Close to $60bn in Canadian oil and gas projects in jeopardy: report |

- Close to $60bn in Canadian oil and gas projects in jeopardy: report

- Cliffs closes Bloom Lake iron ore, sells coal assets

- Here is why miners should think ‘accountability’ when talking ‘responsibility’ (Part II)

- Chile’s Supreme Court won't hear Barrick appeal on Pascua Lama fine

- Why you need to own gold in 2015 and beyond

- Gold’s year-end rally surprises investors

| Close to $60bn in Canadian oil and gas projects in jeopardy: report Posted: 02 Jan 2015 08:26 AM PST  A growing number of energy players are shelving expansion plans in the oil sands, as a consequence of plummeting prices. As many as 16 oil sands projects may be deferred and a few gas endeavours halted in the next three years if the current drop in oil prices and the plummeting investment in the sector persist, analysts are warning. According to experts quoted by Financial Post, $12 billion worth of projects in the Canadian oil and gas sector could be deferred this year, $20 billion in 2016 and $27 billion in 2017, should the oil prices remain depressed. Mark Oberstoetter, Calgary-based lead analyst of upstream research at Wood Mackenzie, told the paper such rescheduling could curtail the 650,000 barrels per day of additional oil expected to come on stream in the next three years. According to the source, the most endangered projects are Cenovus Energy Inc.'s Christina Lake Phase H and its Narrows Lake Phase A; Husky Energy Inc.'s Sunrise SAGD plant expansion; and PetroChina's MacKay River project. |

| Cliffs closes Bloom Lake iron ore, sells coal assets Posted: 02 Jan 2015 06:05 AM PST Cliffs Natural Resources (NYSE:CLF) announced Friday that active production at its Canadian Bloom Lake iron ore mine has completely ceased as the firm continues its plans to exit Eastern Canada as previously announced. The company, which is the U.S.'s biggest iron ore miner, also said it has conclude the sale of part of its struggling coal division for $174 million, in cash, to Coronado Coal II LLC. The Cleveland-based miner's move aims to fully exit higher-cost operations to focus only on its iron ore business in the U.S. As most of its peers, Cliffs has been struggling as a consequence of tumbling prices for iron ore and metallurgical coal, triggered by a slowdown in the Chinese steel industry. Since becoming chairman and chief executive officer in August, Lourenco Goncalves has started unloading some of Cliffs's previous acquisitions. "As we approach the final steps of our exit from Eastern Canada, we have brought to an end the flawed expansion that has cost Cliffs and its shareholders billions of dollars," Goncalves said in a today's statement. He added he believed Cliffs was better positioned than any other iron ore mining company in the world to deliver profits in 2015. In October last year, Cliffs took a $6bn charge related mainly to the ill-timed purchase of Bloom Lake, which was supposed to supply the then-booming Chinese steel market. |

| Here is why miners should think ‘accountability’ when talking ‘responsibility’ (Part II) Posted: 02 Jan 2015 03:43 AM PST  Chile's Supreme Court ruled in October that mining giant Goldcorp wasn't allowed to move forward with its $3.9 billion El Morro gold and copper mine (pictured) until local indigenous groups who oppose the project are better consulted. Embracing Corporate Social Responsibility (CSR) has become much more than a matter of public relations. Today there are several practical and legal reasons for companies to have a CSR strategy in place. Less than two months ago, Canadian Minister of International Trade Ed Fast unveiled an "enhanced" strategy to advance the use of CSR by local mining and energy companies. "Enhanced" refers to some modifications that result from a five-year review of an earlier strategy released in 2009. These changes are serious and James McNally, technical director at Wardell Armstrong International, explains why they matter.

There is no single international body as such, but today the general acceptance of CSR in the mining industry is a big step forward from the situation only a few years ago. Intergovernmental frameworks have emerged from United Nations (UN) conferences, from organizations such as the International Labour Organization (ILO), the Organization for Economic Co-operation and Development (OECD) and the World Bank. Frameworks have also been established by financing bodies such as the International Finance Corporation (IFC). The Equator Principles are now subscribed to by over 80 of the world's major banks. Various aspects of global CSR are also being increasingly managed through campaigning from civil society organisations, and industry associations such as Bettercoal, London Bullion Market Association, World Gold Council, Responsible Jewellery Council, Kimberley Process etc., the list goes on.

My impression is that there is a now a multitude of frameworks, codes and standards delivered through many organizations across the supply chain. Some are legislated, but most are guidelines or voluntary codes. There is often overlap between many of these frameworks and reporting formats often differ with the end result that such sources and frameworks may appear "uncoordinated and generate confusion". The challenge going forward will be to develop common indicators and reporting formats, so CSR activities can be meaningfully evaluated and compared.

Whilst this may sound like a good idea it would be difficult to set up, organize, manage and police. There remains the issue of compliance and who will monitor the findings. Will this be managed unilaterally or will there be an international approach driven by a common set of standards. Industry self-regulation is important. A model that has been successful is the International Council on Mining and Metals (ICMM), which was founded in 2001 to improve sustainable development performance in the mining and metals industry. Today, ICMM brings together 21 mining and metals companies as well as 35 national and regional mining associations and global commodity associations to address core sustainable development challenges. The objective of ICMM is for the collaboration of industry leaders to catalyze sustainable industry performance. The organization is governed by a Council of the chief executives from their member companies as well as two representatives from member associations.

