Spot Chart | <b>Gold</b> Up On Friday, A Sustained Rally? — <b>Chart</b> This <b>...</b> | News2Gold |

- <b>Gold</b> Up On Friday, A Sustained Rally? — <b>Chart</b> This <b>...</b>

- Trader Dan's Market Views: <b>Gold</b> Flirting with Dangerous <b>Chart</b> <b>...</b>

- Don't Ignore This <b>Chart</b>: <b>Gold</b> Miners BPI Forms Bullish Divergence <b>...</b>

- Don't Ignore This <b>Chart</b>: <b>Gold</b> at 700 was the Beginning of the End <b>...</b>

- Don't Ignore This <b>Chart</b>: Leveraged <b>Gold</b> ETFs Duke it Out on Ticker <b>...</b>

- Don't Ignore This <b>Chart</b>: Stocks, Oil and <b>Gold</b> Remain Positively <b>...</b>

| <b>Gold</b> Up On Friday, A Sustained Rally? — <b>Chart</b> This <b>...</b> Posted: 03 May 2014 04:11 AM PDT Gold prices were up on Friday, but is this a sustainable rally? Gary Wagner is on Kitco News to talk about the charts and where he sees the metal headed. "Everybody was eyeing the nonfarm payroll report that came out this morning," he says. "Last time we spoke, I was looking for the beginning of a sustained rally in terms of the gold market…to be honest, I've been disappointed." Wagner also comments on the silver market and shares some of his key technical trading tools with the viewers. Tune in now to learn more about trading, the gold market and more! Kitco News, May 2, 2014. Join the conversation @ The Kitco Forums and be part of the premier online community for precious metals investors:http://kitcomm.com – Or join the conversation on social media: @KitcoNewsNOW on Twitter: http://twitter.com/kitconews — Kitco News on Facebook: http://facebook.com/kitconews — Kitco News on Google+: http://google.com/+kitco — Kitco News on StockTwits:http://stocktwits.com/kitconews |

| Trader Dan's Market Views: <b>Gold</b> Flirting with Dangerous <b>Chart</b> <b>...</b> Posted: 01 May 2014 09:44 AM PDT Gold has once again fallen into a support region on the charts which continues to gain in importance as it is being tested yet again. The more it is tested, the greater the chance of it breaking for each test begins with the top side of the range moving lower, first from near $1400, then from just above $1320 and most recently from slightly above the $1300 level. Resistance is moving lower and lower but thus far the $1280 level has held. Bulls have their backs up against the proverbial wall therefore as we head into tomorrow's big payrolls number report. Any strong number is going to break their backs. If the number comes in weak, they will have dodged a bullet yet once more. Were it not for this report due out tomorrow, I do not believe $1280 would have held today. Bears are reluctant to press it further due to the volatile nature of these recent jobs reports. They do not want to take the chance of getting blindsided by another miserable number. Bulls however are in serious trouble if the number is strong as that will remove yet another leg of support under their already wobbly stool. Out of all the economic data releases that regularly hit the market, these payroll reports are the most important and most illuminating. Ultimately the health of the economy depends more on the number of people working that anything else in my view. Given the Fed's rather optimistic reading of the economy in the FOMC statement yesterday ( remember, they blamed the weather for the poor showing ), anything that confirms an improvement on the labor front will be viewed as confirmation that the QE program is on track to be phased out entirely before this year is out. In looking at the chart, note that gold has not yet had a CLOSE below $1280 since February. It has closed right at that level or just barely above it, but has always managed to bounce higher. A good part of this has been due to geopolitical concerns involving the Ukranian situation. While that factor remains in play, it seems to be fading from traders' minds as the turmoil looks to remain localized in that region ( for now ). That makes tomorrow's report all the more critical to gold's fortunes moving ahead. Let's see what we will get. Grains are weaker again today as those weather forecasts look much more conducive to planting prospects this weekend and into next week. Also, soybean export sales were terrible as the high prices appear to be doing their work at rationing demand. Funds are big longs in both the corn and beans so this will bear watching. Thus far they have been buying dips and keeping prices supported but if their computers shift into sell mode, watch out. Again, this has not yet happened however as the pattern of late has been for them to come charging back in just ahead of the closing bell. We'll see if that is the case today or not. New crop December corn seems to have run into a temporary wall just shy of the $5.20 level. New crop November beans have done the same near $12.50. Currencies are rather subdued today - again, I suspect this is due to the upcoming payrolls report tomorrow. No one wants to get too aggressive ahead of it. Some good news, at least for consumers and some businesses, gasoline prices have fallen back below the $3.00 level wholesale. They have lost almost $0.20 over the last week. We should see a bit of relief showing up the pump shortly as a result. |

