What Is The Best Way To <b>Invest In Gold</b>? | Benzinga | How to invest in gold |

| What Is The Best Way To <b>Invest In Gold</b>? | Benzinga Posted: 03 Jun 2014 04:35 AM PDT What is the Best Way to Invest in Gold? When we look at precious metals, we see one of the most trusted and established markets in the world's financial history. But what many investors don't know is that there are many different ways to invest in gold that go above and beyond the traditional usage of gold bars, coins, or jewelry. Gaining exposure to assets like mining companies or exchange traded notes and funds (ETNs and ETFs) can help to hedge positions and protect your investments from unpredictable market gyrations. Gold investments can be further complicated by the use of options contracts and margin accounts, so it is important to understand that these types of strategies carry extra risk and do not need to be used in order to generate consistent and long-term profitability. One market timing service that takes a prudent protected approach is GoldPriceDirection.com, which uses an advanced trading algorithm to discover high-probability trading signals for subscribers.

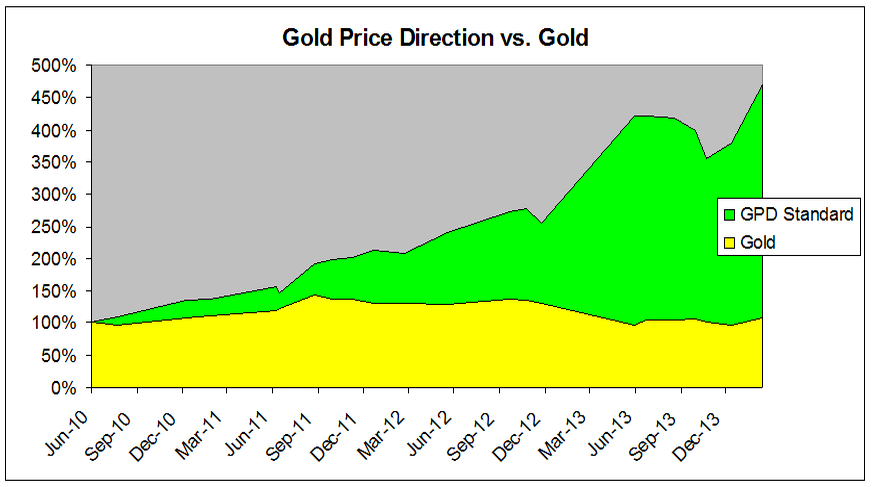

The chart above shows the results of the algorithm's accuracy, relative to the performance in the long-term gold price. The gains here are impressive. Given that the past few years resulted in catastrophic losses for most in the gold market, including for leading hedge funds, there is a lot that can be said for the GoldPriceDirection verified approach. Profiting in Both Directions One of the reasons GPD has been able to soundly beat the performance of gold is the fact that the precious metals market can (and should) be played from both directions. No asset ever travels straight up or down, so it is important to watch for opportunities to buy and sell as price trends change. This does not mean that day-trading strategies offer the best approach. In fact, there is a good deal of risk associated with short-term strategies. To avoid these risks, the gold trading signalssent to GoldPriceDirection subscribers are longer-term, which adds the convenience of being able to monitor positions with greater time flexibility. Investment Advantages Relative to traditional gold investments, the approach used by GoldPriceDirection offers key advantages. The excellent timing model allows you to affect a single hedge position, which incurs only one trade commission and tax event. At the same time, you are able to keep your existing portfolio intact. Additionally, it is important to remember that bullion positions are difficult and costly to enter and exit. This often involves removing the assets from storage, transporting them, and taking a sizable financial hit when being charged dealer fees. This type of activity also triggers potentially taxable events, which could then trigger IRS scrutiny. If the IRS becomes interested in your gold holdings, you might be on the receiving end of unwanted questioning (How much bullion do you have? Why are you hiding these assets? Should we be aware of any other assets you might be hiding?) Buying/selling a variety of positions (such as when holding shares in various mining companies for diversification) can also lead to prohibitive tax events. Even worse, it can lead to trade paralysis -- i.e. not taking action when warranted. By contrast, aligning yourself with a signal from a service as accurate as GPD means that you will enter into just one position. This makes it easier to take action as all long holdings can be hedged via one single short position, for example, which at most will cause only one taxable event. On the whole, it makes sense for investors to consider alternative strategies when investing. Looking back at the next few years, long and deep drops are likely to happen in gold and as recent history has shown it's very important to be hedged when those occur. The following article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited. |

| Public <b>Gold</b> offers physical <b>gold investments</b> : my Sarawak – News <b>...</b> Posted: 03 Jun 2014 03:49 PM PDT

