Silver and <b>Gold Prices</b> Higher, <b>Gold Price</b> Climbed $9 to Close at <b>...</b> |

- Silver and <b>Gold Prices</b> Higher, <b>Gold Price</b> Climbed $9 to Close at <b>...</b>

- <b>Gold Price</b> Slipping Again While Silver Sees Further Risk | Gold <b>...</b>

- <b>Gold Price</b> Short-Term Bottom Coming Due :: The Market Oracle <b>...</b>

| Silver and <b>Gold Prices</b> Higher, <b>Gold Price</b> Climbed $9 to Close at <b>...</b> Posted: 05 Jun 2014 05:16 PM PDT

The GOLD PRICE climbed $9.00 (0.72%) today to $1,253.00. Silver rose also, 28.9 cents (1.54%) to 1905.5c, over 1900c for the first time in five days. Silver's volume rose strongly, but the SILVER PRICE has passed no milestones. 20 DMA stands above at 1922c. Indicators are moving toward the upside, but no proof yet. The GOLD PRICE RSI is coming up from a very overbought reading. Full stochastics are scraping bottom, ready to rise. MACD might be ready to rise. So we have silver and gold prices higher today, but without any solid confirmation that they have indeed reversed. I've been suckered so many times that I want some proof. But do watch out. Silver can move with blinding speed when it turns. By fall silver and gold prices at these levels will seem absurd. Today the European Criminal Bank announced it was trimming its main lending rate from 0.25% to 01.5%. It also instituted a CHARGE (but called a "negative deposit rate") on bank reserves parked at the central bank, lowering that rate from zero to -.1%. On its marginal lending facility the ECB cut the rate from 0.75% to 0.40%. Charging banks for parking reserves with the ECB is supposed to flush them out of the bushes and make them lend. We'll see, as no other central bank has tried this trick. Other technical measures will also add to euro inflation. On a huge trading range (1.2%, from $1.3503 to $1.3670) the euro shot up 0.46% to $1.3663. That close took it above its 200 day moving average and left it not far below its 20 Dma (1.3676). The shorts got caught short. This action shows how loony, how goofy, these central bank denominated markets have become. Now think: interest rates chiefly determine currency exchange rates, along with inflation expectations: higher the rates, more desirable the currency; lower the inflation, more desirable the currency. The ECB just CUT its interest rate to inflate the currency more, and the euro rose. Give the euro a week or two, then gravity will reassert itself. The European criminals are taking the same path Bernanke and the US criminals have taken, guaranteeing perpetually rising stock markets by keeping the new money flowing. This will end in tears, wailing, and gnashing of teeth. But who knows? I'm only a nacheral born fool from Tennessee. Maybe in Europe pigs do have wings and anvils can fly. Some 56% or so of the US Dollar Index is made up of the euro, so big gains in the euro translate to big losses in the US dollar index. Dollar hit a high of 81.07 before turning and sinking to close at 80.39, down 33 basis points (0.42%). From 8:00 Eastern Time until the ECB announcement about 8:30 the dollar was climbing, then commenced dropping and kept on dropping all day. Yen rose 0.32% to 97.66, which didn't paint much of a splash on the chart. On the other hand, today could end the dollar's promise of a rally. Yield on the US 10 year treasury note fell 0.84% to close at 2.584%. That means that both bonds AND stocks rose today, a right rare occurrence. Stocks went hog wild at the prospect of money printing spreading around the globe. Dow made a new all time high, up 98.35 (0.6%) to 16,835.88. S&P500 made its seventh new high in eight days, rising 12.54 (0.65%) to 1,940.42. Folks, when the thought that crosses your mind is "It don't get no better than this," it probably won't. Now here's an odd and intriguing observation. While the Dow and S&P500 have been making new highs, the Dow in Gold and Dow in Silver have turned down. Oh, nothing dispositively certainyet, but still down. Dow in silver hit its overhead resistance line at 892.99 oz (S$1,154.57 silver dollars) on 1 June and bounced down. Today it dropped 0.98% to 882.26 oz (S$1,140.70). Chart is right here, http://scharts.co/Tj9TcZ RSI, MACD, Rate of Change, and full stochastic are all rolling over. But I'd like to see confirmation with a close below the 20 DMA at 864.84 oz (S$1,118.18). My maximum upside target has been and remains 912 oz (S$1,179.15). Dow in gold chart can be seen here, http://scharts.co/1unBfMx Since June 1 it has stalled, but only sideways. Today dropped 0.18% to 13,43 oz (G$277.62 gold dollars). Indicators are trying to roll over but no strong confirmation yet. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Gold Price</b> Slipping Again While Silver Sees Further Risk | Gold <b>...</b> Posted: 02 Jun 2014 03:29 AM PDT One of the most respected technical analysts we are following is Louise Yamada. Her independent research company provides in-depth and thought-provoking analysis on all markets, including precious metals. She has a background of 25 years at Smith Barney and was top-ranked in "Institutional Investor" for four years in a row, before going independent. We have been following Yamada's work for a long time and appreciate her analysis because it is truly unbiased, very sharp and broad (it covers plenty of markets worldwide). An outstanding feature of the analysis is that readers are offered different perspectives on each market, which sometimes reveals trends that are rather invisible. For precious metals investors it helps to put the metals markets activity in a broad perspective of ongoing market trends. In other words, understanding broad market activity is helpful to interpret the state of the metals market. The following is an excerpt from Yamada's latest monthly update for premium subscribers, released today. We highly recommend subscribing to the monthly in-depth analysis of Louise Yamada on www.lyadvisors.com. Gold: Slipping againGold Spot price (GOLDS-1,249.73, see Figure 28) retained a tight trading range through April and May, allowing speculation as to resolution. We have been neutral awaiting technical evidence of a directional move which has now taken place to the downside, breaking the lower band of the tight trading range and failing under the 2012 downtrend again. The breakdown now suggests that there is a good possibility that 1,200 will again be tested. The wide trading range between 1,200 and roughly 1,400 has lasted for two years, not unexpected considering the degree of the prior decline. Now the momentum models from all three timeframes, daily, weekly and monthly are all negative, suggesting the decline could continue. If 1,200 cannot hold, the bear market for Gold that began in 2011 will be extending to a new down-leg and there again would be further risk toward 1,100.

