Buy Gold Bullion | <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News | News2Gold |

- <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News

- Goldman Sachs in huge <b>bullion buy</b> from cash-strapped Ecuador <b>...</b>

- One Ton <b>Gold</b> Shipment Into Hong Kong Revealed To Contain Just <b>...</b>

- At MoneyNews: Selecting a <b>Gold Bullion</b> Retailer : Edmund C. Moy

- <b>Buy Gold Bullion</b> Using Karatbars at Brash Berry

- Credit Suisse <b>Gold Bullion</b> Bar | <b>Buy Gold</b> 1-866-775-3131 <b>...</b>

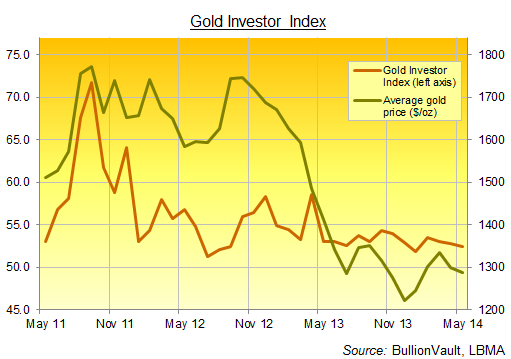

| <b>Gold</b> Investors <b>Buying</b> Dips, Not Bull | <b>Gold</b> News Posted: 03 Jun 2014 01:02 AM PDT Gold Investor Index falls, one-fifth of May's buyers jump on 4-month lows... If GOLD INVESTOR sentiment reflects financial stress and anxiety, then it has clearly dropped since the price peaks of mid-2011, writes Adrian Ash at BullionVault. The stock market is setting new record highs, after all. Right alongside, gold sentiment amongst private investors ebbed further in May, as our Gold Investor Index shows today. Wall Street's S&P500 broke 1,900...a rise of 23% from 12 months ago and more than doubling from May 2009. The gold price meantime fell to 4-month lows. And sentiment?

The Gold Investor Index is calculated using proprietary data from Bullionvault, the 24-hour precious metals exchange which leads the market for physical bullion online. More than 52,000 people have now used BullionVault to buy, store and trade physical gold and silver – the internet's largest pool of private precious metals investors. Between them, they own $1.3 billion worth of gold bullion (£785m, €965m) – more than is held by most of the world's central banks, and unchanged in May from April. Instead of surveying intentions, or simply reporting the change in total client property, the index shows the balance of individual actions across the month. It take the number of net sellers – people who reduced their holding – from the number of net buyers (including new users, who started at zero), and gives that figure as a proportion of all gold owners at the start of the month. That is rebased so that 50.0 would signal a perfect balance. The chart above shows how the Gold Investor Index has varied over the last three years. (Data attached as XLS below. You can read more about its methodology and aims in Fear, Delusion & the Gold Investor Index here.) The index recorded a series low of 48.8 in February 2010 as the financial crisis took a pause. It then peaked at 71.7 in September 2011 as gold prices hit record highs. And in May 2014, with prices in a tight, boring range until the very last week, the index gave a low but positive reading of 52.4. That 3.9% drop in Dollar gold prices counted, however. One-fifth of May's net gold buyers on Bullionvault acted in the last 4 days of the month, pulling the index higher...from what would have been a near 2-year low...as investors took advantage of lower prices. Short term this looks still distinctly unbullish. Investors are buying the dips, not driving any new phase in the metal's previously long upwards trend. More starkly still, silver buyers on Bullionvault last month added more metal than any month since December 2012. Again, this bargain-hunting came on a sharp drop in prices, swelling total silver holdings by 2.9% in May to some $282m by value (£169m, €207m). Longer-term, such Dollar-cost averaging looks smart. Private investors as a group continue acquiring bullion as part of their broader savings, well-remembering the lessons of the financial crisis but not chasing prices higher as they buy financial insurance. And since the price crash of last spring, gold sentiment has mirrored the broader moves in bullion prices, flattening but holding positive as new investors continue to join the market. |

