Spot Chart | <b>Chart</b> of The Week - <b>Gold</b> - INO.com | News2Gold |

- <b>Chart</b> of The Week - <b>Gold</b> - INO.com

- Fourth Reversals in The <b>Gold</b> and Silver <b>Charts</b> :: The Market Oracle <b>...</b>

- <b>Gold</b> and silver – 2014 coud be a yawner; be prepared for a surprise

- <b>GOLD</b> MONTHLY <b>CHART</b> – Technically Bearish! | Mentor Pelaburan <b>...</b>

| <b>Chart</b> of The Week - <b>Gold</b> - INO.com Posted: 14 Apr 2014 12:00 PM PDT Each Week Longleaftrading.com will be providing us a chart of the week as analyzed by a member of their team. We hope that you enjoy and learn from this new feature. After a week where we saw a correction in stock index futures, we will be looking at June Gold Futures (NYMEX:GC.M14.E) to receive a possible flight-to-safety bid. The focus remains on the Russia-Ukraine conflict, where the prospect for violence is extremely high. This shifts the gold market's focus from physical commodity fundamentals to safe haven issues. Further Russia-Ukraine tensions or continued pressure on stock index futures can provide an influx of buyers in the gold market. On the technical side, gold has shown a lot of strength after rebounding from its April 1, 2014 low of 1278.3. Last Friday's session was relatively quiet, consolidating and trading within the previous day's range between 1324 and 1310.8. For this reason, along with multiple fundamental catalysts, I would be a buyer in June Gold futures and look for it to reach $1350.00 in the near future. For a swing trade, I would be a buyer if the market retraces down to $1324.00, last Thursday's high print. If filled, I would look to place a stop below Friday's low of 1314.7 and roll it up accordingly to mitigate risk. To take advantage of this move with a long-term viewpoint, I would look to purchase relatively inexpensive call options and option spreads where risk on the position is limited to what you pay for the option. I advise clients on trading futures and futures options markets on a day to day basis. If you have any questions regarding this chart or questions regarding trading futures and futures options, feel free to call me directly at 888-272-6926. Thank you for your interest, ** There is a substantial risk of loss in trading futures and options. Past performance is not indicative of future results. The information and data contained in this article was obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Information provided in this article is not to be deemed as an offer or solicitation with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this article will be the full responsibility of the person authorizing such transaction. |

| Fourth Reversals in The <b>Gold</b> and Silver <b>Charts</b> :: The Market Oracle <b>...</b> Posted: 14 Apr 2014 07:01 AM PDT Commodities / Gold and Silver Stocks 2014 Apr 14, 2014 - 11:01 AM GMT

