Silver prices | Gold and <b>silver prices</b> break out as a classic hedge to inflation from <b>...</b> |

- Gold and <b>silver prices</b> break out as a classic hedge to inflation from <b>...</b>

- Gold And <b>Silver Prices</b> – June Lows Again Start Of Long Rally <b>...</b>

- Gold and <b>Silver Price</b> Manipulation :: The Market Oracle :: Financial <b>...</b>

- <b>Silver Prices</b> Today Jump on "Perfect Storm" of Buying | The Wall <b>...</b>

- Soaring Gold and <b>Silver Prices</b> Should Not Be a Surprise to Anyone

- Geopolitics more important than Fed hints on inflation in shifting gold <b>...</b>

| Gold and <b>silver prices</b> break out as a classic hedge to inflation from <b>...</b> Posted: 19 Jun 2014 06:16 AM PDT Posted on 19 June 2014 with 4 comments from readers

Silver tripped across the $20 an ounce line this afternoon and gold prices added $15 to rise to $1,287 in the wake of a Fed statement yesterday that appeared to indicate more inflation was in the works than presently expected and no plans to do anything about it. The degeneration of Iraq into a state of civil war is also pushing oil prices higher which has direct inflationary consequences on transport and industry. This is exactly the inflationary scenario that author Jim Rickards warns about in his new book 'The Death of Money' (click here) though he might already be wishing his portfolio allocation had included more gold and silver. Inflation So far the global financial markets have avoided a correction. But they surely cannot stand up to much retail price inflation before giving up some of their recent increases in value. For higher energy prices act as a tax on both the consumer and producer lowering sales and profits. Nominal inflation hides some of this damage but it's pretty unpleasant under the hood. The worry is always that the central banks have kept on printing money just a little too long and that the obvious 'unexpected consequence' follows with a rising supply of money and a more limited supply of goods leading to price inflation. The wonder is that this has taken so long. However, the chance of the Fed or any other of the central banks which have joined in the money printing party – Bank of Japan, Bank of China and the Bank of England to name a few – getting the exit strategy right is about nil. They know that and their preference is for inflation rather than destructive deflation. Bottom spotting Anybody who read the ArabianMoney confidential investment newsletter for this month will know that we spotted June as the bottom in the precious metal cycle (subscribe here). We are therefore not surprised to see this happening. However, we are surprised by the turn of events in Iraq. With temperatures soaring this time of year even the hottest heads usually cool down. Not so this year and the impact on oil prices just adds fuel to the inflationary fire. The next conundrum will be to try to predict how far and how fast gold and silver will rise. Maybe that can wait for the next newsletter. It's nice to be right about the breakout first… Posted on 19 June 2014 Categories: Gold & Silver, Oil & Gas | ||||||||||||||||||||

| Gold And <b>Silver Prices</b> – June Lows Again Start Of Long Rally <b>...</b> Posted: 20 Jun 2014 06:47 AM PDT This article was submitted by Peter Degraaf who is an online stock trader with over 50 years of investing experience. He produces a daily alert for his many subscribers. To view a recent report please visitwww.pdegraaf.com or request a report at itiswell@cogeco.net The first, chart courtesy www.seasonalcharts.com, shows the historical trend of the price of gold, based on 30 years of data. Once the doldrums of June and July are out of the way, price usually rises until January-February. The challenge is to catch the June lows.

The next chart by the Federal Reserve Bank of St. Louis shows the total amount of debt in the USA is now 60 trillion dollars. This cannot possibly be paid off, and it will be inflated away. Gold and silver will benefit.

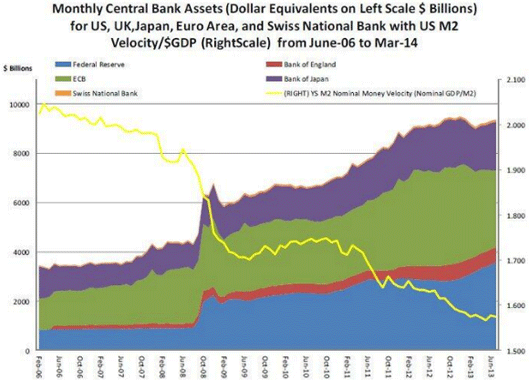

"Gold, unlike all other commodities, is a currency…and the major thrust in the demand for gold is not for jewelry. It's not for anything other than an escape from what is perceived to be a fiat money system, paper money, that seems to be deteriorating." Next we look at the Monetary Base having just topped the 4 trillion dollar level, and it does not reflect any 'tapering'! Instead it shows the US Monetary Base has increased from 800 billion dollars to over 4 trillion dollars in just 5 years. This new money has inflated the bond market and the stock market, and soon a lot of this money will find its way into the precious metals sector, as price inflation motivates investors to seek protection from 'asset destruction'.

