Silver prices | Gold and <b>Silver Price</b> Underlying Strength :: The Market Oracle <b>...</b> |

- Gold and <b>Silver Price</b> Underlying Strength :: The Market Oracle <b>...</b>

- <b>Silver Price</b> Fix - Wealth Daily

- <b>Silver prices</b> rose twice as much as gold in June will this continue <b>...</b>

- <b>Silver Prices</b> May Be Cooling Down, but They're Ready for Second <b>...</b>

- Threading the Needle of <b>Silver Price</b> Discovery :: The Market Oracle <b>...</b>

- <b>Silver Prices</b> Today Jump on "Perfect Storm" of Buying

| Gold and <b>Silver Price</b> Underlying Strength :: The Market Oracle <b>...</b> Posted: 04 Jul 2014 06:05 AM PDT Commodities / Gold and Silver 2014 Jul 04, 2014 - 12:05 PM GMT By: Alasdair_Macleod

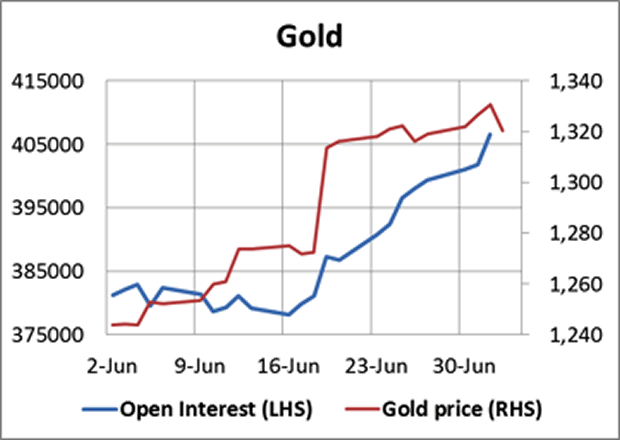

The increase in open interest tells us that the rise in price was on the back of buying rather than a bear squeeze, which would have seen rising prices on steady-to-declining OI. This is an important development, because it indicates that speculators are beginning to think the downtrend of the last 30 months might be over. Without buying into a new rising trend, any rally would be limited to a bear squeeze.

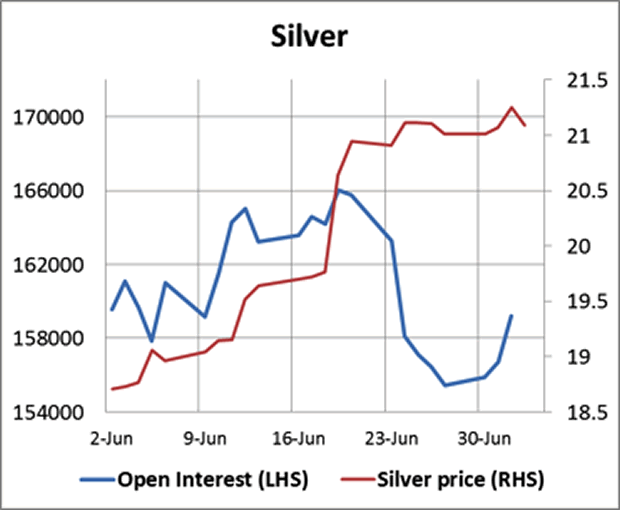

It appears the bullion banks have increased their short positions, but there is possibly a good reason for this. If they had squeezed the bears and allowed the gold price to run up to, say, $1400, they would have shown larger losses on their short positions at the half-year. In other words, bullion banks dressing up their own profit and loss account took temporary precedent over trading strategy. The silver chart looks different at first glance, with open interest declining sharply before picking up in the last few trading days. This is shown in the second chart.