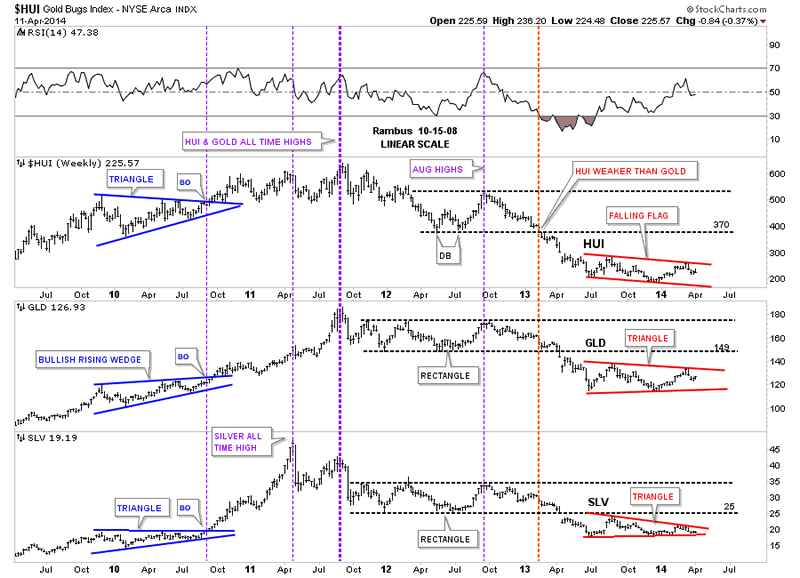

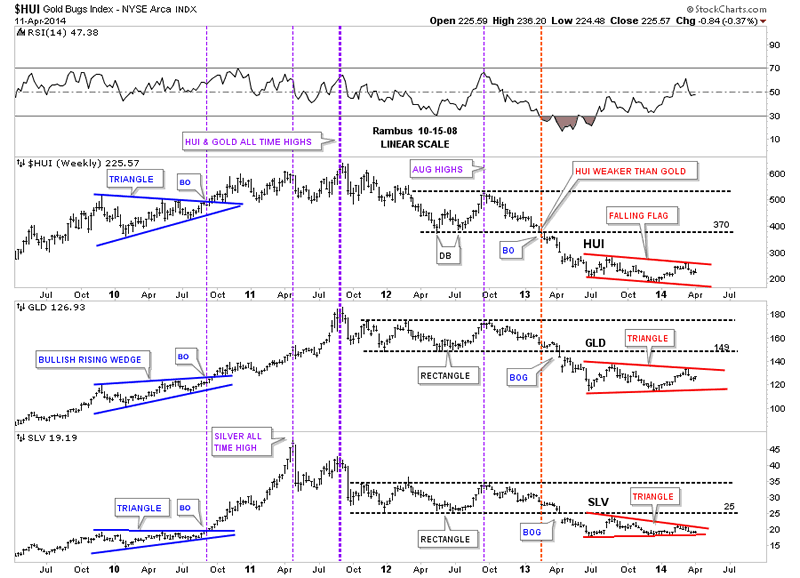

Before we look at some of the precious metals stocks I want to show you a combo chart that puts everything into perspective and gives you a feel for where we are in the intermediate term time frame. This combo chart has the HUI on top, GLD in the middle and SLV on the bottom. First I want you to look at the left hand side of the chart where you see that the HUI and silver each formed a blue triangle while gold formed a bullish rising wedge. Each consolidation pattern took the same amount of time to build and all three broke out together, first purple vertical dashed line. Note the impulse move out of the blue patterns that show SLV leading the way higher as GLD and the HUI had a backtest while SLV didn't. Here's where it gets interesting. As you can see SLV rallied straight up to its bull market top way ahead of the HUI and gold that were lagging behind, second thin purple vertical dashed line. After a few months of consolidation it was gold's turn to go parabolic and make its bull market high in September of 2011. The heavy purple dashed line shows where all three topped out together with the HUI and gold making their bull market highs while SLV was already in correction by falling way short of reaching its bull market top that it made back in April. What was so frustrating for those of us that were holding precious metals stocks is that they hardly moved when gold and silver had their parabolic moves higher. As you can see the HUI did in fact make its bull market high at the same time gold did but the HUI had no parabolic move up. As you can see it was more of a slightly rising horizontal type move. That had to be one of the worst times to be a gold bug, to see gold and silver go parabolic and the precious metals stocks hardly budging. I'll post this chart here so you can see the blue consolidation patterns on the left side of the chart then we'll discuss the red consolidation patterns on the right side of the chart.

Let's not fast forward to the heavy red dashed vertical line that shows how the HUI was the first of the three to really show weakness by breaking below its horizontal black dashed line first. The precious metals stocks were leading he way down. It took about another 12 weeks or so before GLD and SLV joined the party to the downside when they finally broke out of their nearly 22 month consolidation patterns with a breakout gap. As with the blue consolidation patterns on the left side of the chart our current red consolidation patterns all bottomed at the same time, late June of 2013, and have been chopping out their respective chart patterns ever since. As you can see all three are working on their fourth reversal points right now. Even though the HUI is building out a falling flag formation, which will be pretty bearish if it breaks through the bottom rail, the SLV is trading the closest to its bottom rail of its red triangle. This chart gives you the big picture look and lets you know where we stand and what to look for. One last comment before we move on. As you know reverse symmetry plays a big role in how I interpret the price action. Until something changes, I'm viewing the blue consolidation patterns, that formed on the left side of the chart with the price action going up, equal to the red triangles on the right side of the chart with the price action going down as reverse symmetry. Since the bull market top in 2011 you can see a series of lower lows and lower highs all the way down to our current price which is just the complete opposite of what we seen in the bull market years. Until we can see a higher low and a higher high the downtrend remains intact.

