This <b>chart</b> shows mini <b>gold price</b> rally could have legs | MINING.com |

- This <b>chart</b> shows mini <b>gold price</b> rally could have legs | MINING.com

- This <b>Gold</b> Model Calculates <b>Prices</b> Between 1971 & 2017 | Deviant <b>...</b>

- The Smoking <b>Graph</b> – Janet Yellen Has Learned <b>...</b> - Latest <b>Gold Price</b>

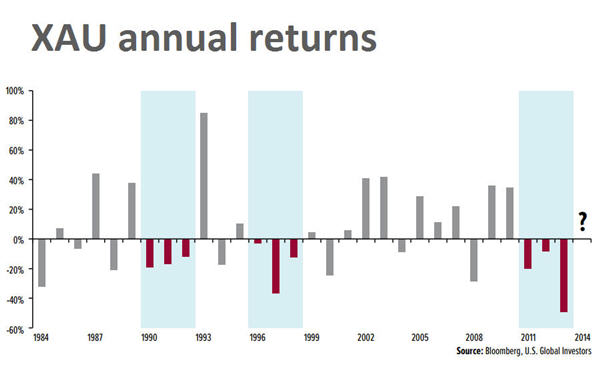

| This <b>chart</b> shows mini <b>gold price</b> rally could have legs | MINING.com Posted: 12 Jun 2014 02:39 PM PDT The gold price jumped to a near three week high on Thursday, buoyed by safe haven buying following outbreak of violence in Iraq and disappointing economic news out of the US. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery in afternoon trade exchanged hands for $1,274.20 an ounce, up $13 or 1% from Wedensday's trading session and near its highs for the day. Technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing how the Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) of top precious metal stocks can act as a leading indicator of the gold price: The XAU index rises faster than rising prices of gold and silver and falls faster than declining prices of gold and silver. And over the past week or so the metals and the XAU have been rising with the XAU rising faster. In fact InvesTRAC's OB/OS indicator (0-100 scale) is rising at 8.7 which suggests a good deal of upside potential before becoming overbought…InvesTRAC's forecaster is showing high June 16, low 27 and high July 8…let's look at the daily chart below which shows that the XAU/GOLD PRICE ratio has pushed up through its declining upper channel line and is through the tandem moving average…it is about to encounter its 200 day moving average with the potential to rise to the previous top at 0.0783 which is 10 per cent higher than the current level. What I like about the chart is that the ratio is bouncing off its previous low which implies further upside potential.  Source: InvesTRAC Back in February, firm US Global Investors also used the performance of the XAU index which thanks to its long existence has turned out to be a good predictor of trends. The boutique investment argued that shares in precious metals miners were approaching "the historical limits of multi-year declines" pointing out that over the last three decades there has never been a period where gold and silver stocks have declined four years in row. So far this rule of thumb is holding up: XAU is up 9% so far this year. | ||||||||||||

| This <b>Gold</b> Model Calculates <b>Prices</b> Between 1971 & 2017 | Deviant <b>...</b> Posted: 03 Mar 2014 11:05 PM PST Read the Latest News About: Gold persistently rallied from 2001 to August 2011. Since then it has fallen rather hard – down nearly 40%. This begs the question: What happens next?

The answer, in my opinion, can be found in my gold pricing model that has accurately replicated AVERAGE gold prices after the noise of politics, news, high frequency trading, and day-to-day "management" have been purged. I presented the specifics of my model at the Liberty Mastermind Symposium in Las Vegas on February 22, 2014. A detailed presentation would be much too long for this article, so the following is a quick summary. Like this blog? You might enjoy my e-book:Survival Investing |

| Bill Holter | Jim Sinclair in Austin, Texas |

| Eric Sprott | Do Western Central Banks Have Any Gold Left? |

| Gold Silver Worlds | Jim Rickards: Target Gold Price |

| Casey Research | 23 Reasons to Be Bullish on Gold |

| The DI | Gold Investors: Take the Red Pill |

| Jim Sinclair | MineSet |

GE Christenson

aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail.

Promote, Share, or Save This Article

If you like this article, please consider bookmarking or helping us promote it!

You can skip to the end and leave a response. Pinging is currently not allowed.

The Smoking <b>Graph</b> – Janet Yellen Has Learned <b>...</b> - Latest <b>Gold Price</b>

Posted: 18 Jun 2014 05:34 AM PDT

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "This chart shows mini gold price rally could have legs | MINING.com"