Buying Gold | <b>Gold</b> And Silver Explode Higher! Finally Time to <b>Buy</b>? :: The Market <b>...</b> | News2Gold |

- <b>Gold</b> And Silver Explode Higher! Finally Time to <b>Buy</b>? :: The Market <b>...</b>

- <b>Gold</b>, Silver Recover on Jewellers <b>Buying</b> - NDTVProfit.com

- <b>Gold</b> Investors Weekly Review June 20th | <b>Gold</b> Silver Worlds

- Why this top technician recommends <b>buying gold</b> now - CNBC.com

| <b>Gold</b> And Silver Explode Higher! Finally Time to <b>Buy</b>? :: The Market <b>...</b> Posted: 20 Jun 2014 09:15 AM PDT Commodities / Gold and Silver 2014 Jun 20, 2014 - 06:15 PM GMT By: Jason_Hamlin

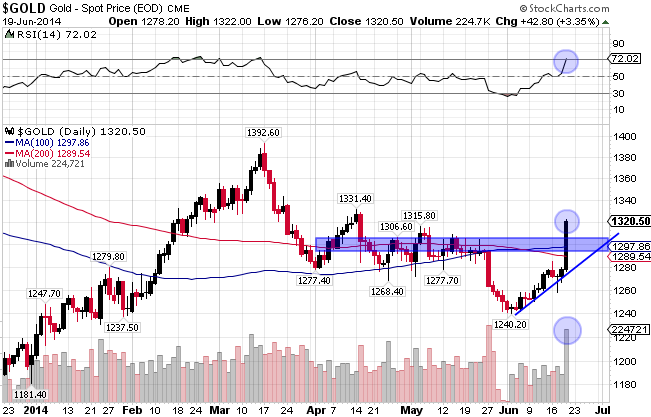

The technical chart for gold shows the importance of today's surge through key resistance and through both the 100-day and 200-day moving averages. This occurred with strong volume, which helps to reinforce our bullish outlook. The RSI hit overbought levels on today's break out, but I expect only a mild pullback before the uptrend resumes.

The chart for silver is even more dramatic, with the price blasting through key levels of resistance and both moving averages. Volume was strong and I expect that previous resistance at $20 may now turn into support.

Those are impressive numbers for a single day, but this uptrend has been in the works for a few weeks. Since the start of June, gold is up $75 or 6% and silver is up over $2 or 11%. June is typically the worst month for precious metals when looking at seasonal charts, but not this year. Many of the mining stocks that we track are up 30% or more in the past 3 weeks. Looking forward, prices start to gain momentum after June and close the year very strongly. While a pullback tomorrow would not be surprising, I believe the trend will be towards higher prices for the remainder of the year. Part of the recent gains can be attributed to increasing instability in Iraq, as the Sunni Jihadist group ISIS has taken over much of Western and Northern Iraq, plus a large portion of Eastern Syria. They have been on a brutal rampage slaughtering civilians indiscriminately and have looted the central bank in Mosul of $450 million, making them the most wealthy terrorist organization in the world. As of today, they are now reported to be in charge of the largest oil refinery in Iraq. But, the advance in precious metals started well before this new insurgency took hold. Inflation is finally starting to pick up, as the May consumer price index (CPI) rose 0.4%, 2.1% year-over-year, well above the consensus estimate. Furthermore, the Federal Reserve made bullish comments for gold today, saying they are committed to accommodative measures and low interest rates well into the future. These comments drove the dollar down and boosted demand for precious metals. With China, Russia, India, Brazil and countries around the world abandoning the dollar in international trade, dollar weakness is likely here to stay. The United States has benefited immensely by controlling the world reserve currency at the expense of other nations. We exported our inflation and were able to live well beyond our means. But these days are numbered and the end of the dollar's rein in rapidly approaching. Adding fuel to the fire, many technical traders and gold shorts were forced to cover positions this week on the advance in precious metals. These large and leveraged paper positions tend to exacerbate the price movements in both directions. If we are indeed finally witnessing the end of the 2-year correction in precious metals, the upside potential is absolutely staggering.