The reason for the fall in OI in the second half of June was simply the expiry of the July contract when over 100,000 contracts had to be either closed or rolled into the next active month (September). That process is now complete, with some bulls understandably booking short-term profits. This being the case, we can now expect OI to climb again towards the 160,000+ region. Base metals have had a new lease of life, partly reflecting dollar weakness and partly a bear squeeze in the wake of wild stories about multiple hypothecations of warehouse metal in Chinese ports. Platinum was a stand-out beneficiary, and gold and silver obviously benefited as well. Perhaps the most interesting news this week was the House of Commons Treasury Committee called before it senior officials from the Financial Conduct Authority and the CEO of the London International Financial Futures Market to give evidence on the London gold market and the gold fix. The televised version can be found here <http://www.parliamentlive.tv/Main/Player.aspx?meetingId=15681> . It rapidly becomes apparent that the answers to the Committee's questions were inadequate. The second session, with Rhona O'Connell of Thompson Reuters and Alberto Thomas a lawyer from Fideres LLP appeared to confirm the Committee's worst fears about the London bullion market and the gold fix. As the Chairman, Andrew Tyrie summarised, "You've told us a pretty depressing story: the market has the potential to be rigged, that's it's not remotely competitive enough, that 10-30% of the days traded it's likely to have been rigged, that up to 40 basis points are likely to have been extracted from customers, and that regulators could and should have acted earlier, particularly after LIBOR. So is there any reason we should not be treating this as an appalling story?" It is clear that the London gold market faces a radical overhaul, involving closer regulation and greater transparency. In this environment, bullion banks are likely to hold back on aggressive trading activity until the regulatory position clarifies. Next week Alasdair Macleod Head of research, GoldMoney Alasdair.Macleod@GoldMoney.com Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online. © 2014 Copyright Alasdair Macleod - All Rights Reserved © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>Silver Price</b> Fix - Wealth Daily Posted: 03 Jul 2014 06:38 AM PDT

