Gold price | Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Rose $1.40 Closing at <b>...</b> |

- Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Rose $1.40 Closing at <b>...</b>

- The <b>Gold Price</b> Closed Higher Today, Up $1.00 to $1260.80

- <b>GOLD Price</b> Could Test $1000 - Elliott Wave Analysis :: The Market <b>...</b>

| Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Rose $1.40 Closing at <b>...</b> Posted: 09 Jun 2014 05:11 PM PDT

Today the GOLD PRICE rose $1.40 to $1,253.50 and silver rose 8.2 cents but stopped at the same old bus stop, 1904.5c. We've been here so many times I've got my name carved in the sidewalk. The GOLD PRICE range today was $1,257.30 - $1,251.60 or 0.46%. Put a mirror under gold's nose to check if it's still breathing! The SILVER PRICE range, 1919c - 1899c, at least amounted to 1%. Stocks are sucking attention and investors away from silver and gold. Now here's the set-up. Everybody in the mainstream investing world except the precious metals diehards believe the silver and gold bull market has ended and metals will drop lower this year. Likewise the other article of their creed is that central banks, especially the Fed, has fixed the economy and the magic money machine will keep stocks rising forever. These things are demonstrably false, but that's not the point: for a while, when EVERYbody believes something, that belief can drive markets. Once the belief is shown to rank for truthfulness right up with the Yeti and Probity in Politicians and the Sincerity of Cats, it collapses as reality takes charge. But markets -- not always! -- often do the opposite of what everyone expects. Right now that would be accomplished either by a sharp fall in stocks or fast rally in metals. I can be patient. I know that when the cause doesn't change, the outcome won't change. Those central banks haven't stopped printing money yet, have they? I've been thinking about Germany in the 1930s as the Nazis built their police and surveillance state. Most Americans aren't familiar with that history, so they don't know that many people opposed the Nazis, especially from the Church. Nor do folks realize how careful the Nazis were to push only hard enough to make progress, but not to provoke any pushing back. Then one day, it was too late to try to oppose them. They had built the police state brick by brick, and the trap was shut. Then the war made it easy to brand anyone who opposed the regime a traitor. War offers that cover for totalitarian states. An even more thorough police state is being built in the US today, with capabilities the Gestapo could only dream of. Many complain, but few oppose at any risk to themselves -- I mean principled opposition that is willing to stand lawfully on the constitution and the law in court and even risk jail. I don't mean morons who think that shooting up a post office will change anything. Until somebody says, "No, that's illegal and I won't go along," nothing will change. Self-government cannot be preserved by cautious people watching heroes from the sidelines, or blogging or surfing the internet. Only a "belligerent claimant in person" can enforce his rights. Now to markets: Ho-hum, stocks today made new all-time highs. Dow added 18.82 (0.11%) to 16,943.10 and the S&P500 added 1.83 (0.09%) to 1,951.27. This only drives both indices further into overbought territory. But overbought can get overboughter. Some correction, sharp, ought to come shortly. Top might be put in then, or later in the fall. Dow in Gold rose 0.14% to 13.53 oz (G$279.69 gold dollars), barely inching up. Dow in Silver fell 0.13% to 889.64 oz (S$1,150.24 silver dollars). Odd, the one forecast I feel trust most is the Dow in Silver topping not higher than 912 oz. (S$1,179.15). Bumping along the top line of a rising wedge, the Dow in Silver could plunge any time. Sorry, I will be travelling this week and will not be publishing any commentaries until next Monday, 6 June, unless something huge happens or I just take a notion. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The <b>Gold Price</b> Closed Higher Today, Up $1.00 to $1260.80 Posted: 11 Jun 2014 07:24 PM PDT

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

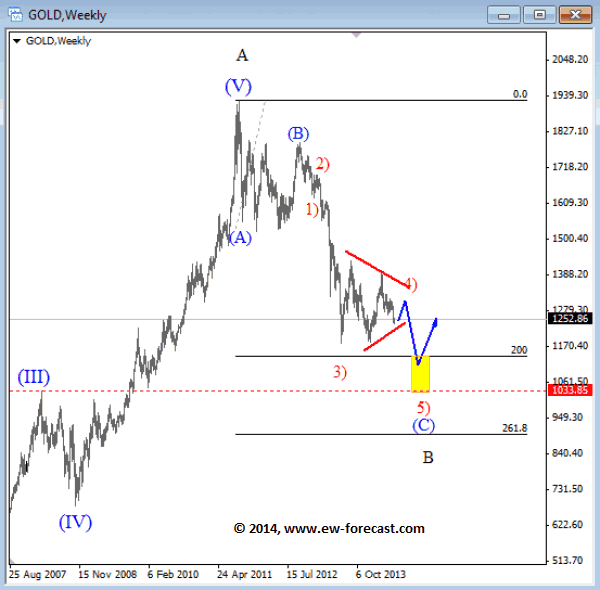

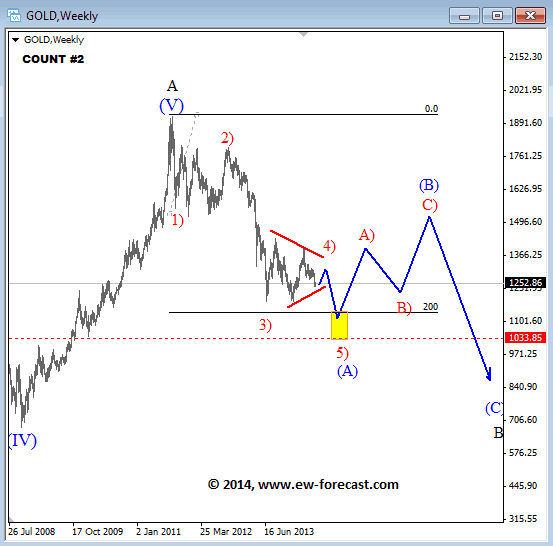

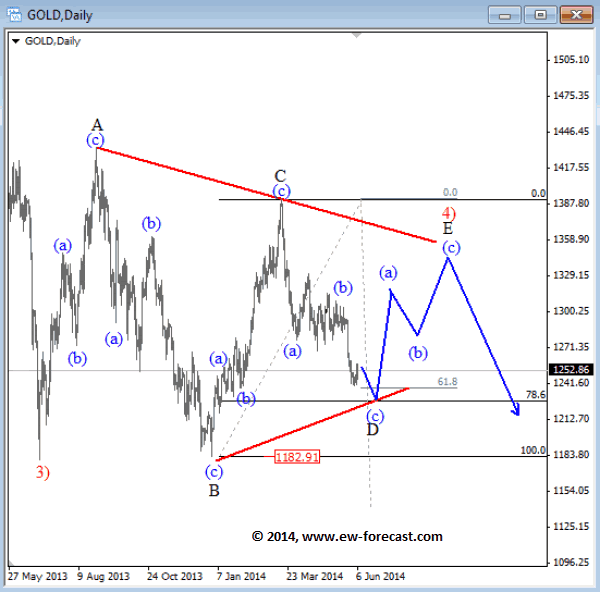

| <b>GOLD Price</b> Could Test $1000 - Elliott Wave Analysis :: The Market <b>...</b> Posted: 10 Jun 2014 10:08 AM PDT Commodities / Gold and Silver 2014 Jun 10, 2014 - 04:08 PM GMT By: Gregor_Horvat

|

| You are subscribed to email updates from Gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

GOLD Weekly

GOLD Weekly

0 Comment for "Gold price | Silver and Gold Prices: The Gold Price Rose $1.40 Closing at ..."