African potash limited – four highly prospective drill targets identified at flagship Lac Dinga Potash Project |

- African potash limited – four highly prospective drill targets identified at flagship Lac Dinga Potash Project

- Europe's leap into inflation unknown bumps gold price

- Alaska to join Pebble Partnership in lawsuit against EPA over mine project

- BHP admits mistakes in its China, iron ore strategy

- Newmont halts all operations in Indonesia, declares force majeure

- Fresh name bidding to take over 117-year old silver fix

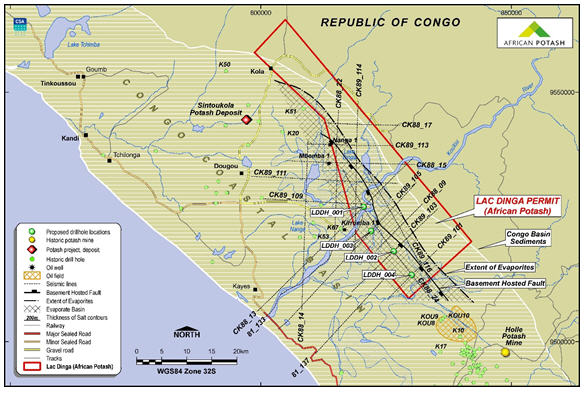

| Posted: 05 Jun 2014 03:26 PM PDT African Potash, the AIM listed exploration company focused on sub-Saharan potash assets, is pleased to announce that it has completed the interpretation of seismic data and delineated four prospective drill targets at its Lac Dinga Potash Exploration Project in the Republic of Congo ('Lac Dinga' or the 'Project'). The delineation of the target areas marks the conclusion of the planning and preparation phase, as African Potash prepares to commence a maiden drilling programme. Overview: Interpreted 415 line kilometres of recent oil exploration 2D seismic data covering 470km2 on and around the Lac Dinga licence area acquired in March 2014

African Potash CEO, Edward Marlow, said, "The interpretation of the newly acquired data is a final achievement in completing the planning and preparation phase of our exploration programme at Lac Dinga. With four highly prospective target areas identified, two of which we plan to start drilling in Q3 2014, this is a very exciting and significant point of development. The Congo Basin is underlain by an extensive evaporate sequence, which is the repository for potentially vast potash mineralisation as indicated by historical, basin-wide exploration drilling. With a defined exploration programme in place to advance the Project we look forward to the outcomes of this upcoming drill programme." African Potash acquired approximately 415 line kilometres of high quality 2D oil industry seismic data that covered and area of approximately 470km2 in March 2014 (Figure 1). The acquisition of this new data allowed the Company to commission a structural geological and drilling target delineation study over the Project area. The objective for the maiden drilling programme is to test the interpreted prospective salt sequence for the development of high-grade sylvinte (KCl) horizons within basin-wide carnallite [KMgCl3 x 6(H2O)] layer. The programme is planned to include two approximately 400m to 500m deep vertical drill holes. It is expected that the holes will intersect the evaporite horizon between 300m and 350m below surface. The drill holes are planned to be drilled as open rotary holes through the cover sequence consisting of mainly poorly consolidated sandstones, limestone and dolomites and to be cased to the top of the salt and then PQ size (~9cm diameter) core drilling into the evaporite formation. The geological study was conducted by CSA Global Pty Ltd and resulted in a regional structural geological framework and an interpretation of the extent of the evaporite (rock salt and potash salts) sequence across the Project area. The study confirms stratigraphic-structural continuity of the salt (including potash horizons) into the Lac Dinga area. The evaporite sequence is interpreted to underlie approximately 250km2 of the Project area and to thicken to about 300m to 400m near the southern and western property boundary. The evaporite sequence appears to have relative consistent thickness up to the "salt basin" margin where it rapidly decreases in thickness over about 3km (Figure 1). The geometry of the evaporite sequence is controlled by a structure in the underlying rocks which defines the "salt basin" geometry. The seismic data shows no major disturbances in the salt formation, which implies laterally stable condition. Four drill target areas were identified near the basin margin where favourable conditions have been interpreted for the formation of high-grade potash mineralisation within the evaporite sequence (Figure1). The historic drill hole information confirms the development and presence of potash mineralisation in the form of sylvinite and carnallitite in the area immediately to the south (~5km) of the Project area. The records refer to layers of sylvinite and/or carnallitite developed in the same stratigraphic position as that exploited in the nearby Holle historic potash mine. Figure 1: Location of acquired 2D seismic lines, extent of salt bearing formations and proposed drilling target locations. About African Potash African Potash was established to invest in/acquire potash assets or projects in sub-Saharan Africa. The Directors believe the fundamentals of the global potash market, a key source of potassium fertiliser, represent a compelling opportunity to create shareholder value. The Company is currently focused on the Lac Dinga Project in the Republic of Congo and has a highly experienced Board with a proven track record in identifying, operating and developing resource projects in Africa. |