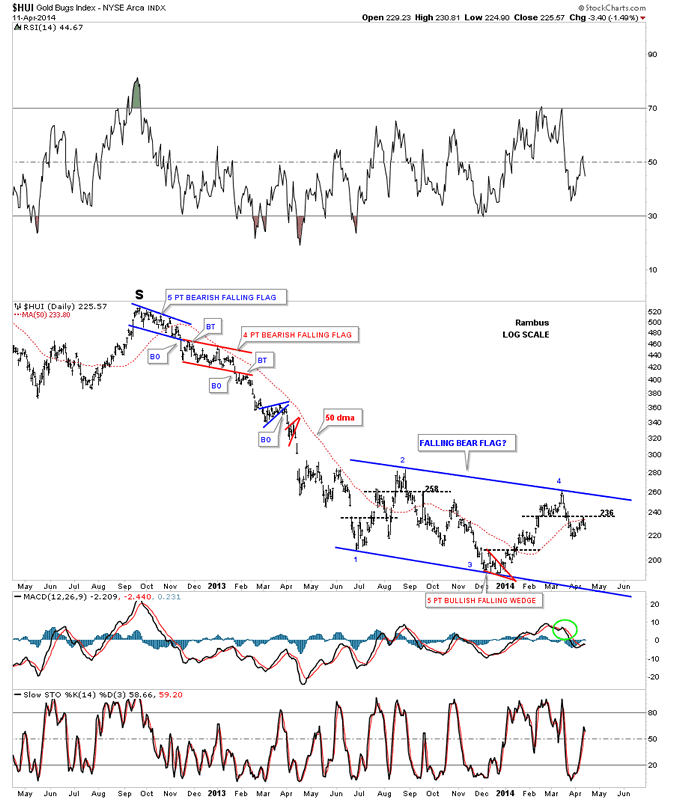

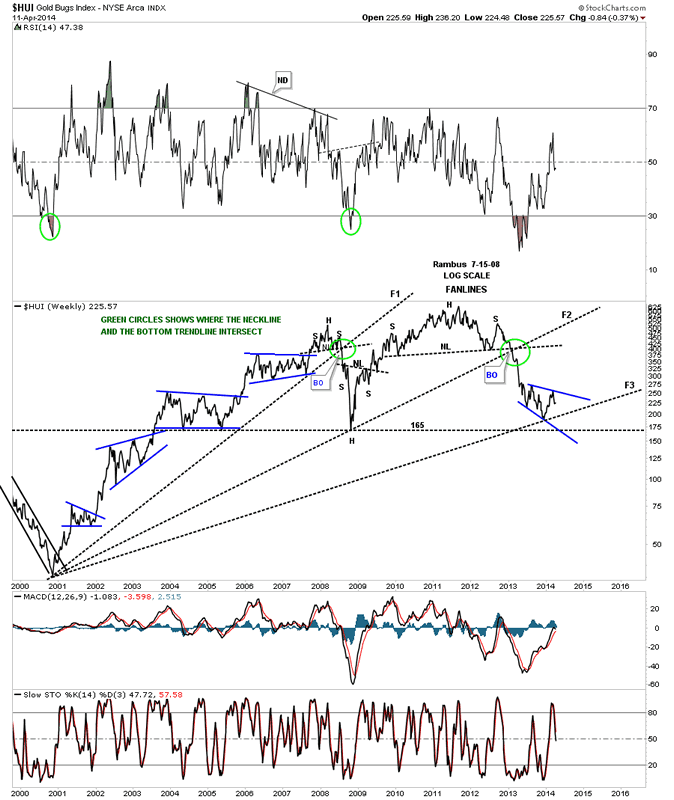

Lets take a quick peek at our red consolidation patterns starting with the HUI. Here we see the blue falling flag that is working on its fourth reversal point down. As you can see we had an important test of horizontal resistance last week at the 236 area. Also note the big impulse move down that has led to the formation of our current consolidation pattern that I will view as a halfway pattern if the bottom rail is broken to the downside. The HUI should show a similar move that led into our current blue falling flag when the price action leaves, thus this pattern will show up between the two impulse legs down.

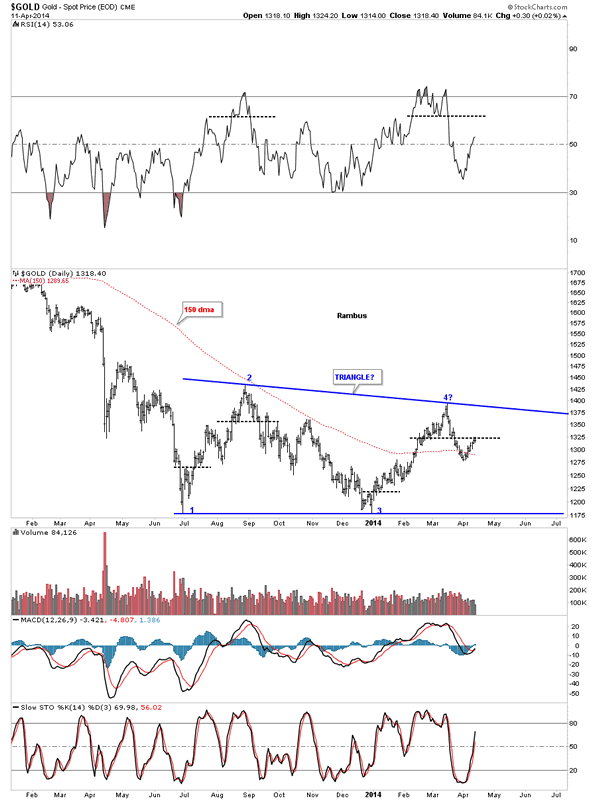

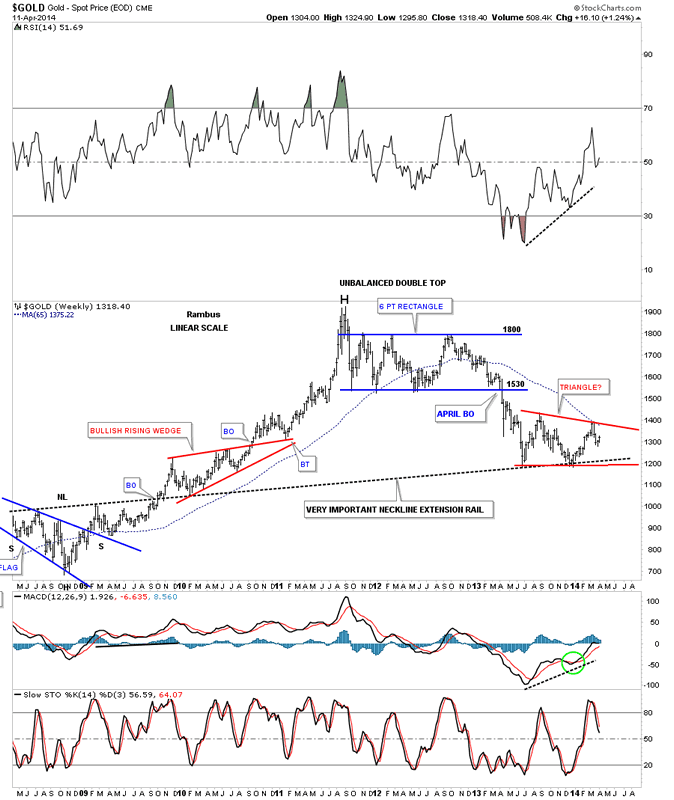

Below is gold's blue triangle that is showing the most strength right now between the three. It to is working on its fourth reversal point to the downside. Keep in mind these potential consolidation patterns won't be complete until their bottom rails are decisively broken to the downside. I expect there will be a very big down day once the possible breakouts occurs that will leaves no doubt as to what just happened.

