Silver prices | Trend Change Developing In Gold And <b>Silver Prices</b>, Just Not <b>...</b> |

- Trend Change Developing In Gold And <b>Silver Prices</b>, Just Not <b>...</b>

- <b>Silver Prices</b> Today Ride FOMC Minutes to Slight Gains

- Gold Ends Near 4-Month High, <b>Silver Prices</b> Jump 2.1% | Coin News

- Gold and <b>Silver Price</b> Positive Developments :: The Market Oracle <b>...</b>

- Gold And <b>Silver Price</b> Trend Change Developing, Just Not Confirmed

- Gold and <b>Silver Prices</b> Are Now Poised To Skyrocket - ETF Daily News

| Trend Change Developing In Gold And <b>Silver Prices</b>, Just Not <b>...</b> Posted: 12 Jul 2014 08:20 AM PDT If you never read a newspaper, listened to television/radio, or read any one of the numerous blogs that exist and were left with just charts to look at, the information contained in the them would put you head and shoulders above everyone else. Why? Charts contain the resulting input from all the decision-makers, from the most informed to the least informed, and the aggregate information that can be gleaned from news, regardless of source, including blogs and so-called expert opinions can not be superior to that combination of price and volume over time, found in the charts. There has been a smart rally over the past two months, but far from the strongest and the most dollar gain. It is still occurring within the confines of a protracted TR [Trading Range]. The June and December 2013 respective rallies gained much more, and the current rally may as well, but we can always only deal with what is known and not what may or may not come to pass. Price has rallied just above the 50% of range level, but the past three week rally has overlapping bars, more a sign of struggle between buyers and sellers, by contrast with bars that have much less overlap, like the rallies of January and July 2012. A better example would be the decline from the March high on the daily chart below. The ease of movement is much clearer to the downside. This does also happen in rallies, just not yet in gold. It cannot yet be determined if this will lead to a change in trend, hence the NMT, or Needs More Time. The daily chart may provide better clues. D/S = Demand overcoming Supply, [determined by a very wide range bar, strong rally and close, typically on a large increase in volume], followed by 13 TDs [Trading Days], of mostly overlapping bars. In an up trend, this would have been a no-brainer to buy into. In a TR within a larger down trend, it becomes riskier. We have attempted long positions in both gold and silver on apparent strength, in the recent past, with poor results. Whenever anything is in the middle of a TR, the level of trading knowledge is at its lowest, and one should be more cautious and respect the trend. Last Thursday's high volume, wide range breakout is hard to ignore. The question then becomes, How to establish a long position [in futures]? What most people do not know or understand is how one form of market activity confirms [or negates] what preceded it. The 19 June D/S needs to be confirmed. The confirmation is typically a weak reaction, lasting between 3 – 8 TDs, and on smaller range down bars and less volume. This says sellers are weak. If during the course of a correction the down bars are wide and volume increases, the rally will not likely stand. You do not need to read about anything in the news to know this. It is the activity market itself that makes this information known, first- hand, as it develops. Thursday's upside breakout on increased volume gave the green light to get long, if one did not use the previous information of the past few weeks to do so. Intra day activity will show this in greater detail. After the 19 June then surprise strong rally, price moved sideways for two weeks of TDs. This was clearly a weak reaction, but occurring in a sideways to down trend, depending on which time frame used, but not up, in any event. There was still a possibility that the sideways activity could lead to another turn down. Mention for context must be made that weak reactions to price rallies, more especially in an up trend, lead to higher prices. This market premise does not always hold as true in a down trend. Confirmation that the weak reaction would lead to higher prices came on the 10th, last Thursday, with another D/S bar upside breakout on increased volume. The clinching clue comes from the highest intra day negative volume, see arrow. There was no further downside, and that is the market letting us know that the selling was from weak holders and the buying was going into strong hands. This confirms the same thing from starting on 19 June. The smaller intra day correction that held above the breakout was used to establish an entry with about a $1,000 risk. Odds favor higher prices next week, but nothing is ever guaranteed. How the market activity develops in the days and weeks ahead will provide all the information/confirmation needed. Of course, this is good news for holders and buyers of physical gold, and eventually higher prices will prevail. By holding physical, market corrections are less important, as is true of timing. The stage is set, and gold has never failed to preserve value, even increase worth, historically speaking. Silver has yet to break its primary down trend line, but developing market activity preceding it will give advance notice, as discussed in gold. Silver has been in a TR without turning up. There is no known formula for how long a TR will persist. What is known for certain is the farther price moves along the RHS [Right Hand Side], of a TR, the closer it comes to reaching an eventual resolve. The market will provide clues as to the when, a few of which were discussed in gold. There are numerous ways in which a market conveys solid information, and one has to exercise a lot of patience to follow the market's lead, as opposed to one's own preferred time frame of sooner rather than later. Here again, knowledge of the fundamentals has not been pivotal in discovering the "when" factor. Even those with the greatest expertise, or the most detailed information have been way off in timing, as often happens. Despite the numerous calls for much higher prices over the past few years, the market's TR has been the most reliable of all indicators that higher prices will not come unless and until price successfully moves out of the TR to the upside. Sentiment aside, there has been no confirming evidence of that. The clustering of prices over the past few weeks, followed by last weeks upside breakout is a potentially positive sign. There are sill many overhead