Gold price | Gold Mining Stocks Break Out but <b>Gold Price</b> Fails to Follow :: The <b>...</b> |

- Gold Mining Stocks Break Out but <b>Gold Price</b> Fails to Follow :: The <b>...</b>

- Will <b>Gold Price</b> See A Bullish Reversal? :: The Market Oracle <b>...</b>

- Suppressing the <b>Price</b> of <b>Gold</b>: JPMorgan Chase, Goldman and the <b>...</b>

- 2014 <b>gold price</b> rally fades as ETF investors, hedge funds exit market

| Gold Mining Stocks Break Out but <b>Gold Price</b> Fails to Follow :: The <b>...</b> Posted: 29 Apr 2014 02:10 AM PDT Commodities / Gold and Silver Stocks 2014 Apr 29, 2014 - 11:10 AM GMT By: P_Radomski_CFA

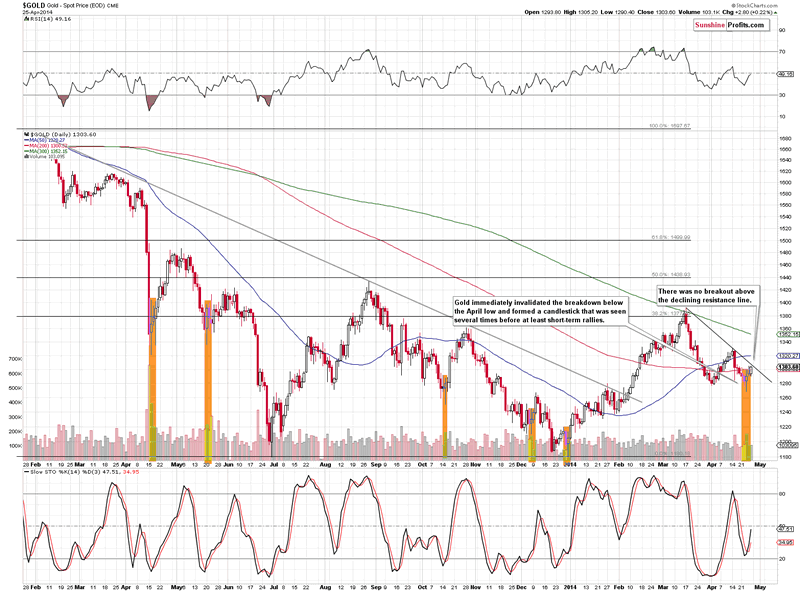

The situation in the precious metals sector remains tense - miners have broken above the declining resistance line, while gold hasn't. However, taking Friday's intraday move in the USD into account, we can say more about the gold-USD link. Let's take a closer look (charts courtesy of http://stockcharts.com).

Much of what we wrote previously remains up-to-date:

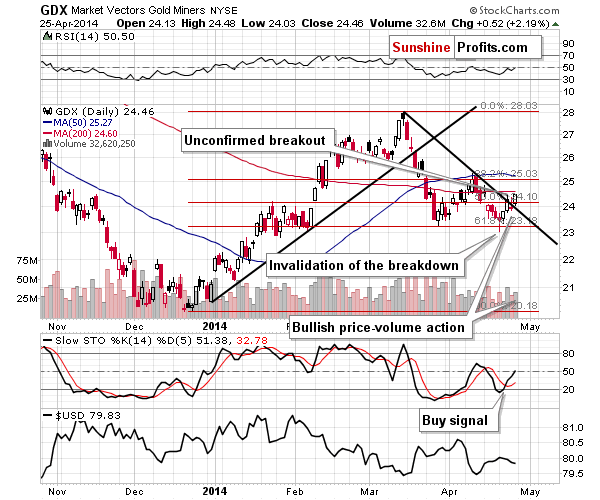

Gold has indeed moved higher, but it hasn't moved above the declining resistance line, so the short-term outlook here is rather mixed. We have already seen a short-term rally that was possible based on the above-mentioned comments, so this move might be over or close to being over. The volume was not low during Friday's move higher, but it was not high either, so the implications are rather unclear. The same goes for the silver market, the situation is a bit more bullish than not, but overall rather unclear.

