Silver <b>Prices</b> at Historic Disparity with Fundamental Reality |

| Silver <b>Prices</b> at Historic Disparity with Fundamental Reality Posted: 02 Jun 2014 11:45 AM PDT In last week's "Greatest (Manipulated) Disconnect of All Time," we discussed how Western financial markets have never been so dissociated with reality; certainly not in our lifetimes, and perhaps ever. With global economic activity plunging – whilst debt, inflation, unemployment and social unrest surge TPTB have resorted to history's most aggressive, heavy-handed campaign of money printing (overt and covert), market manipulation and propaganda in a desperate attempt to delay the inevitable collapse their policies have wrought. Fortunately, the world is rapidly realizing that "markets" don't reflect the terrifying political and economic realities underlying them; and thus, the "propaganda leg" of the "three-legged deception stool" is on the verge of failing – in the process, making the other two legs dramatically more unstable. When it comes to the "market manipulation leg," no segment comes close to the dislocation in precious metals prices; but particularly silver, which due to its extraordinary physical tightness has been given "special attention" by the Cartel. Why it has been foolish enough to push prices this far below the cost of production is beyond us. However as sure as day follows night, the ramifications will be dramatic just as when the London Gold Pool was forced into disbanding in 1968. Today we will empirically demonstrate why silver prices must rise in the coming years no matter what economic scenario unfolds. That said, before the "main course," we have myriad "horrible headline appetizers" to get through – starting with the all-out economic collapse in Japan as "the biggest lie in history" has been exposed within weeks of its dissemination. As the chart below screams, Japan's April sales tax increase may one day be viewed as the final death knell of the "land of the setting sun." Indisputably, consumer demand has collapsed in its wake setting the stage for the inevitable, worldwide realization that Abenomics has failed. And what will the Bank of Japan do as an encore? Take a guess, considering that fiat Ponzi schemes must grow larger to survive.  Testosteronepit.com Unfortunately, Japan is one of dozens of economies directly tied to the collapsing worldwide fiat Ponzi scheme. To wit, fully two-thirds of global PMI readings were negative in May with the only material "increase" being Australia's rise to a still negative 49. Comically the "official" Chinese manufacturing PMI was reported this weekend to have risen to a "whopping" 50.8 in May (i.e., barely positive) contrary to private estimates putting it solidly in negative territory and essentially all other data points. This weekend, the PBOC actively discussed the need for expanded QE! Actually if you look at the chart below, you can see the Chinese government is clearly playing the U.S. government created game of DLITR or "Don't Let it Turn Red" with its official PMI index. Note how it seems to be "supported" at 50, whilst the economic data underlying it (beneath in red) depicts an economic collapse on a par with 2008. Better yet, take notice of the big pink elephant in the room, i.e. the fact the Chinese government last year admitted its PMI data is erroneous. And how about this article depicting just how rapidly the Chinese real estate bubble is bursting? Yes, regional Chinese governments have gotten so desperate to delay the inevitable they – as a policy – will not allow home price declines of greater than 15% to be reported! In a nutshell, there is no way the global economic collapse can continue to be hidden by propaganda; and shortly, financial markets' "message" will be disregarded altogether. When the ECB eases monetary policy further this Thursday it will only enhance the global understanding of what's really going on…

…putting an exclamation point on the sad reality that the global economy permanently peaked at the turn of the century. Throw in the accelerating inflation cancer created by Central bank printing presses – as loudly warned of this weekend by the World Bank – and you can see why TPTB are at the "end of their rope" regarding their ability to hold back the massive tsunami of economic reality. And note bene, as I write the ISM manufacturing PMI and industrial production figures were reported way below expectations – suggesting the economy is barely growing, if at all.