obstacles, and how the market behaves when approaching them will give us the best information of what to expect. Silver's slightly stronger reaction to the 19 June D/S rally bar gave stronger reason to take a long position in the futures. Our more conservative approach of waiting for a correction that leads to stronger likelihood of upside continuation occurred in overnight trade that increased the risk for regular trading hours. There were one or two occasions when we almost pulled the trigger, but hesitation while the market rallied kept increasing the risk exposure. The trend is not up, so there will be many more occasions while waiting for an edge. When you see increased volume on sell bars [those with a close lower than the preceding bar], and/or selling volume diminish on down bars, it is an indication that sellers are not actively in control, and price needs to rally higher to uncover new selling efforts. This is how to use the information the market provides in order to take a position and possibly obtain a trading edge. The second D/S rally bar gave another, albeit higher entry opportunity. Contrary to the 90m intra day gold chart, silver's high volume sell off attempt, on the 10th, closed just marginally lower than the preceding bar, but more importantly, on the high-end of the bar itself, a clear sign that buyers had overwhelmed sellers and took control. It was sufficient confirmation that the previous TR formation was likely accumulation. By observing the highest intra day volume bar was to the downside, and seeing there was zero follow through lower, the market was telling us the increased volume came from weak sellers, weak longs taking some short-term profits, and buyers were of the strong hand kind. That indicated that price would not likely continue lower, and for the day, at least, we were seeing what should amount to a successful retest of the upside breakout. This was for the futures market. Another piece of information taken from the market is that when selling at one level does not move price lower, expect continuation to the upside that will eventually uncover the price level that will induce sellers and create resistance Being long physical silver, always advocated as the smartest financial decision to make by getting rid of the overinflated fiat paper Federal Reserve Note, has been more rewarding the past few months, and that will continue with each new passing week or month. As the read of developing activity in price and volume proves, the market sends out the best and most reliable information, and the information sent each day supersedes all other sources. Markets never lie. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Silver Prices</b> Today Ride FOMC Minutes to Slight Gains Posted: 09 Jul 2014 01:37 PM PDT  Silver prices began to flounder this week coming off impressive gains in June, but the U.S. Federal Reserve provided a quick spark in afternoon trading Wednesday. Silver prices began to flounder this week coming off impressive gains in June, but the U.S. Federal Reserve provided a quick spark in afternoon trading Wednesday. By close of market Tuesday, silver was down 0.6% on the week and trending downward. But after the minutes from last month's Federal Open Market Committee (FOMC) meeting were made public at 2 p.m. EDT today (Wed.), silver prices rose 0.8% to $21.20 an ounce within the hour. By 3:22 p.m. ET, silver was trading up to $21.21. Silver is an alternative investment and store of value that investors will add to portfolios primarily as an inflation hedge. While it isn't a premier precious metal investment like gold, it tends to attract like-minded investors and its price usually moves with the yellow metal - albeit, in a more volatile manner. Its prices have also been tied to the words of the Fed as of late. In March, Fed Chairwoman Janet Yellen followed up an FOMC meeting with a statement to the press that had many investors thinking interest rates would rise earlier than anticipated. Since rising interest rates put downward pressure on inflation, investors moved out of silver and prices plummeted. The week after Yellen's comments, silver was down 5.3%. However, June's FOMC meeting had the opposite effect. In the press conference to follow, Yellen reiterated the point that interest rates would stay low for a "considerable time," and her continued dovish talk on the matter provided a spark. Silver was up 4.3% on the day, and rose 6.2% in the week to follow, trading at $21.12. The minutes to FOMC meetings are released three weeks after the fact, and with the recent release reaffirming much of what was already said on interest rates last month, silver got another quick bump and made up some of its losses on the week. Silver Prices Cooling Down from Hot JuneThis week's sluggish trading came after a June rally that was sparked by not only the Fed's reticence on interest rates, but also a number of short sellers liquidating their positions and going long in the face of yearly lows below $19 at the end of May, Jeffrey Christian, a managing partner at the CPM Group, told Money Morning. "We didn't necessarily see a big spike in physical purchases in India or China or the United States," Christian said. "What we mostly saw was the price rising over the last couple weeks due to short covering." He added, "Since that time the price has sort of stalled out." Summer trading is historically weak for the white metal, and in the weeks to come there is likely to be some selling off and low-volume trading days that could cause prices to stagnate. "I wouldn't be surprised to see a bit of profit-taking as the price may have gotten temporarily ahead of itself," said Money Morning Resource Specialist Peter Krauth. But after that, Krauth said "we could well see continued strength," making now a good time to invest in silver. After 117 years the London Silver Fix is finally shutting down in August, unencumbering the white metal from the artificially low price fixes set by a small coterie of banks. Here's what that means for white metal's price in 2014... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Ends Near 4-Month High, <b>Silver Prices</b> Jump 2.1% | Coin News Posted: 10 Jul 2014 12:17 PM PDT  Gold and silver prices surged on Thursday Gold prices clocked in near a four-month high Thursday as investors scooped up havens on concerns over the health of Portugal's top publicly traded bank. Gold for August delivery advanced $14.90, or 1.1%, to end at $1,339.20 an ounce on the Comex division of the New York Mercantile Exchange. The closing marks the highest price since Mar. 19 when gold finished at $1,341.30.

