Silver prices | Spike for <b>Silver Prices</b> Ahead? This Options Activity Suggests So <b>...</b> |

- Spike for <b>Silver Prices</b> Ahead? This Options Activity Suggests So <b>...</b>

- Attention <b>Silver</b> Traders: Increased Volatility Is Coming (SLV,SLW)

- <b>Silver</b> Still Trading Sideways, but Lack of Volatility Promising for <b>Prices</b>

| Spike for <b>Silver Prices</b> Ahead? This Options Activity Suggests So <b>...</b> Posted: 08 May 2014 10:55 AM PDT In a pattern that has become all too common in recent weeks, the market averages went one way and the screening data went the other. Click here to download complete report in pdf format (Professional Edition Subscribers). Try the Professional Edition risk free for thirty days. If, within that time, you don't find the information… Indications are mixed. The law says the trend is your friend. It also says somewhere that the more often resistance is tested, the weaker it becomes. When in doubt, resort to slogans. I learned that from watching financial TV. Click here to download complete report in pdf format (Professional Edition Subscribers). Try the Professional Edition… Gold's weakness yesterday and this morning leaves the 13 week cycle in a weak sideways up phase, a structure that usually has bearish implications. Click here to download complete report in pdf format (Professional Edition Subscribers). Try the Professional Edition, including this Precious Metals update risk free for thirty days. If, within that time you… Cycle screening measures continued the whipsaw theme of this market, failing to follow through on 2 days of weakening. Here we sit, trying to interpret rangebound reactive trading to news noise, when the best thing to do might be to just shut up until the market finally stages a confirmed jailbreak. Instead, I'll take a… Gold continues to trade in a tight range below a key benchmark that needs to be cleared for the uptrend to resume. Click here to download complete report in pdf format (Professional Edition Subscribers). Try the Professional Edition, including this Precious Metals update risk free for thirty days. If, within that time you don't find… Finally, Monday's weakness in cycle screening measures foreshadowed a weak day for stocks on Tuesday. That caused additional weakening in the cycle screens with important implications about both the short term and possibly the intermediate term. Click here to download complete report in pdf format (Professional Edition Subscribers). Try the Professional Edition risk free for… The market has failed a test of the high and fallen back from resistance at 1890. Short term cycles and 13 week cycle indicators have edged to the sell side. Upside cycle projections are no longer on the table for the time being. Click here to download complete report in pdf format (Professional Edition Subscribers).… |