Public Gold master dealers Hafizul (left) and Adzlan. KUCHING AND KOTA KINABALU: Public Gold is offering physical gold investments which may be ideal in the long term for emergencies. Public Gold master dealer Hafizul Hakim Mohamad Kerta, 30, said it may not give a monthly profit like other gold investment schemes, but with a few techniques, quick profits can be made. "I aim to educate myself to be more successful besides being encouraged by other factors such as financially-successful friends, being debt-free and having a peaceful life. That is why I got involved in gold investment with Public Gold because of personal interest in physical gold, real estate, stocks and more," said the trained electrical engineer. Hafizul explained that gold and silver prices at Public Gold follow world prices, which change every 20 minutes except on weekends when prices are fixed. "To gain more profit, the gold must be sold to the same company or Public Gold dealers to avoid a decrease in value or price cut. Another way is to become a Public Gold customer so that you can buy and sell gold online 24 hours," he said. He pointed out that Public Gold's products are certified and each branch has a testing machine. "Public Gold has been established since 2008 and has 40,000 customers who believe in the level of authenticity. Public Gold has also appointed Assay Penang Office Sdn Bhd to test the gold," he said. Hafizul pointed out that even if the company closes down in future, the physical gold kept by customers can be sold to any goldsmith globally. For details, text or Whatsapp him on 019-8884452. During his time with Public Gold, Hafizul has won the Top Performance Dealers award for Kuching branch 2011/2012 and 2013/2014 and incentive programmes to Australia, South Africa and Japan. Meanwhile, Muhamad Adzlan Yusuf never thought a hobby three years ago would lead him to selling some RM10 million in gold and becoming a master dealer. His journey started with earning RM500 to RM600 a month as a part-time dealer with Public Gold, which is recognised by the Malaysia Book of Record as the first local company to produce gold and silver bars. The 30-year-old now receives RM10,000 to RM15,000 monthly in commission alone. "Gold, unlike cash, does not diminish in value over time. So, I thought it was a good savings, but nothing more. However, when I held my first gold bar in my hands, I felt excited. I was eager to share with others why it is a good idea to invest in gold," said Adzlan, who was born in Sarawak. His first purchase with Public Gold worth RM20,000, which automatically qualified him as a dealer, came with benefits including commission for introducing new customers. He receives dealer discounts for gold or silver from the company and grew more passionate about the job. Adzlan began buying and trading in physical gold more seriously and soon opened his own company for Public Gold's products and services. "If people could just see the potential in gold, I would not be surprised if one day they started buying gold like buying potato chips," he said. "You need a legitimate gold trading company with strong buyback power. Public Gold offers a buyback guarantee of up to RM2 million a day, and the highest record it has so far is RM6 million. So you can buy gold at any time and sell it back when the price goes up with no problem." He explained that when the US dollar goes up, gold prices would usually go down, making it a good time to plan purchases. "When the US dollar is weak, gold prices go up, so it's time to sell and make a profit. Secondly, gold prices depend on demand. If demand is strong, prices go up, just like any other commodity. And just like everything else, gold prices are also affected by major events," Adzlan said. He said even if the aim is not to be a gold dealer, investors can keep the gold as a long-term savings. "The current 10-year average price increase for gold, from 1995 to 2015, is 12 per cent. If you look at legitimate low risk investments or savings, this is probably the highest you will get," he said. To learn more go to Adzlan's blog at www.kerajaanemas.com. Category: Sarawak |

| You are subscribed to email updates from how to invest in gold - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "What Is The Best Way To Invest In Gold? | Benzinga | How to invest in gold"