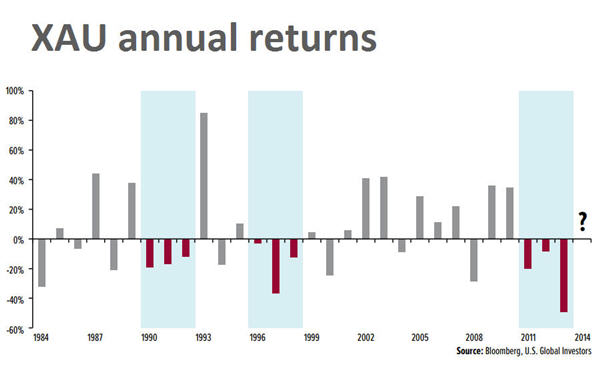

| This <b>chart</b> shows mini <b>gold price</b> rally could have legs | MINING.com Posted: 12 Jun 2014 02:39 PM PDT The gold price jumped to a near three week high on Thursday, buoyed by safe haven buying following outbreak of violence in Iraq and disappointing economic news out of the US. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery in afternoon trade exchanged hands for $1,274.20 an ounce, up $13 or 1% from Wedensday's trading session and near its highs for the day. Technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing how the Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) of top precious metal stocks can act as a leading indicator of the gold price: The XAU index rises faster than rising prices of gold and silver and falls faster than declining prices of gold and silver. And over the past week or so the metals and the XAU have been rising with the XAU rising faster. In fact InvesTRAC's OB/OS indicator (0-100 scale) is rising at 8.7 which suggests a good deal of upside potential before becoming overbought…InvesTRAC's forecaster is showing high June 16, low 27 and high July 8…let's look at the daily chart below which shows that the XAU/GOLD PRICE ratio has pushed up through its declining upper channel line and is through the tandem moving average…it is about to encounter its 200 day moving average with the potential to rise to the previous top at 0.0783 which is 10 per cent higher than the current level. What I like about the chart is that the ratio is bouncing off its previous low which implies further upside potential.  Source: InvesTRAC Back in February, firm US Global Investors also used the performance of the XAU index which thanks to its long existence has turned out to be a good predictor of trends. The boutique investment argued that shares in precious metals miners were approaching "the historical limits of multi-year declines" pointing out that over the last three decades there has never been a period where gold and silver stocks have declined four years in row. So far this rule of thumb is holding up: XAU is up 9% so far this year. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold Prices From 1971 To 2014 in 3 Waves | Gold Silver Worlds"