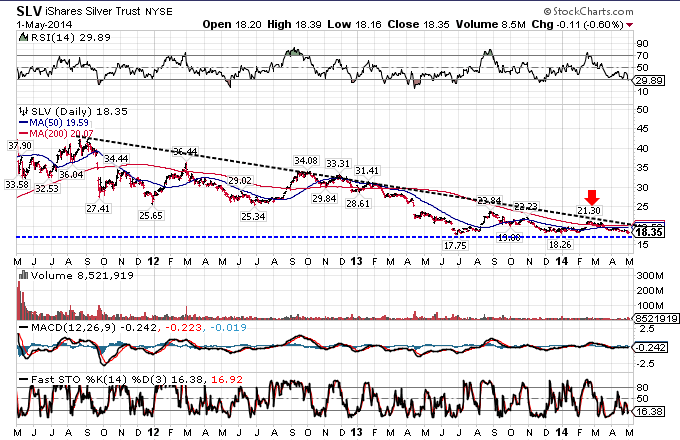

| Attention <b>Silver</b> Traders: Increased Volatility Is Coming (SLV,SLW) Posted: 06 May 2014 03:40 PM PDT For those who may not closely follow silver prices it may come as a surprise to learn that 2013 was the worst performing year in more than three decades. Prices fell an astonishing 36% before finding support near $18.50. Since July 2013, the story has been one of extreme volatility. The bulls managed to send the price above $25 in early September only to see it drop back toward $18.75 by the end of the year. The start of 2014 looked promising for the bulls and again the price was able to make its way back to $22. Unfortunately, weak investment demand and slower global growth have driven prices back down to $19. For traders the question now is whether the price is going to bounce higher off its defined support level or if this is the beginning of a long-term move lower. For more, check out A Silver Primer Easy Access To Silver Many traders are not at the level where they feel comfortable to open a futures account. Luckily, the iShares Silver Trust ETF (NYSE:SLV) was created to closely track the price of silver and act as an inflation hedge. The fund is a popular tool for those who want to invest in silver but not physically hold it. As you can see from the chart below, prices have fallen sharply over the past few years, but have managed to find support near $18 (blue dotted line). The period of consolidation since July 2013 suggests that the market is near equilibrium and the bulls and bears are currently fighting over what the direction of the next leg will be. For more, check out Technical Analysis: Introduction. The declining 200-day moving average (red line) currently suggests that the long-term trend will remain downward. As you can see from the chart, the bulls were unable to see a sustained breakout when the price moved above the 200-day moving average in February (red arrow). The immediate downward reaction shown by the bounce off the nearby long-term descending trendline suggests that the bears are in control of the direction and that it will require a fundamental shift to move prices higher. Notice how the price is nearing the intersection between the descending trendline and the long-term support level (blue dotted line). This suggests that volatility will likely increase dramatically over the coming weeks and only those who can handle extreme risk should be trading in silver-related assets.

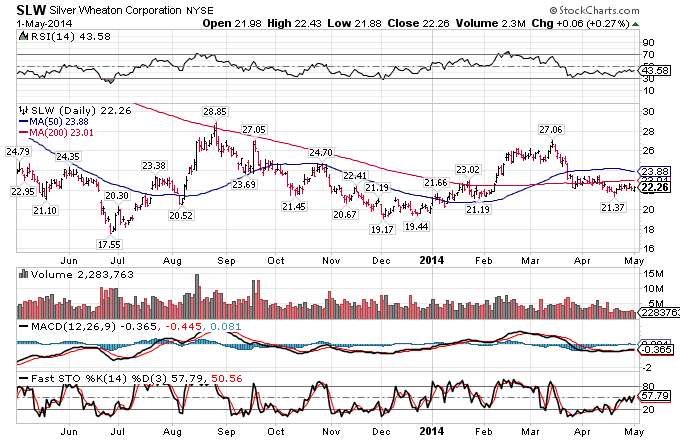

Increasing Exposure To Silver Mining companies that generate revenue primarily from the sale of silver may be another venue for traders looking to take advantage of increased volatility. One of the biggest players in the space is Silver Wheaton Corp. (NYSE:SLW). Taking a look at the chart you'll notice how declining silver prices have weighed on the company's share price. The nearby resistance of the 50-day and 200-day moving average suggest that the next move will be lower. In the event that the price of silver falls below key support levels (shown by the blue horizontal line) then traders would watch for prices of companies such as Silver Wheaton to make a move lower. For more, see The Best Way To Buy Silver

The Bottom Line So far in 2014 the price of silver has managed to increase 12% and then give it all back. With the spot price of silver nearing the intersection of a declining trendline and a long-term support level, traders are likely to suggest that volatility is on its way over the coming weeks. If the bears continue to dominate the direction it wouldn't be surprising to see companies such as Silver Wheaton continue to lead the way lower. Disclosure: At the time of writing, Casey Murphy did not own any shares of companies mentioned in this article.