Extractive industries play an increasing role in their country's economy but all companies in the extractives sector have a legal, commercial (reputational) and moral obligation to manage their human rights impacts. The environmental and social performance of poorly performing companies also reflects on the reputation of home governments and could indirectly undermine other companies and industry sectors back home. The concept of a government-backed initiative to manage CSR abroad is being looked at by various nations. In the UK, the Business, Innovation and Skills (BIS) Select Committee has recently published a report to encourage companies to act responsibly and the Committee calls on the UK Government to enable investors to look into and rank mining companies according to factors such as governance ethics, community relations, and the management of climate change. This outlines the concept that to improve the performance and accountability of mining firms, a Social Responsibility Index is proposed, which features extractive companies listing in the UK. This would build on existing schemes or the Government could establish a new index. Such a scheme is working, first-hand, with the SRI index at the Johannesburg Stock Exchange. In short, Governments needs to ensure their countries are as strong on Environmental and Social Governance as they are on Financial. A rigorous index would help achieve this goal, assist responsible investors and provide an incentive for all extractive companies to conduct themselves in a socially and environmentally responsible way. |

| Chile’s Supreme Court won't hear Barrick appeal on Pascua Lama fine Posted: 02 Jan 2015 02:49 AM PST Chile's Supreme Court has declined to hear Barrick Gold's (TSX, NYSE:ABX) appeal of a lower court's decision involving fines imposed on its now shelved $8.5 billion Pascua Lama gold-silver project by the country's environmental regulator, the company said. The appeal, filed by Barrick's local subsidiary, Minera Nevada, followed a confusing ruling in March last year that revoked the $16 million penalty — the largest ever imposed in the country— over alleged mishandling of the process by the regulator, the Superintendence for the Environment (SMA). That resolution not only ordered the Toronto-based miner to keep Pascua Lama's operations halted, but also instructed the SMA to re-write the resolution containing the fine, as it said it contained a number of "errors and illegalities." Barrick took the case to the Supreme Court, arguing the fines were calculated based on applicable law and commonly accepted legal principles. However, Barrick says Chile's top court refused to consider the appeal on procedural grounds, ruling that the company is not a party to the case because the original action was brought against the government watchdog. As a result of the ruling, the SMA will now re-evaluate the administrative fines it imposed on the Pascua Lama project, Barrick said in the statement. What to expect in 2015 The drafting of new sanctions could take at least three months, an SMA spokesperson told BNamericas. After the new amount is determine the company notified, Barrick has the legal rights to file a new appeal with the environmental court and, depending on that ruling, also a fresh plea with the Supreme Court. Construction at the project site, which straddles the Chile-Argentina border, was indefinitely postponed because of the ongoing legal issues and the company's own decision to halt work in October 2013, after investing $5 billion in a project also hit by cost-overruns and a falling gold price. Pascua Lama, which would produce about 800,000 to 850,000 ounces of gold a year in the first full five years of its 25 year life, was scheduled to start production in the second half of 2014. Here's Pascua Lama long and troubled history that dates back to the mid-1990s: |