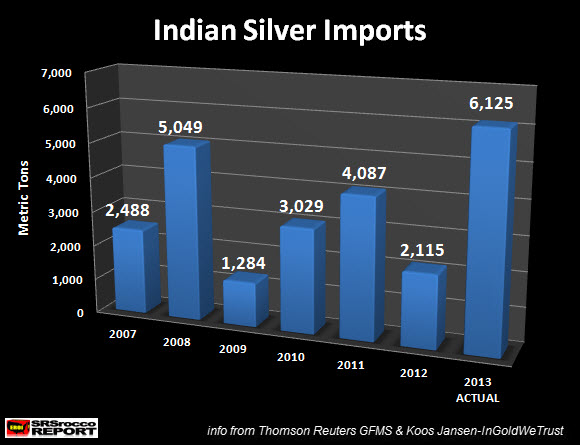

On to today's "main event" – as Cartel suppression has pushed precious metal valuations to their most attractive of the entire 14-year bull market; and arguably, since the London Gold Pool was disbanded 46 years ago. To start, recall what we wrote in January 2013's "Peak Silver?" of how global production was on the verge of collapsing, amidst historically low inventories and exploding demand. A few years back, the U.S. Geological Service predicted silver will be the first "extinct" element on the periodic table; and given demand has since surged, whilst the mining industry has been pushed to precipice of collapse, my guess is their views have only strengthened further. From a demand standpoint the MSM consistently fails to point out that silver is not just a monetary metal but the second most widely utilized industrial commodity – trailing only crude oil in number of applications. Moreover, most of said applications are indispensable and utilized in such minute quantities that the odds of substitution with cheaper elements are slim to none. To wit, "non-investment" demand – i.e., excluding coins and bars – has risen by 10% over the past two years despite global economic activity dramatically declining. Global mine production has been no higher than industrial demand in all three periods; thus relying solely on scant remaining "scrap" metal to supply the industrial demand deficit – let alone, the aforementioned explosion in investment demand. Clearly, such numbers defy reality; as in freely-traded markets, there is no way prices would have declined in the face of such wildly bullish fundamentals.

Highlighting this "manipulation comedy" further, I have listed how far more "economically sensitive" base metals have performed since the Fed's "QE3" program commenced at the end of 2012 – as well as crude oil and the CRB commodity index. And thus, we ask – "recession" or "recovery" – can you concoct any scenario in which silver prices would dramatically underperform? I mean if we're indeed in a recession (we are), the aforementioned increase in investment demand should have yielded dramatic silver price outperformance. Conversely, if we truly were "recovering" (we're not) how can the aforementioned demand increase – in one of the most widely utilized industrial commodities – not yield at least average price performance?

And then, of course, there's that other pink elephant in the room, i.e. the global silver mining has been utterly destroyed by three years of unprecedented Cartel suppression – commencing with the May 2011 "Sunday Night Paper Silver Massacre?" Per the data below from the incomparable Steve St. Angelo, the top 12 primary silver miners – i.e., those operating the world's low-cost mines – suffered an astounding $1.7 million of losses in 2013 with a silver "break-even" level of $42/oz. or $24/oz. excluding "one-time" write-offs. Remember these are the world's best mines, and after the industry-wide 50% capital expenditure reductions enacted for 2014, not only will $24/oz. – at the least - still be required to enable operating profits but it's all but guaranteed reserves will continue to decline, yielding an equivalent certainty that global production has or will shortly peak. To wit, the world's largest silver producer, Australia's Cannington Mine has depleted by 18% in the past two years alone; and cumulatively, the top 12 primary silver miners, plus the top 10 non-primary silver owned silver mines, account for less than a third of global silver production. Thus, the below estimates in our view, dramatically underestimate the global breakeven price as the remaining two-thirds of production is largely by-product of other metal mining operations, in many cases with significantly higher production costs.

Here at the Miles Franklin Blog, we can only highlight the historical disparity between prices and fundamentals that Cartel suppression has created in the PM markets; and particularly silver. Beyond that it's up to you to decide if given the aforementioned fundamental factors, can the Cartel possibly break the "triple bottom" in the mid- to high $18s they have inadvertently created over the past years' time?

If you don't think so, we may be looking at the most attractive silver valuation of our lifetime; and subsequently, if you decide to purchase some we ask you to call us at 800-822-8080 and "give us a chance" to earn your business! Similar Posts: |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver Prices at Historic Disparity with Fundamental Reality"