This <b>chart</b> shows mini <b>gold price</b> rally could have legs <b>...</b> - News 2 Gold |

- This <b>chart</b> shows mini <b>gold price</b> rally could have legs <b>...</b> - News 2 Gold

- This is the scariest <b>gold price chart</b> you'll see today | MINING.com

- New <b>Gold Price Chart</b>, Plus the Latest Gold News - Money Morning

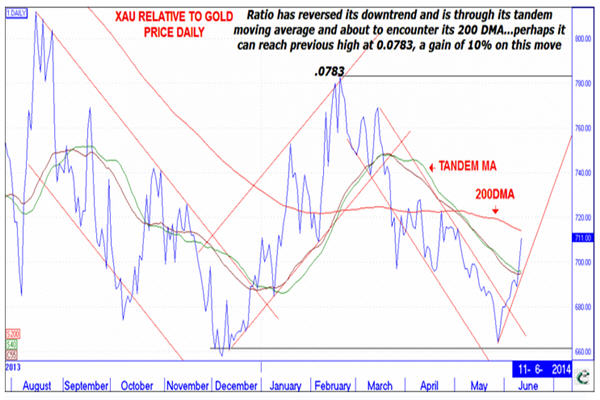

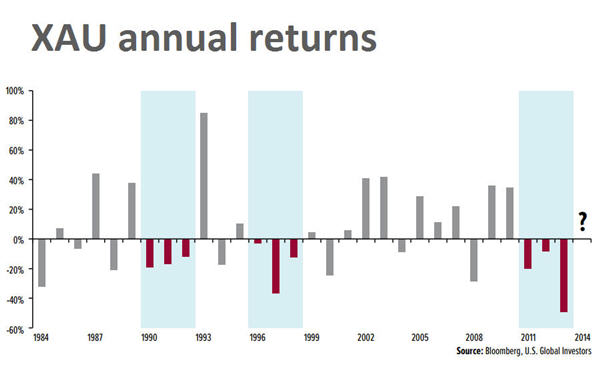

| This <b>chart</b> shows mini <b>gold price</b> rally could have legs <b>...</b> - News 2 Gold Posted: 19 Aug 2014 04:02 PM PDT The gold price jumped to a near three week high on Thursday, buoyed by safe haven buying following outbreak of violence in Iraq and disappointing economic news out of the US. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery in afternoon trade exchanged hands for $1,274.20 an ounce, up $13 or 1% from Wedensday's trading session and near its highs for the day. Technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing how the Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) of top precious metal stocks can act as a leading indicator of the gold price: The XAU index rises faster than rising prices of gold and silver and falls faster than declining prices of gold and silver. And over the past week or so the metals and the XAU have been rising with the XAU rising faster. In fact InvesTRAC's OB/OS indicator (0-100 scale) is rising at 8.7 which suggests a good deal of upside potential before becoming overbought…InvesTRAC's forecaster is showing high June 16, low 27 and high July 8…let's look at the daily chart below which shows that the XAU/GOLD PRICE ratio has pushed up through its declining upper channel line and is through the tandem moving average…it is about to encounter its 200 day moving average with the potential to rise to the previous top at 0.0783 which is 10 per cent higher than the current level. What I like about the chart is that the ratio is bouncing off its previous low which implies further upside potential.  Source: InvesTRAC Back in February, firm US Global Investors also used the performance of the XAU index which thanks to its long existence has turned out to be a good predictor of trends. The boutique investment argued that shares in precious metals miners were approaching "the historical limits of multi-year declines" pointing out that over the last three decades there has never been a period where gold and silver stocks have declined four years in row. So far this rule of thumb is holding up: XAU is up 9% so far this year. |