For years, many precious metals traders and investors believed – and many still do – that the fix was in on metals prices, with some accusing banks and metals dealers of outright price manipulation. Now the fix is on its way out, starting with the silver market. If the transition to a new benchmark pricing mechanism in the silver market is successful, the daily price fixes of other metals, including gold, might soon be removed as well. The daily silver fix is a 117-year old process whereby three large trading houses – Canada's Scotiabank, Germany's Deutsche Bank, and the British division of HSBC – determine silver's price by phone conference at noon London time each business day. Gold, for its part, has five trading houses agreeing to fix its daily price. As of August 14th, silver's daily price fix will be no more, opening the door to numerous proposals by large banks and trading houses for a replacement of the fix with some other kind of benchmark pricing system. But do we really need any price fixing mechanism at all – be it the current daily fix or a replacement of another type? And if it turns out that we don't really need them, won't any kind of daily fixing mechanism simply keep the suspicions of price manipulation alive? What really is their point? Why The Fix Was In The need to have the prices of silver and other precious metals "fixed" or "matched" on a daily basis originally stemmed from the metals' once fragmented marketplace. Worldwide there are hundreds of suppliers selling the metals they extract from their mines, and thousands of buyers from banks, to mints, to jewellers purchasing them. With transactions taking place in dozens of currencies and in hundreds of cities scattered all over the world, prices can quickly fall out of alignment from one city to another, especially when there is heavy buying in some cities and light buying in others. Such disparities in metals prices can really add up if someone were able to capitalize on them, which is precisely what the Rothschild banking dynasty of Europe did during the 18th century, amassing the world's largest privately held fortune at their zenith by the 19th century. As precious metals prices varied from city to city, messengers on horseback would relay the prices back and forth. Luckily, prices didn't fluctuate as quickly then as they do today, so a list of quotes across Europe's major cities would still be fairly accurate several days later. One Rothschild banker would then buy gold or silver in a city where prices were low, while another would sell in a city where prices were high. They would then take a week or two to arrange for the pick-up and delivery of the metals, pocketing the difference in prices between the two cities. Pretty clever. Today it's called "price arbitrage", and it can still happen from one stock exchange to another, where a stock can trade in two different countries at two different prices slightly out of sync with each other, until traders notice the disparity and arbitrage-away the gap. So even today there exists a need for "matching" or "fixing" a metal's price globally on which buyers and sellers in all cities can base their trades. Really, then, the daily fixing of metals prices actually prevents price distortions, rather than causing them as many conspiracists believe. As London Silver Market Fixing Ltd describes its practice: "For over 110 years we have been fixing the price of silver providing market users with the opportunity to buy and sell silver at a single quoted price. It also provides a published benchmark price that is widely used as a pricing medium by producers, consumers and investors." What Will Replace the Fix? After working so well for 117 years, the silver price will receive its last fix on August 14th of this year. Why? Well, it turns out it really wasn't working as well as everyone liked to believe. While there is value in the concept or intent of realigning fragmented prices into one global fix to ensure a fair price for buyers and sellers the world over, the execution of the fix may not have been all that transparent. "The move [to abandon the fix] comes on the heels of increased scrutiny by European and US regulators into precious metals price-setting following the Libor scandal and probe into possible forex market abuse," reports the Financial Times. It looks like the conspiracists weren't simply paranoid after all. Duestche Bank recently resigned its membership on the silver and gold fixes, leaving just Scotiabank and HSBC to take care of the silver price all by themselves – which makes the conspiracists laugh all the more. The UK's Financial Conduct Authority subsequently asked Deutsche Bank to remain on the fixing board until a smooth transition to another silver benchmark can be made, hopefully by August 14th when the London silver fix will finally be broken. In preparation for its demise, discussions will soon be undertaken "to explore whether the market wishes to develop an alternative" to the fix benchmark. Already several companies and firms have come out with suggestions for possible replacements. Platts, "a division of McGraw Hill Financial (NYSE: MHFI), a leader in credit ratings, benchmarks and analytics for the global capital and commodity markets," as the company describes itself, has suggested moving the existing daily fix to an open and transparent electronic auction system with an independent chairperson adjusting silver's benchmark price according to the auction's supply and demand. Autilla, a London-based commodity firm, also proposed retaining the daily fix's process, but having it automated on a cloud-based platform for global traders to see. The London Metal Exchange – the world's largest metals trading market – has proposed creating a new electronic spot silver auction which would be listed on its LMEselect trading platform. Even financial news provider Bloomberg has tossed its hat into the ring, offering to create and carry a new silver auction on its Bloomberg Professional trading platform. Reinventing the Wheel Perhaps the experts see something the rest of us don't, and for that reason get paid the big bucks. But it seems to me they are looking for ways of reinventing the wheel. The market already has what they are looking for, a silver auction price which can be used as a benchmark to ensure a fair silver price around the world… silver futures. But that's just way too easy. We'll just leave them to their work for now. Over the next few weeks before the August 14th termination of the silver fix they will surely concoct some new fancy and likely unnecessary replacement. And they probably won't stop there. As Ireland's Trinity College professor of finance Brian Lucey points out, "There will now be pressure on the gold fix to make clear its [usefulness]. If one fix can go, why not another?" But now in the 21st century, we have the marvels of electronic markets which already host futures contract auctions in which buyers and sellers all over the world can participate. This seems to be a clear case of simply letting the market set its own price according to the natural forces of supply and demand. Sometimes it really is as simple as just letting the market fix itself. Joseph Cafariello Media / Interview Requests? Click Here. |

| <b>Silver prices</b> rose twice as much as gold in June will this continue <b>...</b> Posted: 01 Jul 2014 11:38 PM PDT Posted on 02 July 2014 with 1 comment from readers