The following chart (released on Zerohedge) shows someone making a gold purchase of almost half a billion dollars early on Thursday June 19th. Sometimes 'they do ring a bell!'

Based on the chart from www.Ingoldwetrust.ch it appears that custodial gold stored at the Bank of England fell by 755 tonnes in 2013. This proves the demand for physical gold is greater than mine supply can meet.

This chart courtesy BLS and CNSNews.com shows the food index at BLS has just reached a new all-time high at 252.8. The index rose 7.7% during the past 12 months.

Looking at the price of PHYS the Sprott gold trust, it appears that PHYS is breaking out at the moving averages. A close above the green arrow will turn the trend bullish. The 3 supporting indicators are positive.

The Stockcharts.com chart below shows TIP the bond fund that is indexed to inflation. Investors in TIP seem to know when price inflation is on the horizon. Historically, whenever TIP breaks out after a pullback (as now), the price of gold (top of chart) begins to rise! Once again TIP is setting the example for gold to follow.

Let's move on to Franco-Nevada's weekly price chart. In January we drew attention to the fact that the 13 week exponential moving average had crossed over and risen above the 34 WEMA, thereby issuing a buy signal. Last week price broke out above the 3 month old downtrend line, while the two moving averages remained in positive alignment. This is a very bullish signal. The supporting indicators (SIs) are positive, including the A/D line which turned up even before the January buy signal. Since FNV is a royalty company, it is useful as a leading indicator for the mining industry.

Looking at the Stockcharts.com chart for the GDX gold and silver producers, it appears the ETF has broken out at the downtrend lines. The supporting indicators are positive, including the important A/D line. We await the breakout at the green arrow. This will confirm an 'inverted head and shoulders' pattern, with a target at 36!

This chart courtesy Stockcharts.com shows the US dollar ETF is dropping below the most recent support line. The supporting indicators are negative. Almost always, the US dollar index moves in the opposite direction to gold and silver.

The following chart from www.goldmoney.com shows 'managed money' (mostly hedge funds), is short the largest number of contracts since at least 2006. These positions have to be covered, when the price of silver begins to rise. From a contrarian perspective this is a very bullish chart.

Featured below is PSLV the Sprott silver trust. Price is breaking out at the bullish falling wedge pattern. A close above the green arrow will turn the trend bullish. The 3 supporting indicators are positive. The premium over bullion is a positive +2.0%.

Our thanks to www.nowandfutures.com for the quotes used in this article. DISCLAIMER: Please do your own due diligence. Peter Degraaf is NOT responsible for your trading decisions. | ||||||||||||||||||||

| Gold and <b>Silver Price</b> Manipulation :: The Market Oracle :: Financial <b>...</b> Posted: 20 Jun 2014 11:02 AM PDT Commodities / Gold and Silver 2014 Jun 20, 2014 - 04:02 PM GMT By: Peter_Vogal

The rapid decline in gold and silver since 2011 has certainly achieved its goal in shattering investor confidence, so its natural to want a reason such as market manipulation as vindication for having made an ill-timed investment decision. Escaping the psychology of those times without a doubt is a difficult task. But what about now, is the psychology any different? Silver and gold was on everyone's bucket list for a decline to much lower lows, despite the fact gold and silver were witnessing strong accumulation by professionals - long silver future contracts in early June stood at about 70,000 or the equivalent of 350 million oz. of silver. This is a significant increase since last summer, all the while silver has been testing its lows. On the flipside, speculators increased their short positions to 50,000 contracts, not far off its 15-year record set last December, and compare that to the 15-year average short position of 22,000 contracts. Both the longs and shorts in silver are showing their strong conviction. Who do you think will ultimately win, the commercial/professional traders or the speculators? This is what you call a Colt 45 loaded with a silver bullet. Now that the bear pundits got shot, perhaps they can declare manipulation to the upside or stealthily become bullish. Here's what InvestorKey had to say about precious metals in our blog on June 4 titled "Gold's Time to Shine":