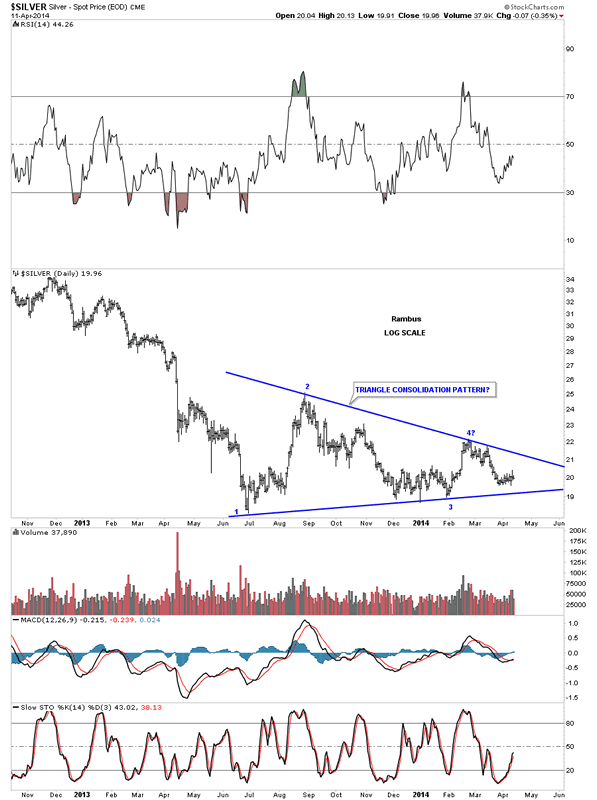

Below is silver's potential blue triangle that is trading the closest to the bottom blue rail. The 18.50 area on the bottom blue rail will be critical support.

Lets now put our blue consolidation patterns in perspective so you can see how they fit into the big picture. This first chart is for the HUI, which is a long term weekly line chart, that goes all the way back to the beginning of the bull market. Keep in mind a line chart only uses the closing price so the patterns will look slightly different. There is a lot of good information on this chart that we can use to help us understand where we are in the big picture. First notice all the blue consolidation patterns that formed during the bull market years, one on top of the other. That's a bull market folks. Next notice our massive H&S top that reversed the bull market and has led to our current price. We are now reversing symmetry down and what I believe is our first consolidation pattern to the downside with its blue counterpart on the left side of the chart. Next lets look at the fanlines which is a chart pattern. The rule of thumb is when the 3rd fanline is broken to the downside is when you get your big move. Note fanline #1 and #2 that have the green circle around where the fanline and the neckline intersect. Once that area was broken to the downside the HUI wasted little time declining in earnest. Some of our long term subscribers may remember this chart as I was showing it as we were watching the neckline and fanline #2 breaking down. A daily bar chart will show there was a small backtest to the underside of the neckline before the impulse move began.

Lets now look at gold's potential triangle and how it may fit into the bigger picture. Gold's potential triangle has formed on top of the neckline extension rail that is taken off of the 2008 H&S consolidation pattern in which I extended all the way to the right hand side of the chart. Are we seeing reverse symmetry with our current red triangle vs the red bullish rising wedge that formed in the uptrend on opposite side of the chart?

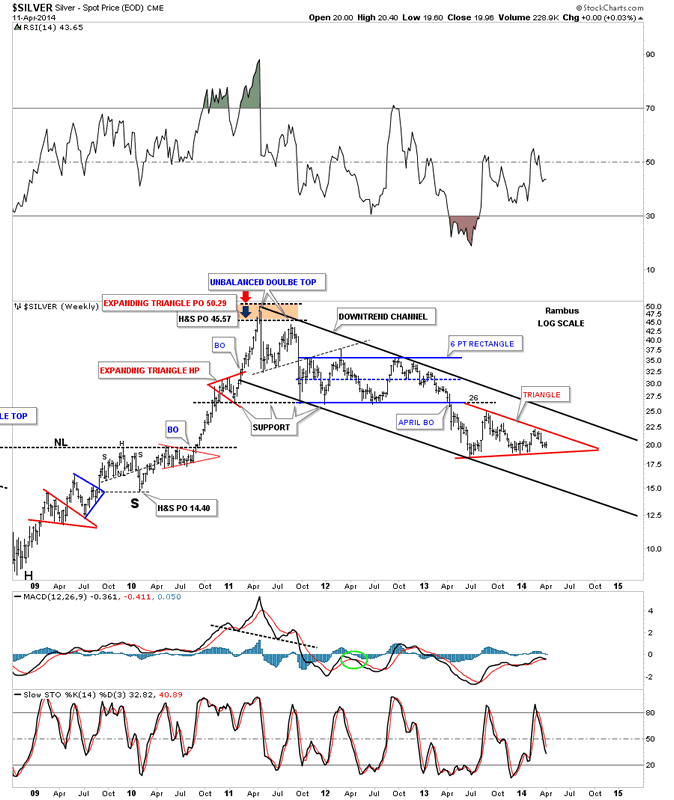

If someone can look at this weekly chart for silver and tell me silver is in an uptrend I would have to call them crazy. Just look at the price action on the left side of the chart when silver was going parabolic creating a series of higher highs and higher lows all the way up to its bull market top. Now compare that price action to the right hand side of the chart since silver topped out just under 50 in April of 2011. Silver has now completed three years of its bear market, this month, by creating lower lows and lower highs. This is basic elementary Chartology. Maybe something will happen to create a new higher high and higher low but until that happens the major trend is down and that is the best direction to trade unless you're a day trader. It's always the easiest to trade in the same direction of the major trend as it can fix a mistake if you bought at the wrong time. Just the opposite in a bull market.