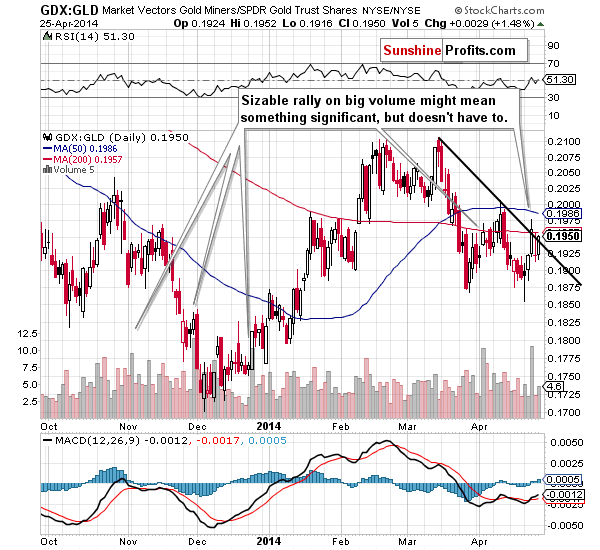

The mining stocks to gold ratio moved higher on Friday after a daily decline and overall closed slightly lower than it had on Wednesday. We don't view this action as a breakout just yet.

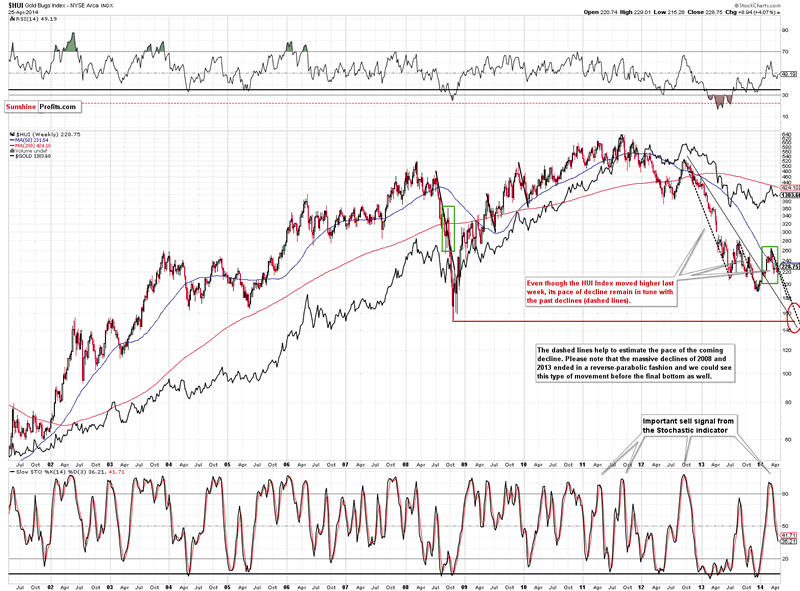

If we take a look at gold stocks from a broader perspective, we get a picture in which gold miners are declining in tune with the previous declines. By zooming out we stop to see individual short-term upswings and downswings and start to see the general direction in which the market is moving. At this time, the trend that we see is down and the pace at which gold stocks decline is normal - there has been no divergence so far. The implications are bearish.

On a short-term basis, we saw a breakout in the GDX ETF, which, of course, is a bullish sign. It hasn't been confirmed yet, and given what we wrote below the 2 previous charts, it's not strongly bullish just yet. The overall pace of the decline and the lack of breakout in the GDX:GLD ratio make waiting for the GDX's breakout necessary. There is also another ratio that we would like to comment on today.