| Goldman Sachs in huge <b>bullion buy</b> from cash-strapped Ecuador <b>...</b> Posted: 03 Jun 2014 03:13 PM PDT New York investment bank Goldman Sachs has picked up 466,000 ounces of gold from cash-strapped Ecuador. According to the South American nation's central bank, Goldman acquired 1,165 gold bars, worth roughly $580 million at today's ruling price. Ecuador under socialist President Rafael Correa is seeking sources of cash "after borrowing more than $11 billion from China since defaulting on $3.2 billion of foreign debt five years ago," reports Bloomberg. Ecuador's is the only country on the continent using the US dollar as currency and the central bank explained it "invested" the gold with Goldman in exchange for more liquid assets. The country will get the gold back within three years and the central bank expects to turn a profit of as much as $20 million on the transaction without explaining how. George Gero, a vice president and precious-metals strategist in New York at RBC Capital Markets told Bloomberg: "It's really a puzzling transaction. The idea that there was a large sale and you don't know when it will come out into the market is probably pressuring prices." The price of gold fell 3% last week and on Tuesday continued to hover near four-month lows of $1,245 an ounce. Gold remains some 4% to the upside for 2014 but is down $135 from highs reached mid-March as the rally on the back of safe haven demand and bargain hunting loses steam. |

| One Ton <b>Gold</b> Shipment Into Hong Kong Revealed To Contain Just <b>...</b> Posted: 06 Jun 2014 11:49 AM PDT Two years ago, stories of fake tungsten-filled gold coins and bars began to spread; it appears, between the shortage of physical gold (after Asian central bank buying) and the increase in smuggling (courtesy of India's controls among others) that gold fraud is back on the rise. As SCMP reports, a mainland China businessman, Zhao Jingjun, discovered that HK$270 million of 998kg of gold bars he bought in Ghana had been swapped for non-precious metal bars. What is perhaps even more worrisome, given the probe into commodity-financing deals and the rehypothecation evaporation; these gold bars were shipped to a Chinese warehouse before Zhao was able to confirm the fraud. As South China Morning Post reports, police were last night making arrangements with a mainland businessman to check whether HK$270 million of gold bullion he bought in Africa was genuine after part of the consignment was swapped with metal bars.

We can't help but feel this is not the last time as commodity-backed financings are unwound en masse and the underlying collateral found missing... sourcing the underlying by any means will be on the rise. * * * For those who want to learn more about China and gold, please read "How China Imported A Record $70 Billion In Physical Gold Without Sending The Price Of Gold Soaring" For those curious what a fake 10oz bar looks like, here it is again: It appears in thise case, the fraudsters could not even afford Tungsten (or maybe the Tungsten was rehypothecated elsewhere)... (47 votes) |

| At MoneyNews: Selecting a <b>Gold Bullion</b> Retailer : Edmund C. Moy Posted: 09 May 2014 09:36 AM PDT With more than 4,000 dealers and other retailers selling gold bullion, how do you select which one is right for you? As director of the U.S. Mint, I saw firsthand the incredible growth of this market segment. The Mint produced new supply to supplement the existing market, and sales grew from 198,000 ounces in 2007 to 1.435 million ounces in 2009. Thousands of new companies entered the market during this boom period. An investor cannot buy a gold bullion coin directly from the U.S. Mint. When the program was first set up in 1986, the gold bullion market was in its infancy in the United States, and Congress wanted to make sure there was a two-way market. It was possible for the Mint to sell them directly to consumers, but the Mint did not have the ability to buy them from owners who wanted to sell. As a result, the Mint sold the coins in bulk to Authorized Purchasers, who in turn sell them directly to dealers and other retailers, and direct to consumers. Authorized Purchasers are contractually committed to buy gold bullions from sellers at fair-market value. I use five criteria when I decide to buy gold bullion coins: reputation, experience, volume, selection and pricing. Look for a firm that has a reputation for being transparent, fair and honest. If they are not, complaints are usually a telltale sign. The Federal Trade Commission and your state's attorney general's office are government websites to start your research. The Better Business Bureau is an objective third-party reviewer that has a robust accreditation process for listing a company and compiles ratings and lists complaints. I prefer a business that is experienced. It takes a long time to build a reputation, but it can disappear in a moment. If they have thrived through a boom and bust, they will likely have the wisdom to handle the twists and turns of this current market. Look closely at the management team, because many times the reputation lies with the individual and not the firm. A long history of repeat clients is a good sign. What is the sales volume of the dealer you are considering buying from? It is easier to maintain a good reputation if there are only a few transactions per year. But to move millions or even hundreds of millions of gold bullion a year requires excellent people, time-tested processes and outstanding customer service. Usually the greater the volume, the better the price. Product selection is also important. There are many popular gold bullion coins produced by quality mints around the world, and each bullion coin has its pros and cons. I have a bias toward gold bullion coins made by the U.S. Mint because of my confidence in their quality, my patriotic pride in their unique American designs and their popularity worldwide (which translates into liquidity). Pricing is where the rubber meets the road. The U.S. Mint sells gold bullion coins to Authorized Purchasers for the spot price of gold plus the cost of manufacturing (around 3 percent) the coin plus a 2 percent surcharge that gets put in a reserve fund to offset any potential losses (so that taxpayers never have to subsidize buyers of the coins). An Authorized purchaser then puts a mark-up on the coin when it is sold to a dealer or other retailer, who then adds a mark-up when they sell to an individual. Most pricing for a specific type of gold bullion coin will be competitive within a tight range. Occasionally, there might be a low-cost dealer, but you may have to make a commitment to buy a specific volume or they may not have the coin in stock and you will have to wait until gold prices match the price you bought at for the dealer to buy and deliver your coin. While higher pricing may not be best for most buyers, it does not necessarily mean that the dealer is trying to take advantage of the buyer. Sometimes it goes to pay for a higher level of customer service, premium shipping and expertise (which benefits first-time buyers). Other times it may be due to the dealer's inventory and what price it was purchased at. Coins in inventory means it can be delivered immediately. Most of the problems I have seen have to do with dealers who deliver your coins to a "secured facility" but not to you (gold IRAs being the exception). Those coins might not be the quality described or they may not exist. Beware of scam artists who significantly overprice their coins, use hard-sell tactics to intimidate you into buying or pass bullion coins off as rare coins (professionally graded coins being the exception). Some private mints and illegal mints have issued fake bullion coins with little or no precious metal content. If you apply the five criteria of reputation, experience, volume, selection and pricing, you will significantly reduce your risk when investing in gold bullion coins. Originally published at MoneyNews.com. Tags: Gold Categorised in: News |

