Glencore smashes claims it paid zero tax in Australia over last three years |

- Glencore smashes claims it paid zero tax in Australia over last three years

- Randgold hoping for major discovery in Ivory Coast

- Barrick Gold ready to offload Montana-based Sunlight Mine

| Glencore smashes claims it paid zero tax in Australia over last three years Posted: 03 Jul 2014 09:04 AM PDT Swiss-based commodities trader Glencore (LON:GLEN) has slammed a recent Fairfax Media report that said by claiming Australian tax breaks, the company had paid zero tax over the past three years, despite earning income of A$15bn. In an email to staff published by Business Insider, Glencore's coal chief executive, Peter Freyberg, said the firm has paid A$400m in corporate income tax since 2011. He also stated Glencore had paid A$8bn ($7.5bn) in royalties and taxes, including A$2bn related to corporate income tax, in Australia since 2007. "As you will be acutely aware, for much of this period the resource industries in which we participate have faced significant challenges including low commodity prices, high input costs and a robust Australian dollar," Freyberg wrote. "Despite these difficult circumstances, we paid more than $400m in corporate income tax in respect of this period." The report also claimed Glencore had borrowed from "associates overseas" at inflated rates of 9% on a $3.4 billion loan, the same amount the company says it has paid in taxes and royalties. Tax avoidance is highly controversial issue in Australia, where the corporate tax rate is 30%, one of the highest rates in the developed world. Glencore has operated in Australia for more than 15 years. Other than coal, it also has copper, zinc and nickel operations in the country. In March the company announced it was closing its Ravensworth underground coal mine (pictured) in the Hunter Valley, due to falling prices and stock surplus in the market. |

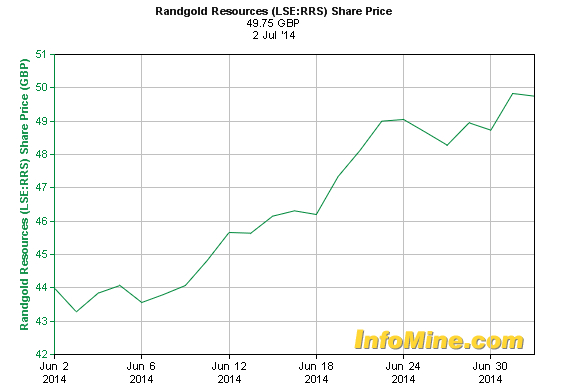

| Randgold hoping for major discovery in Ivory Coast Posted: 03 Jul 2014 07:31 AM PDT  Mark Bristow (55) founded Randgold in the 1990s. Under his management, the company has grown to have a market value of $7 billion and be the U.K.'s biggest gold producer. Ivory Coast, which has just announced one of the most investor-friendly mining codes in Africa, is on top of the list for Africa-focused gold miner Randgold Resources (LON:RSS) CEO Mark Bristow, who is hoping for one last major discovery before retiring. "We pour the gold and I'm out of here. I don't want to hang around. I don't want to be the chairman or anything like that. I've got other things to do," he told reporters Thursday, according to Bloomberg. Bristow (55) founded Randgold in the 1990s. Under his management, the company has grown to have a market value of $7 billion (4.2 billion pounds) and be the U.K.'s biggest gold producer. A geologist by training, Bristow led the discoveries of three gold mines in Mali holding 20 million ounces in deposits. The company has also built the Kibali mine in the DRC and Tongon in Ivory Coast. Thanks to the executive's conservative policies, Randgold has not needed to write down its reserves and resources as the gold price dropped, unlike most of its gold peers. This is because the firm has calculated its reserves at $1,000 per ounce and its resources at $1,500 per once for the past three years. "We have looked closely at all our mines to ensure that they will still be profitable at US$1,000/oz and we'll continue to review our operations against a range of gold price scenarios. We've also put a solid budget in place for 2014, kept our rolling five year plan intact and are now building this into a ten year plan," Bristow said in a statement in March. Now he is searching for a gold deposit that has a minimum of 5 million ounces gold, so that it can generate a return on investment of 20%, and Bristow believes that discovery will likely happen in Ivory Coast. "The country has good infrastructure, low-cost power and an amenable political climate," he told Bloomberg. Randgold currently holds two permits in Ivory Coast: Mankono prospect and Fapoha. The later is south of its existing Tongon, a 6 million-ounce deposit, which already is the country's biggest gold producer. |

| Barrick Gold ready to offload Montana-based Sunlight Mine Posted: 03 Jul 2014 03:45 AM PDT Barrick Gold (TSX, NYSE:ABX), the world's largest producer of the precious metal, is reportedly ready to offload its aging Golden Sunlight mine in southwestern Montana, US, as part of a now two-year-long move to shed non-core assets and pay back debts. According to The Wall Street Journal, the gold giant has hired Canadian Imperial Bank of Commerce (CIBC) to help sell the mine, which it acquired after taking over Placer Dome in 2006. The open-pit mine, located in Jefferson County, is one of Barrick's smallest properties, producing 92,000 ounces of gold in 2013, according to the company's website. In January, the Toronto-based company sold its interest in the Kanowna operation in western Australia to Northern Start Resources for $75 million cash. The transaction followed the sale of its Plutonic mine also to Northern Star for $25 million in December. Barrick's earning per share plummeted in the most recent quarter, in comparison to its performance from the same quarter a year ago. The company has reported a trend of declining earnings per share over the past two years. Being the most debt-heavy company in the gold sector has meant for Barrick to be among those that have lost the most due to volatile bullion prices. "The company has never been known for managing its cash or resources well or, for that matter, being investor friendly," writes Steve McDonald, bond strategist for The Oxford Club. "It has a history of being too aggressive in its growth efforts and having too many underperforming assets that are too spread out," he adds. Barrick's shares were down -0.55% to $18.24 Thursday in pre-market trade. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Glencore smashes claims it paid zero tax in Australia over last three years"