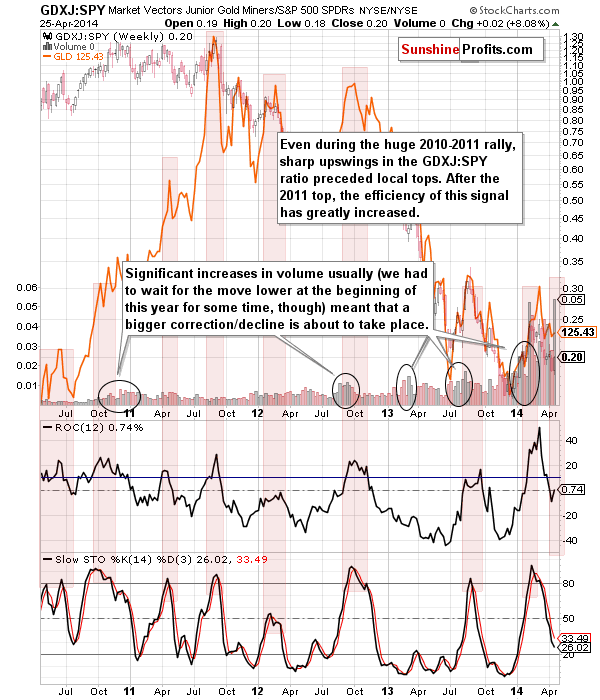

The above chart features the junior mining stocks to the general stock market ratio. In the majority of cases when the ratio of volumes was huge, gold was about to form a top or at least pause the rally. The signal was a bit too early in the early part of this year, but please note that gold's price at this time is lower than it was when we saw the huge ratio of volumes. Last week we saw a huge spike in the volume ratio - a record one. As explained above, the implications are bearish.

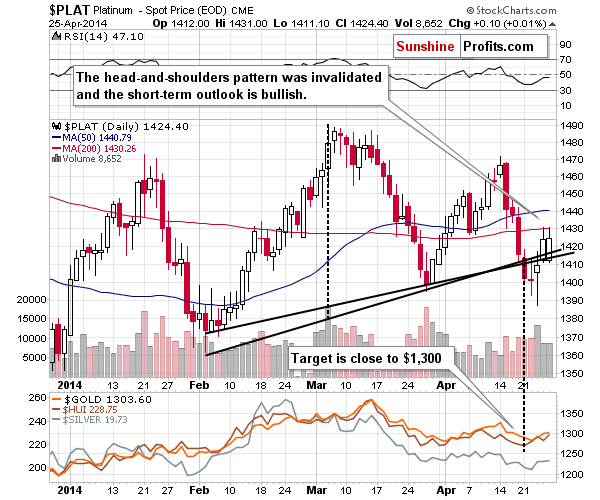

Meanwhile, the previously-completed head-and-shoulders pattern in platinum was invalidated in the final part of last week. The invalidation itself is a bullish sign and the above chart now suggests higher platinum prices (which also, to a smaller extent, indicates higher prices for gold, silver, and mining stocks).