So far we looked at the HUI, gold and silver potential consolidation patterns on the short term to longer term look charts. Now we need to look under the hood and see what some of the precious metals stocks are showing us to help bolster these possible consolidation patterns as having some validity. What we have forming on some of the precious metals stocks are several different consolidation patterns ranging from triangles. expanding triangles, rectangles and rising wedges Editors Note: This Portion of tonight's Weekend Report engaging the Chartology of 10 Individual Stocks is for Subscribers . In Summary There are many more charts I could post but I think you get the picture of what I'm trying to show you. By looking under the hood you can get a totally different perspective than just looking at an index. These charts give me the confidence to hang on to our game play when I know many are in doubt. So far nothing is broken from a Chartology perspective which is why we are still short. Until something changes, this is the way I will stay and hopefully we will be able to catch another big impulse move down. I believed we are positioned very well especially if these fourth reversal points hold on these nine month consolidation patterns. All the best Gary (for Rambus Chartology) FREE TRIAL - http://rambus1.com/?page_id=10 © 2014 Copyright Rambus- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. Rambus Chartology Archive © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>Gold</b> and silver – 2014 coud be a yawner; be prepared for a surprise Posted: 12 Apr 2014 09:13 AM PDT Commodities / Gold and Silver 2014 Apr 12, 2014 - 02:13 PM GMT By: Michael_Noonan