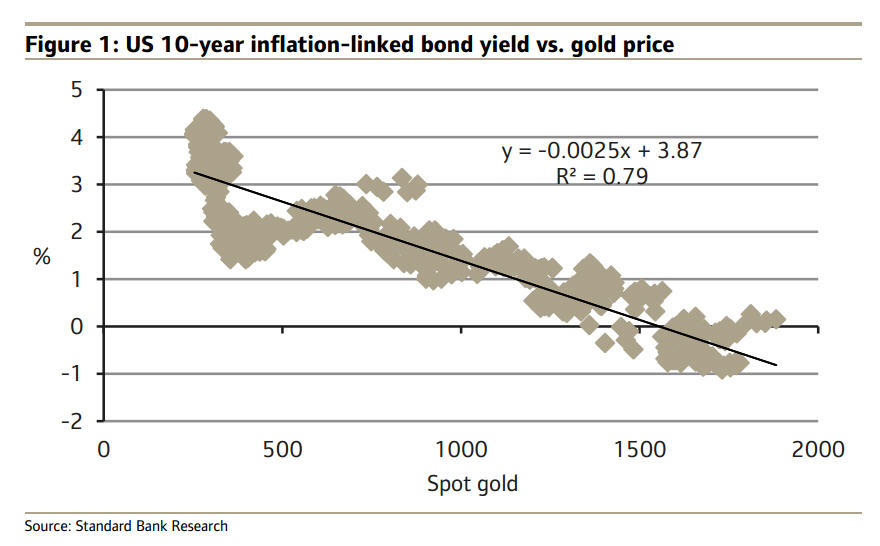

| This is the scariest <b>gold price chart</b> you'll see today | MINING.com Posted: 25 Mar 2014 11:23 AM PDT The Standard Bank commodities team's always cogent analyses revealed a stunner this week. The specialists at the commodities trading arm of the bank – which is being bought by China's ICBC and may get a table at the daily London gold fix – are not the first to point out the correlation between real US bond yields and the price of gold. But the chart plotted in the London and Johannesburg-based firm's latest research note to show the connection puts the trouble ahead for the gold price in stark relief. Analyst Leon Westgate, says the house view is that "real interest rates in the US will continue to rise in coming months as the Fed monetary policy normalises, which will put downward pressure on gold. The relationship between real long-term interest rates in the US (as proxied by 10-year US inflation-linked bonds) and the gold price is strongly negative." 10-year real yields (Treasury Inflation Protected Securities or TIPS) are currently at 0.59% which seems consistent with today's gold price of around $1,310 an ounce. Absolute future gold price levels probably shouldn't be divined from this chart, but it does point to one thing: If you buy into this theory, the gold price is going down. |

| New <b>Gold Price Chart</b>, Plus the Latest Gold News - Money Morning Posted: 09 Jun 2014 11:29 AM PDT Gold shifted higher today (Monday) following recent record lows - our up-to-date gold price chart shows that in late May, gold tumbled to its lowest level in four months, to $1,243.00. Today, gold for August delivery was up 0.1% at $1,253.90 a troy ounce on the Comex division of the New York Mercantile Exchange. London gold was up 0.1% at $1,253.77 an ounce. Here's the top market news that's affecting gold prices right now... Top Stories Affecting Gold Prices NowFriday's release of U.S. payroll data came in a little better than what analysts forecasted. But the slight beat wasn't enough to get a gold market reaction one way or another, as seen by today's flat numbers. "Most major players remained on the sidelines at the end of last week," VTB Capital bullion analyst Andrey Kryuchenkov wrote in a note to clients, reported by The Wall Street Journal. "From the investor perspective, Europeans would rather choose blue-chip equities or a stronger dollar given improving risk sentiment." Recent data from Reuters revealed that money managers' bets on gold have settled back to the depressed levels last seen in January, when gold prices were at a similar low, as is reflected in our gold price chart. According to data released on Friday by the Commodity Futures Trading Commission, money managers who trade futures and options are net "long" 51,000 contracts - around half the level a month earlier. Barron's reports that the number of gold futures and options contracts currently outstanding in the market (the "open interest") is also near 2014 lows. Still, the case for owning gold has never been more clear, according to Money Morning Chief Investment Strategist Keith Fitz-Gerald. "Many investors are asking themselves if now is the time to buy gold. I think that's the wrong question," Fitz-Gerald said in May. "What they should be asking themselves is if they can afford not to buy gold." Fitz-Gerald highlighted the fact that central banks are trillions of dollars in the hole, so they are buying gold as a means of supporting their currencies. According to the World Gold Council (WGC), in 2013 net purchases totaled 369 tonnes. That represents 12 consecutive quarters in which the central bankers have reported net inflows. But it's the most recent gold news that corroborates Fitz-Gerald's bottom line... You see, Fitz-Gerald also stressed that consumers in India and China - who jointly represent three out of every five people alive today - generally believe that gold is going to increase in price over time. Yet few actually own it, according to the WGC and U.S. Global Investors. "As the economic development in these two countries continues at a rapid pace, overall demand will increase, even if it falls off in developed countries like the United States and in the European Union," Fitz-Gerald said. "Already the statistics are proving this point. Consumer demand in China rose 32% in 2013 to a record 1,066 tonnes, while in India, demand rose 13% to 975 tonnes." Indeed, Barron's reported on Friday that although gold will likely remain depressed for the next three weeks, demand out of India and China should bolster gold prices in the second half of 2014. "We expect the weak physical demand seen in Asia of late to pick up again in the second half of the year, which should result in a rising gold price, especially since the headwind from ETF investors is likely to further abate," analysts Barbara Lambrecht and Michaela Kuhl said to Barron's. "We are confident that gold demand in India will pick up noticeably as compared with the first half year and last year once the import restrictions have been eased. China is also likely to demand more gold again in the coming months." If Asian demand picks up, look for our gold price chart to include an upswing in the latter half of the year. Money Morning recently detailed for our Members the importance of owning gold now - and delivered a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here. Related Articles:

|

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "This chart shows mini gold price rally could have legs ... - News 2 Gold"