| Why you need to own gold in 2015 and beyond Posted: 01 Jan 2015 04:05 PM PST Debt is a rock, and spending reform is a hard place. The taxpayers of today and tomorrow are saddled with crushing obligations. Yet we must watch helplessly as leadership in Washington DC continues expanding government — borrowing what they can and simply printing what they cannot. Each day more Americans sense a reckoning is coming. Our government is increasingly insolvent. The unbacked dollar is certain to be worth less, and it may not survive at all. The problem is dishonest money. Federal Reserve officials are free to print as many dollars as they wish, completely unaccountable for the purchasing power stolen from your savings. Honest money in the form of physical gold is the solution. Gold coins, bars, and rounds represent value that cannot be inflated away. In the long run, no other asset offers the same track record — particularly during turbulent times. Families who save using private, portable, and enduring gold have been passing wealth from one generation to the next for literally thousands of years. Also, during key periods in history, investments in gold did more than simply hold value; they produced real profits. We are likely living in the next of these periods now. Inflation is a worldwide phenomenon forcing entire populations to look for alternatives to the paper in their wallets. As more and more turn to finite gold, its purchasing power will rise — perhaps dramatically — as people bid more aggressively for available stocks. We've seen it before. If history is a guide, now is a particularly opportune time for wise investors to buy physical gold coins and bars — both for protection and profit. To understand why requires some background. Gold is beautiful and rare. Our ancestors picked up the first golden nuggets thousands of years ago and found themselves delighted. Virtually everyone wanted some of their own — a fact not lost on people seeking to trade. A person with gold to offer could bargain for all manner of valuable goods. A little of the beautiful metal went a long ways in terms of buying power. Gold became money — the preferred medium of exchange when trading locally and across the world. Gold Represents Timeless Value Gold's universal appeal across continents makes the metal extraordinary. But it is gold's appeal across time that makes it unique. People navigate in a world of cycles and change. Investment manias come and go. Societies move inevitably from relative peace and prosperity to crisis and war and back again. Governments rise and fall. In recent centuries these governments began introducing paper currencies in their ascendance then inflating them away in their decline. Through all of these cycles, gold remained sought after and highly valued — making it one of history's few constants. An anecdote, often told, highlights gold's relatively constant value. In 1916, just after the Federal Reserve was established and before politicians decoupled the U.S. dollar from gold, a man with a $20 bill or a $20 "Double Eagle" gold piece (containing very close to 1 ounce of gold) could walk into a men's clothier and buy a fine suit, shirt, belt, shoes, socks, and a tie with either the bill or the coin. Today, the gold coin will still buy the same thing. But the $20 bill may not even be enough to purchase a belt. This constancy is the reason politicians and bankers, the purveyors of fiat currency, began a concerted effort to divorce gold psychologically from its role as money. It is hard to maintain the illusion of value in a paper currency with gold acting as a foil. John Maynard Keynes, the British economist most admired by the advocates of big government and unlimited borrowing, declared the gold standard a "barbarous relic" in 1924. A few generations later, bureaucrats talk about sophisticated monetary tools which supposedly render gold irrelevant. Ultimately, the talking will fail. It doesn't change the true nature of gold, nor the true nature of the paper they want you to use as money. Paper currency is supported only by confidence — its value resides exclusively in people's minds. Intrinsically, the bills we all carry are simply colored bits of paper whose supply is limitless. They are designed and managed by officials to lose value over time — a stealthy tax benefiting politicians and those they favor, to the detriment of ordinary earners and savers. That is why governments inevitably get larger while the value of the currency they issue inexorably declines. It is the ultimate confidence game. Paper Money Is Losing Credibility by the Day But the essential trust in fiat currencies is beginning to fade. People look aghast at the "debt clock" in Times Square now surpassing $18 trillion. Their minds are boggled at the trillions of new dollars created by the Fed via extraordinary maneuvers such as Quantitative Easing. Today, there are real questions about the solvency of the U.S. government, and the value of the scrip issued on its behalf. Meanwhile, gold is reasserting itself. Citizens in places like Venezuela, Holland, and Germany are clamoring for the repatriation of gold reserves stored outside of their borders. Perhaps most telling, we find the same central bankers who publicly denigrate gold quietly adding bars to the stockpiles held in their nations' vaults… stockpiles most of them somehow never quite got around to liquidating. Despite all this, today most Americans still do not own gold bullion. We are conditioned by Wall Street to focus on conventional assets — stocks, bonds, money markets, and mutual funds. Less than 2% of people in the U.S. own any physical bullion according to most estimates. Even fewer hold a position significant enough to provide a meaningful defense against inflation. Roughly 10% of the population owned gold or silver in 1980 — the end of the last bull market in metals. Decades before that, everyone carried some in their pockets. The current cycle moved the entire world into fiat currencies and away from money backed by gold. When will this cycle reverse — perhaps suddenly — and gold ownership return to vogue? What will happen to the gold price when masses of cynical people tire of holding dishonest money and look for an incorruptible alternative? Smart investors aren't waiting to find out. Every day more Americas buy their first physical gold coins or bars, no matter what the financial elite say about it. ____ Witten by Clint Siegner | Money Metals Exchange |

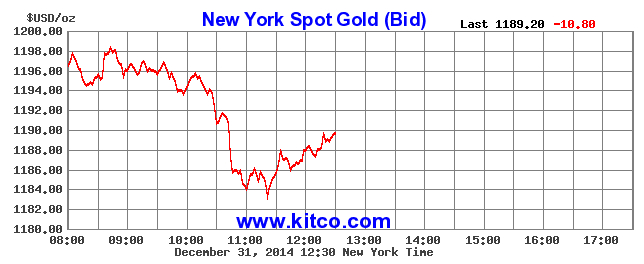

| Gold’s year-end rally surprises investors Posted: 31 Dec 2014 09:48 AM PST Risk aversion among year-end buyers and short covering boosted gold prices in the last days of 2014, but the rally could be short-lived, with the stronger dollar keeping a lid on further gains, experts warn. The precious metal, in fact, is ending the year nearly unchanged after plummeting about 30% in 2013. After closing Tuesday at $1,200 an ounce, spot gold fell in New York during Wednesday morning and recovered a bit at noon, trading at $1,189.30.  Live gold prices by Kitco.com "Geopolitical tensions could bring gold back up," Donald Selkin, the chief market strategist at New York-based National Securities Corp., which oversees $3 billion told Bloomberg. "Central banks will probably start buying, and prices are getting close to production costs. China could loosen its monetary policies to boost the economy." The precious metal was extremely volatile this year. All ups and downs considered, gold fell only 0.6% when compared to an average annual move of 12% in the past 14 years. Prices touched a four-year low in November as the dollar strengthened and investors bet on the Fed planning to hike interest rates. Despite being on the way down for two years now, some believe that $1,200 will be the new normal for the precious metal in 2015. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

0 Comment for "Close to $60bn in Canadian oil and gas projects in jeopardy: report"