<b>Gold price</b> drops $30 after Fed | MINING.com |

- <b>Gold price</b> drops $30 after Fed | MINING.com

- Silver and <b>Gold Prices</b> Remain in Uptrends from the Summer Lows

- Central banks, LBMA are one and the same; and <b>gold price</b> <b>...</b>

| <b>Gold price</b> drops $30 after Fed | MINING.com Posted: 28 Oct 2015 12:02 PM PDT After a strong run-up ahead of a crucial US Federal Reserve decision on interest rates on Wednesday, the gold price came crashing down again after a hawkish statement by the central bank. On the Comex market in New York, gold futures with December delivery dates fell more than $30 an ounce from where it trading just before the announcement. In afternoon trade the sell-off accelerated with gold last exchanging hands at $1,152.30 from $1,183.50 ahead of the Fed statement. While the Fed decided to keep interest rates unchanged it hinted at a rate rise at its next meeting in December against market expectations of a first move only in March next year. Higher interest rates boost the value of the dollar and makes gold less attractive as an investment because the metal is not yield-producing. The Fed voted 9 to 1 to leave rates in a range of zero and 0.25% where they have been since December 2008. Interest rates in the world's largest economy has not been raised in more than nine years. Gold hit its highest level since June 22 a fortnight ago, amid fresh indications that a limp US economy may push a rate hike further into the future, but that narrative now seems to be in trouble. Hedge funds reduced bullish bets to more than five year lows ahead of the September Fed decision, but since then large futures speculators – referred to as "managed money" – have played catch-up with the turnaround in sentiment towards gold and the fading expectations of a rate hike in 2015. According to the CFTC's weekly Commitment of Traders data for the week to October 20 hedge funds added more than 47% to their long positions – bets that gold will be more expensive in the future – from the week before. Last week's rise was 66% and hedge funds have now added net long positions for five straight weeks. Net longs now stand at 12.2 million ounces (345 tonnes), the highest since February. At the start of the year bullish positions topped out at 16.7 million ounces when gold briefly traded north of $1,300. Speculators also made deep cuts to short positions ahead of last week's rally – bets that gold could be bought cheaper in the future – reducing overall positions more than 20% to 3.7 million ounces, down from record highs above 11 million ounces set in July. In late July and early August, hedge funds entered net short positions for the first time since at least 2006, when the Commodity Futures Trading Commission first began tracking the data. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and <b>Gold Prices</b> Remain in Uptrends from the Summer Lows Posted: 30 Oct 2015 05:54 PM PDT

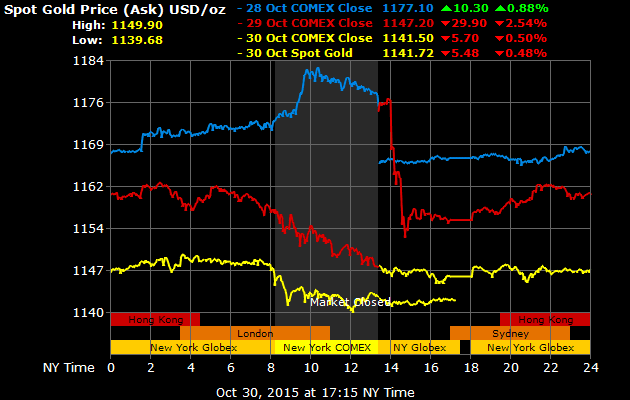

On Comex today, where they take no prisoners and show no mercy, the GOLD PRICE fell $5.70 to $1,141.50 and silver gained 2.2 cents to $15.566.

The gold price traded down to its 50 DMA and stopped there today, having closed beneath its 20 DMA on Wednesday. A 62.8% correction of the foregoing move takes it to $1,137.10. Today's low came at $1,138.40.