| Europe's leap into inflation unknown bumps gold price Posted: 05 Jun 2014 02:29 PM PDT The European Central Bank's unprecedented new plan to boost inflation and weaken the euro gave gold a much-needed bump on Thursday. After hovering at four-month lows for more than a week, gold futures during a busy session in New York jumped by double digits to a high of $1,258 an ounce, the best level since May 28. The European Central Bank on Thursday made good on promises to take bold steps to stimulate the bloc's economy by taking interest rates into negative territory. It's the first time a major central bank has taken such a step. (Denmark experimented with a negative rate but dropped the measure in April.) ECB President Mario Draghi announced the the deposit rate would be adjusted to -0.10%, that is, banks will have to pay 0.1% interest to the ECB on funds held there. Before, the ECB paid zero interest on the money parked in its vaults, but that did not stop financial institutions from hoarding it. The thinking behind forcing banks to pay for the privilege, is that it would prompt greater lending to their customers and inject money into the real economy. The US Federal Reserve has also played around with the idea to alter the interest rate it pays on reserves held on behalf of commercial banks in an efforts to minimize the impact of the tapering of its stimulus program, but US financial institutions warned that a reduction in the 0.25% rate would be passed onto consumers. The ECB's move to fight "unacceptably low inflation" in the Eurozone predicted at just 0.7% this year may be followed up later by a fully-fledged quantitative easing (QE) program similar to the one in place in the US since end-2008: "We think (what we've done is) a significant package. Are we finished? The answer is no. We aren't finished here. If need be, within our mandate, we aren't finished here," said when asked why there was no announcement on QE on Thursday.

The Bank of Japan may hit the gas again on its ongoing stimulus program and if the ECB goes ahead trillions more will be added to all the easy money already sloshing around on global financial markets. While asset purchases under the Fed's quantitative easing program is expected to be wound down by end-2014 after pumping $4.2 trillion into the US economy, a rise in interest rates is at least a year away. Monetary expansion in the US and around the globe, particularly since the financial crisis, has been a massive boon for the gold price. Gold was trading around $830 an ounce before then Chairman Ben Bernanke announced Q1 in November 2008. Gold is up some 8% in 2014, but down more than $100 an ounce from its year-to-date high struck mid-March. |