The past two advances more than doubled in their magnitude, as did the past two declines. If the is trend holds true this time around, we are looking at an advance of at least $2,400 from the cycle low of $1,200, which gives us the minimum price target of $3,600 for gold! These cycles last 24 to 36 months, so we can expect this price target at some point around the start of 2017. Applying this analysis for silver forecasts a minimum price target of $100 in the same time frame. If this price target comes to fruition, anyone picking up precious metals at current prices is going to become very wealthy. And while we advocate holding physical bullion in your possession, we expect quality mining stocks to offer leverage of 2X to 4X the advance in the underlying metal. So, if gold triples over the next few years from $1,200 to $3,600, a solid mining company should see their share price go up 6 to 12 times! And if you are able to pick successful junior mining stocks before the market piles onboard, the gains will be orders of magnitude higher. As bullish as I am on precious metals going forward, it is important to realize that manipulation is still occurring and there are banks with access to nearly unlimited funds and extreme leverage via futures markets that can slam the price down at will. They are finally being exposed and even fined for the manipulation, putting an end the cries of "conspiracy theory." But I am not convinced that they are out of the market quite yet. So, I think it is wise to scale into positions slowly at this juncture and keep some cash on the sidelines. Going forward, I believe that the all-in cost of production for gold and silver will continue to act as support on any take down attempt. And the downside risk of such a drop is minuscule compared to the upside potential detailed above. To get regular updates like this in your inbox and more thoughts on why I believe the end of the current monetary system and collapse of the petro-dollar is near, consider signing up for the Gold Stock Bull premium membership. You will get our monthly contrarian newsletter, access to the GSB model portfolio, email trade alerts whenever we are buying/selling and a free subscription to our technology newsletter with updates on Bitcoin and other crypto-currencies. You can try it out for just $39 before committing to a full year subscription. By Jason Hamlin Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here. Copyright © 2014 Gold Stock Bull - All Rights Reserved All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor's investment objectives, financial situation, and needs. Accordingly, investors should not act on © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>Gold</b>, Silver Recover on Jewellers <b>Buying</b> - NDTVProfit.com Posted: 18 Jun 2014 03:03 AM PDT New Delhi: Gold prices recovered by Rs 150 to Rs 28,050 per ten gram in the national capital on emergence of buying at prevailing levels by jewellers to meet rising demand amid weakening rupee. Silver also moved up by Rs 300 to Rs 42,900 per kg on increased offtake from industrial units and coin makers. Traders said recovery in gold prices was mostly supported by fresh buying by jewellers to meet rising demand and depreciating rupee against the dollar, making imports costlier. In Delhi, gold of 99.9 and 99.5 per cent purity traded higher by Rs 150 each to Rs 28,050 and Rs 27,850 per ten gram respectively. It had lost Rs 130 on Tuesday. Sovereign, however, held steady at Rs 24,600 per piece of 8 gram. Globally, gold was trading 0.35 per cent lower at $1,267.20 an ounce in Singapore. In a similar fashion, silver ready rose by Rs 300 to Rs 42,900 per kg and weekly-based delivery by Rs 120 to Rs 42,170 per kg. The white metal had lost Rs 400 in last trade. On the other hand, silver coins remained steady at Rs 77,000 for buying and Rs 78,000 for selling of 100 pieces. |