The SILVER PRICE has hit the old support at $15.50-$15.60 and stopped. Silver is holding up better than gold, which makes me nervous because silver's Commitments of Traders look more negative than gold's. Will silver even the score with gold in one swoop? On the other hand, a 50% correction of the October advance would be $15.365. Down below at $15.00 is the uptrend line from the August low. For all the worrying, silver and gold prices remain in uptrends from the summer lows, and they had an excellent higher month. GOLD/SILVER RATIO remains where it ought to be if they are rallying, namely, below its 200 DMA in a downtrend. What if the Nice Government Men and criminal central bankers, in order to hold at bay the due penalty of their monetary crimes and economic sins, worked together to manipulate interest rates? "Aww, you Tennessee fool! Don't you already know all them central bank knockers sit down to eat together once a month in Basel at the Bank for International Settlements? Whatta you think they talk about, the rubber chicken and cheap wine?" No, I understand that, what I mean is that last week, not to put too fine a point on it, was the most luxuriant and pyrotechnic display of central bank jawboning and smoke-blowing we've seen since Draghi's famous we'll do "whatever it takes." The end of the month was drawing close, and all good bureaucrats keep one eye on the calendar, because they are graded month to month. How to get stock prices up, especially before the FOMC meeting? The Chinese obliged by dropping interest rates on Thursday, Friday Draghi rattled his throat making noises about more QE coming in December, maybe, perhaps. Then the FOMC said they would definitely/maybe/probably/possibly raise rates in December. I'd say it was a brilliant propaganda campaign, and succeeded in pushing up the Dow 7.9% and the S&P 8.1% on the month, and helped erase the memory of the searing pain and bleeding from the August plunge. No new bolts were turned, no screws tightened, no new houses or cities or refrigerators built, nothing was produced, no economic demand grew nor economic supply, yet it SEEMED as if it had, because stocks were suddenly more valuable. 'Twas all seeming, without being. But it worked. And what if the US dollar index is being managed the same way. Draghi says to Yellen, "You let your currency rise this month, and we'll let ours rise next month." Dollar has traded in a roughly 5 point range, even with the August drop, since May. Nice round number, five. Now the details.

Dow Industrials lost 92.26 (0.52%) today to 17,663.54. S&P500 gave back 10.05 (0.48%) to 2,079.36. Get clear in your mind: If they can pierce the bottom of that upturned bowl the central bank magicians have engineered an extension to the stock boom. If not, stocks will move lower than a rich deacon stealing out of the collection plate.

Dow in Silver rallied to a high of 1,140.02, but settled today at 1,137.02 oz. Also above the 200 DMA. Looks tired but hasn't confirm that by lying down and going to sleep.

