Why Bitcoin's Volatility is Unique Among Commodities - CoinDesk |

- Why Bitcoin's Volatility is Unique Among Commodities - CoinDesk

- <b>Gold</b>: More Than A Real Store Of Value - Recent Evidence [ETFS <b>...</b>

- Has The S&P 500 Topped At Exactly The Same <b>Price</b> As <b>Gold</b> <b>...</b>

- <b>Gold Prices</b> To Rise on Bullish Technical <b>Charts</b>

| Why Bitcoin's Volatility is Unique Among Commodities - CoinDesk Posted: 29 Apr 2014 03:15 AM PDT

A single bitcoin broke the price of an ounce of gold five months ago. Now, it's worth less than half that – and, of the two, it's bitcoin's price that's bouncing around the most. For people trying to evaluate bitcoin's potential against other commodities, its relative price volatility could be a worry or an opportunity, depending on your appetite for risk. So, how closely can we map bitcoin's volatility against other commodities? Not very closely, argues Kirill Gourov, Director of Finance for Blocktech, a new company that creates open-source block chains for industries in need of disruption. He recently wrote a paper that explored whether there was an intrinsic value for bitcoin. Gourov pointed out that it is difficult to find a direct correlation between bitcoin and other commodities:

Copper's recent price drop looks dramatic, for example, but it represented a 9% decrease in its value. That may be considerable, but it's hardly in line with some of bitcoin's more dramatic yo-yoing. In five or 10 years, when the market is more developed, trends will be more prevalent and will force bitcoin to spike less, Krill suggested. But, today, the market is too easily manipulated. Physical vs virtualIf bitcoin's age is one factor that stops it being correlated easily with other commodities, then are there others? One of the issues separating bitcoin from other commodities is physicality, argues Antony Lewis, who works in business development at itBit. Most other commodities are used and transformed into something else, which drives certain behaviours, pointed out Lewis, who used to trade interbank foreign exchange at Barclays:

Conversely, he says, virtual currencies are bought either as a store of value or as a payment mechanism putting them in a different category to conventional commodities. Correlations existLet's not write bitcoin off as entirely separate from the commodities market, though, said George Samman, Chief Operations Officer at BTC.SX, which offers derivatives services for bitcoin traders. There are correlations today between bitcoin and at least one other commodity, Samman said, but they're only obvious if you turn them on their head. They are negative correlations, and we see them particularly between bitcoin and gold. When bitcoin goes up, gold falls, and vice versa, he suggested. Samman pointed to longer-term pricing for evidence of this effect. For example, when bitcoin rose dramatically at the end of last year, gold can be seen to fall (see chart). The linear chart shows bitcoin's price from around the time that it spiked, shortly after the financial crisis in Cyprus last year. However, the digital currency was showing slight gains on gold as far back as 2011, said Samman. Bitcoin's price doesn't seem to cross that of gold because the chart isn't granular enough, but it did. That crossover happened for a period of hours, and we're plotting closing prices at two-day intervals here. Gold's movement in relation to bitcoin might not seem that pronounced, he said, but don't be deceived. A $10 move in bitcoin wouldn't show clearly in a long-term chart because of its significant moves later on; furthermore, gold's high value makes it difficult to spot smaller price moves. Gold has been moving back up since the beginning of the year, while bitcoin has been going down, Samman added, which is clearly visible on the graph. Since then, gold has trended downwards, while bitcoin has been "semi-stable" in the mid-$400 range, he said. Samman admitted, though, that bitcoin has "bounced around" in that $400-$500 window, as would be natural for a young, relatively thinly-traded asset influenced by events such as the suspension of bitcoin trading in China by certain banks, and the perceptions around those events. Fear assetsThe link between bitcoin and gold makes sense. When the market flies from bitcoin, it has to go somewhere, and the argument goes that gold gets some of that action. If you see negative correlations in this chart, then why do they exist? It's because Gordon Gecko was only half right. Greed isn't the only factor driving financial markets: the other is fear. ItBit's Lewis calls gold a 'fear asset', and said that in time, it will make sense to compare bitcoin against the VIX. Also known as the 'fear index', the VIX is the colloquial name for the Chicago Board Options Exchange Market Volatility Index. It is a weighted blend of 30-day options across the S&P 500 index, enabling people to use it as a broad measure of volatility over the coming month. In short, when markets get wild, the VIX goes up. In the meantime, Samman is waiting for the time when he can more easily compare bitcoin's activities in a broader context, outside of commodities. He likes exploring intermarket dynamics, evaluating the performance of different asset classes such as equities, bonds, and commodities, in relation to one another. What about the longer-term opportunities for bitcoin? While we read the market's entrails looking for relatively short-term correlations now, will bitcoin and other commodities draw closer over the years? "Some people believe we are in a commodity supercycle which began around 1990, supercycles generally last 30 years, give or take, if thats the case we are likely to see another up leg in this cycle, and I think it will be caused by inflationary events," Samman said of long-term cycles in the commodity markets. Built-in scarcityIn particular, the tendency towards quantitative easing – central banks creating more money – and the spectre of rising interest rates come to bear here. "This all bodes well for bitcoin to spike again as well," he argued. Some also point to correlations between the price of bitcoin throughout its young life, and the longer-term price of gold, potentially supporting theories of long-term similarities.