| <b>Buy Gold Bullion</b> Using Karatbars at Brash Berry Posted: 13 May 2014 07:06 PM PDT

Choice makes gold bullion not just to be more accessible but in addition less costly as are going to received either in one gram at a time or perhaps lump sum payment. Karatbars therefore comes with a person a no cost saving account and enables money to get stored in the varieties of small certified sums of gold in ways that an individual who seeks to pursue the karatbars system must then open a karatbars account where their savings will likely be stored. Karatbars will therefore issue each one member a gram of pure 24 carat gold which is implanted within a uniquely designed card just the dimensions of a normal bank card and with each card featuring its own inbuilt 999.9 certification of pure sums of gold through the LBMA. Karatbars is thus an affiliate program that allows members to make money either when you purchase the gold or needing to recruit others this agreement they will be able to earn money as well with the purchase or on recruitment of others . The karatbars cycles are paid back each and every Friday, as the remaining units recycled and scheduled for one more cycle. Therefore the two major ways that this karatbars program permits people to generate money are: First, from the direct commissions in the referrals which acts as a uni-level pay plan. The person that selects this is offered a direct commission oneach individual plan they are signed up on. The commission off emerged contingent on the package ,rank and so on the volume.This is therefore categorised in direct commissions respectively the bronze package that is offered in 5 % ,the silver is provided in 10% while gold is offered fifteen percent direct commission as well as the VIP package that is provided in 20 percent direct commissions. Secondly there is a dual system which can be paid inside a cycle basis similar to 75 units, and therefore if someone which you recruit somewhere has the capacity to accumulate 50 units while the one on the reverse side accumulates 25 units then your program would cycle thereby choosing remunerated based on your favorite package.The karatbars has the bronze package that gives 10 euros,silver gives 40 euros, gold packages which provides 60 euros even though the VIP packages offers about 80 euros per every cycle. |

| Credit Suisse <b>Gold Bullion</b> Bar | <b>Buy Gold</b> 1-866-775-3131 <b>...</b> Posted: 01 Jun 2014 10:40 AM PDT

|

| You are subscribed to email updates from Buy gold bullion - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Have you ever heard of Karatbars, the ins and outs and the way an individual start this program? Basically, karatbars is simply product from your karatbars international company in Germany that enables individuals to buy gold .

Have you ever heard of Karatbars, the ins and outs and the way an individual start this program? Basically, karatbars is simply product from your karatbars international company in Germany that enables individuals to buy gold .

0 Comment for "Buy Gold Bullion | Gold Investors Buying Dips, Not Bull | Gold News | News2Gold"