The euro, the Frankencurrency, rose 0.26% to $1.1007, but who cares? Now below its 200 dma and couldn't buy credibility if it had its own central bank to issue money. Wait, wait. It does. Yen is tanglefooted in its converging 20, 50, and 200 DMAs. Range-trading. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banks, LBMA are one and the same; and <b>gold price</b> <b>...</b> Posted: 29 Oct 2015 01:00 PM PDT Dear Friend of GATA and Gold: Freelance financial journalist Lars Schall today reports another brief exchange with the press officer of Austria's central bank, Christian Gutlederer, that is illuminating though it wasn't meant to be. Schall originally asked Austria's central bank to have its executive director, Peter Mooslechner, answer some questions about his comment to Kitco News last week at the London Bullion Market Association conference in Vienna. Asked about the role of central bank gold reserves, Mooslechner volunteered that "central banks in Asia ... are increasing their reserves a lot and they are much more active in using also their reserves in trading in the market and intervening into the market": http://www.gata.org/node/15878 Schall sought details from Mooslechner -- http://www.gata.org/node/15897 -- asking: -- Can you elaborate on the trading of gold by central banks and their use of gold for market intervention? -- Exactly which central banks are doing this trading and intervention, what are its purposes, objectives, and results, and what markets are involved? -- Are this trading and intervention public and announced or are they secret and surreptitious? -- Are this trading and intervention undertaken directly by central banks or through intermediaries? -- If this trading and intervention are undertaken through intermediaries, who are they? -- Should markets and citizens generally have the right to know about this trading and intervention? -- And how do you know about it, Herr Mooslechner? Gutlederer replied: "Sorry, we are not going to answer your questions. We never comment on our investment strategy and trading." When Schall protested that he had not asked about the Austrian central bank's "investment strategy and trading" but about Mooslechner's assertion of surreptitious intervention in the gold market by Asian central banks, Gutlederer replied: "We are never commenting on the strategies of other central banks and to make it clear from the very beginning I added we are not commenting also on our strategies." But of course Mooslechner had commented on "the strategies of other central banks." If this is something the Austrian central bank "never" does, how did Mooslechner get away with violating bank policy? The explanation lies in the context of the central banker's seemingly prohibited comment. Mooslechner was speaking on the sidelines of the LBMA meeting in Vienna to a simpleminded and compliant reporter for an Internet news organization that always shills for the financial establishment. Given the location, the central banker well could have thought that he was among colleagues and that his remarks would not escape a friendly circle. Indeed, other recent interactions between central banks and representatives of the LBMA also demonstrate that for all practical purposes central banks and the LBMA are actually the same institution. For example, telling disclosures about surreptitious trading in the gold market by central banks were made by the director of operations for the Banque de France, Alexandre Gautier, at LBMA meetings in Rome in September 2013 and in Lima in 2014. At the meeting in Rome, Gautier said that the Banque de France is trading gold for its own account and for the accounts of other central banks "nearly on a daily basis": http://www.gata.org/node/13373 At the meeting in Lima, Gautier said central banks are managing their gold reserves "more actively" using gold swaps: http://www.gata.org/node/14716 And in a letter to the Bank of England's Fair and Effective Markets Review Committee in January this year -- http://www.gata.org/node/15241 -- LBMA Chief Executive Office Ruth Crowell argued that the bank should facilitate gold lending by central banks as a means of providing "liquidity" to the gold market. That is, that central banks should keep letting LBMA members handle central bank gold reserves to prevent any shortage of metal in the market that might drive the price up and make government currencies and bonds less attractive. Crowell could not have expected that her letter to her pals at the Bank of England would become public, even if it was placed in the bank's public archive, because no mainstream financial news organizations will ever consider market rigging by central banks. All this signifies that the London Bullion Market Association is a primary mechanism of central banks for surreptitiously managing the gold market, for preventing it from becoming a market at all. The central bankers and LBMA members get together regularly at LBMA meetings around the world to share information relevant to this market rigging and to nurture social relationships. What is supposed to be confidential government information is shared with friendly outsiders, like Mooslechner's observation about secret intervention in the gold market by Asian central banks. And when this information accidentally leaks out through overconfidence in the central bank and bullion bank fraternity that nobody else is paying attention, central banks like Austria's pretend that the information is not supposed to leave central bank offices at all, though it is being shared with LBMA members all the time and is immensely tradable and facilitates insider trading. * * * Mooslechner's specifying Asian central banks as the ones lately using their gold reserves to intervene secretly in the gold market gives credence to the speculation three years ago by the U.S. economists and fund managers Paul Brodsky and Lee Quaintance that the central bank gold price suppression scheme is part of a plan to redistribute world gold reserves more fairly, particularly to holders of large surpluses of U.S. dollars and U.S. government debt, so they may be hedged against a devaluation of the dollar: http://www.gata.org/node/11373 It would make no sense for Asian central banks to be, as the Austrian central bank's Mooslechner says, "increasing their reserves a lot" and then "using their reserves in trading in the market and intervening into the market," knocking the price down, unless the objective was to scare off private buyers of gold so central banks could obtain more for themselves. There's a great story here, the financial news story of the modern age, about the subversion of markets, the producing class, and democracy by the unelected elite of the financial class, central banks. Too bad that the first rule of mainstream financial journalism is never to put a critical question to a central bank, and especially not a critical question about gold. CHRIS POWELL, Secretary/Treasurer Join GATA here: The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: -- Posted Thursday, 29 October 2015 | Digg This Article  | Source: GoldSeek.com comments powered by | Source: GoldSeek.com comments powered by Previous Articles by Bill Murphy |

| You are subscribed to email updates from gold price - Google Blog Search. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

2 Comment for "Gold price drops $30 after Fed | MINING.com"

Thankyou for giving useful info.To know more about stock market, stock market tips visit Epic Research.

Information is really very useful.Thanks for sharing.

To know more about stock market you can get help from Epic Research.