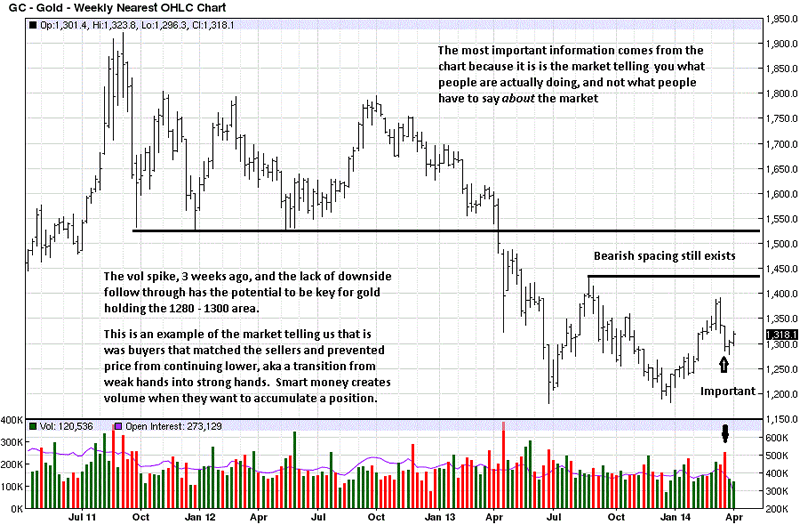

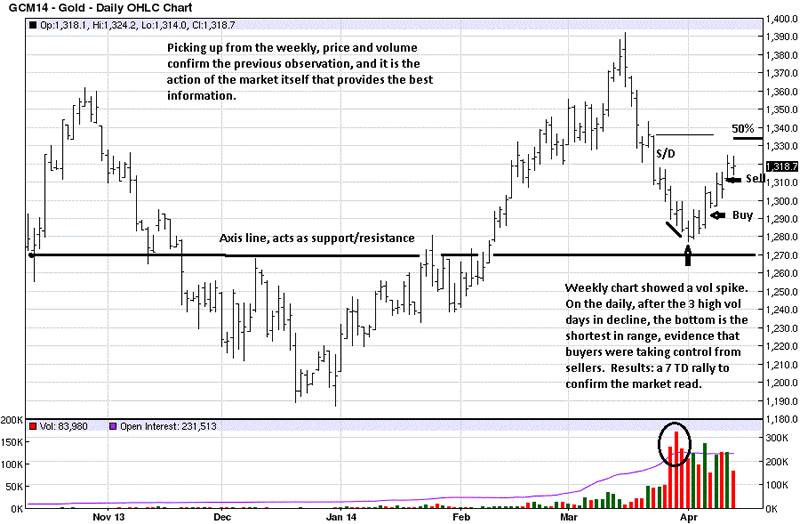

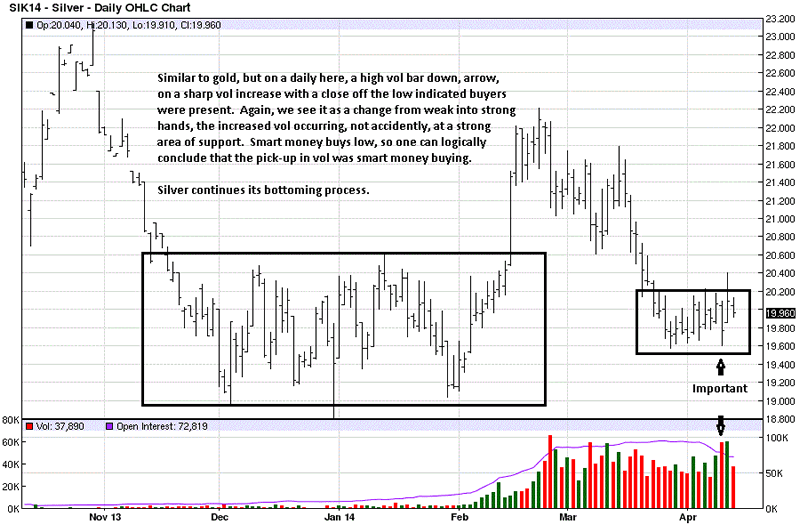

What is likely to cause a sharp price reversal to the upside for gold and silver? If both were allowed to simply adjust to inflation, you would see a fairly substantial rally. Given that will not be the case, what will be a/the catalyst for a precious metal [PM] change in trend? Could it be enormous purchases of whatever-is-available physical gold by countries like China and India? No. That has been in the works and a known fact for a few years now, and gold continues to languish near recent lows. How about prospects for a U S-prompted breakout of war? [No other country seems interested in starting one.] No. Libya failed to ignite anything, nor did the Arab Spring or the ongoing Syrian situation where the US sees chemicals everywhere, except in rebel hands. What about Iran and its "nuclear proliferation" that needs to be stopped? No. Pakistan and North Korea have nuclear capabilities well beyond that of Iran, so a nuclear threat from a country that does not have nuclear capability is another US false flag. What Iran does have that neither Pakistan nor North Korea have is oil. Wait. Are not all contracts for trade in oil based on use of the petrodollar? The first "yes!" How about the US-sponsored coup d'etat in Ukraine as an instigation for war? No. It has been well-checked by Putin, so far. Wait. Are not all contracts for natural gas trade based on use of the petrodollar? A second "yes." What about the loss of the petrodollar as a world reserve currency? Would that cause the prices for gold and silver to rise dramatically? A huge yes for that one. Come to think of it, the reason for the US-led invasion of Iraq was due to Saddam's cache of Weapons of Mass Destruction. Turns out, there were none, but Iraq did have oil, just like Iran, and both countries were selling their oil for gold, by-passing the use of the US fiat-issue petrodollar. The elites have consequences for when their rules are ignored. Iraq was invaded, and partially ruined, and Iran has been economically sanctioned Syria is not known as an oil-producing nation. True. That is not the threat to the US. What is a threat is the strategic location of a Syrian port used as an integral part for sending Russian natural gas to Europe. A successful pipeline that is not run by the US is a huge concern, especially because the natural gas coming from Russia will not use the petrodollar. Without the petrodollar standard, the US cannot export its inflationary fiat to the rest of the world. Countries that use the petrodollar hold large quantities of US treasury bonds to facilitate trade agreements. If countries, let us say like Iraq and Iran, stop basing oil trade on the petrodollar, other countries will follow suit. The elites cannot allow this to happen. Both countries are relatively small compared to the BRICS alliance, of which China is fast- becoming the world's biggest energy user. All of the BRICS nations,[Brazil, Russia, India, China, South Africa], and a host of other countries are starting their own trade agreements, and guess which country is "odd man out?" The elite's own United States. The elites cannot allow this to happen, but they cannot stop it, either. This is a problem for them. While everyone is focused on the demand side for gold, doing all kinds of calculations, trying to figure out the real number of tonnes China has purchased. Our simple answer: a lot, and the real number is of no consequence. All of the charts depicting countries purchasing gold, graphs showing the depletion of COMEX, LBMA, GLD, et al, are well done and nice to look at, but none address why the price of gold and silver are at relatively low levels, these days. Gold, more so than silver, has been purposefully suppressed to keep the fiat petrodollar propped up. The elites will stop at nothing to prevent gold from being recognized as an alternative to their Western world fiat Ponzi scheme. Why has the elite-puppet Obama been continually enabling and prompting the illegally sponsored coup in Ukraine? The US is fighting to keep the Wizard behind the curtain from being exposed for the fraud that it is. The fraud is the fiat Ponzi scheme and the utter insolvency of the entire Western central banking system. What keeps it alive, actually more on a respirator, at this stage, is the grip over the entire Western world political system which is designed to keep the masses enslaved to the debt system from which there is little hope of escape. There is a reason why there has been such a militarized build-up in the United States, used against certain countries to keep all other countries in line, lest they be next. The militarization of local police forces, with their highly armed swat teams, former military vehicles being "donated" to cities and towns. This is by elite design to have the means of keeping the masses under control, no match for the excessively armed police. This is why elite-kisser Michael Bloomberg, who has turned the NY police into a virtual private military, and why he has been busy campaigning for national gun control. A population with no means to defend itself is an easy target to keep under control. Chicago has some of the strictest gun-control laws in the nation, yet crime and death by gun is amongst the highest in this country. What will more gun controls accomplish? Nothing. Not a thing. All that needs be done is to enforce the gun laws on the books, but that would not solve the disarming of the people, which is what the corporate federal government wants in order to eliminate all forms of civil resistance. We got a little off topic re the threat of dismantling of the petrodollar, and with it the rapid fall of the United States into a third-rate country drowning in debt with no way out. The elites can ill afford to lose its primary ATM machine that feeds the top .0001% who profit by controlling all the money. All of these seemingly extraneous events are really tied into the control of the powerful and power-hungry elites. The Rothschild crowd. As was stated last week, we know of no sentence that has had a more profound effect on the people of the world than the one uttered by Mayer Amschel Rothschild, "Give me control of a nation's money, and I care not who makes the laws." [See Power Of Elites More Important Than China's Gold, 5th paragraph and the ones following as explanation.] Why is it that 2014 may be like a repeat of 2013 in failed expectations for gold and silver to reach new highs and beyond? For as long as the elites maintain their monetary power to destroy countries via their imposition of financial terrorism, [Greece, Cyprus, Ireland, Spain, et al, and now trying to gain financial control over Ukraine, in desperation. The utter inability of Germany to repatriate its own gold, to which one should ask, why is Germany not in an uproar over this? Hint: Power of the elites to keep Germany in line.], the price of gold and silver will take time to turn around. The catalyst will not be how much gold China owns. The catalyst will be the fall of the petrodollar. Once that happens, checkmate elites. Game over US. Gold and silver, rise to your natural relationship between supply and demand, no longer being artificially suppressed. The problem for now? There is no viable alternative to replace the broken fiat petrodollar scam. The Chinese have already made clear that they do not want their Yuan tied to the price of gold, and China is not really equipped yet to have their currency be a substitute world reserve, emphasis on the adverb "yet." Russia's ruble is not sufficiently held by other countries to make the ruble a reserve currency. It is in a position to grow into that status, but not in the near future. Which country has the ability to replace the petrodollar? None of which we are aware. The BRICS nations are successfully building an alternative to trade that eliminates the fiat petrodollar, and that, more than anything else in the interim, poses the biggest threat to its demise. We could see a marking of time during which all of this continues to unfold. No one has a clue as to the how or to the when, which is why 2014 could be an extension of 2013. The way in which Obama keeps prodding Russia could precipitate an event that escalates out of control, just possibly, as an example. This is why we say to watch out for weekend surprises. When people least expect, and/or are in a position to least react, some kind of announcement could be made that devalues the fiat Federal Reserve Note, still wrongly called the "dollar." A few paragraphs back, we said the there is little hope of escape. For as long as the fiat monetary Ponzi scheme exists and people remain tethered to it though debt, dependent upon government through assistance/subsistence, there is no exit. The only means, or perhaps the best means is through the buying and personally holding physical gold and silver. Both PMs represent a form of wealth that leads to independence from control of any government. This is why the Rothschilds took over this country via the Federal Reserve Act, ["Give me control of a nation's money, and I care not who makes the laws."], gained control of the money, and then once in control, had FDR make the Executive Order to have "all persons" turn in their gold under penalty of $10,000 and/or confiscation. This was also another sham that fooled people into believing an Executive Order applied to them, which it did not. But that is how the Rothschild formula works, through total deception. [We keep repeating the Rothschild sentence about control over the money supply because once you comprehend how it is the genesis for all what ails people in their own country. Governments are nothing more than instruments for elite control over the people.] These are the reasons why we keep exhorting everyone to buy gold and silver. Price is immaterial, having it is all that matters. Having gold and/or silver is what will keep you financially viable when this country falls apart, and fall apart it will. The US has been hollowed out since the Rothschild central bankers took over in 1913, in a financial coup d'etat. On a final note, before reviewing the charts, a second interview conducted by SGTReport has been posted on the site. Here is the link for anyone interested. The Rothschild IMF Bankster Fiat Death Machine. The title was selected by Sean of SGTReport, and it gives a clue to some of the content discussed. There is not a shred of evidence that the price of gold is about to embark upon a much higher trajectory. This is the value of reading developing market activity within the context of all the world news and events that potentially impact price. What the market is saying is that nothing in the news is disturbing the bottoming process. What people are saying about the market may be a different "story," but it is the market that has the final say. Pay attention to it. What we are paying attention to in this chart is the volume spike. Whenever you see a sharp increase in volume, the immediate question to ask is "why?" Remember, it is not the public that creates volume. The public reacts to it. Therefore, almost always, any increase in relative volume is indicative of "smart money" activity. When volume increased while price was declining, one would naturally expect to see more downside follow through. When the opposite happens, it is worth paying closer attention. The lack of further downside suggests buyers were overcoming sellers, shifting market composition from weak into stronger hands, and that is positive for a market trying to form a bottom.