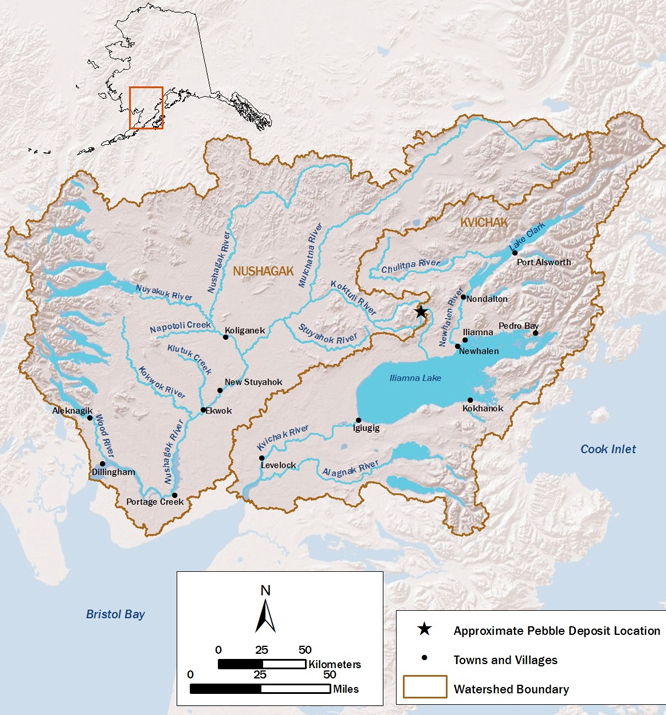

| Alaska to join Pebble Partnership in lawsuit against EPA over mine project Posted: 05 Jun 2014 11:54 AM PDT  Bristol Bay region in Southwest Alaska | Image by Nick Hall, Bristol Bay Alliance. The State of Alaska has decided to join a group seeking to develop a massive copper-gold mine by Bristol Bay in a lawsuit against the US Environmental Protection Agency (EPA) for taking steps that could result in the project being limited or plainly forbidden. Authorities are particularly critical of the EPA's decision of initiating a rarely used process under the Clean Water Act that may block development of the Pebble mine, before any permit application has been filed. "Perhaps the most troubling aspect of the EPA seeking to veto a hypothetical project before any permit application has been filed, is that it sets precedent for the EPA to take land anywhere in the United States and prematurely limit development of a valuable resource," Attorney General Michael Geraghty said in a press release. "The EPA's action undermines Alaska's ability to utilize its mineral resources to grow the economy and create jobs if, after detailed and lengthy environmental review, permitting is warranted," he added. The original lawsuit, filed by Pebble Limited Partnership, claims the agency s overused its statutory authority.  EPA says it wants to ensure the Kvichak and Nushagak River watersheds are protected from "unacceptable impacts" from mining. EPA Administrator Gina McCarthy said in February that the agency started the process because the Bristol Bay fishery "is an extraordinary resource and is worthy of out-of-the-ordinary agency actions to protect it." She also stressed that no final decision had been made. Anglo American (LON:AAL) left the project last September, handing its 50% stake in the project back to Northern Dynasty and taking a $300 million write down in the process. Rio Tinto (LON, ASX:RIO) followed Anglo's steps last month, announcing it was donating its 19.1% stake in Northern Dynasty to two Alaskan charities. Opponents have long said the environmental risks of the Pebble project outweigh the benefits, citing the potential for widespread damage if polluted water were to enter streams in the region. Northern Dynasty says the mine could be developed safely, and would boost Alaska's economy with about 1,000 jobs through its operating life. |

| BHP admits mistakes in its China, iron ore strategy Posted: 05 Jun 2014 11:22 AM PDT The world's number one mining company BHP Billiton (LON:BHP) is shifting its investment strategy away from products like iron ore and coal in high demand during China's infrastructure and industrial boom towards more consumer-oriented commodities. Comments by CEO Andrew Mackenzie are in line with Beijing's stated goals of changing the world's second largest economy from investment-driven to consumer-led growth and opening up all sectors to market forces. Mackenzie told reporters in Beijing on Thursday he expects rising Chinese demand for materials with more consumer uses, such as copper, while greater food consumption could lead to more demand for the soil nutrient potash. "We see a Chinese economy gradually shifting from construction to consumption, and so, we will transition," said Mackenzie adding that "We imagine we will continue to creep our exports of steelmaking materials like metallurgical coal and iron ore, but we're much more likely to make major investments in what we feel are the next phase of China's growth in energy and in food." Mackenzie said making acquisitions is not on the radar for the $174 billion company and it may look at selling more of its units to "simplify its portfolio". Mackenzie acknowledged the Melbourne-based firm's expansion of its iron ore business "was too rapid and that it did not focus as much as it should have done on the underlying expansion of the overall business." While not as aggressive as top iron ore miners Vale and Rio Tinto in adding output, BHP is on track to up production at its newest iron ore mine Jimblebar to 55 million towards its longer term target of 270 million tonnes per annum. Despite the shift of focus, iron ore is far from being a drag on the bussines and Mackenzie expects China's steel production could rise to 1.1 billion tonnes over the next decade: "China's urbanization has a long way to run." The price of iron ore is down more than 30% in 2014, copper 8% and potash is trading 25% below last year's levels. |