| Don't Ignore This <b>Chart</b>: <b>Gold</b> Miners BPI Forms Bullish Divergence <b>...</b> Posted: 24 Oct 2013 08:33 AM PDT October 24, 2013 at 02:33 PM | The Gold Miners ETF (GDX) got a nice bounce the last seven days with a break above the late August trend line. Even though the big trend remains down, the short-term trend is now up with this small breakout. Longer-term, a potential double bottom is taking shape with the August highs marking key resistance. The indicator window shows the Gold Miners Bullish Percent Index ($BPGDM) holding above its prior low and forming a bullish divergence. Click this image for a live chart |

| Don't Ignore This <b>Chart</b>: <b>Gold</b> at 700 was the Beginning of the End <b>...</b> Posted: 12 Mar 2009 08:55 PM PDT March 13, 2009 at 02:55 AM |  Click here for a live version of this chart. Click here for a live version of this chart.The S&P 500 Index (yellow line) hit its most recent high in early October of 2007 (red arrow). Since then it's been all downhill. Were there any clear warning signs before the plunge began? It's interesting to compare $SPX to $GOLD (the red line). After creeping upwards consistently (on a log scale chart) since early 2001, gold spiked up to 715 in mid-2006 but quickly retreated back to its normal uptrend line. However, gold's rate-of-increase increased as soon as it crossed 700 the second time in late August (blue vertical line). $SPX began its fall soon afterwards. Last November $GOLD retreated back to 705 before rallying again in the face to more bad economic news. This suggests that the 700 level is important for both stocks and gold. $GOLD probably needs to move below 700 in order to $SPX to begin a sustained recovery. |

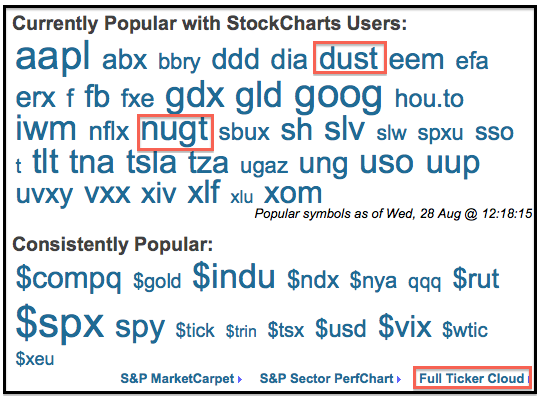

| Don't Ignore This <b>Chart</b>: Leveraged <b>Gold</b> ETFs Duke it Out on Ticker <b>...</b> Posted: 28 Aug 2013 09:32 AM PDT August 28, 2013 at 03:32 PM | Want to see what's hot today? Check out the ticker cloud on the home page. The bigger the symbol, the more popular the chart. As you can see, the Direxion Gold Miners Bull 3X ETF (NUGT) and the Direxion Gold Miners Bear 3X ETF (DUST) are quite popular today. There suggest that there is not much middle ground on gold: chartists are either raging bulls or raving bears. |

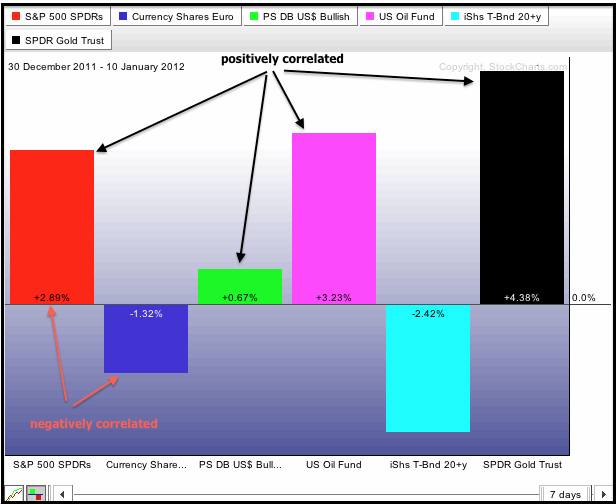

| Don't Ignore This <b>Chart</b>: Stocks, Oil and <b>Gold</b> Remain Positively <b>...</b> Posted: 11 Jan 2012 01:14 PM PST January 11, 2012 at 07:14 PM | The PerfChart below shows six intermarket related ETFs. The S&P 500 ETF (SPY), US Oil Fund (USO) and Gold SPDR (GLD) are positively correlated as all show gains in 2012. In an interesting twist, the Euro Currency Trust (FXE) and the S&P 500 ETF (SPY) are negatively correlated in 2012. SPY is up and FXE is down. Will this negative correlation last? |

| You are subscribed to email updates from gold chart - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Spot Chart | Gold Up On Friday, A Sustained Rally? — Chart This ... | News2Gold"