Espírito Santo International said it missed payments on some of its debts. The firm is the parent of Banco Espírito Santo, Portugal's top listed bank. Gold prices traded from an intraday low of $1,325 to a high of $1,346.80. In rounding out the precious metals complex:

London Fix Precious MetalsEarlier fixed London precious metals were mixed. In contrasting the London bullion fix prices from Wednesday PM to Thursday PM:

US Mint Bullion Sales in JulySales of United States Mint bullion coins were unchanged as of 2:53 p.m. ET. Below is a sales breakdown of U.S. Mint bullion products with columns listing the number of bullion coins sold last week, this week so far, last month, the month to date, and the year to date.

*On Monday, June 30, the U.S Mint reduced sales of Arches silver coins. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and <b>Silver Price</b> Positive Developments :: The Market Oracle <b>...</b> Posted: 11 Jul 2014 09:15 AM PDT Commodities / Gold and Silver 2014 Jul 11, 2014 - 06:15 PM GMT By: Alasdair_Macleod

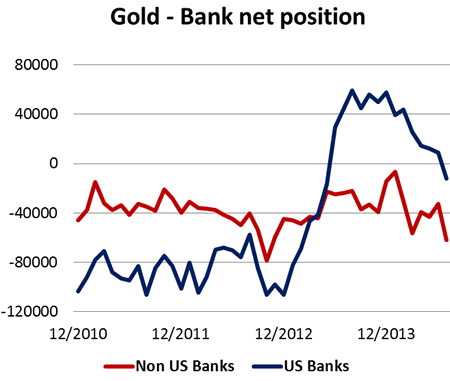

This is healthy and indicates that the uptrend has some wind behind it. However, the Bank Participation Report for 1 July shows a sharp deterioration in the banks' positions, illustrated in our third chart.

