Silver prices | Silver Futures Market Is Keeping <b>Silver Prices</b> Down - but Not for Long |

- Silver Futures Market Is Keeping <b>Silver Prices</b> Down - but Not for Long

- <b>Silver Price</b> Reverting to Pre-Summer Levels | Silver Investing News

- <b>Silver Price</b> Forecast: End-of-Year Rally to Start in September

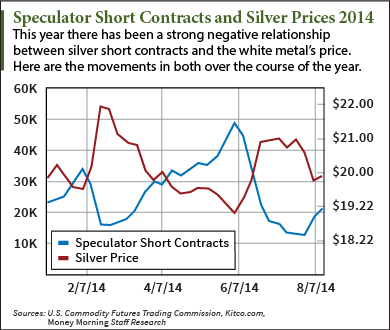

| Silver Futures Market Is Keeping <b>Silver Prices</b> Down - but Not for Long Posted: 08 Sep 2014 10:19 AM PDT  Silver futures activity has been smothering silver prices, with the white metal trading down seven of the last eight weeks as it nears three-month lows. And not surprisingly, speculators have taken center stage in this protracted bear session, adding to their short positions for the fifth straight week. As of last Tuesday, speculators held 39,025 short contracts - paper bets on silver's decline - representing 195.1 million ounces of physical silver, according to the most recent data by the U.S. Commodity Futures Trading Commission. This was an increase from the week before, when speculators staked out 31,632 short positions, or 158.2 million ounces of silver, and it is the continuation of a buildup that began in late July when the number of contracts was at a low not reached since February 2013, at 12,603. This silver futures market activity is significant because this year the number of contracts and the movement of prices have had a very strong negative correlation. This means that as speculators take out more short contracts, prices will go down in a similar trend. And since July 29, this has been the case. Short contracts have grown by 26,422 contracts, and silver prices have fallen in that same time by 6.9%. While this is discouraging for silver bulls, there is a reason for optimism. That's because as sure as short contract buildup puts downward pressure on silver prices, liquidation of these contracts does the opposite. When speculators see silver headed near lows, they begin to move out of their short contracts because they understand that silver can only fall so far. This leads to liquidation of short contracts and fresh long buying on a large scale and has the potential to send silver prices into a long rally. This last happened in early June. At that time, silver short contracts were at their highest on record, hitting close to 49,000 positions, all while silver languished and traded below $19 an ounce. As speculators saw these lows, they reversed course, and over the next eight weeks as these traders sold off their short contracts and bought new long positions, the price of silver moved from $18.81 an ounce to $20.56, good for a 9% gain. And in this time, silver closed in on its 2014 highs, trading at one point as high as $21.45. Now, with short contracts growing in the manner they have, and prices approaching three-month lows, it's primed to happen again... When Speculators - and Silver Prices - Will Reverse CourseAs of market close Friday, silver was trading at $19.19 an ounce, down 1.5% on the week and 1.9% on the year. The last time it had traded this low was in late May, just as the speculator contracts had built toward a peak. It's still unknown when exactly this current session of short building will hit a peak, given that June's 49,000 contracts was the highest the white metal has ever seen, but the current number of shorts is about 10,000 contracts shy of this mark. If the current figure is indeed a peak, then you'll likely see silver prices begin to move up as early as this week. But if short contracts are building up to a new record high, at the current pace, then you can expect a peak - and subsequent rally - in two weeks. Since contracts bottomed out in late July, speculators have added to short positions at an average of about 5,300 contracts a week. Money Morning Resource Specialist Peter Krauth called silver "gold on steroids" and said it has the potential for double-digit gains in the near future. But at the moment, it is very cheap, presenting an attractive buying opportunity. "Silver is cheap based on a number of indicators, and its bull market is far from over," Krauth said. "So the time to take a position is now, before the crowd." More on Precious Metal Investments: Money Morning Resource Specialist Peter Krauth was right about palladium when he recommended in March - it's up almost 14%. Here's another precious metal currently flying under the radar that's ready to head higher... |