|

| <b>Silver</b> Still Trading Sideways, but Lack of Volatility Promising for <b>Prices</b> Posted: 08 May 2014 04:45 PM PDT Articles Return to Article Directory Last week, Silver Investing News quoted Gold Seek's Chris Mullen, who accurately summed up silver's recent price action with the comment that it "continues to attract selling at the $20 level and buying near the $19 level meaning its boring range bound trading pattern continues." Unfortunately, that trend continued this week, with the white metal trading in a fairly small range of $19.12 to $19.68 per ounce. While fans of silver no doubt hoped for a better performance, it was fairly clear even on Monday that this week would be a bit of a write off. Though the precious metal reached $19.67 that day, bouncing back from Friday's weakness, Ole Hansen, head of research at Saxo Bank, told Reuters, "the move so far has not been convincing, so we're still not sure whether it will stick." Indeed, it did not. Though silver managed to keep above $19.40 for all of Tuesday, supported by tension caused by the deaths of 30 pro-Russia separatists in a conflict with Ukrainian government forces, it took a fall on Wednesday, ultimately closing at $19.29. That decline continued fairly steadily today, with silver sinking as low as $19.12 on the back of reduced concern about Ukraine, as per Investing.com. Silver ended today at $19.15. Sideways movement not to last? Fortunately, silver's sideways movement is not likely to last much longer, at least according to Mike McGlone, head of US research at ETF Securities. He told Kitco News earlier this week that 30-day silver options volatility was sitting at about 12 percent at the end of the day on Tuesday, quite far off from its usual level of 30 percent or so. That's significant, he said, because "[v]olatility is always mean-reverting, so when volatility is that low, [prices are] ready for a big move." Of course, that big move won't necessarily be up. However, McGlone thinks "the path of least resistance is up," largely due to the high gold/silver price ratio, strong retail investment demand and increased fabrication use. "Something has to give," he concluded, "the question is where, when and how." Company news Vancouver-based SilverCrest Mines (TSX:SVL,NYSEMKT:SVLC) said on Monday that it has started commissioning a 3,000-tonne-per-day CCD-MC processing plant at its Mexico-based Santa Elena mine. According to N. Eric Fier, the company's president and COO, that's a "significant milestone in the successful development of Santa Elena and the responsible growth created by the 'phased approach' business plan of the Company." Tahoe Resources (TSX:THO,NYSE:TAHO) capped off the week by providing its financial results for the first quarter of 2014. Its net earnings amounted to $24.8 million, or $0.18 per share, while its silver production came to 4.1 million ounces at an all-in sustaining cost of $10.25 per ounce produced, net of by-product credits. Commenting positively on the results, Kevin McArthur, Tahoe's CEO, said, "[w]e are extremely pleased with the Company's first quarter of commercial production. The ramp-up to 3,500 tonnes per day (tpd) proceeded according to plan, and despite a handful of normal startup issues, the operations team maintained operating costs within expectations." Junior company news On Monday, Tarsis Resources (TSXV:TCC) announced the completion of sawn channel sampling, mapping and rock and soil sampling at its Mexico-based Yago gold-silver project, commenting that assay results from sawn channel sampling include 3 meters grading 11.1 grams per tonne (g/t) gold and 31.6 g/t silver. That includes 1.35 meters grading 22.34 g/t gold and 36.5 g.t silver. The next day, Dolly Varden Silver (TSXV:DV,OTCBB:DOLLF) released the results from the geophysical program completed at its British Columbia-based Dolly Varden property, commenting that they "further confirm drill targets for the Company's proposed 2014 drill program." They also have led to the identification of a number of new targets. Also on Tuesday, Bayhorse Silver (TSXV:BHS) put out flotation assay results from two bulk samples from its Oregon-based Bayhorse mine silver property. They have allowed the company to essentially confirm "historic flotation recoveries in excess of 80% silver." However, with optimization, Bayhorse thinks it will be able to achieve silver recovery of 90 percent. Finally, Kootenay Silver (TSXV:KTN) said it is in the midst of planning a 3,000-meter drill program at the La Negra silver prospect in Sonora, Mexico. Drilling dates and the budget for the program will be announced in a future press release. Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article. Related reading: Frustration Rife After Yet Another Range-bound Week for Silver The Gold/Silver Price Ratio is Out of Whack — What's Next? Return to Article Directory Read more articles by Charlotte McLeod+ |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver prices | Spike for Silver Prices Ahead? This Options Activity Suggests So ..."