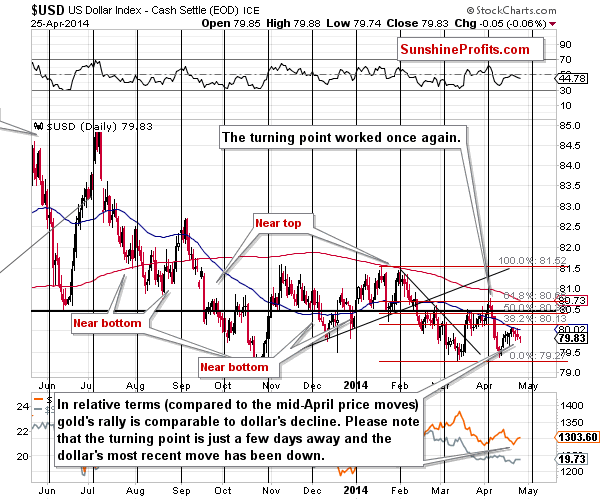

We started today's alert by writing that we can say a bit more about the gold-USD link. The USD Index moved lower in the first part of Friday's session and taking this move into account, we now have a clearer picture. Comparing the 2 most recent price moves (mid-April move higher in the USD and the last several days of lower values) in the USD and gold we see that they were quite alike. The dollar corrected some of its rally and gold corrected some of its decline. There's not short-term underperformance or outperformance to speak of and the implications are neutral. There is, however, one thing that can tell us more about the near future of the USD and precious metals prices and that's the fact that the turning point is just around the corner. In the first days of May, we can expect to see a local extreme in both markets. At this time, the short-term direction is up in case of the precious metals and down in case of the USD Index, so we are quite likely to see a downturn start in metals and miners within a week or so. We were asked if we still think that there is real downside in the precious metals sector. The answer is yes, because the medium-term trend is still down in metals and miners (note the pace of decline in the HUI Index) and the medium-term trend is still up in the USD Index. The negative gold-USD link remains in place. We are keeping our eyes opened and will monitor the market for signs of strength. The bottom line is that the situation in the precious metals market remains too unclear to open any speculative position and the medium-term trend remains down. The situation in gold is unclear, unclear with a bullish bias for silver and mining stocks, bullish for platinum, but with bearish indications coming from the USD Index and the juniors to other stocks ratio. "When in doubt, stay out" - and so we do. To summarize: Trading capital (our opinion): No positions Long-term capital (our opinion): No positions Insurance capital (our opinion): Full position You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website. As always, we'll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you'd like to receive them, please subscribe today. Thank you. Przemyslaw Radomski, CFA Founder, Editor-in-chief Tools for Effective Gold & Silver Investments - SunshineProfits.com * * * * * About Sunshine Profits Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing. Disclaimer All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | |

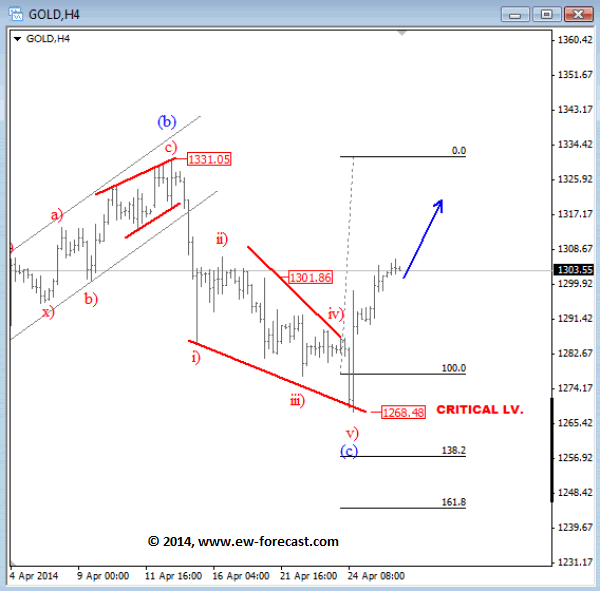

| Will <b>Gold Price</b> See A Bullish Reversal? :: The Market Oracle <b>...</b> Posted: 28 Apr 2014 12:11 PM PDT Commodities / Gold and Silver 2014 Apr 28, 2014 - 04:11 PM GMT By: Gregor_Horvat Gold has been trading nicely to the downside since mid-April from 1331 where we called a bearish turning point. The market did not move aggressively to the downside, but still managed to take out the 1277 low-our minimum expectations. Based on the very slow and overlapping price action in the last two weeks, we suspect that the market made an ending diagonal in wave (c) that is now showing signs of completion at 1268, so we need to be aware of more upside in days ahead.