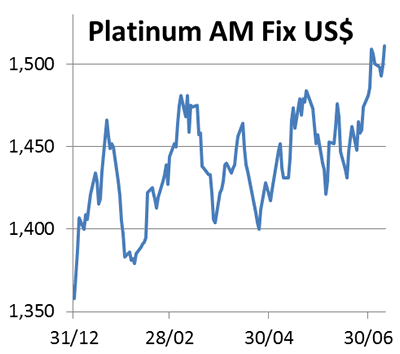

The net long position of the US banks for the past year have gone, and they are now short a net 12,324 contracts, while the Non-US banks are short a net 62,099 contracts. Neither position is extreme, but how should we read this? Well, trading patterns altered this week, with the gold market strong outside US trading hours and softening during New York's trading. This obviously indicates demand is from Asia and Europe, giving some short-term traders in the US an opportunity for profit-taking. Buying is therefore likely to be for physical metal rather than derivatives, which should tighten the market overall. Additionally it should be noted that platinum has been exceptionally strong, rallying nearly $200 (15%) from its December low. In practice there is little or no short-term correlation with the gold price, but platinum often leads the precious metals group over the medium term. Platinum this year is shown in our last chart, which is refreshingly bullish.

So overall, precious metal markets feel better based, but beware of whipsaws in New York trading because the banks will want to close their bears by marking gold and silver prices sharply down to trigger stops. But gold has now broken above resistance at $1320-30, which should now offer some support before a possible attempt on the $1355+ territory. Confirmation of why Europeans might be buying physical gold arises from concerns over the financial health of Portugal's Banco Espirito Santo, which has undermined share prices of the entire Eurozone banking sector. The ghost of the Cyprus bail-in may be returning to the financial stage. Also this week Germany reminded us that large deposits are going to be subject to bail-ins if a bank fails, because the German cabinet resolved to put forward the necessary legislation for the New Year. Talking of Germany, BaFin, the bank regulator, has asked all German banks and investment intermediaries to hand over details of their clients' dealing in precious metals derivatives, according to Goldreporter.de. This follows its investigation into Deutsche Bank's precious metal dealings which coincided with DB's withdrawal from the gold and silver fix. This may be a developing story worth monitoring. Monday. Japan: Capacity Utilisation, Industrial Production. Eurozone: Industrial Production Alasdair Macleod Head of research, GoldMoney Alasdair.Macleod@GoldMoney.com Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online. © 2014 Copyright Alasdair Macleod - All Rights Reserved © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold And <b>Silver Price</b> Trend Change Developing, Just Not Confirmed Posted: 12 Jul 2014 07:22 AM PDT Commodities / Gold and Silver 2014 Jul 12, 2014 - 04:22 PM GMT By: Michael_Noonan