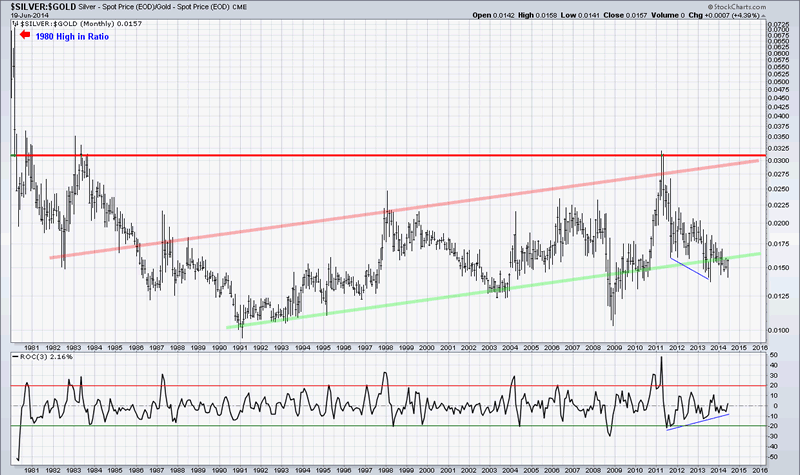

We were clear about the bottoming process in precious metals in July 2013, Jan 2014 and Jun 2014. There were painful moments, however, as well, where we were stopped out during nasty whipsaws that would take out previous highs or lows by a few cents. Despite the pain, our confidence in understanding markets comes from our experience in ratio analysis. Another technical supporting factor for a move up in precious metals is the Silver/Gold ratio which is currently in undervalued buying range as shown by the green lower trend channel line that has marked lows in the silver price during the last 25 years. Further supporting that silver is building for a move up is the 3-month rate of change momentum in the lower panel that shows positive momentum building. We believe the support level on silver and gold is formidable and that the current move is initiating the next major trend.

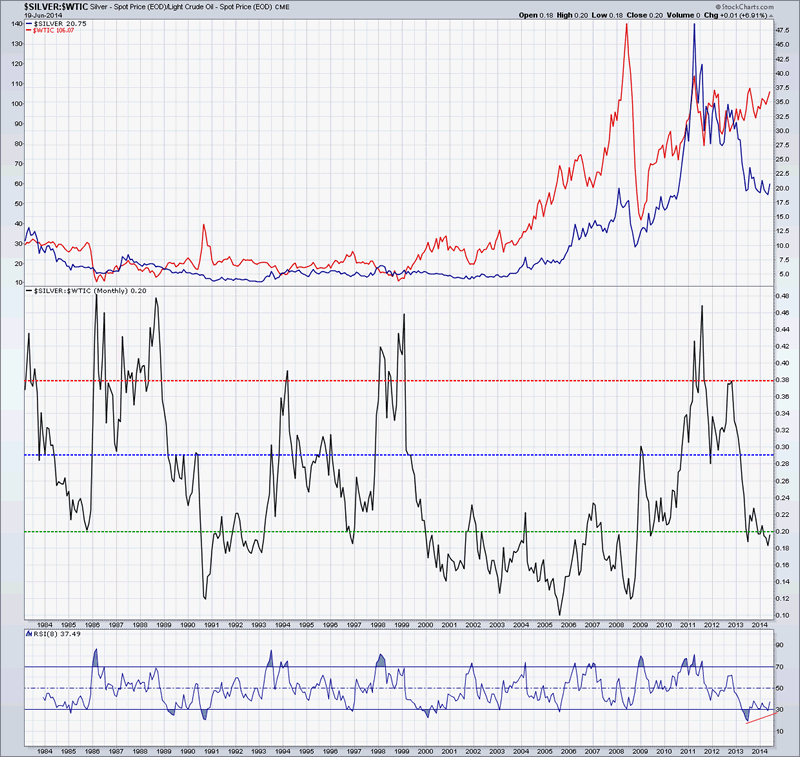

The second chart is a monthly Silver/Oil ratio back to 1983 that clearly shows the overvalued and undervalued levels of Silver verses Oil. The top panel shows Oil in red(price left scale) and Silver in blue(price right scale). Since 1998, the only period Silver clearly outperformed Oil was from the 2008 low to the 2011 high. From an investment perspective, investing in Oil would have been better than the precious metals. Currently, we are again in oversold territory showing Silver being undervalued relative to Oil, which in the past has also correlated well with the lows in silver. The RSI momentum is in oversold territory and there appears to be a divergence developing.