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power. Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders. © 2014 Copyright Gregor Horvat - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | |

| Suppressing the <b>Price</b> of <b>Gold</b>: JPMorgan Chase, Goldman and the <b>...</b> Posted: 27 Apr 2014 03:54 AM PDT

Video interview: In this exclusive video interview on behalf of Matterhorn Asset Management / GoldSwitzerland Lars Schall talks with William S. Kaye, the Senior Managing Director of the Pacific Alliance Group of Companies in Hong Kong. They speak about the motive, the means and the opportunities to suppress the gold price. Kaye says the motive is simple as a free-market price of gold would essentially cast the interventions for what they are and stabilize policy measures taken by Central banks. However, he explains and predicts that the price suppression scheme can't go on forever and that in the 'end game' the 100 fold paper gold market must eventually be settled with physical gold and that it will require an extremely high price of gold to entice owners of physical gold outside the banking system to be willing to meet that massive anticipated demand. - About William S. Kaye William Kaye is the Founding Partner, Chief Investment Officer, Senior Managing Director and Vice Chairman at The Pacific Alliance Group of Companies based in Hong Kong. He oversees all portfolio and direct equity management activities of the group's various investment efforts. He is the Managing Partner of the Greater Asian Hedge Fund and a predecessor of Asian Hedge Fund, L.P. Prior to this, he was a Founder and Director at ASIMCO in 1992 to 1998, where he pioneered the investment of approximately $380 million in China. Mr. Kaye orchestrated the profitable sale of Pacific Alliance Group's stake to GE Pension Trust in 1998. Disclaimer: The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible for any inaccurate or incorrect statement in this article. The Center of Research on Globalization grants permission to cross-post original Global Research articles on community internet sites as long as the text & title are not modified. The source and the author's copyright must be displayed. For publication of Global Research articles in print or other forms including commercial internet sites, contact: [email protected] www.globalresearch.ca contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of "fair use" in an effort to advance a better understanding of political, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than "fair use" you must request permission from the copyright owner. For media inquiries: [email protected] Copyright © Lars Schall, goldswitzerland.com, 2014 | |

| 2014 <b>gold price</b> rally fades as ETF investors, hedge funds exit market Posted: 22 Apr 2014 03:15 PM PDT The gold price extended recent weakness on Tuesday losing sight of the psychologically important $1,300 level as investors rotate out of the metal into surging stocks. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery settled at $1,281.10 an ounce, down $7.0 from yesterday's close. Earlier in the day the gold price fell to levels last seen February 10 of $1,275 an ounce. In contrast the US benchmark stock index, the S&P 500 recorded its sixth straight session gain. Post-Easter trade remained thin with only 110,000 contracts changing hands against usual volumes of closer to 200,000 contract of 100 ounces each. "Traders seem to have given up on gold as a provider of safe haven at the moment," Saxo Bank's head of commodity research Ole Hansen said in a note: "Instead the focus remain firmly on the United States, where earnings and economic data continue to indicate interest rates will rise sooner rather than later. "Hedge funds cut their net-long position back to February levels and total ETP holdings have dropped to a new 2009 low. So with the US healing, Chinese demand questionable and investment demand not showing signs of picking up, gold is back on the defensive." Latest data from US Commodity Futures Trading Commission show hedge funds and other large investors added to bets that the price of the metal would fall for the fourth week in a row. Short positions – bets that price would decline – held by managed money increased 15% to just under 28,000 lots in the week to April 15 according to CFTC data. At the same time long positions were cut by 4,766 contracts which translates into a 8.5% decline in the net-long positions held by commercial traders in the precious metal to 90,137 futures and options. Investors also continued to pull money out of the SPDR Gold Trust (NYSEARCA:GLD), the world's largest physically-backed gold ETF accounting for some 40% of total holdings in the industry. Holdings in GLD dropped to 792.1 tonnes or 25.46 million ounces on Tuesday, the lowest level since January and down almost 30 tonnes in less than three weeks. The world's physical gold trusts have experienced net redemptions of more than 800 tonnes collectively last year, with the value of precious metals assets investments falling by a record $78 billion in 2013. |

| You are subscribed to email updates from Gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Briefly: In our opinion no speculative positions are justified from the risk/reward perspective.

Briefly: In our opinion no speculative positions are justified from the risk/reward perspective.

0 Comment for "Gold price | Gold Mining Stocks Break Out but Gold Price Fails to Follow :: The ..."