The S&P 500 to Gold ratio depicted herein last month has moved up in favor of the S&P 500 outperforming over Gold. We have been very skeptical of owning Gold stocks since 2008 when the XAU / GOLDS ratio broke down, showing structural outperformance of Gold over the stocks (see Figure 29). The reason related directly to the Gold ETFs which enabled investment directly in the bouillon, avoiding fundamental stock risks.

A further breakdown occurred in 2013 and now the ratio looks poised for another break (see arrow), furthering the underperformance of the Gold stocks. Silver: Further riskSilver Spot price (SILV-18.82, see Figure 30) is failing along with Gold, currently below both MAs and breaching support at 19; risk 18 or lower. A lift through 19 again and then 20 would now be needed to suggest another rally attempt.

Platinum: NeutralPlatinum spot price (PLAT-1,452.75, see Figure 31) has moved little, retaining a sideways pattern above support at 1,400 and 1,325 for nearly a year, and more recently in a narrower range between 1,400 support and 1,500 resistance. The three-year downtrend remains in place, currently intersecting at 1,550, and weekly and monthly momentum are still barely positive and barely negative respectively … effectively still neutral. Price needs to exceed 1,500 to reverse the more negative bias of the downtrends. But maintaining the higher support at 1,400 is a short–term technical positive, any breach of which could return price to 1,300.