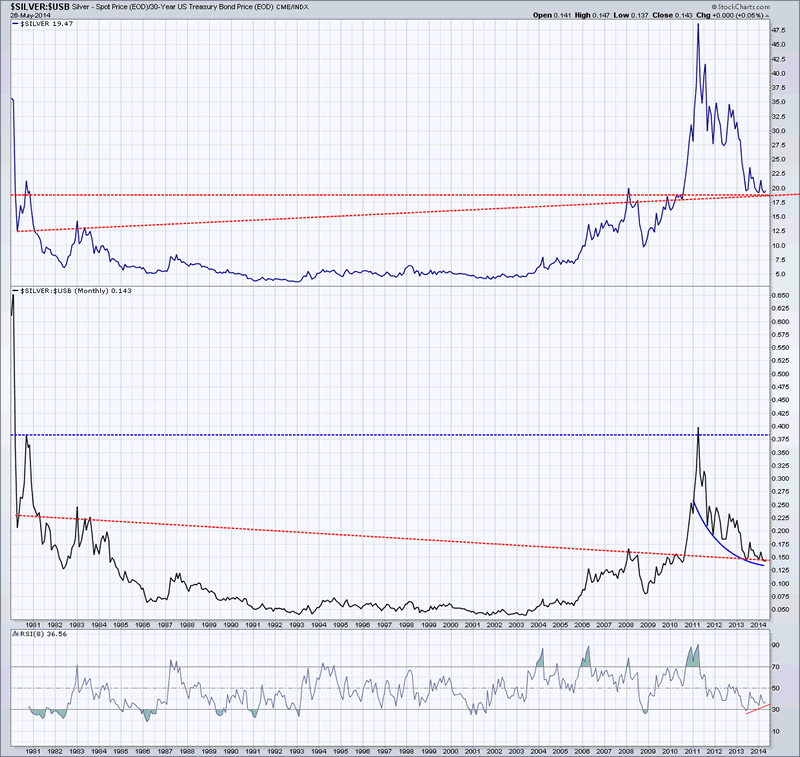

The reason these ratios are important, is because they show "relative value", meaning it can reveal the truth behind the price of an individual asset. Looking at only the price of an individual asset, such as silver, gold, bonds, stocks may not always reveal the true direction. Relative values can be many different ratios representing many assets, hence manipulating ratios would be an impossible task, as the capital required would be untenable. The 3rd chart is the Silver/30-Yr Bond ratio back to 1980, with Silver plotted in the top panel. A note on the Silver chart; no matter how you draw the neckline from the early 1980's through the 2008~09 highs, they both end up as support directly under the price during this last 11 months. Likewise, the ratio in the Silver/Bond chart shows the exact same resulting neckline and support. Can that really be coincidence or a manufactured result? The argument of manipulation may hold some truth, but from a technical perspective the price decline over the last 3 years in gold and silver needed to happen. Whether the root cause is manipulation, the psychological cycles of mankind, or act of God is completely irrelevant. The Silver/Bond ratio is also showing signs of a rounding bottom and the RSI momentum appears to be completing a third trough divergence against price, generally recognized as the last trough before the more significant move begins.

Using a top-down approach, we provide short and medium term daily signals on the charts similar to those above in our blog. In our June 12 blog titled "What You Can't See", we gave this advice:

This is an important time to be on the right side of the precious metal and commodity markets and soon the stock market as well. As an investor, one of the most important things you should do right now is look back to the first 10 days of June and review the articles that were bearish and bullish, look to see if there is any valid foresight in their reasoning or whether they are just blowing with the wind. If you were caught empty-handed on this move as a result of something you read, then maybe its time to turn the page. Disclosure: Peter Vogel Peter Vogel began his investment career in 1981, first as a Floor Trader and then as an Investment Advisor for a major securities firm. During that time he acquired several securities and options licenses and became registered as a Commodity Trading Advisor (CTA). He also co-founded a venture capital organization that helped finance and commercialize a number of new technologies. Since the beginning of his 33+ years of investing, he developed his own style of technical analysis by focusing on ratio analysis and money management techniques, creating methods that often allow him to buy near precise turning points with confidence. Copyright © 2014 Peter Vogel- All Rights Reserved All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor's investment objectives, financial situation, and needs. Accordingly, investors should not act on © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | ||||||||||||||||||||

| <b>Silver Prices</b> Today Jump on "Perfect Storm" of Buying | The Wall <b>...</b> Posted: 20 Jun 2014 10:37 AM PDT Silver prices today (Friday) are still on the rise after ripping through the $20-an-ounce level Thursday. July Comex silver was trading up $0.20, or 0.95%, at $21.10 in morning trading Friday. The silver price hasn't seen today's $21 level since March 17.