Silver prices rose by 12.5 per cent in June compared to 6.7 per cent for gold though for the year-to-date gold is still fractionally ahead. Silver bulls see this as the start of a rocket to the moon for prices. It is a bit early for this conclusion but there is reason for cautious optimism. The two graphs below show the relative strength of the shiniest of metals last month: Can this outperformance by silver continue? Actually if gold continues to advance in price it would be very surprising if it did not. Silver is leveraged positively to gold prices on the upside and negatively when gold prices decline. That's because the available supply of gold to silver is in a one-to-three relationship while the price ratio is currently one-to-63. In fact silver is a tighter market and more responsive to higher precious metal demand than gold. That said the short position cited by technical analyst Clive Maund in his latest market summary is alarming (click here). Hedge funds The hedge funds are betting that gold and silver prices will shortly decline sharply, most probably due to a serious stock market sell-off that would be a sinking tide for all ships. That's what happened in 2008 though precious metals were also the fastest ships to rise back up and then some. Have the hedgies gotten this wrong? It would not be the first time. The funds have generally underperformed the S&P 500 by betting against the index over the past six years. They could be wrong again this time or gold could perform differently for another reason. In 2008 the gold price was at an all-time high. This time around it has just been through a 32 per cent correction last year. Indeed, with a gain of 10 per cent this year gold is on a roll ahead of US stocks. The seasonal pattern is now very much with gold. June is the usual annual market bottom. Then comes the religious seasonal buying of gold. Ramadan has just started for Muslims. How many are down the gold souks of Dubai at night buying up the precious metal? And that is just the start with the Hindu festivals to come. Stock market crash? It is true the global economy looks delicately poised at the moment with much talk of a recovery though little evidence of it apart from a worrying surge in US car loans funding record sales. A stock market crash could come at any time with Iraq or Ukraine the most obvious black swan events to cause it. On the other hand, if the US economy really is on the road to recovery then inflation lies around the corner and precious metal prices are simply far too low for such a scenario. Whether as a safe haven asset class or hedge against inflation gold and silver will come into their own. The last ArabianMoney confidential investment newsletter sets this out in full. But if history is any guide then silver will come out on top. Posted on 02 July 2014 Categories: Gold & Silver |

| <b>Silver Prices</b> May Be Cooling Down, but They're Ready for Second <b>...</b> Posted: 03 Jul 2014 08:59 AM PDT Silver prices have been sideways this week, cooling off from a mid-June rally sparked by inflation-minded investors wary of the U.S. Federal Reserve's dovish talk. Prices of the white metal were up just 0.7% by the close of market yesterday (Wednesday) at $21.20 an ounce and were actually trading lower than the week's start on Thursday morning. This was after a rally that began the week of the Fed's FOMC meeting, when Fed Chairwoman Janet Yellen's reticence on inflation prompted traders to pour into alternative investments. Volume was up 129.5% on the day of the FOMC meeting, and silver traded up 6.1% on the week.

Silver has ebbed and flowed this year. Its prices saw big gains in February when it surged about 15% to a closing high of $21.96 and hit an intraday high of $22.18. But all of the year's gains were erased moving into April, with Yellen once again a likely culprit. Her talk of earlier-than-anticipated interest rate hikes spooked investors out of precious metals, and the descent pushed the price of silver down to $18.80 by the start of June. From that point on, silver "has almost not looked back since, with nary a down day in that time," said Money Morning Resource Specialist Peter Krauth. It has seen its most productive month, tallying a 12% increase in June that has since been blunted by thin holiday trading. "Very recently speculators were the most bearish in a decade," Krauth said. "I think silver prices have been strong because they've simply lagged for a long time." Here's where we see silver prices going next. Slow Summer Trading Could Open the Door for Fall RallyThe summer is historically a weak time for silver trading, Richard Checkan, president and Chief Operating Officer (COO) of Asset Strategies International in Rockville, Md. told Money Morning. There may be a slow gradual rise going into the fall – when it could really begin to start climbing – making now a good time for investors to get in. "For me, when it stays kind of muted then there's great opportunity where you don't have to rush in but you can step in," Checkan said. This month silver may have grown too fast and investors may have been a little overeager, Krauth said, which could prompt traders to sell off at these new three-month highs. However, he still sees opportunity for growth. "I wouldn't be surprised to see a bit of profit-taking as the price may have gotten temporarily ahead of itself," Krauth said. "After that, we could well see continued strength." The next target for silver, Krauth said, is $22.50, and at this pace it could take out the February highs. After 117 years the London Silver Fix is finally shutting down in August, unencumbering the white metal from the artificially low price fixes set by a small coterie of banks. With demand for physical silver hitting all-time highs, and market forces overtaking manipulation, now is the time to jump in on the coming silver bull market…read more… |

| Threading the Needle of <b>Silver Price</b> Discovery :: The Market Oracle <b>...</b> Posted: 03 Jul 2014 10:05 AM PDT Stock-Markets / Financial Markets 2014 Jul 03, 2014 - 03:05 PM GMT By: Dr_Jeff_Lewis