Scarcity helps drive up the price of a commodity. Food prices rise when a drought chokes off supplies, for example, and bitcoin has its scarcity built in, Samman said, adding.

This scarcity is both a known and unknown quantity in bitcoin. Scarcity has a big impact on price action, which is caused by big disparities in supply and demand. Conventional commodities can be moved by external events that affect demand and supply, such as bad weather (wheat), or growing unrest in Ukraine (oil), for example. With bitcoin, there is a base level of supply which is relatively known, because it is underpinned by the mining community, which produces them at a predefined rate of 3,600 coins per day. However, bitcoin's algorithmically coded scarcity isn't the only part of the equation; just as with commodity markets, other factors come into play. With institutional miners producing bitcoins, and with large funds holding significant percentages of the digital currency, it's hard to predict what that supply will look like in the future, and when people will begin letting more bitcoins out onto the market. The same is true on the demand side. "Demand is the unknown here. We are hearing of many millions of dollars being lined up to buy bitcoin when the time is right," pointed out Lewis. Looking for liquidityIf and when the volume of bitcoin trading increases substantially, we'll see bitcoin become more liquid. Liquidity dampens volatility, because there is more of an asset moving through the system. This in turn makes it harder for people to move the market substantially with relatively small trades, or for events to move the market by spooking enough inexperienced investors into knee-jerk reactions. One thing that will help here is the build-out of more established, reliable exchanges to provide a base level of reliability and choice to the market. The other is the building up of more sophisticated services on those exchanges, such as derivatives trading. We're starting to see markets for bitcoin derivatives emerge, such as BTC.SX. More will come, said Gourov, although the market is too immature to support complex trades yet. He explained:

However, he thinks that will change: "There are several companies creating products and platforms to facilitate this as I type." Even when its price volatility smoothes out, though, the chances are that bitcoin will remain a distinctly different animal from many other assets, making it hard to see correlations with lots of commodities. For now, the cryptocurrency is a young, idiosyncratic asset all its own. As the honey badger of money, it tends to be a solitary animal, unaccustomed to moving with a herd. Graphs image via Shutterstock |

| <b>Gold</b>: More Than A Real Store Of Value - Recent Evidence [ETFS <b>...</b> Posted: 31 Mar 2014 11:35 AM PDT

I often like Barry Ritholtz's thinking. A March 28, 2014 article in Bloomberg on the long term real price of gold however, needs re-framing in a global context. Since Roy Jastram published his deservedly esteemed "The Golden Constant", gold has been viewed as a (constant) store of real value. A wealth of statistics presented by Jastram seemed to show this. An update of some of his analysis in a LBMA article by Jill Leyland has this graph:

In his article, Barry Ritholtz presents a graph from Catherine Mulbrandon of Visualizing Economics:

This chart includes the market price of gold as well as the U.S. government pegged price. Sure enough, the real gold price seems to be going nowhere in the long run; a store of value. In this SA article, I have argued that gold in fact is more than a store of value; it earns a real yield and thus gains in world purchasing power in terms of goods and services per unit. Rather than use my data, I thought I would show some relevant and interesting findings from others. A recent BusinessInsider article has this chart from Ian Bremmer of Eurasia Group showing national shares of world GDP: Now, let's consider the implications of a quintupling share of U.S. world GDP over the period of time when the USD real price of gold remained constant. The two main world economic powers were the United Kingdom and the U.S. The USD purchasing power in terms of pounds sterling remained fairly constant since 1820 before nearly tripling since the early 1900's. The purchasing power of the dollar moved much higher against other world currencies, however. Further evidence of this comes from a graph in Barsky-Summers' seminal 1988 paper on the Gold Standard Gibson's Paradox "Gibson's Paradox and the Gold Standard". Their chart of the world price index during this time is declining. Since most of the world in terms of GDP was on a fixed gold standard, the price is in terms of gold - meaning, that the purchasing power of gold in real terms, against a basket of world goods and services - rose. The inescapable conclusion is that a constant real USD gold price actually gained in world real purchasing power. Jastram and other analysts fell into the mindset of viewing gold through pricing in the two strongest currencies of the time - not in terms of world purchasing power which is what matters for an asset traded in a world market. I made precisely this critique of the gold-as-a-store-of-value belief in my eBook showing how gold is actually valued. Investment Considerations Contrary to World Gold Council research, store of value graphs and popular belief based on statistics showing the price of gold in dollars, gold obtains an increasing global real yield and return. In the long run, a unit of gold will earn in real terms exactly what other long term investments return including stocks and long bonds. The logic, match and evidence for this is beyond the scope of this brief article but is more fully discussed in the referenced book and a number of journal publications. Disclosure: I am long DUST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. |

| Has The S&P 500 Topped At Exactly The Same <b>Price</b> As <b>Gold</b> <b>...</b> Posted: 24 Apr 2014 01:56 PM PDT Chances are high that the S&P500 is in the process of making a huge top. We will discuss our rationale in this article, based on the gold to equities ratio, as well as current market conditions. The extremely interesting fact is that spot gold has topped at exactly the same level as the S&P500 top (to date, on a closing basis). Compare the following data:

The following chart shows both assets over the last three years. Chart courtesy: Stockcharts. Both assets have traded visibly inversely correlated since mid-2011:

The following chart shows looks at the gold to S&P 500 ratio in the last 100 years. Note that the red arrows and blue ovals are own additions. Chart courtesy: Macrotrends. The last three years are marked in the blue oval at the right. One of the following two statements must be true:

The second scenario would be a replay of the 70ies. Back then, the secular uptrend in gold corrected significantly and equities experienced a cyclical uptrend. As the chart points out, the cyclical trends lasted for three years. We cannot exclude the first scenario indicated above. However, we estimate the probability to be very low, in the range of 5% to 15%, based on the "set of circumstances" we see in equities and in the economy. Of course, the fact that the S&P 500 and gold have reached the same (price) level and is merely a chart observation. It does not tell anything as such. The more important point is the set of underlying market conditions. In that respect, we currently observe conditions which, in our belief, confirm the chart observation. The "set of circumstances" we discuss in the remainder of the article are related to the equities market, in particular the US, but also the broader economic context and even the monetary system. First, US equities are rising for 5 years now. Technically, the current bull market is +270 days old. This is the second longest bull run in the last 80 years, being beaten by the bull run which started in October 1990 with a duration of 406 days. Source: Standard & Poors. Second, based on the Crestmont P/E ratio, the S&P Composite is trading at very high levels, only beaten twice in the last +100 years, i.e. in 1929 and 2000. Third, margin debt in US equities is at all time highs. SeekingAlpha released an article which explains that "margin debt at the New York Stock Exchange rose to an all-time high of about $465.72 billion in February from its previous record high of about $451.30 billion in January. There is a strong positive correlation between NYSE margin debt and SPY." Although the equities bull run is currently still intact, at least from a technical perspective, the risk of speculation is getting higher as well. The more speculation, the sharper the inevitable correction. Fourth, IPO fever has popped up again, in a similar fashion as during the highs of the dot com era. According to Sentimentrader, the share of money losing IPO's (i.e., IPO's with negative earnings) stands at a remarkable 83%. This is just a hair's breadth away from the all-time record from mid-March 2000, when 84% of the companies that insiders were selling to the public could not prove their business models. Fifth, according to ShortSideOfLong, in the last 140 years, there have only been 7 prior events where markets gave investors returns in excess of 100% over 5 years. The chart below shows that 6 out of the 7 instances have led to serious corrections or outright crashes, while the one in 1956 lead to only a mild pull back. The chart also shows that equity market trends with 1.5 standard deviations above the 140 year historical mostly mark an intermediate or long term top. "The market has only ever traded at these overextended levels 8.6% of the time or 143 months in the last 140 years (with the outright majority of that during the late 1990s tech bubble)." It is very likely that the run into 2014 is going to produce another major decline.