The daily chart confirms the weekly. The read of the developing market activity prompted a buy recommendation at 1291. Because of our own trading rules, a sell, about $18 higher was made a few TDs later. Price is still under a half-way retracement from the March swing high to the recent April swing low. On the wide range bar lower, market "S/D," which indicates Supply overcoming Demand, a thin horizontal line was drawn off the high, a place where sellers will defend a retest. That high is just above the 50% mark of the trading range. The confluence of two separate indicators could make the 1235 area resistance on a rally to that area. For now, it looks like gold can be bought on breaks, based upon whatever rules one has for establishing a position in the market.

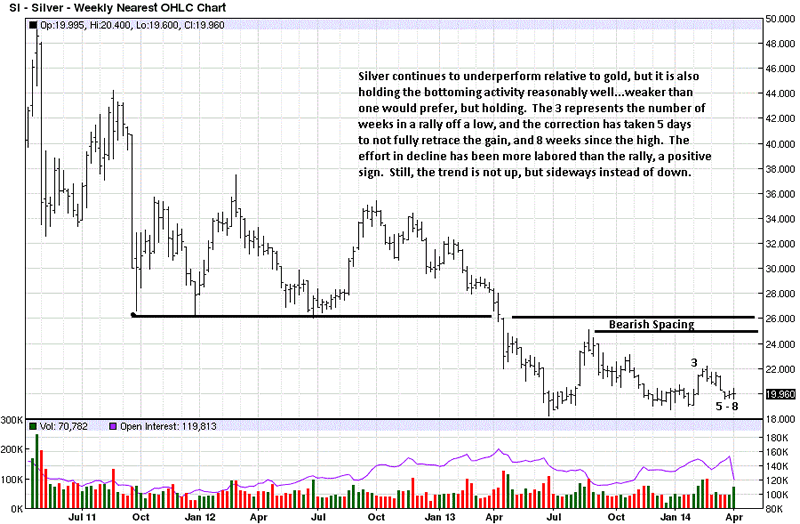

While silver is not showing signs of strength, it is showing signs of resistance to downward selling pressure. It has taken 5 - 8 weeks to correct the previous 3 week rally, shown on the chart. This tells us that even in a weakened state, silver is showing an ability to rally with greater ease than decline. Little signs like this can be the forerunner of more change to come. Preparation becomes important in order to take advantage should a buying opportunity present itself.