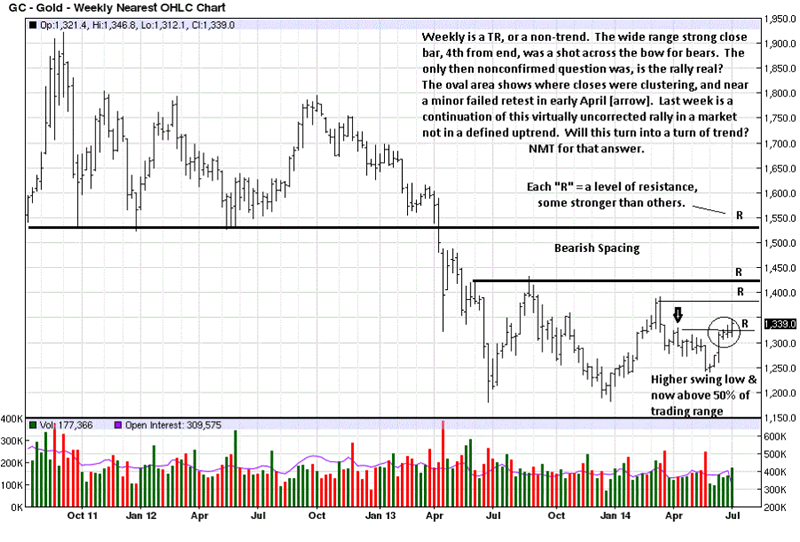

Why? Charts contain the resulting input from all the decision-makers, from the most informed to the least informed, and the aggregate information that can be gleaned from news, regardless of source, including blogs and so-called expert opinions can not be superior to that combination of price and volume over time, found in the charts. There has been a smart rally over the past two months, but far from the strongest and the most dollar gain. It is still occurring within the confines of a protracted TR [Trading Range]. The June and December 2013 respective rallies gained much more, and the current rally may as well, but we can always only deal with what is known and not what may or may not come to pass. Price has rallied just above the 50% of range level, but the past three week rally has overlapping bars, more a sign of struggle between buyers and sellers, by contrast with bars that have much less overlap, like the rallies of January and July 2012. A better example would be the decline from the March high on the daily chart below. The ease of movement is much clearer to the downside. This does also happen in rallies, just not yet in gold. It cannot yet be determined if this will lead to a change in trend, hence the NMT, or Needs More Time. The daily chart may provide better clues.

D/S = Demand overcoming Supply, [determined by a very wide range bar, strong rally and close, typically on a large increase in volume], followed by 13 TDs [Trading Days], of mostly overlapping bars. In an up trend, this would have been a no-brainer to buy into. In a TR within a larger down trend, it becomes riskier. We have attempted long positions in both gold and silver on apparent strength, in the recent past, with poor results. Whenever anything is in the middle of a TR, the level of trading knowledge is at its lowest, and one should be more cautious and respect the trend. Last Thursday's high volume, wide range breakout is hard to ignore. The question then becomes, How to establish a long position [in futures]? What most people do not know or understand is how one form of market activity confirms [or negates] what preceded it. The 19 June D/S needs to be confirmed. The confirmation is typically a weak reaction, lasting between 3 – 8 TDs, and on smaller range down bars and less volume. This says sellers are weak. If during the course of a correction the down bars are wide and volume increases, the rally will not likely stand. You do not need to read about anything in the news to know this. It is the activity market itself that makes this information known, first- hand, as it develops. Thursday's upside breakout on increased volume gave the green light to get long, if one did not use the previous information of the past few weeks to do so. Intra day activity will show this in greater detail.

After the 19 June then surprise strong rally, price moved sideways for two weeks of TDs. This was clearly a weak reaction, but occurring in a sideways to down trend, depending on which time frame used, but not up, in any event. There was still a possibility that the sideways activity could lead to another turn down. Mention for context must be made that weak reactions to price rallies, more especially in an up trend, lead to higher prices. This market premise does not always hold as true in a down trend. Confirmation that the weak reaction would lead to higher prices came on the 10th, last Thursday, with another D/S bar upside breakout on increased volume. The clinching clue comes from the highest intra day negative volume, see arrow. There was no further downside, and that is the market letting us know that the selling was from weak holders and the buying was going into strong hands. This confirms the same thing from starting on 19 June. The smaller intra day correction that held above the breakout was used to establish an entry with about a $1,000 risk. Odds favor higher prices next week, but nothing is ever guaranteed. How the market activity develops in the days and weeks ahead will provide all the information/confirmation needed. Of course, this is good news for holders and buyers of physical gold, and eventually higher prices will prevail. By holding physical, market corrections are less important, as is true of timing. The stage is set, and gold has never failed to preserve value, even increase worth, historically speaking.