Sixth, the following chart shows that the average small investor portfolio has a 70% allocation to stocks, a level. Although not visible on the chart, the remaining capital is evenly allocated to bonds and cash. Zero interest rate policy (ZIRP) inflates capital to risk assets, leading to asset inflation. Participation of small investors typically peaks at the end stages of a bull run. In the broader economic context, we observe some worrisome facts. Leverage in the financial system is at all time highs. As we noted earlier, "Global derivatives have a notional value of around $700 trillion (latest official BIS data from mid 2013), the highest point historically." We believe this has the potential to accelerate a downward move in whatever asset class. In that respect, we believe that the crash of precious metals in April 2013 was a shot across the bow in increasingly distorted markets, courtesy of the central bankers' policies of this world. Other asset classes will follow with the same vengeance. Meantime, the debt bubble is growing bigger, especially in the US, Japan and China. A credit crisis seems to lure around the corner. The Chinese credit bubble is showing signs of cracking. The housing market in the US is propped up mostly by speculators (think Blackrock) while the real owners of houses account for a minority in the "housing recovery" of the last years. A credit induced economic recession would be similar to the 2008 collapse. The most worrisome fact, however, lies in the monetary system. On the one hand, the central bank narrative is showing signs of cracks. As we all know, a narrative is extremely powerful … until it stops working. The insight that central bank stimulus does not contribute to productive effects in the real economy but only leads to specific asset price inflation, is spreading around. Increasingly, data out of Japan and the US underpin this insight. On the other hand, of higher importance in our view, is the cracking dollar reserve currency. It is widely accepted that the US has enjoyed an exceptional privilege having a world reserve currency. The US has been able to grow its debt mountain to a level never seen before in history of mankind because it had a universally accepted currency which was used in the most traded asset classes, in particular oil (the petrodollar). However, the end of the dollar reserve currency seems to be imminent. Based on historical standards, world reserve currencies have lived on average 27 years. Note that the current dollar hegemony is ongoing for 43 years. Prior threats to the petrodollar have been laughed away by the use of military force. The Ukrainian case, however, has the potential to become a pivot point. Clumsy sanctions against Russia by the West point to retaliation right to the core of the monetary system: the petrodollar. Russia is about to sign energy contracts with its major trading partners in non-dollar currencies. We believe this will act as a precedent, and several Asian and emerging countries will follow. It will result in a loss of trust in dollar denominated assets, undoubtedly affecting US equities. Needless to say, this should also be a major catalyst for precious metals. In the short run, we do not exclude that equities could go higher. However, several factors confirm the longer term view. We see a three double top forming, a huge trading range which is lasting 2 months (very unusual since the bull run of November 2012), and a huge distribution in the RSI and market breadth. Again, it is the combination of all circumstances described in this article, as well as the point of maturation of each, that confirm a major decline in US and European equities is very close. One could argue that the stock market will climb a wall of worry. However, that is what has been going on for five years now, and any historical standard shows that its duration is already stretched. |