A "Perfect Storm" for Higher Silver Prices TodayFrequent CNBC contributor Dennis Gartman said Thursday's movement in precious metals was thanks to a "perfect storm" of buying as the market finally reacted to the Fed's comments and weakness in the U.S. dollar. U.S. Federal Reserve Chairwoman Janet Yellen said Wednesday the Fed will leave interest rates at rock-bottom levels into 2015 in an effort to help the uneven American economy. Those comments sent the dollar reeling to a four-week low, giving investors an added incentive to buy precious metals. Another factor in higher silver prices: inflation. "Both gold and silver have seen strong price action since early June. It's still early, but just maybe these are signals that inflation is becoming entrenched," said Money Morning Resource Specialist Peter Krauth. Yellen sounded unconcerned about inflation at the Fed press conference Wednesday. She dismissed data that shows inflation is gaining momentum. "I think recent readings on, for example, the CPI index have been a bit on the high side, but I think the data we're seeing is noisy. I think it's important to remember that broadly speaking, inflation is evolving in line with the committee's expectations," Yellen said. The worry is that the U.S. central bank will print money for too long, the money supply increasing faster than real output, which equals inflation. Moreover, global central banks, including the Bank of Japan, Bank of China, and the Bank of England, to name a few, have also engaged in money printing. While worldwide economies are enjoying the stimulus now, it's the exit strategies that are worrisome. Action in precious metals was delayed a day as the Fed's news, and Yellen's conference, came after the regular metals trading on Wednesday afternoon. Fueling silver gains is safe-haven demand as violence in Iraq escalates and tensions continue to simmer in Ukraine. Also driving the white metal higher is an overall firming trend in global precious metal markets amid expectations that borrowing costs will remain at historically low levels for a good while. And as is typically the case, when gold and silver prices start to run, people worry about missing out on gains. Indeed, the Fed's dovish view on the economy and interest rates caught some market participants off guard. Many were anticipating a more hawkish tone from the June FOMC meeting. That forced some traders to cover shorts. Silver's robust 4.4% gain Thursday pushed some $2 billion worth of silver short positions into the red. Other investors simply bought into the rally. So what's next? Bullish bullion option activity suggests more gains are ahead for silver. Lured by strong performances in stocks, market participants that have been underinvested in silver are swiftly and solidly returning to the white metal. Geopolitical turmoil is pushing silver prices higher – and has also triggered new 2014 highs for oil prices. Our energy expert Dr. Kent Moors outlined everything investors need to know in The Oil "Crisis Spike" Is Just Getting Started | ||||||||||||||||||||

| Soaring Gold and <b>Silver Prices</b> Should Not Be a Surprise to Anyone Posted: 19 Jun 2014 01:37 PM PDT June 19, 2014

Precious Metals June 19, 2014

The reasons for today's huge gains in precious metals varied in the mainstream press but soaring prices should have been no surprise to long term investors who understand why gold and silver should be a part of every portfolio. Gold and silver constitute a fundamental defense for wealth preservation against the rapidly eroding value of paper currencies backed by broke governments which is Why All Governments Hate Gold.

If last year's price correction shattered your conviction in owning gold and silver please consider The Fundamental Reasons for Owning Gold and Silver Are Stronger Than Ever.

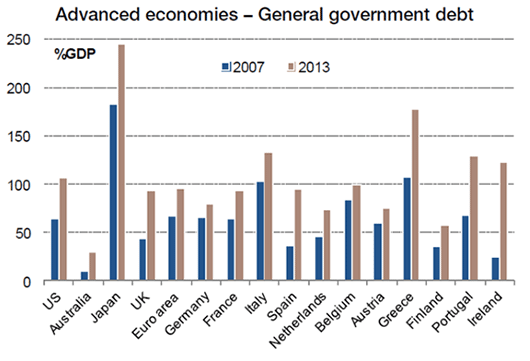

Virtually every government in the world has taken on debts and liabilities that are clearly unsustainable. Governments "don't go broke" is the sustaining mantra for those with faith in paper currencies but governments do and will continue to print money that accelerates the loss of purchasing power of fiat currencies. Please consider the following charts courtesy of John Mauldin Economics.