Silver has yet to break its primary down trend line, but developing market activity preceding it will give advance notice, as discussed in gold. Silver has been in a TR without turning up. There is no known formula for how long a TR will persist. What is known for certain is the farther price moves along the RHS [Right Hand Side], of a TR, the closer it comes to reaching an eventual resolve. The market will provide clues as to the when, a few of which were discussed in gold. There are numerous ways in which a market conveys solid information, and one has to exercise a lot of patience to follow the market's lead, as opposed to one's own preferred time frame of sooner rather than later. Here again, knowledge of the fundamentals has not been pivotal in discovering the "when" factor. Even those with the greatest expertise, or the most detailed information have been way off in timing, as often happens. Despite the numerous calls for much higher prices over the past few years, the market's TR has been the most reliable of all indicators that higher prices will not come unless and until price successfully moves out of the TR to the upside. Sentiment aside, there has been no confirming evidence of that. The clustering of prices over the past few weeks, followed by last weeks upside breakout is a potentially positive sign. There are sill many overhead obstacles, and how the market behaves when approaching them will give us the best information of what to expect.

Silver's slightly stronger reaction to the 19 June D/S rally bar gave stronger reason to take a long position in the futures. Our more conservative approach of waiting for a correction that leads to stronger likelihood of upside continuation occurred in overnight trade that increased the risk for regular trading hours. There were one or two occasions when we almost pulled the trigger, but hesitation while the market rallied kept increasing the risk exposure. The trend is not up, so there will be many more occasions while waiting for an edge. When you see increased volume on sell bars [those with a close lower than the preceding bar], and/or selling volume diminish on down bars, it is an indication that sellers are not actively in control, and price needs to rally higher to uncover new selling efforts. This is how to use the information the market provides in order to take a position and possibly obtain a trading edge. The second D/S rally bar gave another, albeit higher entry opportunity.

Contrary to the 90m intra day gold chart, silver's high volume sell off attempt, on the 10th, closed just marginally lower than the preceding bar, but more importantly, on the high-end of the bar itself, a clear sign that buyers had overwhelmed sellers and took control. It was sufficient confirmation that the previous TR formation was likely accumulation. By observing the highest intra day volume bar was to the downside, and seeing there was zero follow through lower, the market was telling us the increased volume came from weak sellers, weak longs taking some short-term profits, and buyers were of the strong hand kind. That indicated that price would not likely continue lower, and for the day, at least, we were seeing what should amount to a successful retest of the upside breakout. This was for the futures market. Another piece of information taken from the market is that when selling at one level does not move price lower, expect continuation to the upside that will eventually uncover the price level that will induce sellers and create resistance Being long physical silver, always advocated as the smartest financial decision to make by getting rid of the overinflated fiat paper Federal Reserve Note, has been more rewarding the past few months, and that will continue with each new passing week or month. As the read of developing activity in price and volume proves, the market sends out the best and most reliable information, and the information sent each day supersedes all other sources. Markets never lie.

By Michael Noonan Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself. © 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and <b>Silver Prices</b> Are Now Poised To Skyrocket - ETF Daily News Posted: 11 Jul 2014 09:09 AM PDT Home > Gold and Silver Prices Are Now Poised To Skyrocket Gold and Silver Prices Are Now Poised To Skyrocket

What type of revenge? Price revenge and rapid price revenge. Allow me to explain. Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?"I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets -- year-in and year-out." CLICK HERE to get your Free E-Book, "The Little Black Book Of Billionaires Secrets" It is a simple fact that the gold price since 2001 has made an enormous persistent price run higher into the peak of 2011 near $1920 per ounce. Yes, everyone keeps talking about the old high price in gold that was so amazing, but what is more important is the nature of the run that occurred between 2001 to 2011. It was a persistent almost perfect technical run that receives A+ scores for performance, orderly tape action (on the monthly long term price chart) and swiftness of price recovery. So we have that previous bull run phase as clear history of proven price performance of the gold price. It was an enormous sign of strength and simply the best performing market out of any other on a relative basis. But recently we have seen the gold price do a 2 to 3 year price correction. The correction has been nasty and confusing. But now it has ended (for reasons the will become clear later in this article) and it brings up the question: how should price react after finishing a multi year correction given that gold had such a spectacular performance during the 2001 to 2011 time frame? The answer? The answer is that price should react very swiftly back up to the old highs. This should occur because we already know the previous bias of price strength. Now comes the resumption of the price strength. This can occur for several reasons. One big reason is that typically at bear market lows there are large short positions from lingering bearish positions. To close out these short positions traders need to 'buy to cover' and this can cause a massive short squeeze that leads to further buying and in some cases near vertical price moves higher. Another reason is that we are about to enter the strong seasonal zone for precious metals as we move into the end of the year. There are various other technical analysis reasons why I think we could see the gold and silver price spike higher in persistent monthly price bar advances into the end of this year. Here are a few in summary:

The chart below is a commodity chart that is daily prices but I want you to see the head and shoulder bottoming nature of the pattern. Butmore importantly look at the price recovery portion of the chart highlighted in yellow.