| Newmont halts all operations in Indonesia, declares force majeure Posted: 05 Jun 2014 11:12 AM PDT Newmont Mining Corp. (NYSE:NEM) halted Thursday operations at its Indonesian gold and copper mine and will put 3,200 workers on leave with reduced pay from Friday, after it failed to reach a compromise with the government over export restrictions. The Colorado, US-based mining giant had stopped copper concentrate output from its Batu Hijau mine on Tuesday and warned the results of government talks would determine the future of its employees. "Despite our best efforts, we have not been able to export copper concentrate since January, and we still do not have an export permit," Martiono Hadianto, the president director of Newmont's Indonesian unit, said in the statement. "We have taken numerous steps to help resolve the export issue and support the government's desire to increase in-country smelting." The force majeure, which allows the company to miss deliveries because of circumstances beyond its control, signals Newmont does not expect a quick resolution to its dispute with the government. Indonesia banned raw ore shipments on Jan. 12 and put a tax on concentrates in an effort to spur companies to build smelters domestically. Job losses Freeport has warned previously that the export ban would force it to cut production by 60%, resulting in 15,000 job losses and costing the government an annual $1.6 billion in lost royalties and taxes. Indonesia is a key global supplier of metals and a law implemented in January banning exports of raw minerals unless companies build processing plants has thrown the industry into turmoil. Newmont and rival Freeport-McMoRan (NYSE:FCX), which operates a much larger copper and gold mine in Indonesia, both claim that the export restrictions breach their contracts of work and have been locked in negotiations with mining officials for months to find a workaround. The Batu Hijau copper and gold mine, on the island of Sumbawa Barat, began its operations in 2000. Newmont had forecasted copper concentrate output for 2014 at 110,000-125,000 tonnes before the new export rules. Image by Iso1600 | Wkimedia Commons |

| Fresh name bidding to take over 117-year old silver fix Posted: 05 Jun 2014 10:32 AM PDT Amid investigations of manipulation and price-fixing, Deutsche Bank, became the first to resign from both the London Gold Fixing and Silver Fixing panels in May. The lawsuits piling up and the ongoing probe by the UK financial regulator – and the first of what could be a slew of fines – meant that the German banking giant could not find any buyers for the seats. Talks on how to overhaul the London Gold fix which has been used as a benchmark for the global physical trade in the precious metal for the past 95 years is still under discussion. But the body responsible for administering the silver benchmark are ceasing operations on August 14 and the industry under the direction of the London Bullion Market Association (LBMA) is now scrambling to find a new price discovery and benchmarking system which traces its roots back 117 years. Deutsche Bank, HSBC Holdings Plc and Bank of Nova Scotia conduct the silver fixing each day at noon. A new system is supposed to go from being an obscure process conducted via conference call between a handful of banks to a "robust transaction-based electronic system" to set the daily spot price. There has been no shortage of parties interested in taking over the silver spot pricing mechanism, including the news and financial data provider Reuters, the LME and the Chicago Mercantile Exchange. Market information provider Platts has confirmed its interest and now London-based institutional adviser and fund manager ETF Securities has thrown its hat in the ring reports Nasdaq.com: "ETF Securities has been in talks with the London Bullion Market Association about hosting a silver benchmark for several weeks, said founder and chairman, Graham Tuckwell. ETF Securities' proposal is based on the company's silver fund, which trades on the London Stock Exchange and is physically-settled through the LBMA's clearing system. "The banks that are involved in the metal markets would put their bids and offers into the option," said Mr. Tuckwell. "It's open, it's transparent, every bid and offer that goes into the option can be audited and supervised." Silver futures in New York were last trading at $19.07 an ounce, down 2% from 2014 opening levels, after an uncharacteristically quiet trading year to date. The contract hit a high of just over $48 an ounce in April 2011, in nominal terms still below the spike to $48.70 in 1979 when US oil billionaire scions cornered the market and increased the price 8-fold over less than a year. The Hunt saga ended on Silver Thursday in March 1980 when the price halved during a single trading session and the brothers could not cover a margin call. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "African potash limited – four highly prospective drill targets identified at flagship Lac Dinga Potash Project"