Palladium: Breakout extendsPalladium spot price (PALL-837.25) has consistently remained the strongest of the metals we cover and has continued to extend gains after successfully penetrating the trading range resistance near 790 (as depicted herein last month). The next outstanding resistance is at 851 from 2011, which price could easily achieve. The current support is 800, the point of breakout. Subscribe to the monthly analysis of Louise Yamada for in-depth insights on ongoing market activity: www.lyadvisors.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Gold Price</b> Short-Term Bottom Coming Due :: The Market Oracle <b>...</b> Posted: 02 Jun 2014 06:23 AM PDT Commodities / Gold and Silver 2014 Jun 02, 2014 - 11:23 AM GMT By: Jim_Curry

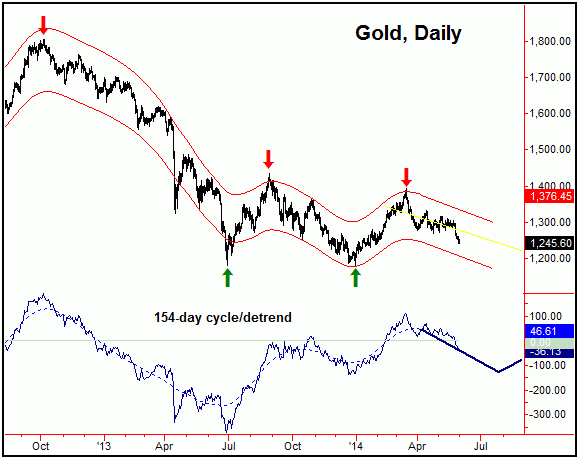

With the position of this larger 154-day wave, the current assumption is that any new rally should end up as a countertrend affair, and - once complete - should be followed by an eventual re-test or break below the December, 2013 bottom of 1181.30. Having said that, there are bullish indications for the very short-term, which is the main subject of this article. The next chart is more important to the near-term action. It shows the 34-day cycle, which is one of the more dominant of the short-term cycles in the Gold market:

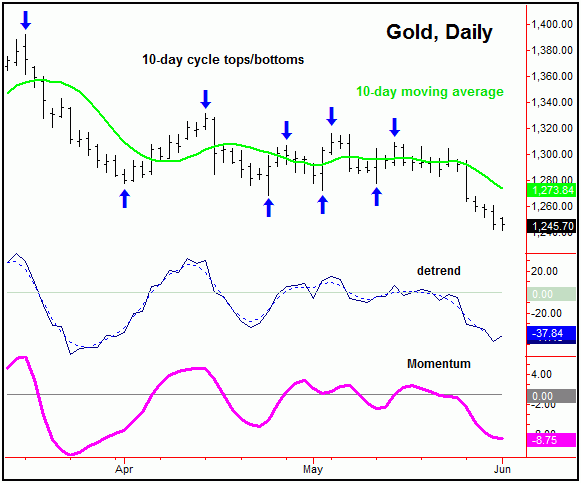

Of immediate note is that the 34-day channel is also pointing south, and is closing in on the lower 154-day channel line. With that, we should be nearing at least a short-term bottom for the metal, with a sharp rally soon favored to materialize, though we can't rule out slightly lower numbers being seen first. Once this 34-day wave does bottom out, then the normal low-end expectation is for a rally back to the 34-day moving average or higher, with that key moving average currently at the 1293 figure (and declining). In addition to the 34-day cycle, there is also a less-dominant 10-day component, which is also due for an extended bottom anywhere in the current timeframe. This cycle is seen on the chart below:

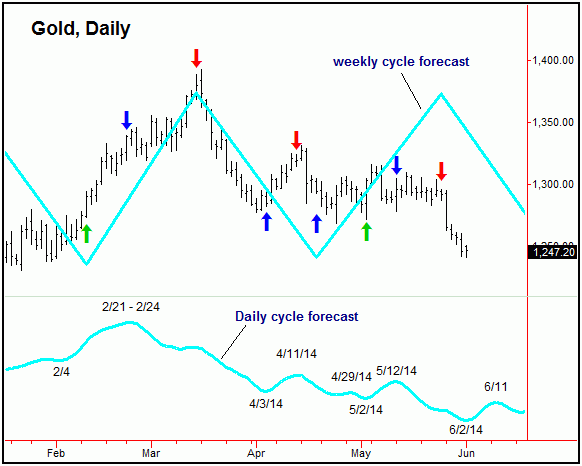

With the above said and noted, we then have both the shorter-term 10 and 34-day waves at or into bottoming range, and with that the current assumption is that the next decent swing low on the daily chart will come from these two waves. In terms of price, any reversal back above the 1262.50 figure on Gold – if seen at any point in the coming days – would tend to confirm an upturn in the 10-day cycle, and likely that of the larger 34-day wave as well. Adding to the notes above, I pointed out in some of my recent market commentaries that taking out the 1289.00 figure on Gold favored a test of the 1277.00 number - and taking that figure out to the downside then confirmed the downward phase of the aforementioned 34-day cycle to be back in force. I like to take a detailed look at how each of the up and downward phases have played out in the past history of each of the cycles that I track, in order to get some idea of what to expect in the near-future. With that, taking out the 1277.00 figure favored a drop on down to the 1254 area or lower, simply due to a normal low-end statistical expectation with the 34-day wave. Going a bit further, the chart below is the most important chart that I track, which shows the daily cycle turning point forecast (in aqua), which is a combination of the dominant cycles on the daily chart of the price of gold. The larger weekly cycle forecast is overlaid (also in aqua), and is pointing lower - which is in line with the position of the larger 72 and 154-day waves. Take a look:

On the above chart, the most important periods are when both the daily and weekly forecast paths are moving in the same direction. With this, I have labeled with red/blue/green arrows the times that both the daily and the weekly forecasts line up together. The green arrows show when both forecasts are moving higher (i.e., a 'buy' signal with the model), and red arrows are when both models are forecasting lower prices (i.e., a 'sell' signal). A blue arrow is shown when the models are in disagreement (i.e., a 'neutral' signal). With the above said and noted, we can see that when both forecast paths are in alignment, that the market tends to move strongly in that direction. I should add that, when the daily and weekly forecasts disagree, that the market has more of a tendency to follow the shorter-term (daily) forecast path. With that, of particular note for the near-term is that the next daily forecast bottom is projected for the 6/2/14 date, which is Monday of this week and is plus or minus a day or so in either direction. Thus, the continued weakness seen into Friday looks to be in line with the next bottom for the daily forecast path – which, ideally, should also end up as the bottom for the aforementioned 10 and 34-day time cycles. Summing up the above, the short-term path favors a bottom fairly soon (i.e., 6/2/14, plus or minus) and at least a sharp bounce into what is looking to be June 11th, plus or minus, which is the next daily forecast peak. Until a lower level actually materializes, any reversal back above the 1262.50 figure going forward, if seen, would likely confirm that move up to be in progress, while remaining below the same allows for a continued break down to the 1230's first, only then to set up this bottom. Jim Curry Market Turns Advisory Email: jcurry@cycle-wave.com Jim Curry is the editor and publisher of Market Turns advisory, which specializes in using cyclical analysis to time the markets. To be added to our mailing list click HERE Copyright 2013, Jim Curry - Disclaimer - The financial markets are risky. Investing is risky. Past performance does not guarantee future performance. The foregoing has been prepared solely for informational purposes and is not a solicitation, or an offer to buy or sell any security. Opinions are based on historical research and data believed reliable, but there is no guarantee that future results will be profitable. The methods used to form opinions are highly probable and as you follow them for some time you can gain confidence in them. The market can and will do the unexpected, use the sell stops provided to assist in risk avoidance. Not responsible for errors or omissions. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

In light of the recent developments in the Gold market, I wanted to post an article on the current cyclic configuration - and what we can expect in the very near future. Since my prior article back in December of last year, we have seen the expected larger countertrend rally with the combination of the 72 and 154-day cycles, which were able to take the metal up to a mid-March peak of 1392.80. The chart below shows the larger 154-day component, which is seen as heading lower into the month of August, which is plus or minus a month in either direction:

In light of the recent developments in the Gold market, I wanted to post an article on the current cyclic configuration - and what we can expect in the very near future. Since my prior article back in December of last year, we have seen the expected larger countertrend rally with the combination of the 72 and 154-day cycles, which were able to take the metal up to a mid-March peak of 1392.80. The chart below shows the larger 154-day component, which is seen as heading lower into the month of August, which is plus or minus a month in either direction:

0 Comment for "Silver and Gold Prices Higher, Gold Price Climbed $9 to Close at ..."