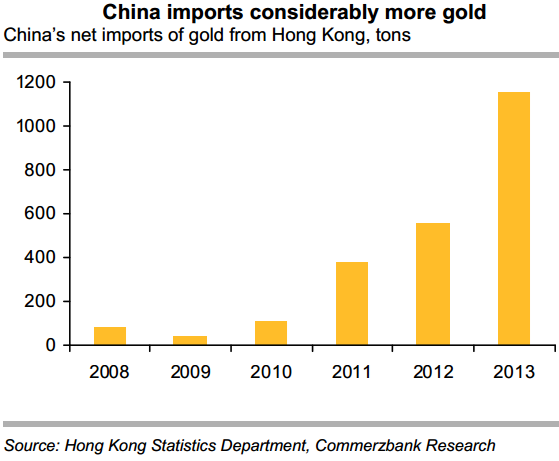

| <b>Gold Prices</b> To Rise on Bullish Technical <b>Charts</b> Posted: 22 Feb 2014 01:11 AM PST  Gold prices to rise further next week on bullish technical charts.Reuters Gold prices are set to rise further next week, supported by bullish technical charts. As many as 19 of 23 analysts polled in a Kitco Gold Survey said they expected gold prices to rise, while two predicted that prices would drop and two forecast prices to remain unchanged. Ralph Preston, principal, Heritage West Financial, listed several technical-chart points -- The double bottom lows from July and December 2013, gold rising above $1,280 and breaking the downward sloping trend-line drawn over the peaks of August at $1,430 and October at $1,375, and the metal rising above the 200-day moving average, which comes in Friday at $1,308.80, Preston told Kitco on 21 February. Adrian Day, chief executive at Adrian Day Asset Management, said the change in sentiment for gold, which compelled formerly bearish traders to scramble, also helped the metal. Kevin Grady, of Phoenix Futures and Options, said: "We continue to see tightness in the forward markets which I feel will spill over into the futures. Although the jewelers do not appear to be buying at these levels, there continues to be a bid under the market. This leads me to believe that we may be seeing some central-bank buying. "A key factor for gold this week was the release of the Federal Reserve minutes. Although the verbiage led us to believe that the current tapering plan would continue, the gold price held up under immediate pressure. The 200-day moving average comes in around $1,305. We need to hold this area for gold to attract new buyers," Grady said.  China's imports of gold from Hong Kong.HK Statistics Department, Commerzbank Research Commerzbank Corporates & Markets said in a 21 February note to clients: "The price of gold has recently climbed to its highest level since October 2013, the main reasons being a weaker dollar, speculative buying and lower outflows from gold ETFs. Last year, investors took some 900 tonnes of gold out of ETFs and contributed significantly to the slump in prices. "Strong physical demand from China in particular should continue to support the price of gold in the medium term. The January figures from Hong Kong's Statistics Department on gold trade with China, due out next week, should confirm high Chinese buying interest. That said, the potential is limited in the short term." Commerzbank Corporates & Markets said in a separate note: "For the first time since 1980, Switzerland [on 20 February] published detailed statistics regarding its gold trading activities, showing that around 85 tons of gold were exported to Hong Kong in January; this accounted for almost half of the country's total gold exports. The gold is likely to have been shipped on to China, which points to continuing high gold demand there. The Census and Statistics Department of the Hong Kong government will be reporting during the course of next week on its trading activities with the Chinese mainland. "Other major buyers of the Swiss gold were India, Singapore and the United Arab Emirates. Switzerland does not produce the gold itself, however; it imports it from other countries and then melts it down to sell to Asian buyers in smaller units. By far the largest quantity of gold (119 tons) was imported from Great Britain - part of this total is likely to have come from sold ETF holdings. This underpins the gold flow from west to east that has been underway for months now." Gold Ends Higher Spot gold inched up 0.2% to $1,324 an ounce on 21 February, down from the three-and-a-half month high of $1,332.10 struck on 18 February. US gold futures for delivery in April finished $6.70 higher at $1,323.60 an ounce on 21 February. For the week as a whole, futures added 0.38%. Bullion prices have risen over 9% so far this year as concerns about global economic growth boosted the precious metal's safe-haven investment allure. However, prices are still far below the record high of around $1,920 per ounce struck in 2011. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Why Bitcoin's Volatility is Unique Among Commodities - CoinDesk"