| <b>Silver Price</b> Reverting to Pre-Summer Levels | Silver Investing News Posted: 10 Sep 2014 03:50 PM PDT Articles Return to Article Directory The summer months are often a quiet time for the resource sector, with many market participants taking the old adage "sell in May and go away" to heart. As a result, investors tend to look forward to September, when prices and market activity typically pick up. Unfortunately, this year that pattern simply hasn't held true for silver — in fact, quite the opposite has happened. A quick glance at a the metal's activity from May until now (see below) shows that it ended May at $18.81 per ounce, then proceeded to move upward throughout the summer, hitting a high point of $21.44 midway through July. Since then, silver has been on a steady decline, today sinking as low as $18.88 — essentially right back where it was three months ago. Silver's unseasonal price rise isn't surprising given that the summer brought tension regarding conflict between Ukraine and Russia and in Iraq — after all, as a safe-haven asset, silver is a magnet for investors when geopolitical uncertainty hits. The current downward movement is also unsurprising given that the US dollar is currently on a tear. That said, silver's unusual behavior certainly has investors wondering what's next for the white metal. While longer-term predictions are scarce, Kitco's Jim Wyckoff suggested Wednesday that silver bulls' next upside price breakout objective is "closing prices above solid technical resistance at $19.50 an ounce." Meanwhile, Julian Phillips states in a post for GoldSeek that the white metal is "waiting for gold to give direction." Silver closed today at $18.95. Junior company news El Tigre Silver (TSXV:ELS,OTCQX:EGRTF) on Tuesday announced "strong" assay results from the year-round exploration program at its Mexico-based El Tigre silver and gold project. Assay results from four samples of underground backfill material from the Southern vein area ranged from 1.28 grams per tonne (g/t) gold to 4.32 g/t gold and 262 g/t silver to 468 g/t silver. Stuart Ross, president and CEO of El Tigre, commented, "[t]he exploration program continues to advance our understanding of the El Tigre vein system and we are extremely encouraged with the results," adding, "[t]he ongoing exploration program continues to build our confidence in the potential at El Tigre. We look forward to the fall of 2014 being a bellwether period for the company." Wednesday, Dolly Varden Silver (TSXV:DV,OTCBB:DOLLF) said that it has started a diamond drill program of up to 8,000 meters, or 20 holes, at its British Columbia-based Dolly Varden project. The program is aimed at testing "numerous defined drill-ready epithermal and Eskay-Creek style targets," as well as expanding known silver mineralization on the Torbrit-Red Point Corridor. The same day, Bear Creek Mining (TSXV:BCM) released an update on the progress made on optimization studies at its Corani silver-lead-zinc deposit, commenting that trade-off studies have identified several design modifications that should enhance project performance. They "will now be carried forward into the detailed engineering," but aren't expected to require a new Environmental and Social Impact Study. Corani is currently moving towards detailed engineering and permitting. Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article. Related reading: Precious Metals Record Losses as Dollar Rises Return to Article Directory Read next article Silver Entering the Wearable Technology Space Read more articles by Charlotte McLeod+ |

| <b>Silver Price</b> Forecast: End-of-Year Rally to Start in September Posted: 29 Aug 2014 10:22 AM PDT Silver Price Forecast 2014: While August provided hope that silver prices would rebound from a disappointing July, speculation kept a lid on price gains.

But September promises to be a more productive month, and the factors that kept the white metal subdued in August trading are slowly fading away. There is early evidence that silver is beginning to pull itself out of the current bear session that has produced six straight weeks of losses. For the first time since July, silver looks poised to finish trading up on the week. As of yesterday's (Thursday) close, silver had gained $0.085 since last Friday, and has finished up the last three days of trading for the first time since early July. This welcome change comes after silver has plunged as much 9.8% from its highs of $21.445 an ounce in early July. In August, silver has so far lost 4.4%, its second-worst month on the year. Similarly, silver futures contracts are down 4.2% to $19.61. And exchange-traded funds (ETFs) backed by silver are also trading down in August. The iShares Silver Trust (NYSE Arca: SLV), which is backed by silver bullion held in vaults in London and New York, is down 4.3% to $18.74, while ETFS Physical Silver (NYSE Arca: SIVR) is down 4.4% to $19.28. Despite a wide range of silver investments taking it on the chin this month, September will likely provide a boost for the bulls that had strong stomachs during this short-lived slump. Here's what is going to help silver reverse course next month... Silver Price Forecast: The Factors Leading to September GainsA big factor in this bullish silver price forecast is activity in the futures markets. Actions in the silver futures market is an important indicator of where prices are headed because in a period where speculators are building up short contracts - paper bets on a price decline - it puts downward pressure on prices. Since bottoming out at the end of July, speculators have been building up short contract positions, holding 12,063 short silver positions backed by about 63 million ounces of physical bullion on July 29, and increasing those positions more than twofold to 27,646 contracts backed by 138.2 million ounces as of the most recent data. But when short contracts build to a peak and silver hits new lows, speculators will begin to liquidate their shorts en masse and buy new long positions - and as the following chart illustrates, that's been bullish for silver.

So far in 2014, silver short contracts have reached two peaks before a mass liquidation took place. The first was on February 4, where these paper bets totaled close to 34,000, and the weeks of short covering to follow drove silver to its highs on the year of $21.965. The other peak happened in June, where contracts totaled about 49,000. Depending on where the peak is in this current period of short-building, silver could open September with some losses, but is likely to ascend once the bulls take notice of silver's low prices and the shorts are squeezed out. Money Morning Resource Specialist Peter Krauth said it is crucial that silver hits $22 an ounce and establishes a new support level. This is likely to happen in the fall months, and from there on out the bulls should be able to prevail and pull the white metal up to between $23 and $24 by the end of 2014. NOW: Countless factors are building that make today's silver prices look downright cheap. Here's how you can invest in silver today for double-digit gains... |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

This protracted period of short covering is what helped propel

This protracted period of short covering is what helped propel

0 Comment for "Silver prices | Silver Futures Market Is Keeping Silver Prices Down - but Not for Long"