The set up for precious metals has been in place for years. In silver, the trading structure has been this way for decades. A short list of giant multi-national hedge funds disguised as banks manages huge, concentrated short (selling) positions, while the price moves within a range far outside of reality. It is the poster child example of how disconnected the macro economy is from the reality of fundamentals. Money supply, in addition to monetary policy, is so far from being priced that the potential for explosive return is a constant yet barely palpable presence in the precious metals pits. It is these shorts that act as the lynch pin, or the tiny plug that holds the massive edifice together. If they were gone, we would be trading in a range that reflects present value based on purchasing power and not at a level that is barely a representation of potential future value. Events in the geopolitical realm - especially those that are unraveling before us now that are mere off-gassing from tensions that were built long ago - bear no real effect on the actual future value of assets across the board. At present it continues to be a game where the derivative tale wags the physical dog. A game played not just in the computerized pits of the COMEX, but all across the spectrum in truly bizarre manifestations. Take the warehouse re-hypothecation issues in China we've commented on recently. In order to maintain liquidity in China's shadow financing sector (a version of our own credit facility), collateral is demanded as pledge for the paper arbitrage and lending deals. Much of this demand is centered on the base metals, especially copper. Whether it is copper or any other metal - including gold - makes little difference. The metal is taken out of supply and stored in a warehouse where it is famously pledged over and over again in an array of transactions that seemingly create a web of shadows. This is a classic example of re-hypothecation. But the methods and madness are simply the results of years of pioneering financiers in the West who do essentially the same. The COMEX futures market is no exception. In practically every commodity there is an overwhelming presence of speculators in relation to the number of true producers and users. Nowhere is the more egregious than in the gold and silver pits, where futures are almost completely dominated by commercial banks and the hedge funds. What we see play out over and over is a simple game that goes unchecked and largely unquestioned. The bullion banks use their dominate positions to move speculators - literally tricking them into buying or selling on a whim, which may or may not appear to be economically sound. The moves are facilitated by the use of technologies or the so-called high frequency trading where compute-run algorithms are able to lean in to the market and paint a character (dumping huge, impossible to fill positions) but not following through. In the wake of the most recent rally, where silver prices moved up nearly 10%, the big banks have once again capped each rally by adding in a record way to their selling positions. We may move up, down or sideways from here, but is really just a matter of time before they harvest a new set of weak longs again. How long can it go on? It can go on for as long as the major market participants, those with a voice and the power, allow it. At some point, the large banks may decide that they've accumulated enough metal to let the price return to equilibrium. But most likely, real values will return when the current pricing mechanism is finally broken beyond repair. Sadly, it will be too late for most. And this, of course, is what passes for reality in financial discourse and commentary. The dominant forces in the price discovery remain entrenched. These bullion banks have a nearly undefeated record when it comes to profiting from whatever positions they hold; despite the moral, ethical, or legal implications and sheer lack of regulator oversight. But the dominance of these positions can only paper over reality for so long. As belief or lack of confidence trickles up toward the now opaque trading structure, it slowly chips away at the entire house of cards until it dissolves all at once. And it is then the intrinsic value of real assets, especially those which are rare and precious, are once again laid bare for all to see. The key is being positioned for the day when value reasserts itself, because once it does, the race will be on. For more articles like this, and/or for a breath of fresh silver market reality amidst the stench of denial and technically meaningless short term price obsessed madness, check out http://www.silver-coin-investor.com By Dr. Jeff Lewis Dr. Jeffrey Lewis, in addition to running a busy medical practice, is the editor of Silver-Coin-Investor.com Copyright © 2014 Dr. Jeff Lewis- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>Silver Prices</b> Today Jump on "Perfect Storm" of Buying Posted: 20 Jun 2014 10:37 AM PDT Silver prices today (Friday) are still on the rise after ripping through the $20-an-ounce level Thursday. July Comex silver was trading up $0.20, or 0.95%, at $21.10 in morning trading Friday. The silver price hasn't seen today's $21 level since March 17.