Here we see the importance of reading developing market activity. You look for patterns because they repeat, over and over. We discussed a volume situation in weekly gold, and here it shows up on a daily silver chart. The patterns will not always be exactly the same, for good reason, but they sure do rhyme a lot. The increase in volume at an area of support is not random. Markets are not random, except for those who have no clue about what price and volume can consistently reveal. We look for these repeating patterns to be prepared for opportunity when it strikes, for when a pattern is recognized, it is the market's way of offering an edge. The most important part of seeing these behavior patterns is to know how to respond to them as they occur. How do you know how to respond? You devise a set of trading rules that fit the pattern behavior. Everything then become a function of following your rules of engagement. Nothing is left to chance. This is how skilled professionals trade. Therein lies a message.

By Michael Noonan Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself. © 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>GOLD</b> MONTHLY <b>CHART</b> – Technically Bearish! | Mentor Pelaburan <b>...</b> Posted: 31 Mar 2014 01:26 PM PDT Hari ni hari terakhir untuk bulan Mac. So ini masa untuk profit taking untuk akaun Trading. Hari ni alhamdulillah profit bersih yang berjaya dijana USD9221.50.00. Sebahagian besar keuntungan diraih dengan posisi SELL Gold sejak seminggu lepas. MACAMANA CARA NAK DAFTAR UNTUK BELAJAR TRADING NI?Untuk belajar Ilmu Gold / Silver Futures Trading ini, anda perlu mendaftar dahulu, selepas mendaftar dan memilih tarikh, baru lah hadir ke sesi POTO yang akan diadakan di Alamanda Putrajaya bermula dari jam 10 Pagi hingga 4.00 Petang.

Ramai yang minat nak Trading, tapi tak mahu belajar cara trading yang betul. Sekadar tahu tekan butang BUY, butang SELL dan butang CLOSE, itu tidak bermakna kita dah pandai Trading dan boleh buat untung.

Ramai juga yang beritahu saya, mereka sebelum ini pernah cuba cuba trading forex, tetapi asyik rugi je. Saya tidak hairan kalau cuma sekadar cuba cuba dan selalu rugi, kerana anda trading tanpa ilmu, maklumat dan sistem yang betul. Bukan trading tu yang menyebabkan anda rugi, tetapi trader itu sendiri yang menjadikan ia rugi. Buktinya ada trader yang mahir dengan ilmu trading boleh membuat untung dengan konsisten. Sebenarnya, Futures Trading tidak berisiko tinggi. Yang menjadikan ia berisiko tinggi adalah Trader itu sendiri. Ada juga yang belum belajar dan belum tahu apa apa, tapi dah tak sabar nak Trading.

Ibaratnya, belum pandai memandu kereta dan tak pernah belajar cara memandu kereta dengan betul, tapi terus gatal gatal beli kereta dan nak cuba cuba memandu! Akibatnya memang 99% berisiko tinggi untuk eksiden lah. Walhal bukannya kereta itu yang berisiko, tetapi pemandunya yang tidak mahir memandu yang menjadikannya berisiko tinggi. CARA MENDAFTAR DAN NO AKAUN PEMBAYARANYuran sesi POTO sebelum ini adalah RM999 seorang. Jumlah tersebut adalah kadar promosi pengenalan. Bermula 10 April ini, kadar promosi pengenalan ini akan ditamatkan dan selepas itu kadar bayaran sesi POTO akan kembali kepada kadar sebenar iaitu RM1499 seorang. Walaubagaimanapun, anda masih berpeluang menikmati kadar yuran promosi RM999 ini jika pendaftaran dan bayaran dibuat sebelum tarikh 10 April 2014. Bayaran yuran POTO boleh dibuat terus ke akaun Maybank TUNE PROFIT NETWORK, No Akaun 5120 5300 6494.

Jika bayaran dibuat melalui online banking, masukkan email tuneprofitgroup@gmail.com dalam ruangan emel penerima. Setelah selesai, ambil screenshot slip bayaran / snap gambar slip bayaran dan hantar kepada saya melalui Whatsapp ke no 016 23 24 916. Selepas membuat pembayaran, anda boleh memilih tarikh yang dikehendaki untuk mengikuti sesi POTO selain hari Sabtu dan Ahad. Berikut adalah tarikh yang masih kosong utk sesi Poto pada bulan April 2014 :MINGGU 1 : 1, 2, 3, 4hb. MINGGU 2 : 7, 8, 9, 10, 11hb. MINGGU 3 : 14, 15, 16, 17, 18hb. MINGGU 4 : 21, 22, 23, 24, 25hb. MINGGU 5 : 28, 29, 30hb. BACA ARTIKEL BERKAITAN – ANALISIS TEKNIKAL HARGA EMAS 30 MAC 2014 |

| You are subscribed to email updates from gold chart - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

In this Weekend Report I would like to look under the hood of some of the precious metals stocks indexes to see what is really taking place. We'll look at a bunch of PM stocks to get a feel for where we are in the short, intermediate and long term pictures. When one just observes an index you really don't get to see, in detail, the stocks that make up that index that could be showing some important clues to the overall big picture. For instance, there are just three or four of the biggest of the big cap precious metals stocks that account for a large percentage move for say the HUI. There are many more stocks in the index but they don't carry as much weight.

In this Weekend Report I would like to look under the hood of some of the precious metals stocks indexes to see what is really taking place. We'll look at a bunch of PM stocks to get a feel for where we are in the short, intermediate and long term pictures. When one just observes an index you really don't get to see, in detail, the stocks that make up that index that could be showing some important clues to the overall big picture. For instance, there are just three or four of the biggest of the big cap precious metals stocks that account for a large percentage move for say the HUI. There are many more stocks in the index but they don't carry as much weight.

0 Comment for "Spot Chart | Chart of The Week - Gold - INO.com | News2Gold"