| <b>Gold</b> Investors Weekly Review June 20th | <b>Gold</b> Silver Worlds Posted: 21 Jun 2014 11:26 AM PDT In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. Gold closed the week at $1,314.85, up $37.96 per ounce (2.97%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, gained 7.12%. This was the gold investors review of past week. Gold Market StrengthsEarlier in the week, gold naysayers were calling for the gold price to consolidate around the $1,280 range despite the escalating conflict in the Middle East that sent oil prices above $105 per barrel. Even in light of intensifying unrest in numerous places around the world, Fidelity's head of asset allocation called for investors to sell gold and buy stocks at today's "attractive valuations." That strategy may work in a riskless world, but according to Mineweb contributor Lawrence Williams, the numerous conflict flashpoints around the world make this the best time to hold gold. Gold rose almost 3 percent this week after Fed Chairwoman Janet Yellen stated interest rates will remain low for an extended period of time, disregarding rising inflation as noise. Surveys show investors expected the Fed to hint it would raise interest rates faster than previously anticipated. As a result, the U.S. dollar weakened to its lowest level this month, and speculators, who had pushed the number of short contracts to a five-fold rise since March, were left scrambling to unwind their trades. The Shanghai free-trade zone international gold trading will be a reality by year-end, according to city government officials. More details leaked out this week to give investors a better idea of the impressive capabilities of the proposed exchange. Testing for interest rate liberalization and currency usage is currently ongoing, as the exchange seeks to allow foreign investors to trade in the market using offshore Chinese yuan accounts. Jiang Shu, senior analyst at Industrial Bank in Shanghai, stated the recent advances show the Chinese authorities are serious about yuan and gold trading reform. Gold Market WeaknessesChina National Gold, the only central enterprise in the Chinese gold industry, announced it is no longer in talks with Ivanhoe Mines on its African assets after talks began last year. Similarly, in Mali, gold production is set to fall 12 percent in the next three years as mine closures outpace new production, thus curbing revenue from the country's main export. Randgold Resources recently announced its Morila mine is in the process of being closed, while IAMGOLD suspended operations at its Yatela mine last year. A new report by SNL Metals & Mining, coming in at a modest 538 pages, concludes that the cost of building a mine has increased significantly over the last decade, from $560 per ounce of production capacity in 2004 to more than $2,300 last year. To make matters worse, SNL analysts argue that curtailment in capital spending since 2013 will take at least until 2015 to reverse the rising trend, as current forecasts show costs will rise to $2,400 per ounce this year. Gold Market OpportunitiesBank of America recommends investors buy gold into the third quarter as the seasonality trade kicks in with Ramadan and Indian buying. Historically, the July-August period sees a demand boost from religious festivities, which Bank of America believes could push gold past $1,400 this year. In a related note, Mining Recruitment Group's outlook suggests mining executives have turned bullish this year as a poll shows the percentage of bearish executives dropped from 64 percent to 14 percent from a year ago. Headline inflation rose robustly in May for the third consecutive month, bringing the annual change above 2 percent for only the second time since the end of the recession. U.S. Personal Consumption Expenditures, the most widely monitored inflation measure by Fed officials, leaped to 1.4 percent. National Bank research argued dismissal wouldn't be easy this time around, but that's exactly what Janet Yellen did in her press conference. On the same note, Canaccord raised gold to overweight following the CPI readings and the belief that the Fed is "cornered." It concludes by saying investors should buy inflation-protection hedges. Gold Market ThreatsA group of more than 40 Congressmen asked the U.S. Fish and Wildlife Service to delay the implementation of new rules and procedures that would be overly prohibitive for economic activity. The proposed changes to procedures could increase in millions of acres the areas designated as critical habitats, regardless of whether the protected species occupy these areas or not. These proposals have resulted from hundreds of closed-door settlements with litigious environmental groups. The five-year-long positive correlation between gold and oil came apart recently as the prospects of a global economic recovery boosted energy consumption and lowered gold's appeal. The relationship tightened over the past two weeks as the Iraqi conflict took over headlines. Analysts continue to expect oil to trade higher on fears of a Middle Eastern supply disruption, which would mean lower gold prices if the negative correlation holds. |

| Why this top technician recommends <b>buying gold</b> now - CNBC.com Posted: 24 Mar 2014 09:53 AM PDT Gold suffered another tough session Monday, dropping nearly 2 percent following a bad week. But one of the most respected technical analysts on Wall Street says it's high time to buy in. Indeed, Sterne Agee chief market technician Carter Worth predicts that gold will rise about 15 percent from current levels. After a painful 2013, bullion was finally finding some strength in the beginning of 2014. The key, for Worth, was that the metal was able to turn around a grim trend. "When you're cascading, you make a low and then you violate it. And make a low, and then violate it. Make a low, and then violate it. Low after low," Worth said Friday on CNBC's "Options Action." "But then, we have this massive low in June, as everyone knows, and again, we have a rally. But this time, we don't violate. So we have a well-defined double bottom." |

| You are subscribed to email updates from buying gold - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Gold and silver both climbed above key resistance levels today at $1,290 and $20, respectively. Gold shot up $40 or 3.2% and silver was up $0.96 or 4.8% today alone. Most of the stocks in the GSB model portfolio were up 6% or more, while our latest portfolio addition rocketed 15% higher today!

Gold and silver both climbed above key resistance levels today at $1,290 and $20, respectively. Gold shot up $40 or 3.2% and silver was up $0.96 or 4.8% today alone. Most of the stocks in the GSB model portfolio were up 6% or more, while our latest portfolio addition rocketed 15% higher today!

0 Comment for "Buying Gold | Gold And Silver Explode Higher! Finally Time to Buy? :: The Market ... | News2Gold"