A "Perfect Storm" for Higher Silver Prices TodayFrequent CNBC contributor Dennis Gartman said Thursday's movement in precious metals was thanks to a "perfect storm" of buying as the market finally reacted to the Fed's comments and weakness in the U.S. dollar. U.S. Federal Reserve Chairwoman Janet Yellen said Wednesday the Fed will leave interest rates at rock-bottom levels into 2015 in an effort to help the uneven American economy. Those comments sent the dollar reeling to a four-week low, giving investors an added incentive to buy precious metals. Another factor in higher silver prices: inflation. "Both gold and silver have seen strong price action since early June. It's still early, but just maybe these are signals that inflation is becoming entrenched," said Money Morning Resource Specialist Peter Krauth. Yellen sounded unconcerned about inflation at the Fed press conference Wednesday. She dismissed data that shows inflation is gaining momentum. "I think recent readings on, for example, the CPI index have been a bit on the high side, but I think the data we're seeing is noisy. I think it's important to remember that broadly speaking, inflation is evolving in line with the committee's expectations," Yellen said. The worry is that the U.S. central bank will print money for too long, the money supply increasing faster than real output, which equals inflation. Moreover, global central banks, including the Bank of Japan, Bank of China, and the Bank of England, to name a few, have also engaged in money printing. While worldwide economies are enjoying the stimulus now, it's the exit strategies that are worrisome. Action in precious metals was delayed a day as the Fed's news, and Yellen's conference, came after the regular metals trading on Wednesday afternoon. Fueling silver gains is safe-haven demand as violence in Iraq escalates and tensions continue to simmer in Ukraine. Also driving the white metal higher is an overall firming trend in global precious metal markets amid expectations that borrowing costs will remain at historically low levels for a good while. And as is typically the case, when gold and silver prices start to run, people worry about missing out on gains. Indeed, the Fed's dovish view on the economy and interest rates caught some market participants off guard. Many were anticipating a more hawkish tone from the June FOMC meeting. That forced some traders to cover shorts. Silver's robust 4.4% gain Thursday pushed some $2 billion worth of silver short positions into the red. Other investors simply bought into the rally. So what's next? Bullish bullion option activity suggests more gains are ahead for silver. Lured by strong performances in stocks, market participants that have been underinvested in silver are swiftly and solidly returning to the white metal. Geopolitical turmoil is pushing silver prices higher - and has also triggered new 2014 highs for oil prices. Our energy expert Dr. Kent Moors outlined everything investors need to know in The Oil "Crisis Spike" Is Just Getting Started Related Articles: |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Gold and silver spent most of the week consolidating recent gains by moving broadly sideways, but their underlying strength was a notable feature. The first chart is of gold and its open interest on Comex.

Gold and silver spent most of the week consolidating recent gains by moving broadly sideways, but their underlying strength was a notable feature. The first chart is of gold and its open interest on Comex.

The next week, silver volume steadied and prices saw a very modest 1.3% gain, buoyed by traders who dragged their feet on the Fed momentum. This week it has slowed down even more ahead of the holiday weekend.

The next week, silver volume steadied and prices saw a very modest 1.3% gain, buoyed by traders who dragged their feet on the Fed momentum. This week it has slowed down even more ahead of the holiday weekend.

Silver for July delivery surged $0.87, or 4.4%, to $20.65 an ounce on Thursday. That was the white metal's highest settlement since March 19, when the

Silver for July delivery surged $0.87, or 4.4%, to $20.65 an ounce on Thursday. That was the white metal's highest settlement since March 19, when the

0 Comment for "Silver prices | Gold and Silver Price Underlying Strength :: The Market Oracle ..."