Eventually, as people realize that the central bank emperors have no clothes it will become clear Why There is No Upside Limit for Gold and Silver Prices.

| ||||||||||||||||||||

| Geopolitics more important than Fed hints on inflation in shifting gold <b>...</b> Posted: 19 Jun 2014 08:33 PM PDT Posted on 20 June 2014 with no comments from readers

Gold and silver staged a spectacular advance yesterday, with prices up three and five per cent respectively, after Fed hints that higher levels of inflation 'noise' may be tolerated as the US economy recovers. But it is the deteriorating geopolitics of Iraq and Ukraine that are really going to shift precious metal prices higher from here. The new government in the Ukraine simply does not get it. They want to sign an EU association agreement on June 27th. Their foreign minister will present a peace plan to EU foreign ministers in Luxembourg next Monday. Do they think the EU can save them from the Russsian invasion of their eastern states? Did it lift a finger over the Crimea? Ukraine's misjudgment Yesterday Nato warned that Russia is again massing troops on the border with Ukraine. They are not there for a summer vacation. Far from Russian-led insurgents laying down their weapons for peace the fighting in the eastern states has intensified in recent days. Is this going to be like the Prague Spring of 1968? That also came as a big shock in the West. Then look at the misreading of Iraq. President Obama said several times yesterday in no uncertain terms that US troops would not be returning. The hawks cling onto the 300 advisers being sent to Iraq. But you don't need to be the brain of Baghdad to see that these are just the specialists needed to safely evacuate American citizens, diplomats and contractors. Is this going to be like the fall of Saigon, the last time an American military adventure turned into a disaster? Iraq is like Vietnam maybe worse, not a US invasion and reconstruction success story like Germany and Japan. Energy price inflation In this seismic shift of geopolitics several things are going to happen on the economic front. The cost of energy will go up as supplies from Russia and Iraq will be in jeopardy and may indeed be jeopardized for an unknown period of time. That will be enough to tip over the over-valued and highly complacent stock markets of the world. Central banks have few levers left to pull to prevent another major recession. Where will you want to stash your money? Bonds are the usual safe haven but how safe will they prove after such a long period of deliberate suppression of interest rates by the central banks? The bond market has become the biggest bubble in the history of money. No, there is only one true money without counterparty risk or a central bank screwing it up and that's the monetary metals, gold and silver. Investors will increasingly get it and buy them. Precious metal prices are heading very much higher from here. Oil, gas and related interests will not be so far behind. The US dollar is in serious trouble. |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

There has always be manipulation, from the smallest levels (individual professional traders) to large size (Inv.Banks & Hedge Funds) and finally the government/central bank. The point I do not agree with is that they can "ultimately" control any market, even such as gold or silver despite their smaller size. The primary drivers of the markets are currencies and bonds because these are a reflection of the health (or illness) within a country's economy. Sure, even these can be moved by gov't policy changes (and moral suasion)(witness Japanese Yen 2012~2013), but for the most part, the free market forces are just too large for even the gov't to pump hundreds of billions per day to move them. Hence, any large enough change in those markets will eventually create a discrepancy between other related markets and consequently affect the stock and commodity markets around the world. No gov't can possibly stand in front of that train for long. If they could, then why did they let gold go up to $2000 and silver to $50?

There has always be manipulation, from the smallest levels (individual professional traders) to large size (Inv.Banks & Hedge Funds) and finally the government/central bank. The point I do not agree with is that they can "ultimately" control any market, even such as gold or silver despite their smaller size. The primary drivers of the markets are currencies and bonds because these are a reflection of the health (or illness) within a country's economy. Sure, even these can be moved by gov't policy changes (and moral suasion)(witness Japanese Yen 2012~2013), but for the most part, the free market forces are just too large for even the gov't to pump hundreds of billions per day to move them. Hence, any large enough change in those markets will eventually create a discrepancy between other related markets and consequently affect the stock and commodity markets around the world. No gov't can possibly stand in front of that train for long. If they could, then why did they let gold go up to $2000 and silver to $50?

Silver for July delivery surged $0.87, or 4.4%, to $20.65 an ounce on Thursday. That was the white metal's highest settlement since March 19, when the price of silver closed at $20.93 an ounce. Thursday's volume was twice last month's daily average.

Silver for July delivery surged $0.87, or 4.4%, to $20.65 an ounce on Thursday. That was the white metal's highest settlement since March 19, when the price of silver closed at $20.93 an ounce. Thursday's volume was twice last month's daily average.

0 Comment for "Silver prices | Gold and silver prices break out as a classic hedge to inflation from ..."