Silver prices | Short-term Investors Killed the <b>Silver Price</b>: CPM Group | Silver <b>...</b> |

- Short-term Investors Killed the <b>Silver Price</b>: CPM Group | Silver <b>...</b>

- <b>Silver Price</b> Pushed Down 2.5% In 30 Minutes | Gold Silver Worlds

- Gold and <b>Silver Price</b> Continue to Drift :: The Market Oracle <b>...</b>

| Short-term Investors Killed the <b>Silver Price</b>: CPM Group | Silver <b>...</b> Posted: 30 Apr 2014 04:30 AM PDT Articles Return to Article Directory

Released yesterday, CPM Group's Silver Yearbook 2014 calls for an average 2014 silver price of $20.37 per ounce. That's 23.8 percent lower than 2013′s average of $23.75 and significantly down from the 2012 average of $31.17. It's not, however, too far off from what many firms predicted at the beginning of the year; it's also in line with CPM's October 2013 statement that silver prices will "consolidat[e] through 2016," finding support "at an average annual price no lower than $18 an ounce" prior to that. But why doesn't CPM think prices will improve sooner? And what supply and demand factors does the firm believe support its outlook? Here's a brief overview of the answers to those questions. What went wrong in 2013? As many silver market participants are no doubt aware, the white metal earned the distinction of being 2013′s worst-performing metal. That's largely because midway through April the precious metal plunged from over $27 to about $23 following violent action in the gold market. Many believe that was caused by investor panic at the potential sale of Cypriot gold reserves. While that explains the initial crash, it doesn't shed any light on why silver prices didn't recover later in the year — or on why they haven't risen this year. Addressing that issue, CPM notes that shorter-term investors "disillusioned by the inability of silver to rise strongly following the highs reached in 2011″ are "primarily responsible" for the metal's sustained weakness. Why? Because they've moved "their funds into other asset classes like equities and real estate that [are] perceived as providing better profit opportunities." Poor demand prospects ahead — and behind Unsurprisingly, that lack of confidence from short-term investors dealt a significant blow to silver demand in 2013. Specifically, on a net basis, investment demand sank 42 percent, hitting 105.3 million ounces, its lowest level since 2008. And, states CPM, don't expect improvement this year — the firm sees net investment demand for silver falling to 86.9 million ounces in 2014. On a more positive note, silver fabrication demand rose 6.3 percent last year, hitting 865.8 million ounces, its highest point since 2007. That rise was largely due to "higher demand for jewelry and silverware and from silver's use in solar technology," as per the report. In addition, CPM notes, "[d]emand for silver also rose from chemical catalysts, brazing alloys, and biocides," helping to offset weaker demand from photography and electronics. Looking at 2014, CPM sees silver demand from electronics and batteries increasing 1.5 percent from the 2013 amount, reaching a record high of 221.7 million ounces in 2014; meanwhile, demand for silver in catalysts should rise to 21.1 million ounces. Supply to perk up in 2014 Total refined silver supply sank 2.4 percent in 2013, reaching 971 million ounces, according to CPM. That's primarily because secondary supply declined by 19 percent on the back of lower silver prices, while mine production rose just 4.1 percent from 2012, hitting 741 million ounces. Most of that mined silver came from top producers Mexico, China and Peru. Of those, "Mexico registered the highest level of growth among all producers during 2013, with output rising 9.6 million ounces from the previous year. This increase in output accounted for 32.7% of the total increase in global silver mine supply," CPM states. Canada and Russia, however, recorded declines in silver production. In terms of what's in store for 2014, CPM said silver supply should reach 977.6 million ounces, with mine supply rising further as secondary supply again declines. Interestingly, "[p]rimary silver mines are expected to make a greater contribution to silver production in the years going forward." Investor takeaway Statistics are all well and good, but what's an investor to do with CPM's information? At least to start with, it might be a good idea to keep in mind the firm's assessment of the short-term investors who've been selling their silver. CPM describes their decision to sell as "unfortunate … because there are many economic, political, and financial problems still at large in the world, and they are likely to negatively affect stocks, bonds, and other traditional investments." As a result, "[b]uying and holding silver as partial insurance and protection against these hostile developments still makes sense, and represents part of a sound investment strategy." The implication, then, is that investors should think of silver as a long-term investment. That means buying when prices for the metal are low, not shying away; indeed, states CPM, last year longer-term investors did exactly that, treating the weakness in silver prices as a buying opportunity. If the firm is correct and we're due for another few years of price consolidation, opportunities are likely to be rife for exactly that type of purchasing. Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article. Related reading: Silver Outlook: Analysts See Silver Around $21 per Ounce in 2014 Silver Hit Hard in Gold Market Crash Top 10 Silver-producing Countries in 2012 Return to Article Directory Read next article Silver Sinks on Back of US Commerce Department Data Read more articles by Charlotte McLeod+ |