What the above chart shows (despite the fact that it is a different commodity and on a different time frame) is the power of an enormous short squeeze after a head and shoulders bottom formation completes. Tags: 2X gold ETFs, 2X silver etfs, 3X gold etfs, 3X silver etfs, 4X gold etfs, 4X silver etfs, best gold etfs, best gold stocks, best silver etfs, buy gold, buy gold today, etf, etf news, etf's, gold, gold and silver etf list, gold and silver ETF's, Gold ETF Analysis, gold etf list, gold etf prices, Gold ETF's, gold forecast, gold futures, gold price, gold price forecast, gold price forecast 2014, gold price news, gold price news today, Gold price trends, gold price trends 2014, gold prices, gold prices 2014, gold prices today, gold projections, gold stocks, gold stocks 2014, Gold stocks to buy, gold stocks to buy now, gold stocks today, How to Buy Gold, inverse gold etfs, inverse silver etfs, investing in gold, investing in gold 2014, INvesting in gold today, leveraged gold ETFs, leveraged silver etfs, list of gold etfs, list of silver etfs, low cost gold etfs, low cost silver etfs, NYSEArca:GLD, NYSEARCA:SLV, physical gold etf list, physical silver etf list, Popular gold etfs, Popular silver etfs, precious metals, price of gold, short gold etfs, short silver etfs, Silver, silver etf analysis, silver etf list, silver etfs, silver forecast, silver futures, silver prices, silver projections, stocks to buy, stocks to buy 2014, Stocks to buy now, Thomas Carreno, Top gold etfs, Top silver etfs Comments | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

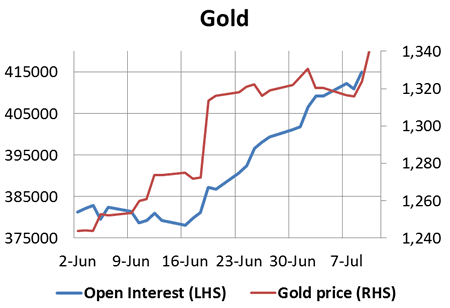

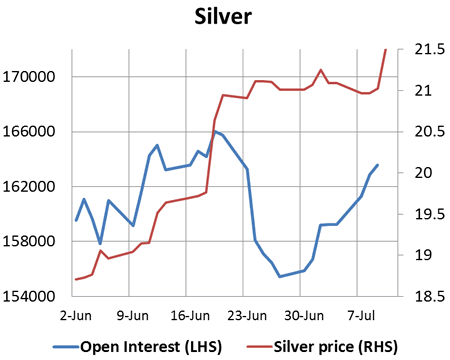

Gold and silver had a good week after the US holiday last Friday. From a low of $1312 on Tuesday, gold rose to a high point of $1345 yesterday, and silver from $20.84 to $21.60. Open interest is climbing too for both metals, as shown in the following charts.

Gold and silver had a good week after the US holiday last Friday. From a low of $1312 on Tuesday, gold rose to a high point of $1345 yesterday, and silver from $20.84 to $21.60. Open interest is climbing too for both metals, as shown in the following charts.

If you never read a newspaper, listened to television/radio, or read any one of the numerous blogs that exist and were left with just charts to look at, the information contained in the them would put you head and shoulders above everyone else.

If you never read a newspaper, listened to television/radio, or read any one of the numerous blogs that exist and were left with just charts to look at, the information contained in the them would put you head and shoulders above everyone else.

0 Comment for "Silver prices | Trend Change Developing In Gold And Silver Prices, Just Not ..."