<b>Gold Prices</b> 1971 - 2014 in 3 Waves :: The Market Oracle :: Financial <b>...</b> |

| <b>Gold Prices</b> 1971 - 2014 in 3 Waves :: The Market Oracle :: Financial <b>...</b> Posted: 01 Aug 2014 07:15 PM PDT Commodities / Gold and Silver 2014 Aug 02, 2014 - 04:15 AM GMT By: DeviantInvestor

|

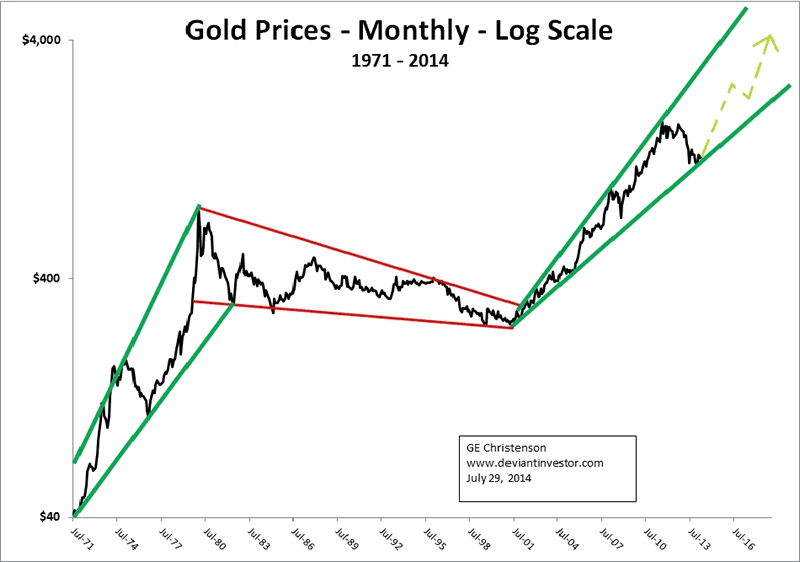

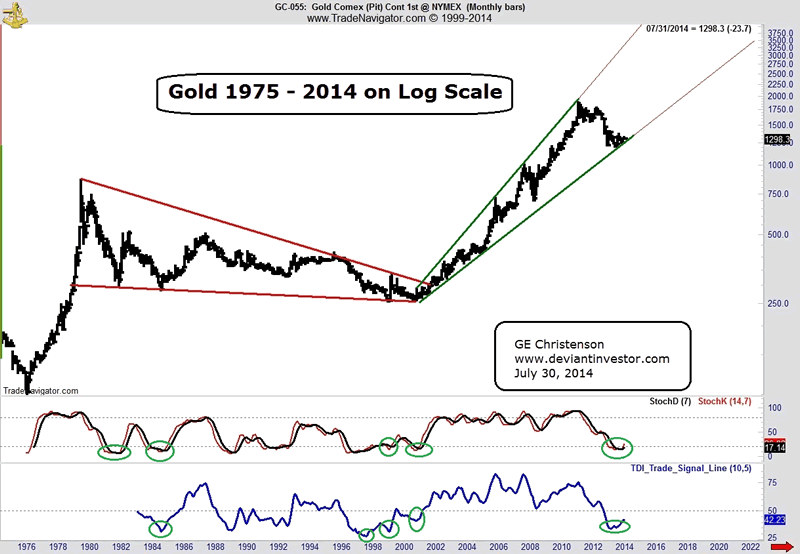

| 1930 Great Depression Unemployment <b>Rate Graph</b> | How to cure <b>...</b> Posted: 02 Aug 2014 09:20 AM PDT What is a gold price chart and why is it so necessary? Could someone go ahead and invest in gold without having it? What is the big issue about this chart? Essentially, it is considered very unwise to take any measures using gold without tracking the current gold prices graph. Generally what the graph achieves is that it details the price changes of gold over a particular period of time which naturally gives you a lot clearer picture of where values are headed and the most likely potential status of the precious metal. How else will you be able to tell when the perfect time to buy or sell is? A typical gold graph will have the bar graph which represents time in the bottom and the price during various points in time on the left or right. The value of gold is spotted at different times and then a line is established connecting the various points hence enabling anybody to see at a glance the pattern and the general path that values are going to. When you glance at the current prices and perhaps come up with a comparison with some weeks back or perhaps a year ago, you will definitely not have a very clear and comprehensive picture. How will you be capable of seeing the trends in the price adjustments? If we're for instance to check out the gold rate chart for the interval between 2008 to 2012, the very first thing you may see is that the price of this metal is on a constant improvement. It means that 2008 would have been a great period to invest in a lot of gold. Even now a close look at the trends shows that it's still not far too late and all signals are that gold values could go on to rise. A glance at the graph must of course lead you to conduct some research that could produce lots of different signals that point to values moving forward to increase steeply for several years ahead. One good reason is that the global financial trouble has caused many national banks to start acquiring gold in large quantities to help protect their states from the changing paper money, deflation and a volatile world economic industry. People are also placing even more focus on gold in their investment portfolios. What all this implies is the demand for gold could continue to climb steeply for a long time and consequently, the values too are bound to continue pointing northwards. Lots may be done by using a gold rate chart. It is possible to make use of statistics to scientifically anticipate the value of gold within the distant future. A gold price chart is very helpful if you're searching for the statistics that will help you generate such predictions. A chart is usually pretty thorough and can present the gold price for every troy ounce. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The Big Picture

The Big Picture

0 Comment for "Gold Prices 1971 - 2014 in 3 Waves :: The Market Oracle :: Financial ..."