Spot Gold | <b>Spot Gold</b>: Challenging the upper downtrend channel | - MelakaFx | News2Gold |

- <b>Spot Gold</b>: Challenging the upper downtrend channel | - MelakaFx

- <b>Spot Gold</b>: Still in a bear channel | - MelakaFx

- Why the <b>Gold Spot</b> Price Is Hovering So Low - Money Morning

| <b>Spot Gold</b>: Challenging the upper downtrend channel | - MelakaFx Posted: 15 Jun 2014 10:07 PM PDT Powered by WishList Member - Membership Software |

| <b>Spot Gold</b>: Still in a bear channel | - MelakaFx Posted: 08 Jun 2014 02:01 AM PDT Powered by WishList Member - Membership Software |

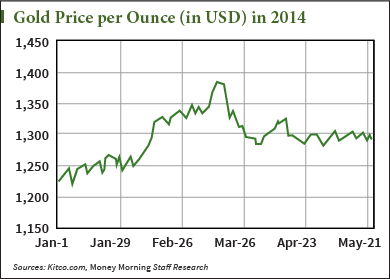

| Why the <b>Gold Spot</b> Price Is Hovering So Low - Money Morning Posted: 04 Jun 2014 11:33 AM PDT The gold spot price, after hitting a 2014 high of $1,383 in March, just tumbled to its lowest level in four months. Gold fell last week to $1,243. That brings it close to where it started the year, at $1,221.  The gold spot price climbed for the first two and a half months of 2014, hitting a peak of $1,383 on March 14. After the high, the last half of March saw the gold spot price slip again. Prices started to steady in April, then shot up in May to $1,310 before falling to last week's low. This week, spot gold has remained close to last week's low. It was quoted at $1,247.75 on Wednesday morning. So after a nice gold price climb at 2014's start, what's weighing on the yellow metal now? Money Morning Resource Specialist Peter Krauth gave us the story. Gold Spot Price Getting Hit from Three FactorsKrauth is a 20-year veteran of the commodities markets. He's been uncovering the best profit plays in precious metals in his Real Asset Returns investment servicefor more than three years. He sat down with us to explain what's affecting the gold spot price now. "There are multiple forces acting to weigh on gold right now," Krauth said. "First is a somewhat strengthening U.S. Dollar Index. Keep in mind this index's makeup is 57% euro. And right now, the euro is weakening because it's widely expected the European Central Bank will soon take measures to weaken its currency. That will, in turn, strengthen the U.S. dollar, which we are seeing as priced in currently. A stronger dollar weighs on gold, as it is priced in dollars." The second factor weighing down gold spot price right now, said Krauth, is demand. "The World Gold Council recently reported that Q1 2014 demand was stable at 1,074 tonnes versus 1,077 tonnes in Q1 2013. However, Bloomberg recently reported that April imports to China from Hong Kong were down to 65.4 tonnes versus 80.6 tonnes in March and 75.9 a year ago. It's thought that Chinese consumers have slowed their buying somewhat due to higher prices than last year. The country's overall gold demand was down 18% in Q1 over last year." "And third," continued Krauth, "we've got technical trading and sentiment. The $1,280 support level was breached to the downside, which encourages traders to short the metal while fostering negative sentiment. The next support level appears to be $1,240, and then around the $1,200 level." Looking forward, there are events scheduled for this week that you can bet will shape the yellow metal... Thursday will bring the monthly monetary policy meeting of the European Central Bank, which Krauth discussed above as a possible drag on the gold spot price. And Friday brings the U.S. Labor Department employment report for May. The early forecast is for non-farm payrolls to have increased 215,000 in the report, according to Forbes. A strong U.S. economic report could lead to a stronger U.S. dollar - and the stronger the dollar, the more of a drag on the gold spot price. While some traders may try to short the yellow metal as the gold spot price and gold futures slip, Krauth disagreed with that method. "There seems to be too little downside and clarity of direction to short gold now. And increasing inflation expectations could help to underpin the price and provide new support." No matter how gold prices finish out this week, the case for owning gold has never been clearer. Here's why - plus a two-part "cheat sheet" that will help you figure out the right amount of gold for your portfolio... Related Articles: |

| You are subscribed to email updates from Spot Gold - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Spot Gold | Spot Gold: Challenging the upper downtrend channel | - MelakaFx | News2Gold"