| <b>Silver Price</b> Pushed Down 2.5% In 30 Minutes | Gold Silver Worlds Posted: 01 May 2014 11:05 AM PDT At 8 o'clock sharp New York time, the price of silver took a dive of 2.5% in a matter of minutes. As the chart below shows, one 30 minute bar had a high $19.20 and low of $18.70. The chart shows that the price went down on very big volume. Apparently a big seller was in a hurry to move the price, as the price was pushed down to exactly the bottom (silver has touched 18.70 three times in the last 12 months). Meantime, the price has recovered, as the chart shows. However, silver is hovering at a critical price level, as we'll explain below. This is the silver price chart for July silver, on the 30 minute chart, courtesy of Barchart.

Up until now, silver has held at $18.70. From a chart perspective, however, three touches make an asset "ripe" to start trending. That's why we consider this price level critical, and, maybe, today's seller as well. Silver has been rather weak lately:

It is mandatory that silver hold $18.50, otherwise chances are high that it will go lower short and mid term. |

| Gold and <b>Silver Price</b> Continue to Drift :: The Market Oracle <b>...</b> Posted: 02 May 2014 12:06 PM PDT Commodities / Gold and Silver 2014 May 02, 2014 - 03:06 PM GMT By: Alasdair_Macleod

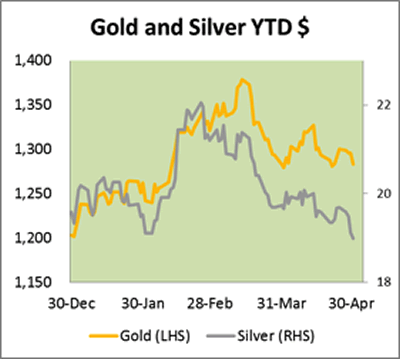

Underlying physical supply is very tight, and GOFO ("The Gold Forward Offered Rate") in London has now been negative every day since 3rd April 2014. Chinese demand measured through Shanghai Gold Exchange deliveries appears to have slackened after a very strong start to the New Year. However, it is not clear whether it is because of lower demand, or alternatively a reluctance among the large Chinese banks to bid up for physical in London. I suspect the latter may be the case, because the Chinese have always bought gold when bullion is available and have never chased the price up. While on the subject of China, the IMF ("International Monetary Fund") announced this week that on a purchasing power basis China is overtaking the US as the largest economy. Her latent power to purchase more precious metals is now far greater than for any single other nation, given a savings rate in excess of 40%; so any concerns about her dwindling demand are essentially short-term. Meanwhile silver has been very weak, as can be seen in the introductory chart, giving up all this year's gains and taking the gold/silver ratio to an exceptionally high 67 times. Interestingly, it appears that silver bullion has been disappearing from the markets at an extraordinary rate <http://www.silverdoctors.com/the-decline-in-shanghai-silver-stocks-picks-up-speed/> , with stocks at the Shanghai Futures Exchange falling from 1,123 tonnes a year ago to 258 tonnes today. Comex stocks have also declined by 218 tonnes since the end of February. Nobody seems to know why this is so, but the most likely explanation is that industrial users are stockpiling the metal as inventory at these ultra-low prices. It is also possible the Chinese government is adding silver to its own strategic reserves. The broader market background to precious metals is extremely unusual. The Federal Open Market Committee ("FOMC") statement was accompanied by the biggest GDP miss in a long time: first quarter GDP consensus was forecast to have slowed to 1.2% annualised, but actually came in at only 0.1%. Furthermore, it is becoming clear that subsequent revisions, particularly from disappointing construction orders in March, will take the GDP number firmly into negative territory. Yet the FOMC stated "Information received since the Federal Open Market Committee met in March indicates that growth in economic activity has picked up recently……" While the Fed is whistling to keep its spirits up low, US Treasury yields are signalling a financial system awash with liquidity and a reluctance to invest in production. The ten-year Treasury bond yields only 2.63%, and even more extraordinary, Spanish 10-yr sovereigns are at 2.99%, Italian 3.05% and Ireland's only 2.81%. Bearing in mind that government indebtedness everywhere has escalated at the fastest rate in history excluding during major war, there should be a substantial risk premium for this debt. The logical explanation for a flight into financial assets and cash can only be a stalling US economy. Corporates are very active in bond markets, but they are only refinancing existing debt. It really feels like the money bubble is poised on the edge of an economic chasm. Not falling into it involves throwing yet more money at the problem, which will eventually persuade western investors to buy gold and silver. Next week's announcements Alasdair Macleod Head of research, GoldMoney Alasdair.Macleod@GoldMoney.com Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online. © 2014 Copyright Alasdair Macleod - All Rights Reserved © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver prices | Short-term Investors Killed the Silver Price: CPM Group | Silver ..."